Refrigeration Oil Market Size & Overview:

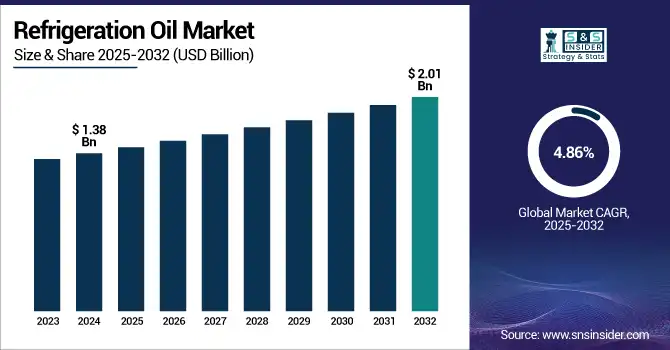

The Refrigeration Oil Market size was USD 1.38 billion in 2024 and is expected to reach USD 2.01 billion by 2032 and grow at a CAGR of 4.86% % over the forecast period of 2025-2032.

To Get more information on Refrigeration Oil Market - Request Free Sample Report

Refrigeration oil market analysis highlights that the expanding adoption of automotive air conditioning systems significantly fuels market growth. The rising temperatures across the globe with consumers wanting as much comfort as ever, air conditioning is a must-have feature in every vehicle, right from entry-level to the premium luxury car segment. With the increase in automotive manufacturing, mainly in developing economies, the consumption of efficient and high-durability refrigeration oils used in vehicle HVA systems is growing.

The U.S. Bureau of Economic Analysis (BEA) provides data on auto and truck sales, which can be used to analyze trends in vehicle production and, by extension, the demand for automotive air conditioning systems. As automotive production surges, especially in developing economies, the demand for efficient and durable refrigeration oils used in vehicle HVAC systems is also increasing, which drives the refrigeration oil market growth.

Refrigeration Oil Market Dynamics:

Drivers

-

Growth In Cold Chain Logistics and Food Storage Drives the Market Growth

The growing need for freezer warehouse infrastructure and temperature-controlled transport systems has emerged as increasing demand for perishable food products, dairy, meat, and pharmaceuticals around the world. Efficient and durable refrigeration oils are used by these systems, then, but the bulk of demand lies with the refrigeration systems themselves, as they are integral to the quality and safety of the product being stored in these facilities. Meanwhile, with the rapid development of e-commerce in the grocery and pharmaceutical fields, the cold chain logistics around the world are developing even faster.

For instance, the description of cold storage capacity for horticulture crops in 2019–20 in India, as captured on the Open Government Data (OGD) Platform India, is one instance of the attempts to improve cold chain capacity in India. Such storage is essential for maintaining the quality of perishable goods, which leads to the demand for refrigeration oils to keep these systems running effectively, as is illustrated by the data.

Restrain

-

High Cost of Synthetic oils May Hamper the Market Growth

One of the significant restraints for the growth of the refrigeration oil market is the high price of synthetic oils. POE, PAG, and PAO synthetic refrigeration oils are also typically more thermally stable, provide better lubrication, and have higher compatibility with newer refrigerants. However, their composition utilizes relatively sophisticated chemical processes and uses high-grade raw materials, so their cost, naturally, is not comparable to the cost of ordinary mineral oils. This price difference can prevent adoption, including small educational surroundings, industrial users, and residential HVAC systems in more developing economies, where the cost difference can be such that only the larger players can benefit from the fittest cell.

Opportunities

-

Increasing Adoption of Electric Vehicles (EVs) Creates the Opportunity For the Market.

Growing electric vehicle (EVs) adoption is a prominent opportunity in the refrigeration oil market. High-performing thermal management systems, essential for battery temperature control and cabin comfort, one of the several areas in which EVs differ from ICEVs, need efficient HVAC units. Electric HVAC systems utilize compressors that require more sophisticated, synthetic refrigerant oils that can operate under higher stress conditions, wider temperature ranges, and greater electrical conductivity constraints. As global EV sales remain on an upward trajectory point and this, not from long-promised government interventions or quasi-blanket consumer demand for zero-emission mobility, but from pragmatic expectations for new drives at lower cost. this, in turn, puts demand on tree-trunk-like environmental-oil-type refrigeration oils that maintain and prolong the performance of electric vehicle air conditioning systems.

The Indian government approved the PM E-DRIVE scheme in September 2024, approving USD 1.3 billion for incentivizing EV adoption. These encompass electric two-wheelers, three-wheelers, ambulances, trucks, and buses, along with subsidies for charging infrastructure and new technologies.

In June 2023, Johnson Controls' transaction reflected the acquisition of M&M Carnot, a company known for ultra-low GWP natural refrigeration solutions. This acquisition allows Johnson Controls to provide sustainable refrigeration solutions and follow the refrigeration oil market trends, which are aligned with the sustainability agendas of several nations around the world.

Refrigeration Oil Market Segmentation Analysis:

By Type

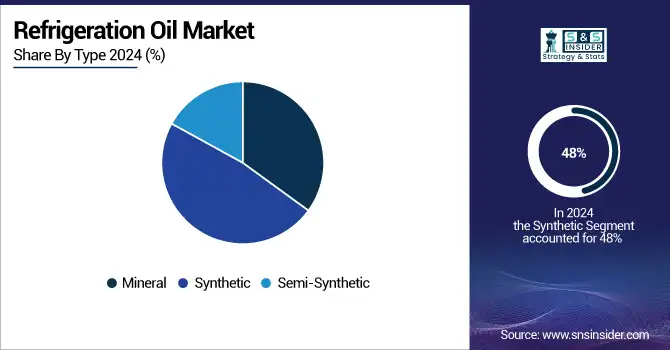

Synthetic held the largest refrigeration oil market share, around 48%, in 2024. This is owing to its superior properties, high efficiency, and compatibility with modern refrigeration and air conditioning systems. Synthetic oils provide improved thermal stability, increased lubricity, and lower volatility when compared with mineral oils, making such fluids ideal, particularly for systems using environmentally friendly refrigerants such as HFCs and HFOs. Ideal for extreme temperature conditions, these oils provide extended equipment life and lower maintenance requirements. When more industries are focusing on energy efficiency, environmental compliance, and long-term operational reliability, the demand for synthetic refrigeration oil has been steadily increasing for the automotive air conditioning, industrial refrigeration, and commercial HVAC sectors.

Semi-synthetic refrigeration oil held a significant market share it is owing to its best cost-to-performance ratio. They combine synthetic base oils with mineral ones, providing many of the benefits of full synthetics, greater thermal stability, improved lubricity, and service life without the high price. This means that they are suitable for a large number of end-users, including commercial and residential refrigeration systems, and want a high-performance HFC replacement but do not want to pay for the complete synthetic alternatives.

By Application

Refrigerators held the largest market share, around 32%, in 2024. It is owing to the rapid global demand for food preservation, along with fast urbanization and mounting cold chain infrastructure, has increased the number of refrigerators used in households, supermarkets, restaurants, and food processing units. These appliances rely on refrigeration oils to maintain compressor efficiency and system stability. Moreover, the expansion of the middle-class category in developing economies and an increase in the standard of living have also contributed to the continuous sales growth of refrigerators.

Automotive held a significant market share because it's driven by automotive applications, owing to the rising global demand for AC systems in automobiles. As temperatures rise, ownership of vehicles increases, and consumers demand high comfort features, air conditioning has been a common feature of most modern vehicles, from passenger cars to commercial trucks, and the development of electric vehicles. Compressor oil for refrigeration are a very important part in providing lubrication and heat dissipation in automotive air conditioning compressors.

Refrigeration Oil Market Regional Outlook:

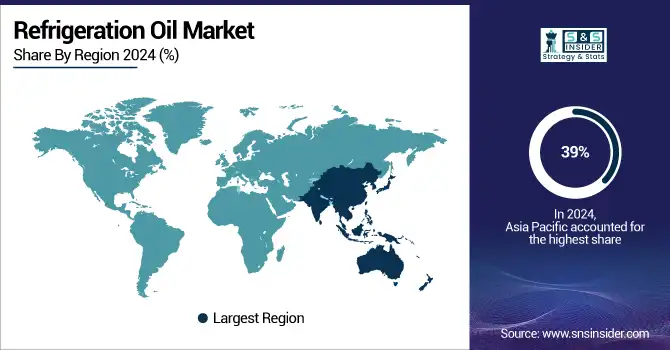

Asia Pacific held the largest market share, around 39%, in 2024. It is owing to the growing industrial base, coupled with faster-growing consumer electronics and automotive sectors, and urbanization in this region. The demand for residential and commercial refrigeration is surging in developing countries such as China, India, Japan, and South Korea, owing to the increasing levels of income, lifestyle change, and a rising middle-class population. Besides, the area is also a production place for air conditioning devices, refrigerators, and cars, where refrigeration oils are important for the performance and life expectancy of compressors in these products. Moreover, the refrigeration oil companies make the strategy and focus on the newly launched and joint ventures, and expansion to increase the growth of the refrigeration oil market.

For instance, in August 2023, Sun Oil Co. launched mineral refrigerant oil compatible with different refrigerants, covering a wide range of refrigeration systems.

Additionally, LABIX, a joint venture of Japan-based Mitsui and a Thai Oil Public Company subsidiary, began production of linear alkylbenzene at its site in Chonburi Province, Thailand, for the regional refrigeration oil supply chain.

North America held a significant market share and is the fastest-growing segment in the forecast period. It is owing to its well-developed infrastructure of refrigeration and air conditioning systems within the residential, commercial, and industrial sectors. There is an existing cold chain logistics capability that the region, especially the U.S., has for food preservation, pharmaceutical, and other temperature-sensitive products. In addition, a well-diversified presence of top producers as well as automotive industry has driven continuous consumption of refrigeration oils in vehicle air conditioning systems.

U.S refrigeration oil market size was USD 244 million in 2024 and is expected to reach USD 397 million by 2032 and grow at a CAGR of 6.25% over the forecast period of 2025-2032. It is owing to its well-established technology base, high penetration of HVAC, and a mature automotive and industrial base. Continuous demand for high-performance refrigeration oils owing to the high penetration of air conditioning and refrigeration units in residential, commercial, and industrial facilities in the country will further boost the market growth. Furthermore, the U.S. cold chain industry is among the largest in the world, which makes regular and reliable refrigeration systems indispensable and performance-driven lubricants a requisite.

In 2023, the U.S. Department of Energy created USD 32 million in funding for research, development, and deployment of monitoring, measurement, and mitigation technology.

This is in line with initiatives related to the Elimination of Hydrofluorocarbons and the promotion of eco-friendly refrigeration oils, and helps in reducing greenhouse gas emissions.

Europe held a significant market share in the forecast period. It is owing to an increasing number of environmental regulations, higher penetration of refrigeration and air conditioning systems, and strong presence of developed and leading market players. As a result, the European Union has established strict targets for lowering greenhouse gas emissions, due to which ecological refrigerants and oils are being increasingly used in food preservation, automotive air conditioning, and industrial areas. Moreover, Europe has a well-developed cold chain system, which is so important for the pharmaceutical, retail, and logistics industry, where refrigeration plays a crucial role.

In April 2024, Carel Industries opened a 4,500 m² research center. The facility features flammable refrigerant-compliant climate chambers and a training center, further enshrining Carel's mission for innovation in HVAC/R systems.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The refrigeration oil market companies include Shell plc, ExxonMobil Corporation, Phillips 66 Company, Chevron Phillips Chemical Company LLC, Rompetrol Rafinare S.A., Sumitomo Chemical Co., Ltd., Honeywell International Inc., Junyuan Petroleum Group, Merck KGaA, and Indian Oil Corporation Limited.

Recent Development:

-

In October 2024, ExxonMobil announced an expansion of its Singapore refinery to provide high-purity Refrigeration Oil to meet growing demand in chemical synthesis and for food-grade applications.

-

In March 2022, Phillips 66 announced a merger with Phillips 66 Partners. The merger also provided Phillips 66 with the opportunity to acquire any outstanding limited partnership interests in PSXP not already owned by the company and its affiliates.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.38 Billion |

| Market Size by 2032 | USD 2.01 Billion |

| CAGR | CAGR of 4.86% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Mineral, Synthetic, Semi-Synthetic) •By Application (Air Conditioner, Refrigerators, Automotive, Coolers & Conditioners, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | ExxonMobil Corporation, Royal Dutch Shell plc, Idemitsu Kosan Co., Ltd., Chevron Corporation, FUCHS Petrolub SE, PETRONAS Lubricants International, TotalEnergies SE, Lubrizol Corporation, Indian Oil Corporation Limited, BASF SE |