Polybutylene Adipate Terephthalate Market Report Scope & Overview:

Get E-PDF Sample Report on Polybutylene Adipate Terephthalate Market - Request Sample Report

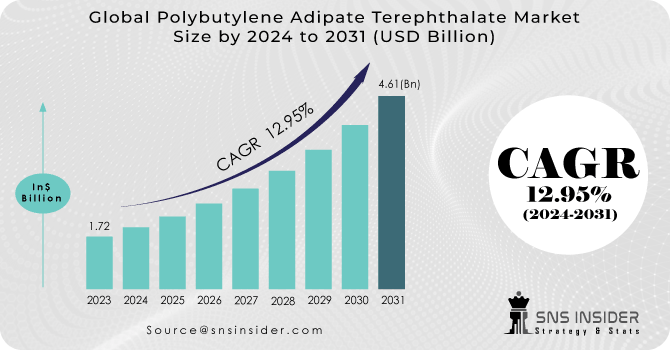

The Polybutylene Adipate Terephthalate Market Size was valued at USD 1.5 Billion in 2023 and is expected to reach USD 3.2 Billion by 2032, growing at a CAGR of 8.8% over the forecast period of 2024-2032.

The growth of the polybutylene adipate terephthalate market can be attributed to the increasing demand for biodegradables. Our report features an environmental impact assessment, a supply chain analysis, and insights into consumer preferences. The report also provides a detailed pricing analysis, an exploration of quality processes and conditions, and an appraisal of market resilience and adaptability, which details how the Polybutylene Adipate Terephthalate market has changed its approach in light of the recent strain faced by economies across the world.

Market Dynamics

Drivers

-

Rising Demand for Biodegradable Materials in Packaging and Consumer Goods Fuels the Polybutylene Adipate Terephthalate Market Growth

The growing demand for sustainable and compostable materials in the packaging and consumer goods sectors is one of the major factors fueling the growth of the Polybutylene Adipate Terephthalate market. As awareness of the adverse environmental effects of conventional plastics increases, businesses and consumers are moving towards sustainable solutions. The segment is anticipated to grow, due to its biodegradable nature, resulting in growing adoption as Polybutylene Adipate Terephthalate for the production of packaging products, including compostable bags, bin liners, and food wraps. This transition aligns with global sustainability trends, moving companies towards using renewable and compostable materials to reduce their carbon footprints. Additionally, the expanding use of biodegradable plastics as governments worldwide implement stricter environmental policies is also driving demand for Polybutylene Adipate Terephthalate in various sectors. On the end-user front, as industries increasingly adopt green products, the space is expected to widen further, boosting demand for Polybutylene Adipate Terephthalate in the process.

Restraints

-

Limited Availability of Raw Materials and Supply Chain Constraints Affect Polybutylene Adipate Terephthalate Market Growth

The polybutylene adipate terephthalate supply chain relies on the availability of its raw materials, which can be limited at times. Polybutylene Adipate Terephthalate's principal raw materials are derived from petrochemical processes, making their availability vulnerable to volatility in the worldwide oil and gas market. Furthermore, Polybutylene Adipate Terephthalate production requires specialized manufacturing processes that may not be available in various regions. Consequently, any disruption in the supply chain like raw material shortage or logistics issues can cause delays in production or an increase in costs. This can impact the cumulative availability of Polybutylene Adipate Terephthalate in the market, hence hampering them from being unstoppable across the different sectors. Stable and dependable delivery of the material will be vital to its ongoing growth in the world market.

Opportunities

-

Growing Government Support and Regulations Favoring Biodegradable Materials Could Accelerate Polybutylene Adipate Terephthalate Market Growth

To mitigate plastic pollution and promote sustainable practices, governments around the world are increasingly implementing regulations that include the support of biodegradable materials. Governments are increasingly tightening the screws on the use of conventional plastics, especially in the form of packaging, waste management, and single-use products, and the resulting pressure for the adoption of biodegradable alternatives is manifesting into a major trend. Polybutylene Adipate Terephthalate a biodegradable substance would take advantage of these regulatory changes. Governments are also providing incentives and subsidies as well as favorable policies for manufacturers to use and produce biodegradable materials, subsequently generating a favorable market environment for Polybutylene Adipate Terephthalate. These driving factors for Polybutylene Adipate Terephthalate are further fueled by rising regulations across the globe which will keep the market demand up, with many industries working towards greener pastures.

Challenge

-

Competition from Alternative Biodegradable Plastics and Materials Threatens Polybutylene Adipate Terephthalate Market Share

One of the challenges for the Polybutylene Adipate Terephthalate market is the competition from other biodegradable plastics and alternative materials that meet the increasing demand for sustainable options. Other competing materials like polylactic acid and polyhydroxyalkanoates are also being used for a wide range of biodegradable product applications. Typically, these alternatives offer some advantages of their own, whether it be lower production costs or greater availability, making them appealing options for manufacturers. Consequently, Polybutylene Adipate Terephthalate might find itself under pressure to offer unique value propositions and sustain a competitive advantage. To remain competitive against these alternative biodegradable materials, manufacturers must invest in research and development to improve the properties and economics of the material.

Segmental Analysis

By Grade

Extrusion Grade dominated the Polybutylene Adipate Terephthalate market in 2023 with a market share of about 45%. Extrusion-grade Polybutylene Adipate Terephthalate is widely employed to produce biodegradable films and packaging materials, thereby contributing to its segmental dominance. Increasing consumer demand for sustainable packaging materials has made extrusion-grade Polybutylene Adipate Terephthalate a material of choice by manufacturers in packaging as well as the consumer goods industry. Rising focus on sustainability and use of sustainable materials by initiatives from various stakeholders including the United Nations and other global programs and policy makers has stimulated the usage of biodegradable materials in packaging applications. The EU's drive for bans on single-use plastic is one contributing factor to the growing consumption of extrusion-grade materials, and reinforcing its market leadership, for example.

By Type

In 2023, Pure Polybutylene Adipate Terephthalate dominated the Polybutylene Adipate Terephthalate Market, contributing about 62% of the market share. Pure Polybutylene Adipate Terephthalate has shown a remarkable increase and widespread attention because of its unique biodegradation properties and comparative performance in many application fields, especially in environmentally friendly fields such as packaging. Its ability to degrade naturally makes it a widely used material with reduced environmental impact. The monopoly of pure Polybutylene Adipate Terephthalate is further cemented by regulatory pressures set by governments across the globe, the European Union’s regulations on biodegradable plastics included. The Biodegradable Products Institute (BPI) and other organizations have advocated for its use, highlighting its appropriateness for compostable bags, packaging films, and other eco-friendly products, which similarly meet consumer needs for decomposable products.

By Application

In 2023, Compost & Garbage Bags dominated the Polybutylene Adipate Terephthalate Market and accounted for about 36% of the Polybutylene Adipate Terephthalate market. The segment for compost and garbage bags dominates on account of the surging global concern toward plastic waste generation and the growing regulatory influence on reducing single-use plastics. Using biodegradable plastic trash bags based on Polybutylene Adipate Terephthalate has become popular in recent years. Regulatory authorities in areas like the European Union and the United States are introducing more stringent regulations on plastic waste, leading to greater demand for eco-friendly products like compostable bags. The increase in this segment in the Polybutylene Adipate Terephthalate market has also been aided by the initiatives like U.S. Environmental Protection Agency's (EPA) encouragement of sustainable waste management practices, for example.

By End-use Industry

In 2023, the Packaging industry dominated the Polybutylene Adipate Terephthalate market with a 48% market share. The rising demand for biodegradable materials in the packaging industry has seen its popularity and usage rise. Polybutylene Adipate Terephthalate represents the way of the future when it comes to packaging as it is biodegradable as opposed to plastics that have been destroying ecosystems around the world. Governments are also getting involved with the European Union releasing the Single-Use Plastics Directive and with it, the requirement that all plastics used in packaging be compostable. Examples of giant packaging companies that are using Polybutylene Adipate Terephthalate are Tetra Pak and Nestlé. The Packaging segment is a major source of driving the market due to the prevalent push towards sustainability.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Regional Analysis

In 2023, the Asia Pacific region dominated the Polybutylene Adipate Terephthalate market with a market share of around 40%. The dominance is attributed to large-scale manufacturing, a rise in sustainability goals, and a growing adoption of biodegradable solutions in industries. This growth is driven by India, China, and Japan. China, the world’s largest producer and consumer of biodegradable plastics, has also adopted policies such as the "National Plastics Reduction Action Plan" to control plastic waste, which has led to increased demand for Polybutylene Adipate Terephthalate. Moreover, the rapidly growing consumer goods sector in India, along with Japan’s advanced technical infrastructure, is also contributing to increasing demand. Rapid inclination towards sustainable packaging solutions in these regions has substantially propelled the market growth across the region. A mix of supportive government policies, industrialization, and increasing environmental awareness will help Asia Pacific hold onto its top position in the Polybutylene Adipate Terephthalate market.

Moreover, Europe emerged as the fastest growing region in the Polybutylene Adipate Terephthalate market in 2023, with a significant CAGR. The growth is fueled by the region’s stringent environmental regulations and rising demand from consumers for sustainable alternatives to plastics. EU Single-Use Plastics Directive as well as various national policies greatly speed up demand for biodegradable materials. Drivers of PDO in the European market are concerned with Germany, France, and the UK with the plastic Polymer Polybutylene Adipate Terephthalate for being used in packaging, compostable bags, and agriculture. Germany’s focus on sustainability and the UK’s plans to ban single-use plastics are among the motivating factors behind the region’s growth. France's policies pushing for biodegradable material usage in packaging also contribute to this growth. The growing environmental awareness and supportive regulations in Europe have also made it the fastest growing region for Polybutylene Adipate Terephthalate and is thus expected to witness a strong market in upcoming years.

Recent Highlights

-

August 2024: DRDO developed a Polybutylene Adipate Terephthalate packaging solution that decomposes in three months. The technology was successfully tested and eventually shared with industries to promote sustainability.

-

June 2024: BASF introduced a new biodegradable Polybutylene Adipate Terephthalate product for sustainable packaging. This is in line with their endeavor to cater to the increasing demand for sustainable materials.

Key Players

-

Amco Polymers (PBAT resins, Biodegradable PBAT)

-

Arkema SA (Pebax Rnew, Rilsan)

-

Asahi Kasei Corporation (Lownox PBAT, Ecoflex)

-

BASF SE (Ecoflex, Ecovio)

-

Braskem S.A. (BioPBS, BioFlex)

-

Celanese Corporation (Ateva PBAT, Celanese Bio-Based PBAT)

-

Chang Chun Group (Bio-PBAT, Eco PBAT)

-

Covestro AG (Desmopan, Bayblend)

-

Dow Inc. (Synflex, Ecoflex)

-

Eastman Chemical Company (Eastman PBAT, Eastman Renew)

-

ExxonMobil Corporation (ExxonMobil PBAT, Exxcore)

-

Far Eastern New Century Corporation (FENC Biodegradable PBAT, FENC Ecoflex)

-

FillPlas Co. Ltd. (FillPlas PBAT, Biodegradable Plastic PBAT)

-

Feddersen Group (PBAT Resin, Biodegradable PBAT)

-

Formosa Plastics Corporation (Formosa PBAT, Green PBAT)

-

Jiangsu Torise Biomaterials Co., Ltd. (Torise PBAT, Torise Bio-PBAT)

-

JinHui ZhaoLong High Technology Co., Ltd. (JZL PBAT, Biodegradable PBAT)

-

LG Chem Ltd. (LG PBAT, Eco-PBAT)

-

Lotte Fine Chemical Co., Ltd. (Lotte PBAT, Bioflex)

-

Mitsui Chemicals, Inc. (Mitsui Eco-PBAT, Mitsui PBAT)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.5 Billion |

| Market Size by 2032 | USD 3.2 Billion |

| CAGR | CAGR of 8.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Grade (Extrusion Grade, Thermoforming Grade, Others) •By Type (Pure PBAT, Modified/Blended PBAT) •By Application (Compost & Garbage Bags, Bin Bags, Mulch Films, Cling Films, Stabilizers, Others) •By End-use Industry (Packaging, Agriculture & Horticulture, Consumer Goods & Homecare, Coatings, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Eastman Chemical Company, SK Chemicals, Novamont S.p.A., Far Eastern New Century Corporation, Lotte Fine Chemical Co., Ltd., JinHui ZhaoLong High Technology Co., Ltd., Covestro AG, SABIC, Mitsui Chemicals, Inc. and other key players |