Drilling Software Market Report Scope & Overview:

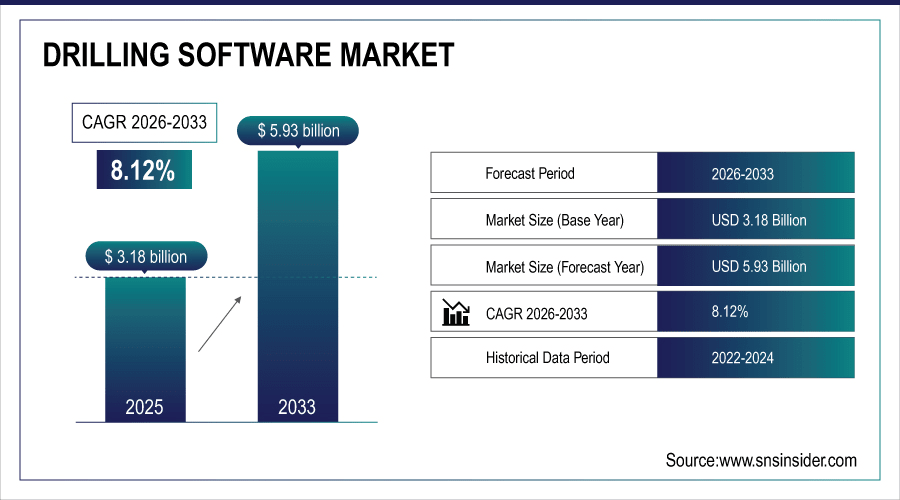

The Drilling Software Market Size was valued at USD 3.18 Billion in 2025E and is expected to reach USD 5.93 Billion by 2033 and grow at a CAGR of 8.12% over the forecast period 2026-2033.

Rising demand for Oil & gas digitalization and automation is the major factor propelling the Drilling Software Market. To maximize operational efficiencies, minimize non-productive time, and reduce drilling cycles, companies are adopting cutting-edge drilling software. Robust capabilities like real-time monitoring, predictive analytics, and automated well planning reduce human errors and assist drilling personnel in accurate decision-making. Moreover, the increased emphasis on reducing costs and maximizing the use of resources and the need for software that minimize the complexities while reducing operational cost and enhancing productivity further fuels the upsurge in demand for upstream software. According to study, automated well planning and real-time monitoring can improve drilling cycle efficiency by 10–20%.

To Get More Information On Drilling Software Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 3.18 Billion

-

Market Size by 2033: USD 5.93 Billion

-

CAGR: 8.12% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Drilling Software Market Trends

-

Increasing adoption of automation and digital tools in global drilling operations.

-

Real-time monitoring and predictive analytics improve accuracy and reduce operational errors.

-

Cloud-based solutions enable remote collaboration and scalable drilling software deployment.

-

AI-driven drilling software enhances hazard detection and predictive maintenance capabilities.

-

Rising demand for offshore and deepwater drilling fuels advanced software adoption.

-

Integration of digital technologies reduces non-productive time and lowers operational costs.

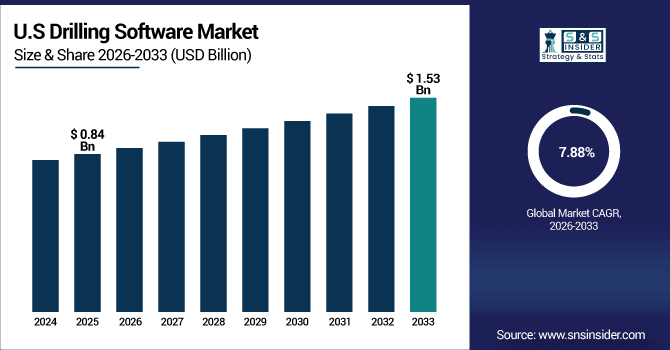

The U.S. Drilling Software Market size was USD 0.84 Billion in 2025E and is expected to reach USD 1.53 Billion by 2033, growing at a CAGR of 7.88% over the forecast period of 2026-2033, due to adoption of advanced technologies, including AI-driven geosteering, real-time monitoring, and cloud-based solutions, enhancing operational efficiency, reducing non-productive time, and improving drilling accuracy across onshore and offshore oil & gas operations.

Drilling Software Market Growth Drivers:

-

Digitalization and Automation Revolutionizing Drilling Operations for Enhanced Efficiency

One of the key factors driving the Demand for Drilling Software Market is the increasing use of digital technologies and automation across the oil & gas industry. To boost well planning and improve operational efficiency to reduce non-productive time, companies are deploying advanced drilling software. Real-time supervisory and predictive analysis, as well as automated decision-making based on data learnings, help companies reduce human error and improve drilling precision while reducing project timeframes. The world is striving to be cost efficient and productive in the upstream operations which is driving companies to adopt software solutions to effectively manage resources, reduce operational costs, improve drilling success ratio further enhances the market growth.

Adoption of real-time monitoring and automation can reduce NPT by 15–25% per well.

Drilling Software Market Restraints:

-

High Implementation Costs Challenge Adoption of Advanced Drilling Software Globally

Despite its advantages, the high price to implement and maintain advanced drilling software acts as a major constraint for the market. For small and medium enterprises (SMEs), licensing fees, integration with existing processes, and infrastructure upgrade requirements can prove costly. Even more, staff need to be trained to use these tools effectively adding an operational cost to the bottom line. However, the need to pay a hefty price upfront creates acceptance challenges for smaller operators and restricts market growth in capital-constrained economies even though the operational benefits of these software solutions are obvious.

Drilling Software Market Opportunities:

-

Cloud-Based AI Solutions Unlock New Growth Opportunities in Drilling Market

Cloud-based and AI-driven drilling software is a significant market opportunity. Through, the Cloud, deployment facilitates remote monitoring, real-time collaboration, and scalable solutions for seamless deployment of complex tools on minimal investment. AI and machine learning help improve predictive ability, giving proportional and accurate hazard detection, well optimization, and automated decision-making. The growing focus on digital transformation in the oil & gas industry and the upsurge in demand for offshore and deepwater drilling support the overall growth strategy for the software solution market, which offers innovative, cost-effective, and intelligent solutions to tackle operational challenges and sustainability objectives.

AI/ML-driven software can increase hazard detection and well optimization accuracy by 30–35%.

Drilling Software Market Segmentation Analysis:

-

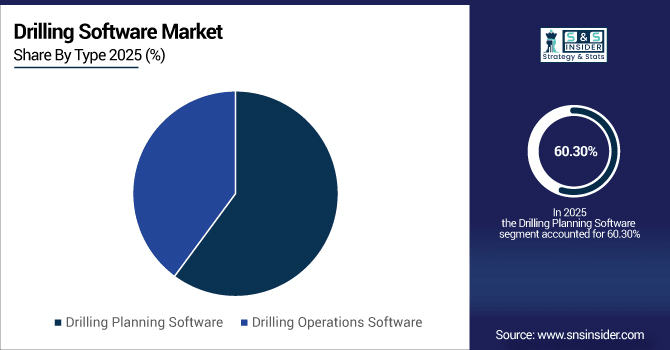

By Type: In 2025, Drilling Planning Software led the market with share 60.30%, while Drilling Operations Software is the fastest-growing segment with a CAGR 8.5%.

-

By Deployment Type: In 2025, On-Premises Deployment led the market with share 55.02%, while Cloud-Based Solutions is the fastest-growing segment with a CAGR 9.20%.

-

By Application: In 2025, Onshore Drilling led the market with share 40.20%, while Offshore Drilling is the fastest-growing segment with a CAGR 8.80%.

-

By End-User: In 2025, Oil & Gas Companies led the market with share 65.34%, while Service Providers is the fastest-growing segment with a CAGR 9.08%.

By Type, Drilling Planning Software Leads Market and Drilling Operations Software Fastest Growth

In the Drilling Software Market, Drilling Planning Software will continue to lead the market owing to its capabilities to optimize well planning, improve resource allocation and operational efficiency. They enable companies to enhance workflows, reduce non-productive hours and improve human errors, becoming integral to upstream oil & gas operations. On the other hand, Drilling Operations Software is the most growing segment due to the rising implementation of real-time monitoring, predictive analytics, and automated decision-making in drilling operations. We believe increasing apartment accuracy, reduced project timelines and cost optimizations will remain key growth drivers in these segments over the next several years.

By Deployment Type, On-Premises Deployment Leads Market and Cloud-Based Solutions Fastest Growth

In 2025, On-Premises Deployment currently dominates the Drilling Software Market as it provides a higher level of data security, more control of sensitive drilling information, and easier integration with existing enterprise systems. Large oil & gas companies favor this model of deployment as they prefer operational stability and compliance to industry regulations. On the other hand, Cloud-Based Solutions represent the fastest-growing segment, due to the rising demand for remote monitoring, real-time collaboration, and scalable software solutions. Cloud Deployment: Enables minimal upfront investment for companies launching with advanced drilling tools while also increasing flexibility, accessibility, and efficiency in operation. Increasing digital transformation of the oil & gas industry, in turn, drives demand and expansion of the market for cloud-based solutions.

By Application, Onshore Drilling Leads Market and Offshore Drilling Fastest Growth

In the Drilling Software Market, the Onshore Drilling segment leads the Drilling Software Market due to the higher volume of projects executed, less complexity, and the widespread use of drilling software to optimize planning and execution. Onshore activities stand to gain greater resource management, lesser non-productive time and allows more informed decision-making using real-time monitoring and automated workflows. On the other hand, the Offshore Drilling, growing at the highest rate, will be fueled by increasing deepwater and ultra-deepwater exploration activities that demand software to be optimized for well optimization, predictive analytics, and hazard mitigation. With an ever-increasing need for energy and the need for new technologies to help optimize offshore drilling operations, adoption is rapidly being accelerated making offshore drilling one of the major growth sectors in the upcoming years.

By End-User, Oil & Gas Companies Lead Market and Service Providers Fastest Growth

In 2025, Oil & Gas Companies hold the largest share in the Drilling Software Market due to the extensive nature of their upstream operations, driving large-scale drilling projects as well as high adoption of advanced software solutions to optimize well planning, reduce non-productive time, and increase operational efficiency. Such companies with the help of real-time monitoring, predictive analysis and automated decision-making drives drilling accuracy and timelines forward. On the other hand, Service Providers is the rapidly growing segment due to rising outsourcing of drilling operations and digitalization of Plug and Abandonment operations to handle several customers. With increasing adoption of third-party service providers and cloud and AI-driven software, this segment will continue to grow rapidly at the global level.

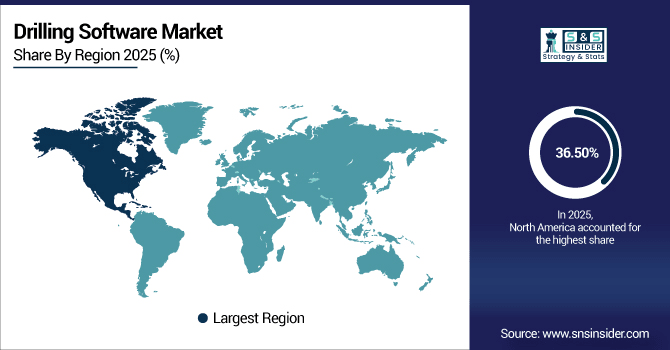

Drilling Software Market Regional Analysis:

North America Drilling Software Market Insights:

The Drilling Software Market in North America held the largest share 36.50% in 2025, due to its well-developed oil & gas infrastructure, widespread upstream activities, and early implementation of advanced digital solutions. The key industry players in the region increasingly use real-time monitoring, predictive analytics, and automated drilling systems to improve efficiency, minimize non-productive time, and speed up decision-making. Moreover, the significant investments in deepwater and shale drilling projects, coupled with the central focus on cost efficiency and sustainability, trigger market growth. The cloud-based options and artificial intelligence used by the local operators turn North America into one of the central leaders in the drilling software segment.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Dominates Drilling Software Market with Advanced Technological Adoption

The U.S. dominates the Drilling Software Market due to early adoption of advanced technologies, automation, real-time monitoring, predictive analytics, and cloud-based solutions, driving efficiency, safety, and operational optimization.

Asia-Pacific Drilling Software Market Insights

In 2025, Asia-Pacific is the fastest-growing region in the Drilling Software Market, projected to expand at a CAGR of 9.10%, ue to rising energy demand and growing offshore and onshore drilling activity. Cloud-based and AI-driven drilling software can facilitate data to monitor operations remotely, real-time collaboration, and predictive analytics to improve operational efficiency and minimize non-productive time. Increasing emphasis on digital transformation in the oil & gas sector paired up with the advancements in complex drilling environments is pushing speed for software adoptions. The demand for advanced drilling software is also bolstered by investments in advanced drilling technologies, automation, and optimization tools, making Asia-Pacific an upcoming promising region for the drilling software market globally.

China and India Propel Rapid Growth in Drilling Software Market

China and India Propel Rapid Growth in Drilling Software Market, fueled by rising exploration activities, increasing adoption of digital and AI-enabled drilling solutions, and growing demand for operational efficiency.

Europe Drilling Software Market Insights

The steady growth of Europe Drilling Software Market can be attributed to the rise in adoption of digital technology and automation in drilling operations. As more organizations adopt real-time monitoring, predictive analytics, and cloud-native solutions, they can streamline their operations, better plan for wells, and minimize non-productive time. Increased emphasis on cost reduction, safety, and sustainability across upstream oil & gas operations also drives more software usage. Besides, investments in deepwater and complex drilling projects are creating an impetus for the development of advanced software solutions that enable accurate planning, workflow optimization and data-driven decision making which makes Europe a leader in the global drilling software market.

Germany and U.K. Lead Drilling Software Market Expansion Across Europe

Germany and the U.K. drive European Drilling Software Market growth through adoption of advanced digital solutions, automation, real-time monitoring, and predictive analytics, enhancing operational efficiency, safety, and cost optimization across the region.

Latin America (LATAM) and Middle East & Africa (MEA) Drilling Software Market Insights

The Latin America and Middle East & Africa (MEA) Drilling Software Market is witnessing gradual growth, due to improving upstream oil & gas investments with the growing adoption of advanced drilling technologies. Across these regions, companies are using real-time monitoring, predictive analytics, and automated equipment to boost operational efficiency, minimize NPT, and increase drilling precision. With an increase in demand for cost optimization, safety, and resource management, the adoption of cloud-based and artificial intelligence (AI) software is on the rise. Furthermore, there is a rising demand for advanced application software for digital transformation as well as data-driven decision-making in exploration of other challenging drilling locations such as deepwater and remote locations.

Drilling Software Market Competitive Landscape

Schlumberger’s drilling software, including Petrel Studio and Neuro autonomous geosteering, integrates AI, cloud computing, and high-speed telemetry to optimize drilling operations. These solutions enhance subsurface modeling, reduce non-productive time, and enable data-driven decision-making, ensuring higher accuracy, operational efficiency, and cost-effective performance for onshore and offshore drilling projects worldwide.

-

In December 2024, Schlumberger launched Neuro autonomous geosteering, an AI-driven solution that dynamically responds to subsurface complexities, optimizing drilling efficiency and well performance.

Halliburton leverages its LOGIX and iCruise platforms to provide intelligent drilling solutions that combine automation, real-time data, and predictive analytics. The software supports optimized well placement, efficient resource management, and hazard mitigation, enabling operators to reduce costs, enhance operational performance, and accelerate drilling projects while improving overall reservoir outcomes.

-

In July 2025, Halliburton launched LOGIX automated geosteering, integrating machine learning and advanced geological insights to optimize well placement and maximize reservoir contact.

NOV focuses on delivering advanced drilling software integrated with its hardware solutions, emphasizing real-time monitoring, predictive analytics, and automated decision-making. Its Evolve performance product line enhances drilling efficiency and reduces non-productive time, helping operators optimize well planning, improve safety, and achieve faster project timelines across complex drilling environments.

-

In March 2025, National Oilwell Varco (NOV) introduced the ReedHycalog Evolve performance product line, a premium drill bit platform designed to enhance drilling efficiency in challenging environments.

Drilling Software Market Key Players:

Some of the Drilling Software Market Companies are:

-

Schlumberger

-

Halliburton

-

Baker Hughes

-

Weatherford International

-

National Oilwell Varco (NOV)

-

IHS Markit

-

GE Oil & Gas

-

Ikon Science

-

Pason Systems

-

Peloton Computer Enterprises Ltd.

-

Petrolink

-

Kongsberg Gruppen

-

Cegal

-

Paradigm

-

Emerson Electric Co.

-

AGR

-

AKITA DRILLING

-

Digital Drilling Data Systems

-

Drillsoft

-

EPAM Systems

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 3.18 Billion |

| Market Size by 2033 | USD 5.93 Billion |

| CAGR | CAGR of 8.12 % From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Drilling Planning Software, Drilling Operations Software) • By Deployment Type (On-Premises Deployment, Cloud-Based Solutions, Hybrid Deployment) • By Application (Onshore Drilling, Offshore Drilling, Exploratory Drilling, Production Drilling) • By End-User (Oil & Gas Companies, Mining Corporations, Geological Survey Organizations, Service Providers) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Schlumberger, Halliburton, Baker Hughes, Weatherford International, National Oilwell Varco (NOV), IHS Markit, GE Oil & Gas, Ikon Science, Pason Systems, Peloton Computer Enterprises Ltd., Petrolink, Kongsberg Gruppen, Cegal, Paradigm, Emerson Electric Co., AGR, AKITA DRILLING, Digital Drilling Data Systems, Drillsoft, EPAM Systems, and Others. |