Digital Logistics Market Report Scope & Overview:

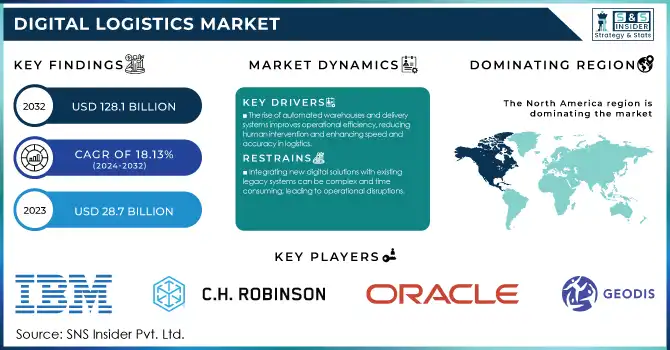

The Digital Logistics Market was valued at USD 28.7 Billion in 2023 and is expected to reach USD 128.1 Billion by 2032, growing at a CAGR of 18.13% from 2024-2032.

To get more information on Digital Logistics Market - Request Free Sample Report

The Digital Logistics Market is rapidly evolving, driven by the increasing need for improved supply chain efficiency, real-time tracking, and automation. By integrating technologies like IoT, artificial intelligence, machine learning, blockchain, and cloud computing into logistics operations, businesses can streamline processes, reduce costs, and enhance customer satisfaction through real-time visibility of inventory, shipments, and delivery schedules. A key growth driver for the digital logistics market is the surging demand for e-commerce, which has created a need for more reliable and efficient logistics solutions. As e-commerce expands, businesses are increasingly adopting digital logistics to manage their supply chains, track shipments, and ensure timely deliveries. Another important factor propelling the market is the growing focus on sustainability in logistics operations. Digital solutions, such as route optimization algorithms, help businesses reduce fuel consumption and lower carbon emissions, aligning with global sustainability targets. According to McKinsey, logistics operations contribute to nearly 8% of global carbon emissions, prompting companies to implement digital solutions that promote energy efficiency and environmental responsibility. With global supply chain disruptions, businesses turned to digital platforms for real-time visibility and to mitigate risks. A report revealed that 79% of supply chain executives were increasing investments in digital supply chain technologies to enhance resilience and navigate pandemic-related disruptions.

The continued investment in digital logistics technologies, along with the growing demand for e-commerce and sustainability, is expected to drive substantial market growth. Moreover, the rise of smart warehouses, automated delivery systems, and data-driven decision-making will shape the future of logistics, making it more efficient, agile, and better equipped to meet consumer demands.

Digital Logistics Market Dynamics

Drivers

-

The rise of automated warehouses and delivery systems improves operational efficiency, reducing human intervention and enhancing speed and accuracy in logistics.

The growth of the Digital Logistics Market is significantly driven by the rise of automated warehouses and delivery systems. Automation in logistics incorporates robotics, artificial intelligence, and machine learning to enhance warehouse operations and streamline delivery processes. In automated warehouses, robots and conveyor belts manage inventory, reducing reliance on manual labor and minimizing errors. These systems accelerate sorting, packaging, and shipping, boosting overall operational efficiency. By leveraging AI, automated warehouses can forecast demand, optimize storage, and enhance inventory management, ensuring products are available when required.

In addition, automated delivery systems, such as drones and autonomous vehicles, are transforming the logistics landscape by reducing delivery times and improving accuracy. These technologies enable faster last-mile deliveries, which are typically the most time-consuming and expensive part of the logistics chain. By minimizing human involvement, automated systems not only improve speed but also reduce operational costs, as fewer resources are needed for manual tasks. Automation also enhances the precision of logistics operations, as automated systems are less prone to human error, ensuring accurate inventory tracking and timely deliveries. Moreover, these systems provide real-time data, allowing businesses to monitor performance, adjust strategies, and boost customer satisfaction. As these technologies continue to advance, the Digital Logistics Market is set to expand, with companies increasingly adopting automated solutions to remain competitive and meet the growing demand for faster, more efficient logistics services.

-

The increasing demand for online shopping drives the need for efficient logistics solutions to manage inventory, track shipments, and ensure timely deliveries.

-

Integration of IoT, AI, machine learning, and blockchain enhances real-time tracking, automation, and data-driven decision-making in logistics operations.

Restraints

-

Integrating new digital solutions with existing legacy systems can be complex and time-consuming, leading to operational disruptions.

The integration of new digital solutions with legacy systems is a significant challenge in the Digital Logistics Market. Many logistics companies still rely on older systems for inventory management, shipment tracking, and other operations, which may not be compatible with advanced technologies like AI, IoT, and blockchain. Integrating these modern technologies with legacy systems can be a complex and time-consuming process due to differences in data formats, system interfaces, and operational workflows. This integration challenge can lead to operational disruptions as businesses face compatibility issues, system downtime, and the risk of data loss or corruption. For example, if a company’s warehouse management system is outdated, incorporating it with a new automated inventory tracking or sorting system could require substantial adjustments. During this transition, businesses may experience delays in order processing, inventory discrepancies, or disruptions in the supply chain.

Moreover, integrating new digital solutions often requires specialized knowledge and expertise that may not be readily available within the existing workforce. This can lead to higher costs for hiring or training employees with the necessary skills. The complexity of aligning new systems with existing legacy technology can also extend project timelines, delaying the expected benefits such as improved efficiency and reduced operational costs. As a result, businesses may be reluctant to adopt digital logistics solutions due to the potential disruptions and costs associated with the integration process.

-

The cost of implementing advanced digital logistics technologies such as AI, robotics, and IoT can be prohibitive for small and medium-sized enterprises

-

The reliance on cloud-based systems and real-time data sharing increases the risk of cyberattacks and data breaches.

Digital Logistics Market Segment Analysis

By Component

The solutions segment dominated the market and represented a revenue share of more than 64% in 2023, due to the increasing demand for comprehensive, technology-driven solutions that address complex industry challenges. Businesses are seeking integrated solutions that enhance operational efficiency, improve decision-making, and streamline processes. The rapid adoption of AI, IoT, and cloud-based technologies is further driving the growth of the solutions segment, as these technologies enable automation, real-time data processing, and enhanced analytics. As industries such as manufacturing, agriculture, and healthcare embrace digital transformation, the need for scalable, customizable solutions is expected to continue growing, making this segment the market leader.

The services segment is projected to register the fastest CAGR during the forecast period, driven by the increasing demand for expert support and consulting. As businesses adopt more complex digital solutions, the need for specialized services, including implementation, integration, and maintenance, is rising. The growing focus on optimizing system performance, ensuring compliance, and enhancing user experience is further contributing to the demand for services. Additionally, the rise of managed services, where third-party providers handle ongoing operations, is expected to boost market growth. As digital transformation accelerates, the services segment is set to become a key growth driver.

By Deployment

The cloud segment dominated the market and accounted for a revenue share of more than 75% in 2023, due to its scalability, flexibility, and cost-effectiveness. Companies are increasingly adopting cloud-based platforms to lower infrastructure costs, enhance accessibility, and foster collaboration. Cloud solutions support real-time data processing, seamless updates, and the integration of advanced technologies like AI and IoT. The rising demand for remote work solutions, data storage, and disaster recovery further drives cloud adoption. Additionally, cloud platforms offer robust security features and ensure compliance with industry regulations, making them attractive to businesses across sectors such as finance, healthcare, and retail.

The on-premises segment is projected to experience the fastest growth during the forecast period, driven by the need for greater control over sensitive data and security. Industries such as banking, government, and healthcare, where data privacy and compliance are paramount, prefer on-premises solutions. The ability to tailor on-premises systems to specific organizational needs, coupled with increasing concerns over data sovereignty and cybersecurity, is fueling demand. As organizations continue to prioritize security and data integrity, the on-premises segment is expected to witness substantial growth in the coming years.

Regional Analysis

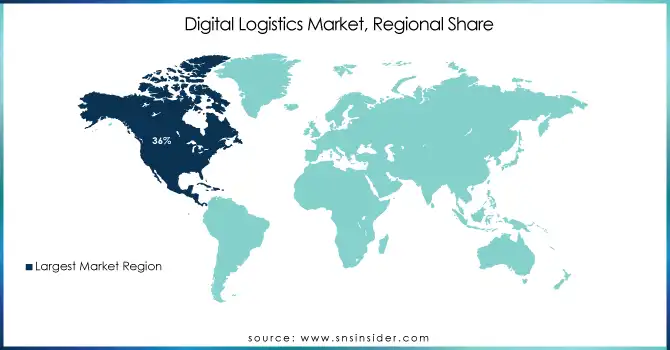

North America dominated the market and accounted for a revenue share of more than 36% in 2023, due to its early adoption of advanced technologies and a strong presence of key players. The region's highly developed infrastructure, coupled with its focus on digital transformation across industries, has fueled the demand for cloud-based solutions and advanced digital tools. The United States, in particular, is home to several major technology companies, making it a hub for innovation and technological advancements. Additionally, the increasing adoption of AI, IoT, and big data analytics in sectors like healthcare, finance, and retail has contributed to the region's market leadership. The strong regulatory environment and emphasis on data security also drive the adoption of advanced technologies in North America.

The Asia-Pacific region is expected to register the fastest CAGR during the forecast period, driven by rapid industrialization, urbanization, and digital transformation initiatives across emerging economies. Countries like China, India, and Japan are investing heavily in technology infrastructure, including cloud computing, AI, and IoT. The growing demand for automation, efficient supply chain management, and data-driven decision-making in sectors like manufacturing, agriculture, and retail is further fueling market growth. Additionally, the increasing adoption of smart cities and government initiatives to promote digitalization are expected to drive significant growth in the APAC region. As businesses in the region embrace digital tools, the market is poised for rapid expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players along with their headquarters

-

SAP – Walldorf, Germany

-

Oracle – Austin, Texas, USA

-

DHL Supply Chain – Bonn, Germany

-

IBM – Armonk, New York, USA

-

Tata Consultancy Services (TCS) – Mumbai, India

-

C.H. Robinson – Eden Prairie, Minnesota, USA

-

JDA Software (Blue Yonder) – Scottsdale, Arizona, USA

-

XPO Logistics – Greenwich, Connecticut, USA

-

Kuehne + Nagel – Schindellegi, Switzerland

-

Siemens – Munich, Germany

-

Geodis – Levallois-Perret, France

-

Ryder System – Miami, Florida, USA

-

Transplace – Frisco, Texas, USA

-

Manhattan Associates – Atlanta, Georgia, USA

-

Infosys – Bangalore, India

Recent Developments

-

In January 2024, discussions resurfaced regarding the privatization of the United States Postal Service (USPS), following significant financial losses of $9.5 billion in 2024. Privatization could lead to slower deliveries, higher shipping costs, and reduced services, particularly impacting remote areas. The USPS's "universal service obligation" ensures consistent rates nationwide, but without it, private companies may prioritize profit, potentially increasing costs, especially for rural deliveries.

|

Report Attributes |

Details |

|

Market Size in 2023 |

USD 28.7 Billion |

|

Market Size by 2032 |

USD 128.1 Billion |

|

CAGR |

CAGR of 18.13% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Solutions, Services) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

SAP, Oracle, DHL Supply Chain, IBM, Tata Consultancy Services (TCS), C.H. Robinson, JDA Software (Blue Yonder), XPO Logistics, Kuehne + Nagel, Siemens, Geodis, Ryder System, Transplace, Manhattan Associates, Infosys |

|

Key Drivers |

• The increasing demand for online shopping drives the need for efficient logistics solutions to manage inventory, track shipments, and ensure timely deliveries. |

|

RESTRAINTS |

• The cost of implementing advanced digital logistics technologies such as AI, robotics, and IoT can be prohibitive for small and medium-sized enterprises |