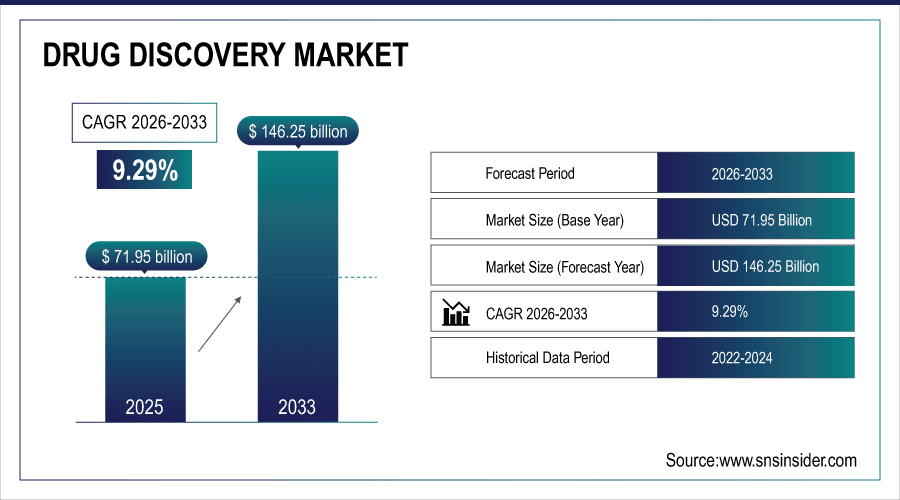

Drug Discovery Market Size and Growth Overview:

The global Drug Discovery Market size was estimated at USD 71.95 billion in 2025E and expected to reach USD 146.25 billion by 2033, growing at a CAGR of 9.29% during the forecast period 2026–2033.

The global drug discovery market is growing at an unprecedented pace due to over 7000 active drug development projects and the growing incidence of chronic & rare diseases. Small Molecules, which it is estimated make up nearly 60% of approved drugs, Biologics and Targeted Therapies are becoming increasingly prominent. High-throughput screening methods, AI-based modeling, genomics and proteomics techniques as well as enhanced collaborations across CROs and research institutes are the factors that are aiding in reducing timelines and driving market growth.

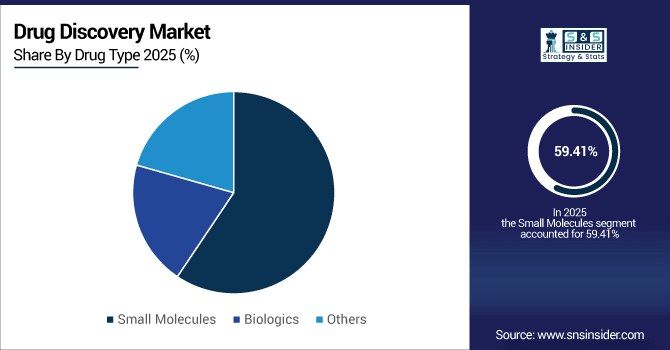

Small molecules accounted for 59% of the global drug discovery output in 2025, while biologics represented 34% and other modalities such as gene and cell therapies held 7%.

To Get More Information On Drug Discovery Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 71.95 Billion

-

Market Size by 2033: USD 146.25 Billion

-

CAGR: 9.29% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Drug Discovery Market Trends:

-

As of 2025, there were globally over 7,000 drug development programs ongoing, and that number is expected to reach more than 12,000 by 2033 because of the surge in demand for new treatments.

-

More than 40% of discovery projects used high-throughput screening in 2025, expected to grow to over 60% by 2033 due to increased application of automation.

-

In 2025, nearly 30% of discovery pipelines were backed up by AI and bioinformatics tools, projected to exceed 55% through 2033.

-

Small molecules accounted for 59% of drug candidates in 2025, but biologics and advanced therapies are going to secure up to around 50 per cent by the year 2033.

-

The global service provider contribution towards discovery activity was approximately 45% in 2025 and expected to surpass 65% by 2033.

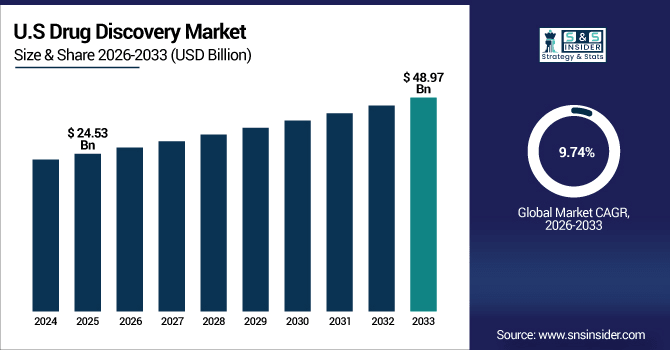

U.S. Drug Discovery Market Insights:

The US drug discovery market had value of USD 24.53 billion in 2025E and is estimated to reach around USD 48.97 billion by end of year 2033, expanding at a CAGR of 9.74%. Growth is underpinned by over 1,500 ongoing active drug development programs in oncology, neurology and rare diseases as well as robust R&D infrastructure and pharmaceutical-CRO partnerships.

Drug Discovery Market Dynamics

Drivers:

-

Growing Pipeline of Novel Biologics and Targeted Therapies Drives Expansion of the Global Drug Discovery Market.

The growth of biologics and targeted drugs is fueling strong drug discovery momentum. As of 2025, nearly 2,200 monoclonal antibodies, vaccines and cell or gene therapies were in clinical pipelines, representing closer to one-third of late-stage development programs. Their expanding use in the treatment of oncology, neurology and rare diseases is forcing pharmaceutical players and CROs to heavily reinvest into sophisticated platforms that will expedite innovation while broadening the scope for globalised discovery portfolios.

In 2026, biologics and advanced therapies are projected to represent 35% of late-stage drug discovery programs, becoming the fastest-growing segment globally.

Restraints:

-

Lengthy Regulatory Approval Processes and Stringent Compliance Requirements Hinder Timely Advancement of New Drug Discovery Programs.

Drug discovery is still slowed down by regulatory approval. In 2025, close to 38% of New Chemical Entities (NCEs) did not progress beyond Phase II because of the need for compliance as a barrier to commercialisation. The time for a new therapy to be developed and gain market approval is typically 10–12 years, with only around 12% of candidate treatments eventually being used by patients. These acquisition barriers impede innovation, elevate the cost of development and delay access to new biologics and targeted agents throughout the world.

Opportunities:

-

Growing Demand for Biologics and Targeted Therapies Presents Opportunities to Expand Drug Discovery Pipelines and Innovative Solutions.

Furthermore, the strong emergence of biologics and targeted therapies is generating a huge market for drug discovery. By 2025, more than 2,200 biologics and advanced therapy candidates were in actively development with close to 40 percent concentrated on oncology and rare diseases. Novel targeted therapies will surpass 4,000 globally by 2033, and when they do, we’ll see a more rapid development of precision drugs; diversity in pipelines; and better treatment options in the wards, research labs and CRO partnerships.

By 2026, biologics and targeted therapies are projected to represent nearly 38% of all new drug candidates in development, accelerating precision medicine globally.

Drug Discovery Market Segmentation Analysis:

-

By Drug Type, Small Molecules accounted for the largest market share of 59.41% in 2025, while Biologics are expected to record the fastest growth with a CAGR of 10.88%.

-

By Process, Target Identification & Validation held the largest market share of 33.47% in 2025, while Candidate Validation is expected to grow at the highest CAGR of 10.45%.

-

By Technology, High-Throughput Screening contributed the highest market share of 41.29% in 2025, while Bioinformatics is anticipated to expand at the fastest CAGR of 11.22%.

-

By End User, Pharmaceutical & Biotechnology Companies comprised 52.56% in 2025, while Contract Research Organizations (CROs) are projected to grow at the fastest CAGR of 10.13%.

By Drug Type, Small Molecules Lead While Biologics Accelerate Rapidly:

Small molecules are the discovery leaders, with more than 3000 candidates in active development by 2025, predominantly for chronic and infectious diseases. The biologics pipeline, which was about 1,500 candidates in 2025, will top 3,200 by 2033 driven by targeted therapies and precision medicine. The growing scale of biologics is fueling innovation across antibody, cell and gene therapies, serving to broaden the spectrum of treatments available for oncological, autoimmune and rare diseases globally.

By Process, Target Identification & Validation Dominates While Candidate Validation Grows Rapidly:

Target ID & Validation is still the key to start drug discovery, with more than 2,300 projects on going in 2025 from Oncology to Neuro and Rare Disease. Validation of candidates, which will be used in almost 1,400 programs by 2025, is projected to exceed 2,700 programs by 2033. This phase also quickens the pace with which promising molecules can be tested, thus facilitating quicker advancement into preclinical testing and allowing for faster and more accurate global development of new drugs.

By Technology, High-Throughput Screening Leads While Bioinformatics Expands Fastest:

High-throughput screening still prevails with over 1,800 screening campaigns by 2025 covering numerous disease targets and involving thousands of compounds. Analysis software, which is used in about 1,200 discovery programmes by 2025 will surpass over 2,500 by 2033 via the introduction of AI and machine learning. These approaches facilitate the move is toward reducing cycle time for target identification and ensure greater confidence in compound prediction that can increase efficiency and success rates for global discovery efforts.

By End User, Pharmaceutical & Biotechnology Companies Dominate While CROs Expand Fastest:

Pharmaceutical and biotech companies drive discovery efforts, directing more than 4,000 active programs in 2025 around the world. CROs are expected to engage in more than 3,800 projects in 2033 versus about 1,800 in the year 2025. Specialising in pipeline expansion Within pipeline, smaller biotech need to support their expanding clinical capabilities CROs shorten drug development timescales through specialisation support, advanced technologies and global experience CROs cut costs and help small biotech’s marshal specialist discovery skills efficiently.

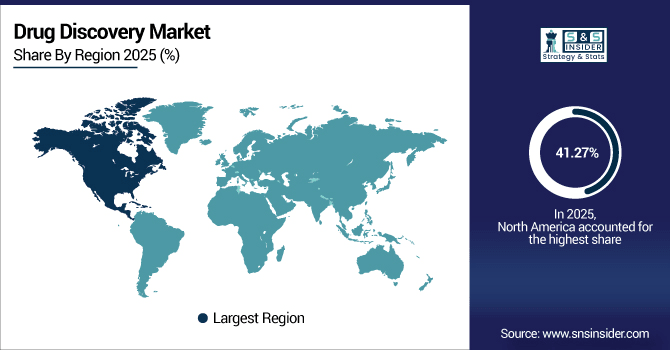

Regional Insights:

North America Drug Discovery Market Trends:

North America leads the global drug discovery market with a 41.27% share in 2025, driven by advanced pharmaceutical R&D infrastructure and strong biotech presence. More than 3,200 drug discovery programs were underway in the region as of 2025, across indications such as oncology, neurology and rare diseases. The partnership between pharma companies and CROs helped drive more than 1,500 preclinical and clinical programs, setting North America up for long-term market growth out through 2033.

In 2025, over 3,200 active drug discovery programs were underway in the U.S., spanning oncology, rare diseases, and neurology. Innovation driven by robust pharmaceutical and biotech presence; Over 1,500 CRO projects in operation. The R&D infrastructure, focus on precision medicines and expanding product pipeline of the biologics are making the U.S. as a leading drug discovery market in terms of size and growth.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia-Pacific Drug Discovery Market Trends:

The Asia-Pacific drug discovery market is projected to grow at a CAGR of 9.82% during 2026–2033, making it the fastest-growing region globally. In 2025, 1,200+ active drug discovery programs were running in oncology, neurology and rare diseases; there were 600+ CRO partnerships. Market expansion is supported by growing pharmaceutical R&D, rising biologics and targeted therapy pipelines, and favorable government policies. The region is projected to represent almost one-third of global drug discovery work by 2033.

China Drug Discovery Market Trends:

Asia-Pacific’s drug discovery industry is a relatively small player in the world market, and in 2025 China will be the regional leader with over 550 active drug discovery programs across oncology, neurology and rare diseases. Rapid growth of pharmaceutical R&D, increasing biologics and targeted therapy pipelines, over 300 CRO collaborations driving expansion.

Europe Drug Discovery Market Trends:

Europe has a few hundred plus early-stage drug development programs in 2025, on oncology, cardiovascular and neuro drugs. Pharmaceutical R&D is dominated by Germany, France and the UK, which sponsor more than 4 200 clinical and preclinical studies throughout the region. Strong government sponsorship, rising biologics and targeted therapy pipelines, and a rise in cross-border research collaborations are boosting the prominence of Europe as one of the most strategic drug discovery markets worldwide.

Germany Drug Discovery Market Trends:

Germany leads the way with more than 420 active drug development programs and over 1,200 preclinical and clinical studies in progress in the European drug discovery market by 2025. Germany is the largest drug discovery platform in Europe primarily because of its infrastructure for strong pharmaceutical R&D, increasing biologics, and targeted therapy pipelines, and government backing.

Latin America Drug Discovery Market Trends:

The Latin American drug discovery market is expanding steadily, with a projected CAGR of 9.01% through 2033. Brazil dominates the region with more than 210 active drug discovery programs in 2025. Mexico and Argentina are close behind, with rising pharmaceutical R&D, expanding biologics pipelines and government efforts to bolster clinical research and innovation across the region.

Middle East and Africa Drug Discovery Market Trends:

The Middle East & Africa drug discovery market is growing steadily, with over 180 active drug development programs in 2025. Leading the way are Saudi Arabia in advanced pharmaceutical R&D and biologics pipelines, with South Africa as the runner-up. Growing prevalence of govenrment funding, surge in targetted therapy programs and development of clinical research infrastructure support the regional growth.

Competitive Landscape:

Eli Lilly leads the global drug discovery market, particularly in targeted and biologic therapies. By 2025 the number of active drug discovery programs worldwide had surpassed 2,300. It covers oncology, neurology and rare diseases pipelines, with vertically integrated R&D of complement system, monoclonal antibody and small molecule. With Lilly’s knowledge of precision medicine and biologics innovation, they will steer the growth and leadership in the drug discovery market for years to come.

-

In September 2025, Eli Lilly launched TuneLab, an AI platform enabling biotech companies to access advanced drug discovery models.

Johnson & Johnson is a global leader in drug discovery across multiple therapeutic areas, including oncology, immunology, and neuroscience. As of 2025, the company had more than 2,100 active drug development programs and 1,100 collaborative research projects with academic and biotech partners. The strong product pipeline of small molecule, biologics and targeted therapeutics, coupled with cutting edge discovery platforms enhance its market presence and also make it a niche player worldwide.

-

In September 2025, J&J’s experimental psoriasis drug icotrokinra showed superior efficacy in late-stage, head-to-head clinical trials.

AbbVie dominates the drug discovery market, focusing on immunology, oncology, and targeted therapies. In 2025, AbbVie boasted of having more than 1,800 active drug discovery programs and collaborating with over 900 research institutions across the world. Its robust biologics pipeline and novel precision medicine strategies drive the speed of development, strengthen competitiveness, and establish AbbVie as a premier leader in the drug discovery space.

-

In August 2025, AbbVie invested $195 million to expand U.S. API manufacturing, supporting innovation and drug development capacity.

Drug Discovery Market Key Players:

-

Merck & Co.

-

Roche

-

Pfizer

-

AstraZeneca

-

Novartis

-

Bayer

-

GlaxoSmithKline (GSK)

-

Amgen

-

Sanofi

-

Bristol Myers Squibb

-

Abbott Laboratories

-

Gilead Sciences

-

Regeneron Pharmaceuticals

-

Vertex Pharmaceuticals

-

Eisai Co., Ltd.

-

Takeda Pharmaceutical Company

-

Biogen

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 71.95 Billion |

| Market Size by 2033 | USD 146.25 Billion |

| CAGR | CAGR of 9.29% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Process (Target Identification & Validation, Hit-to-Lead Identification, Lead Optimization, Candidate Validation, Others) • By Technology (High-Throughput Screening, Bioinformatics, Molecular Modeling & Simulation, Genomics, Proteomics, Others) • By Drug Type (Small Molecules, Biologics, Others) • By End User (Pharmaceutical & Biotechnology Companies, Contract Research Organizations (CROs), Academic & Research Institutes, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Eli Lilly, Johnson & Johnson, AbbVie, Merck & Co., Roche, Pfizer, AstraZeneca, Novartis, Bayer, GlaxoSmithKline (GSK), Amgen, Sanofi, Bristol Myers Squibb, Abbott Laboratories, Gilead Sciences, Regeneron Pharmaceuticals, Vertex Pharmaceuticals, Eisai Co., Ltd., Takeda Pharmaceutical Company, Biogen |