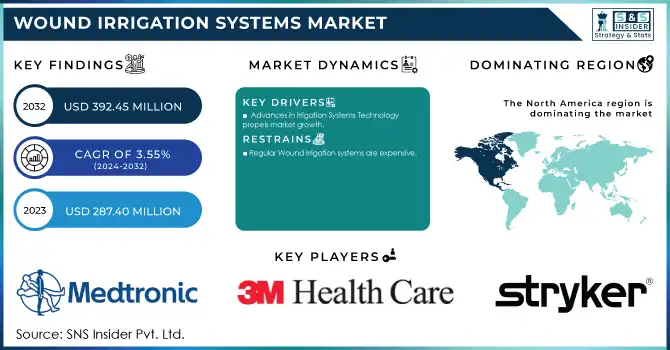

Wound Irrigation Systems Market Size & Overview:

The Wound Irrigation Systems Market was valued at USD 287.40 million in 2023 and is expected to reach USD 392.45 million by 2032, growing at a CAGR of 3.55% from 2024-2032.

To get more information on Wound Irrigation Systems Market - Request Free Sample Report

Infection prevention, advancements in healthcare infrastructure, and growing rates of chronic wounds are bringing a revolution in the wound irrigation systems market by increasing awareness regarding the most important factor in managing wounds. These systems are able to help wash out wounds, thus eliminating debris, bacteria, and necrosed tissue, facilitating wound healing, and minimizing the risk of complications.

The rise in diabetic ulcers, surgical site infections, and other traumatic wounds, particularly among the aging population, is the cause of market growth. Estimates from the International Diabetes Federation, project that 783 million people around the world will have diabetes by 2045.

More advanced irrigation systems with adjustable pressure controls, single-use saline solutions, and automated functions are gaining traction. Today, new therapeutic technologies, including portable battery-powered irrigation devices, have made wound care even more convenient and effective in both clinical and home settings.

Newer innovations include the introduction of green wound irrigation products that help minimize environmental impact along with antimicrobial agents in irrigation solutions to mitigate the risk of infection. Companies also are pursuing an R&D strategy to manufacture personalized wound care devices based on the wound type and the patient requirement.

Advances in technologies like automated irrigation systems and antimicrobial treatments help significantly enhance the effectiveness and attraction of wound irrigation systems for medical providers. The annual cost of treating chronic wounds in the U.S. is around USD 25 billion. Enhanced concern over infection control and safety is another recent trend, which encourages healthcare facilities to pursue comprehensive care of wounds with highly advanced irrigation systems that promote efficient cleaning and hydration of the wounds.

Increased focus on improving patient outcomes has also fueled investment in advanced wound care products. The developed regions with more developed healthcare infrastructure are the primary drivers of these high-end solutions. These developments mark a promising trend for the wound irrigation systems market as healthcare providers seek effective ways to manage wounds and expedite recovery.

Wound Irrigation Systems Market Dynamics

Drivers

-

The increasing incidence of chronic wounds, such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, is a major driver for the wound irrigation systems market.

According to the International Diabetes Federation, over 537 million adults will be living with diabetes in 2021, a number projected to reach 783 million by 2045. Chronic wounds are a common complication of diabetes, creating a significant demand for effective wound management solutions. Diabetic Foot Ulcers affect approximately 15% of people with diabetes globally. According to the Centers for Disease Control and Prevention, SSIs affect 2-5% of patients undergoing inpatient surgical procedures. Advanced wound irrigation systems can minimize infection risk and promote healing, thus emphasizing the need for better systems. In recent times, antimicrobial-infused irrigation solutions have been added to fight infections more efficiently during the process of wound care.

-

Advances in Irrigation Systems Technology propels market growth.

Advances in wound irrigation systems are increasing their effectiveness and convenience, promoting their use in medical institutions. The new-generation systems are automated pressure-controlled and portable with disposable parts, allowing for accuracy and asepsis in wound cleansing. for example, battery-powered portable irrigation equipment, which has become a favorite in outpatient clinics and home care settings, due to ease of use and simplicity. In addition, the introduction of advanced antimicrobial agents and hydrating solutions in irrigation systems has improved outcomes by reducing microbial load and promoting tissue regeneration. Recent launches, such as eco-friendly and single-use systems, address both clinical effectiveness and environmental concerns, further boosting market growth.

Restraint

-

Regular Wound irrigation systems are expensive.

The market growth of advanced wound irrigation systems is limited due to the high costs, particularly in low and middle-income areas. Due to the high cost of these systems, particularly those that have integrated features (such as automated functions, antimicrobial therapies, and transportability), the expense may be prohibitive to some healthcare privileges. While these systems minimize the chances of infections and enhance the quality of patient care, the prohibitive initial cost and ongoing maintenance expense may be out of the reach of smaller hospitals, outpatient clinics, and home care providers. Cost standpoint will hinder the rapid adoption of such sophisticated wound irrigation solutions, particularly in developing markets where demand for budget-friendly solutions is prevalent.

Wound Irrigation Systems Market Segmentation Insights

By Product

Manual segment dominated the market with a market share of 53% in 2023. This type of system is very specific to applying pressure via thumb-controlling for fluid application to a wound, which proves ideal for deep surgical wounds and areas difficult to heal. An increasing number of surgical site infections and diabetic foot ulcers should propel this segment to witness significant growth throughout the forecast period.

The battery-operated wound irrigation system segment is estimated to grow the fastest with a compound annual growth rate of 4.5%. This system allows for an easy and quick removal of necrotic tissue, foreign debris, and bacteria, thereby facilitating ease of use while minimizing cross-contamination risks. It is especially useful for treating burn injuries and chronic wounds, and the growing prevalence of burns is likely to spur growth in this segment.

By Application

The chronic wounds segment dominated the market and accounted for the highest share, at 33% in 2023, fueled primarily by increased chronic diseases worldwide, mostly diabetes. WHO's 2023 report found that NCDs caused 74% of all deaths; diabetes alone is responsible for causing 2 million deaths every year. Some contributory factors here include older-aged populations, malnutrition diets, sedentary lifestyles, and environmental hazards that include air pollutants. Notably, 86% of premature NCD-related deaths happen in low- and middle-income countries.

Due to the steady increase in these conditions worldwide, a proper wound irrigation system is one of the demands that are vital in the care and treatment of chronic wounds. Such systems are essential to improve patient care and healing outcomes as they mitigate the specific issues related to every type of chronic wound.

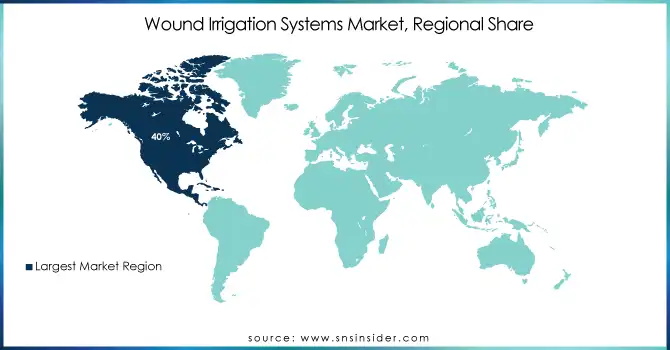

Wound Irrigation Systems Market Regional Analysis

In 2023, North America dominated the wound irrigation system market with a market share of 40%. The region benefits from a robust healthcare infrastructure, high awareness of advanced wound care practices, and the presence of major industry players. The increasing prevalence of chronic diseases such as diabetes and obesity also leads to an increased incidence of chronic wounds, thus driving demand for effective wound irrigation systems. In addition, the increasing number of surgical procedures and the emphasis on infection control further propel the market. As healthcare providers focus on adopting innovative solutions to improve patient outcomes, North America is likely to maintain its leadership position in the wound irrigation system market during the forecast period.

The Asia Pacific wound irrigation system market is expected to grow the fastest with a compound annual growth rate of 4.7% during the forecast period. This growth is driven by a significant increase in healthcare spending, which has spurred research and development efforts leading to new, advanced wound care products. This increase in chronic wound cases, specifically diabetic wounds, also contributes significantly to the expansion of the market. Additionally, an increase in awareness of the effective management of wounds and growing medical tourism have also contributed. With its immense population and vast, untapped markets, the Asia Pacific region offers significant scope for the growth of the wound irrigation system market as healthcare service providers look to provide better alternatives in treating wounds.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Stryker Corporation (Stryker Wound Irrigation System, Stryker Irrigator)

-

3M Healthcare (Clean Site Wound Irrigation System, Steri-Strip Wound Closure System)

-

Medtronic (Wound Irrigation System, Saline Irrigation Set)

-

ConvaTec (Wound Irrigation Syringe, Irrigation Solution Set)

-

Smith & Nephew (ALLEVYN Wound Irrigation Set, RENASYS Wound Therapy System)

-

Hollister Incorporated (Wound Irrigation Tray, Irrigation Syringe)

-

B. Braun Melsungen AG (Irrigation Solutions, Irrigation Set)

-

Johnson & Johnson (Ethicon Wound Irrigation System, Ethicon Fluid Irrigation System)

-

Coloplast (Wound Irrigation Tray, Wound Care Irrigation Solution)

-

Derma Sciences (Acelity V.A.C. Irrigation System, Acelity Wound Care Irrigation Kit)

-

C.R. Bard (Becton, Dickinson and Company) (Bard Wound Irrigation System, Bard Fluid Irrigation Set)

-

Mölnlycke Health Care (Mepilex Wound Irrigation Set, Mepilex Transfer Wound Dressing)

-

KCI Medical (V.A.C. Therapy Irrigation Set, KCI Wound Irrigation System)

-

Zimmer Biomet (Zimmer Biomet Wound Care System, Zimmer Biomet Irrigation Products)

-

Medline Industries (Medline Irrigation System, Medline Wound Care Irrigation Tray)

-

Integra LifeSciences (Integra Wound Irrigation Kit, Integra Irrigation Solution)

-

Wound Care Advantage (Wound Care Irrigation Set, Wound Care Fluid Irrigation Syringe)

-

Cardinal Health (Cardinal Health Wound Irrigation Syringe, Cardinal Health Irrigation System)

-

Vital Care Industries, Inc. (Vital Care Wound Irrigation Tray, Vital Care Irrigation Syringe)

-

Thermo Fisher Scientific (Thermo Fisher Wound Care Irrigation Solution, Thermo Fisher Fluid Irrigation Kit)

Key suppliers

These suppliers support the production of wound irrigation systems by providing critical components, materials, and technical expertise.

-

BASF SE Suppliers

-

Dow Inc. Suppliers

-

3M Purification Inc. Suppliers

-

Freudenberg Medical Suppliers

-

Eastman Chemical Company Suppliers

-

Phillips-Medisize Suppliers

-

DuPont Suppliers

-

Evonik Industries AG Suppliers

-

Henkel Adhesive Technologies Suppliers

-

DSM Biomedical Suppliers

Recent Developments

-

In September 2023, Stryker introduced the PROstep MIS Lapidus, a minimally invasive surgical system designed to address bunions. This innovative system aims to reduce bunion recurrence and minimize scarring, reflecting Stryker's commitment to improving surgical outcomes and advancing wound irrigation system technologies.

-

In 2024, ConvaTec Group Plc announced the results of a pivotal clinical study on its AQUACEL Ag+ Extra dressing, highlighting its effectiveness in managing venous leg ulcers and reinforcing its position in advanced wound care solutions.

-

In 2024, Mölnlycke Health Care strengthened its wound care portfolio by acquiring P.G.F. Industry Solutions GmbH, a leading manufacturer specializing in wound cleansing and moisturizing products.

-

In 2023, Coloplast completed the acquisition of Kerecis, a leading wound care company, for up to USD 1.3 billion. This acquisition significantly enhances Coloplast's portfolio in burn and skin wound care.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 287.40 million |

| Market Size by 2032 | US$ 392.45 million |

| CAGR | CAGR of 3.55% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Manual, Battery-operated) • By Application (Chronic Wounds, Burns, Surgical Wounds, Traumatic Wounds) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Stryker Corporation, 3M Healthcare, Medtronic, ConvaTec, Smith & Nephew, Hollister Incorporated, B. Braun Melsungen AG, Johnson & Johnson, Coloplast, Derma Sciences, C.R. Bard (Becton, Dickinson and Company), Mölnlycke Health Care, KCI Medical, Zimmer Biomet, Medline Industries, Integra LifeSciences, Wound Care Advantage, Cardinal Health, Vital Care Industries, Inc., Thermo Fisher Scientific, and other players. |

| Key Drivers | •The increasing incidence of chronic wounds, such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, is a major driver for the wound irrigation systems market. •Advances in Irrigation Systems Technology propels market growth |

| Restraints | •Regular Wound irrigation systems are expensive. |