Sexual Health Products Market Report Scope & Overview:

Get More Information on Sexual Health Products Market - Request Sample Report

The Sexual Health Products Market Size was valued at USD 118.83 Billion in 2023, and is expected to reach USD 243.83 Billion by 2032, and grow at a CAGR of 8.71% over the forecast period 2024-2032.

Sexually Transmitted Diseases (STDs) are the most common type of infection in human beings, and a significant share are diagnosed with many complications from STIs, while more than 1 million new Sexually Transmitted Infections (STIs) occur daily worldwide that have an average asymptomatic rate throughout infective stages based on data held by The World Health Organization (WHO). There are an estimated 2,7 billion people with either chlamydia (1 million new infections every day), gonorrhea, (78 million new cases each year) syphilis, or trichomoniasis.

Growing cases of sexually transmitted diseases like genital herpes, Human Immunodeficiency Virus ("HIV”), acquired immunodeficiency syndrome (AIDS), chlamydia infection, syphilis gonorrhea and its associated infections including vagina itching or vaginitis & trichomonas vaginalis well demands sexual health products to use condoms for preventing transmission STD dieses coming from HIV. For example, according to the World Health Organization (WHO) 2022 global estimates of prevalence and burden of disease for 2016-2030: HSV-1 & 2, more than half a billion people aged between 15 to49 years had an infection with genital Herpes Simplex Virus (HSV). Likewise, According to WHO estimates in 2021, approximately 38.4 million people were living with HIV worldwide.

MARKET DYNAMICS:

KEY DRIVERS:

-

Rising Prevalence of Sexually Transmitted Diseases Leading to Greater Demand for Convenient and Effective Sexual Health Products Boost Market Growth.

-

Increase in the Number of Sexual Wellness Initiatives by Government & Private Organizations to Create Awareness About Sexual Health are Responsible for the Sexual Health Products Market.

RESTRAINTS:

-

Stigma and Lack of Open Discussion About Sexual Wellness Products Hinder Market Growth.

-

Stringent Regulations Can Impact the Growth of Sexual Health Products.

OPPORTUNITY:

-

Government Initiatives Promoting Menstrual Hygiene are Expected to Drive the Growth of the Sexual Health Products Market.

-

Advertisement as well as Promotional Campaigns are Raising Awareness Regarding Menstrual Hygiene Provide Opportunities for Market Expansion.

MARKET SEGMENTATION ANALYSIS:

By Type

In 2023, the sex toys segment accounted for 37% of revenue share. Therefore, this position is mainly a result of growing consumer interest and the more general proliferation of sex toy use. They became a favorite especially because they have many important advantages to present. In addition to the ways, they can improve our sex lives and make orgasms even better than nature ever intended, numerous studies have shown that using one comes with a host of health benefits. The use of sex toys provides better pain management, quality and regular sleep patterns, less stress levels & even cognitive benefits resulting from it. This wide-ranging effect on health highlights the segment's strong market performance.

In June 2020, Trojan, a brand owned by Church & Dwight Co., Inc. rolled out Tantrix (sex toys). Trojan Tantrix is Trojan's first foray into the male sex toy market, as opposed to women–a curious pink condom locator display case. The new release marks a momentous expansion of Trojan's product portfolio consistent with the growing consumer demand for an array of sexual wellness products by consumers that meet a variety of needs and preferences. Introduction of Tantrix: The launch of the brand is part of the rising wave where new sexual health solutions are introduced to mainstream branding, which will further drive sex toys in the Sexual Wellness Market.

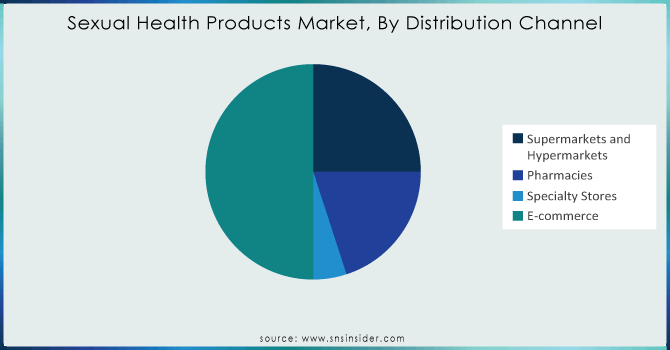

By Distribution Channel

By 2023, e-commerce-based pharmacies captured 51% of the market revenue. This growth is driven by online pharmacies getting smarter at providing personalized product recommendations and an enhanced customer experience leading to increased sales. Personalized tips from e-commerce pharmacies based on analysis of customer data to meet specialized consumer demands have worked wonders, and have been identified as an accelerator for market growth.

In addition, large numbers of consumers are hesitant to buy sexual health items at traditional brick-and-mortar stores because they fear the embarrassment or social stigma associated with it. These are all things that make consumers less inclined to purchase medications in-store, and more likely to complete the transition into e-commerce by ordering from an online pharmacy - where they can shop discretely while not leaving the comfort of their house. For example, take the strategic partnership struck between Doc Johnson Enterprises and start-up company Come Play. This joint venture demonstrates the changing face of e-commerce in sexual wellness. Industry heavyweight, Doc Johnson has partnered with Come Play to assist in material support through the prototype and production stages.

Need any customization research on Sexual Health Products Market - Enquiry Now

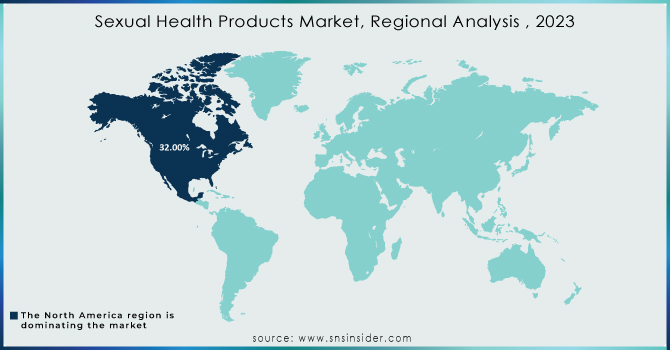

REGIONAL ANALYSIS:

In 2023, North America held a share of 32 %. This is mainly due to an increase in the patient population suffering from spinal disorders. In June 2021, Trojan, the brand belonging to Church & Dwight Co., Inc. introduced its range of condoms called Ultra Fit. Ultra-fit disc-shaped condoms are specially designed to offer a relaxed fit for blistering and lively pleasure. According to Vignesh Sundaram, the team is now discussing incorporating technology into sex toys in Europe with sexual wellness product providers. Some of the manufacturers are promoting their sexual health products based on motors and batteries, touch interfaces over buttons or dials, virtual reality/ artificial intelligence for response/control features as well focusing largely on developing stretchable skins. Various market players are intervening to introduce new technologies in this region & make it aware.

The drivers that are expected to grow the market of sexual wellness in the Asia Pacific region are increasing awareness regarding sexually transmitted diseases & infections, the emergence of new technological advancements, and a rise in development research and studies related to personal hygiene among others. Additionally, the surge in online and e-commerce channels aids in bolstering the sexual health market growth of this region.

KEY PLAYERS:

The key market players include Lovehoney Group, Mankind Pharma, Reckitt Benckiser Group plc., BMS Factory, Doc Johnson Enterprises, FUN FACTORY GmbH, Lifestyles, Karex Berhad, Lelo & Church & Dwight Co., Inc. & other players.

RECENT DEVELOPMENTS

-

Three new sex toys from sexual wellness company Durex launched in October 2023. The goal here is to try and allow for maximum enjoyment of the game, whether solo or with partners in any given situation. The new products are the Deep & Deeper anal plug, the Slide & Ride sleeve, and the Vibe&Tease vibrator.

-

Sirona acquires India's first vegan condom brand Bleü in May 2023. The latter is an India-based personal hygiene company. It signifies the brand's foray into India's burgeoning sexual wellness industry.

| Report Attributes | Details |

|

Market Size in 2023 |

US$ 118.83 Billion |

|

Market Size by 2032 |

US$ 243.83 Billion |

|

CAGR |

CAGR of 8.71% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Type (Sex Toys, Condoms, Lubricants, Female Contraceptives (OTC), Sexual Wellness Supplements (OTC), Performance Enhancement Products, Intimate Hygiene Products & Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Lovehoney Group, Mankind Pharma, Reckitt Benckiser Group plc., BMS Factory, Doc Johnson Enterprises, FUN FACTORY GmbH, Lifestyles, Karex Berhad, Lelo & Church & Dwight Co., Inc. & other players & other players |

|

Key Drivers |

•Rising Prevalence of Sexually Transmitted Diseases Leading to Greater Demand for Convenient and Effective Sexual Health Products Boost Market Growth. |

|

RESTRAINTS |

•Stigma and Lack of Open Discussion About Sexual Wellness Products Hinder Market Growth. |