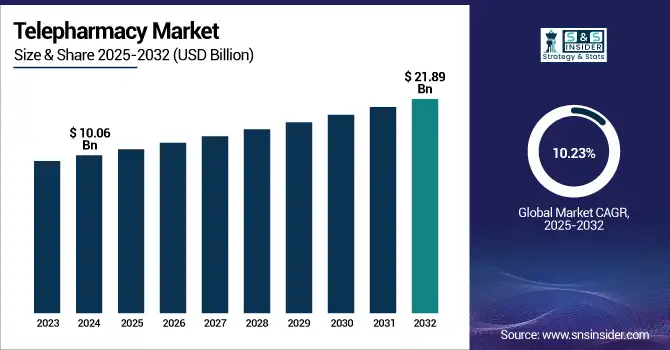

Telepharmacy Market Size Analysis:

The Telepharmacy Market size was valued at USD 10.06 billion in 2024 and is expected to reach USD 21.89 billion by 2032, growing at a CAGR of 10.23% over the forecast period of 2025-2032.

The demand for the telepharmacy market share is strongly driven by healthcare disparity between rural and urban areas, evolving digital health infrastructure, and regulation-backed initiatives. A gap in the availability of pharmacists and clinical services has led to an increase in the adoption of telepharmacy, driven by concern and interest in the 46.1 million Americans living in rural areas (CDC).

To Get more information on Telepharmacy Market - Request Free Sample Report

For instance, MedAvail and PipelineRx have been capitalizing on the technology to automate the process of drug dispensing; this automation is estimated to have cut down the dispensing error rate to 20% and the prescription processing by 50%, thereby contributing to the telepharmacy market trends.

A 2023 JAMA study discovered that rural areas employing telepharmacy services saw a 27% increase in medication adherence. Additionally, 89% of counties in the U.S. that have restricted access to pharmacies have demonstrated an orientation towards remote pharmacy solutions (Rural Health Research Center). Investments in digital health are also fueling growth; NIH reported more than USD 900 million in 2023 R&D funding aimed at remote patient management and pharmacy technologies. Additionally, CMS and state-level telehealth reimbursement expansions also contribute to the high telepharmacy market growth. The U.S. telepharmacy market is very dynamic at the moment, as over 30 states are changing laws to accommodate remote medication review and consultations by Pharmacists. These are not only increasing the telepharmacy market size, but also promoting service availability during health emergencies such as the COVID-19 pandemic and opioid overdoses.

In 2024, the CDC funded projects that permitted licensed pharmacists to write prescriptions pursuant to collaborative agreements, and that has facilitated the expansion of telepharmacy in underserved communities (CDC, Fall 2024 Telehealth Policy Report).

Telepharmacy Market Dynamics:

Drivers:

-

Rising Digital Infrastructure, Policy Support & Chronic Disease Burden Drives Market Growth

Rising prevalence of chronic diseases, coupled with shortfalls of healthcare professionals and government-level support for the growth of digital health, will drive the telepharmacy market. In the U.S., approximately 133 million people have chronic health conditions that necessitate ongoing medication use and consultations with their pharmacist. The CDC reports that there are 0.5 pharmacists per 1,000 people in rural counties, as opposed to 1.2 in their urban counterparts, representing a large void filled by telepharmacy platforms. The FDA’s 2023 Digital Health Policy and the DEA’s relaxation of restrictions on remote prescribing provided further grounds for growth. Broadband deployment has been accelerated through federal programs such as the recently enacted USD 65 billion Infrastructure Investment and Jobs Act, with broadband to be expanded and improved in rural and unserved areas.

At the same time, telepharmacy technology investments were exploding, and more than USD 1.2 billion of funding was raised in 2023, according to Rock Health. Pharmaceutical tech R&D investment grew by 11.7% as companies such as Omnicell and Pharmsmart unveiled smart dispensing units and virtual pharmacist consults. Interoperability standards such as HL7 and FHIR are contributing to the increasing share of the market for telepharmacy. These are positive ways for seeing the future in the telepharmacy market analysis, as innovation-led momentum has been showing strategic momentum in healthcare systems.

Restraints:

-

Regulatory Disparities, Technological Barriers & Trust Deficit Hamper the Market Expansion

Despite the high acceleration in the market, the telepharmacy growth trajectory is bound to face headwinds as a result of fragmented regulations, technological hurdles to adoption, and a trust deficit between patients and providers. Although 38 U.S. states allow telepharmacy in one form or another, the degree of supervision, licensure, and prescription supply requirements vary significantly, which causes inefficiencies in operations.

For instance, in the US, some states require face-to-face supervision from a pharmacist even for virtual visits, restricting the scaling possibilities. In addition, an estimated 14.5 million Americans in rural areas continue to have no reliable access to the internet (FCC, 2023), and the absence of such access increases the need for rural telepharmacy services.

Data privacy, HIPAA compliance also have substantial risks, as NIST identified over 600 breaches in healthcare-related cybersecurity at the time of reporting in 2023, leading to a lack of confidence in the system. And in aging populations, who are also key consumers of pharmacy services, digital literacy can be even more difficult, according to Pew Research that only 26% of adults aged 65+ are very comfortable using telehealth platforms. There are still restrictions on R&D, particularly for small telepharmacy organizations that are unable to get federal grants due to the application process is so competitive. Rural health clinics may not have the resources or funds to invest in high-tech AI-driven dispensing systems as urban hospitals might.

Telepharmacy Market Segmentation Analysis:

By Service Type

The Remote dispensing segment held the largest share of the telepharmacy market in 2024, 42.7%, as automated dispensing systems/remote dispensaries (ADRs) and centralized automated prescription dispensing systems (CAPDS) were the most widely used form of telepharmacy. Remote dispensing has become more common in hospitals and rural clinics, allowing patients to have fewer trips to the pharmacy, improve medication dispensing, and increase pharmacy access in areas with limited resources.

The Patient Counseling segment is expected to register the highest growth, driven by growing drug development and a rise in emphasis on medication non-adherence and patient education. Video conferencing technology has improved, and AI-based medication guidance platforms have been integrated, helping to optimize the provision and individualization of counselling in a highly interactive and widely scalable context, this time focused on a wide variety of patients.

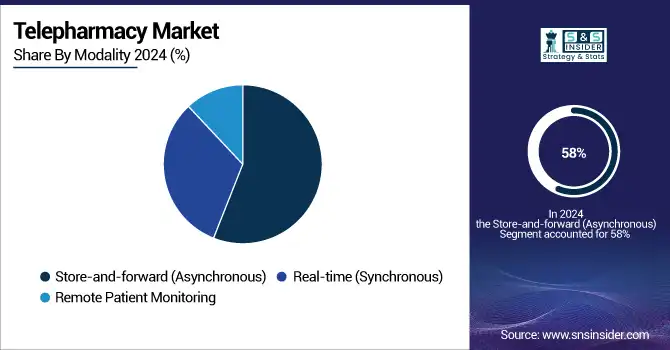

By Modality

In 2024, the Store-and-forward (Asynchronous) market segment led the largest share of the market, based on application, due to its capability to send medical information such as prescriptions, medication history, and diagnostic tests without needing the transfer to be simultaneous. Especially in areas with low internet bandwidth, in other time zones, this model works well.

The Real-time (Synchronous) segment will be the fastest growing, owing to the need for immediate pharmacist consultations, and monitoring patient response in real time. Use of secure video platforms and the availability of real-time analytics continue to expand, enabling personalized and timely pharmaceutical care, particularly in an acute or chronic care environment.

By End-user

By end-user, healthcare facilities accounted for a considerable 38.9% market share in 2024 and can be attributed to the emergence of massive telepharmacy use in hospitals, clinics, and nursing homes for medication therapy management, and reducing pharmacy wait times.

Homecare is anticipated to register the highest growth rate and largest market share during the forecast period, due to telepharmacy services are well-suited for a decentralized, patient-centered care model that is continuing to emerge. This trend has gained momentum through the proliferation of home-based chronic care management and the use of virtual pharmacist visits and smart drug reminders that increase convenience and minimize hospital readmissions.

Telepharmacy Market Regional Insights:

Based on region, the global telepharmacy market was dominated by North America in 2024, which was attributed to strong digital infrastructure, proliferation of healthcare digitalization, and supportive reimbursement policies. With more than 85% internet penetration and wide adoption of telehealth across hospital networks, the U.S. was leading the way in the region. The U.S. telepharmacy market size was valued at USD 3.72 billion in 2024 and is expected to reach USD 7.14 billion by 2032, growing at a CAGR of 8.54% over the forecast period of 2025-2032. Growth of telehealth coverage for Medicare and Medicaid, and from the Center for Connected Health Policy, are major market driving factors. In the U.S., there are telepharmacy laws in 30 states, permitting remote dispensing and pharmacist consultations. Canada is the second biggest market and benefits from provincial telepharmacy regulations and more comprehensive federal investments for rural healthcare access. Mexico is also embracing telepharmacy slowly, buoyed by healthcare digitization policies, but it is behind in infrastructure.

Europe is also a mature and growing telepharmacy market, largest share and rapid growth of Germany also owed to favorable eHealth regulations and clout of teleconsulting with the nationwide introduction of e-prescriptions in 2024. The digital health strategy of Germany has facilitated the spread of telepharmacy services in urban and rural clinics. France and the UK are next in line, motivated by national digitization of health services and chronic disease management programs. The fastest-growing market in Europe is Poland, driven by the digital health projects financed by the EU, and owing to the high adoption rate due to an aging population demanding remote care. With the rise of pharmacy deserts in rural areas, Poland is swiftly shifting toward telepharmacy as a store-and-forward service for reducing the access gaps.

Asia Pacific is projected to witness the highest growth over the forecast period owing to growing digital infrastructure, rising rural-urban health disparity, and increasing government support towards telehealth. India is a thriving country with a large population and widespread mobile penetration, and initiatives such as Ayushman Bharat Digital Mission, which aims to promote telemedicine in remote areas. India is seeing an increasing need for remote care tools as local telepharmacy startups are beginning to gain traction alongside regulatory support from the Health Ministry. China, too, is growing rapidly, due in part to its Healthy China 2030 initiative and growing private investments in AI-enabled digital health. Japan and Australia are making steady moves ahead with mature digital health systems and an increasing elderly population, which supports the out-of-harm way remote pharmacy task.

MEA is one of the rising regions in the telepharmacy market, which will be witnessing steady growth. South Africa is leading the way in driving the adoption of mHealth solutions and telepharmacy pilot programs in public clinics to close the gap in rural healthcare. UAE and Saudi Arabia are growing rapidly, thanks to the national digital health programs, including Vision 2030 and the government initiatives in remote health care programs in place. Telepharmacy is becoming increasingly popular in Latin America, mainly in Brazil, where the practice is on the rise largely as a result of Brazil’s sizeable population and government pushes to digitize its public health services, for instance, through Telessaúde Brasil.

Get Customized Report as per Your Business Requirement - Enquiry Now

Telepharmacy Market Key Players:

Prominent telepharmacy companies in the market include GoodRx, CarepathRx, LOCKE BIO, HevaHealth, NeoHomeRx Technologies, American Well, Teladoc Health, eleClinic, Kranus Health, MedKitDoc, Medley Medical Solutions, and Cardinal Health.

Recent Developments in the Telepharmacy Market:

-

In April 2025, Bingham Healthcare expanded its service offerings in Pocatello by launching a new telepharmacy, alongside ER behavioral health and neurology care, to improve patient access in underserved communities.

-

In December 2024, Avel eCare announced the acquisition of Hospital Pharmacy Management to expand its telepharmacy and clinical support services, enhancing medication management capabilities across rural and underserved hospital networks.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 10.06 Billion |

| Market Size by 2032 | USD 21.89 Billion |

| CAGR | CAGR of 10.23% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Patient Counseling, Patient Monitoring, Remote Dispensing (Prescription, Over-the-counter), and Others) • By Modality (Store-and-forward (Asynchronous), Real-time (Synchronous), and Remote Patient Monitoring) • By End-user (Healthcare Facilities, Homecare, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | GoodRx, CarepathRx, LOCKE BIO, HevaHealth, NeoHomeRx Technologies, American Well, Teladoc Health, eleClinic, Kranus Health, MedKitDoc, Medley Medical Solutions, and Cardinal Health. |