Wound Closure Market Report Scope & Overview:

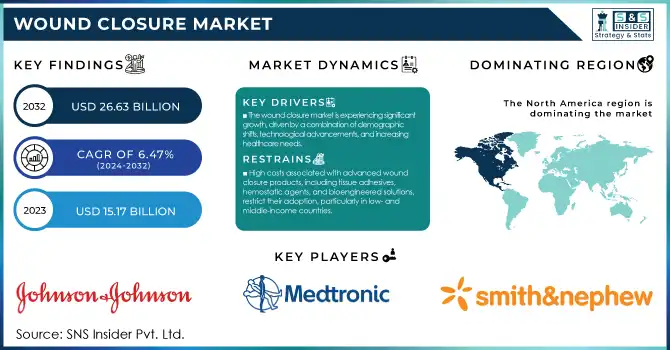

The Wound Closure Market size was estimated at USD 15.17 billion in 2023 and is expected to reach USD 26.63 billion by 2032 at a CAGR of 6.47% during the forecast period of 2024-2032. The report examines key trends and developments within the wound closure device market. It highlights regional variations in the adoption of these devices, emphasizing the increasing preference for advanced solutions across both developed and emerging markets. The analysis also covers healthcare spending specific to wound care, exploring how regional differences in expenditure influence market dynamics. Additionally, the report explores the regulatory landscape, discussing current and evolving regulations that shape the development, approval, and use of these products, providing valuable insights for stakeholders navigating the sector.

To Get More Information on Wound Closure Market - Request Sample Report

The report examines key trends and developments within the wound closure device market. It highlights regional variations in the adoption of these devices, emphasizing the increasing preference for advanced solutions across both developed and emerging markets. The analysis also covers healthcare spending specific to wound care, exploring how regional differences in expenditure influence market dynamics. Additionally, the report explores the regulatory landscape, discussing current and evolving regulations that shape the development, approval, and use of these products, providing valuable insights for stakeholders navigating the sector.

Wound Closure Market Dynamics:

Drivers

-

The wound closure market is experiencing significant growth, driven by a combination of demographic shifts, technological advancements, and increasing healthcare needs.

An important aspect is the growing rate of chronic conditions, including diabetes and cardiovascular disease, that often lead to an increased number of non-healing wounds. With an aging world population, more older adults become prone to chronic wounds and injuries, further driving this issue. Advances in technology through the use of smart bandages and new and innovative products for wound care have increased treatment effectiveness and, therefore, better patient outcomes, and are expanding the market. Raising awareness of how proper wound closure is essential creates a demand for the adoption of specialized wound-closing products. Improved surgical procedures all over the world continue to create high demands for minimal complications and speedier healing post-surgery processes. These considerations are driving factors in the ongoing growth of wound closure.

Restraints

-

High costs associated with advanced wound closure products, including tissue adhesives, hemostatic agents, and bioengineered solutions, restrict their adoption, particularly in low- and middle-income countries.

Limited reimbursement policies and strict regulatory clearances required for new technologies for wound closure limit penetration into the market. Moreover, infections, allergies, and longer healing times resulting from some modes of wound closure might deter general application. Also, the use of alternative techniques to heal wounds, such as regenerative medicine and negative pressure wound therapy, would reduce the demand for traditional closure techniques.

Opportunities

-

The wound closure market presents several growth opportunities driven by innovation and increasing healthcare needs.

New advancements in biomaterials, nanotechnology, and regenerative medicine present novel solutions that would speed up the healing of wounds faster. Telemedicine and digital wound care monitoring enable the remote management of patients, opening new market possibilities. The rising markets of Asia-Pacific, Latin America, and Africa also pose attractive opportunities in these regions as their healthcare infrastructures are developed and medical tourism increases. Increased investment in research and development for bioengineered skin substitutes, smart wound dressings, and minimally invasive wound closure solutions further contribute to market expansion.

Challenges

-

The wound closure market faces challenges, including regulatory hurdles for new product approvals, which can delay commercialization.

Specialized training on the use of advanced wound closure techniques among healthcare professionals has been a key barrier to its adoption. Second, patient heterogeneity in terms of wound healing is also largely influenced by such factors as age, underlying disease, and lifestyle, making the standardization of treatment protocols extremely difficult. Also, supply chain disruptions, mainly for high-tech wound closure materials, may significantly affect market growth, especially under economic or geopolitical instability.

Wound Closure Market Segmentation Analysis:

By Product Type

Sutures dominated the wound closure market in 2023 with a 48.1% share because of their widespread use in surgical procedures under different specialties such as general surgery, orthopedics, and gynecology. Sutures are considered to be a gold standard for wound closure because of the strength that they provide for wound support, their cost-effectiveness, and their compatibility with tissue types. A rise in surgical procedures globally coupled with the prevalence of trauma cases has helped in sustaining the demand for sutures.

However, the hemostatic agents segment will most likely grow the fastest throughout the forecast period. The increasingly significant adoption of these agents in surgical procedures for rapid bleeding control, coupled with the evolution of bioengineered and fibrin-based hemostatic products, is fueling this growth. The increasing number of minimally invasive surgeries and laparoscopic procedures has also increased the demand for effective hemostatic agents that promote clotting and wound healing without the need for traditional suturing. As healthcare providers seek faster, more efficient wound closure solutions, the hemostatic agents market is expected to experience substantial expansion, particularly in emergency and trauma care settings.

By Application

The general surgery segment dominated the wound closure market with a 56.3% share in 2023 due to a high number of surgical procedures around the globe. General surgeries encompass abdominal, colorectal, and emergency surgeries, these operations rely on a foolproof closure method to ensure patients do not become infected quickly or heal. Therefore, increasing the prevalence of disorders such as hernias, appendicitis, and gastrointestinal problems has added up to its lead. In addition, the demand for better postoperative wound care technology has made advancements in wound closure technologies ongoing and has thus intensified the growth within the segment.

The cardiology segment is going to be the fastest-growing within the forecasted period. Key drivers for growth in this industry include an increasingly prevalent rate of cardiovascular diseases and increased interventional cardiology procedure adoption along with the development of advanced vascular closure devices. Minimally invasive cardiac surgeries and catheter-based interventions demand efficient wound closure solutions to evade potential complications like bleeding and infections. Moreover, the developments in bioabsorbable and sutureless closure devices have improved patient recovery, and cardiology is one of the most dynamic segments of the wound closure market.

By End-User

The hospitals & ambulatory surgical centers (ASCs) segment remained the largest because the number of surgical interventions conducted here is high. Hospitals remain primary centers for complex and emergency surgeries and thus require advanced solutions for wound closure to achieve the best outcomes among their patients. The availability of skilled healthcare professionals, well-equipped operating rooms, and reimbursement policies favoring in-patient treatments further support the position of this segment. ASCs are also gradually becoming popular due to their reduced cost and shorter time taken by the patient for recovery, thus making outpatient surgeries a preferred choice.

The specialty clinics segment is expected to grow the at the highest CAGR during the forecast period. Specialized wound care centers, dermatology clinics, and plastic surgery clinics have increased the demand due to the available advanced wound closure products. These clinics offer treatment plans patient-specific, minimal invasion procedures, and cost-effective outpatient care much aligned with the shift to personalized medicine. With outpatient care on the increase in health care delivery, specialty clinics should expect huge growths in this market, particularly in aesthetic and chronic wound management.

Wound Closure Market Regional Outlook:

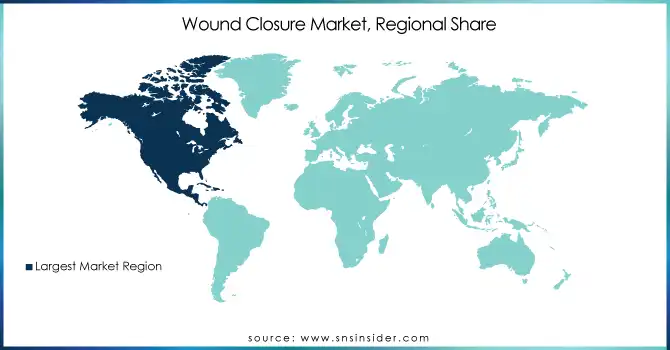

North America dominated the wound closure market in 2023 due to the high volume of surgical procedures, a well-established healthcare infrastructure, and the presence of major industry players. The rising prevalence of chronic diseases such as diabetes and cardiovascular disorders, coupled with a strong reimbursement framework, further drives market growth in the region. Additionally, continuous advancements in wound closure technologies, including bioengineered wound healing products and smart wound dressings, contribute to North America’s dominance.

Europe followed as a major market, driven by the growing geriatric population, increasing surgical interventions, and government initiatives supporting advanced wound care solutions. Countries such as Germany, France, and the UK are at the forefront, benefiting from technological advancements and strong healthcare policies promoting efficient wound management.

The Asia-Pacific region is anticipated to experience the fastest growth during the forecast period. Factors such as a rapidly aging population, increasing surgical procedures, rising awareness of wound care management, and improving healthcare infrastructure in emerging economies like China, India, and Japan are fueling market expansion. Additionally, medical tourism and government investments in healthcare advancements contribute to the region’s growth.

Do You Need any Customization Research on Wound Closure Market - Enquire Now

Key Players and Their Offering Products Related to the Wound Closure Market:

-

Johnson & Johnson Services, Inc. – Ethicon Sutures, Dermabond, Prolene, Vicryl, Monocryl

-

Medtronic – Endo Stitch, V-Loc Sutures, AbsorbaTack, Polysorb Sutures

-

3M – Steri-Strips, Precise Skin Stapler

-

Smith+Nephew – PDS II Sutures, Endo Clip, Allevyn

-

B. Braun SE – Monosyn, Safil, Stratafix

-

Stryker – Stryker Staplers, FlexTack

-

Baxter – TachoSil, Floseal

-

Boston Scientific Corporation – Resolution Clip, EndoClip

-

Frankenman International Ltd. – Surgical Staplers, Wound Closures

-

CooperSurgical Inc. – Surgical Sutures, Forceps

-

Intuitive Surgical – Robotic Surgical Instruments, EndoWrist Suturing

-

MANI, INC. – Surgical Sutures, Needles

-

Artivion, Inc. – Bioprosthetic Devices, Hemostatic Agents

-

CP Medical (Riverpoint Medical) – Sutures, Wound Closure Kits

-

CONMED Corporation – Surgical Staplers, Sutures

-

Genesis Medtech – Sutures, Staplers

-

Cardinal Health, Inc. – Sutures, Staplers

-

Essity AB – Adhesive Bandages, Dressings

-

Medline Industries, LP – Sutures, Staples, Adhesive Strips

Recent Developments:

In March 2024, Intuitive Surgical received FDA 510(k) clearance for its fifth-generation multiport robotic system, the da Vinci 5. This system enhances accuracy and features a next-generation 3D display, building on the success of the da Vinci Xi, which has been used in over seven million procedures globally.

In July 2023, SYNDEO Medical announced a multi-year global distribution agreement with Clozex Medical, Inc., a US-based leader in advanced wound closure solutions. This strategic partnership aims to enhance patient care and revolutionize wound closure treatments worldwide.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 15.17 Billion |

|

Market Size by 2032 |

USD 26.63 Billion |

|

CAGR |

CAGR of 6.47 % From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Product Type [Sutures (Absorbable, Non-Absorbable), Hemostatic Agents (Active Hemostats, Passive Hemostats, Combination Hemostats, Others), Staplers (Powered, Manual, Others)] |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Johnson & Johnson Services, Inc., Medtronic, 3M, Smith+Nephew, B. Braun SE, Stryker, Baxter, Boston Scientific Corporation, Frankenman International Ltd., CooperSurgical Inc., Intuitive Surgical, MANI, INC., Artivion, Inc., CP Medical (Riverpoint Medical), CONMED Corporation, Genesis Medtech, Cardinal Health, Inc., Essity AB, Medline Industries, LP. |