Global Artificial Insemination Market Overview:

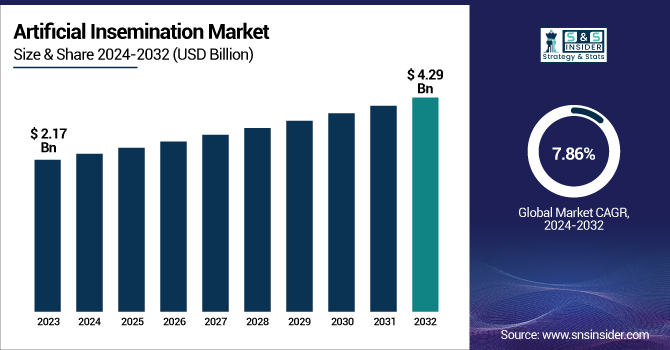

The Artificial Insemination Market size was valued at USD 2.17 billion in 2023 and is expected to reach USD 4.29 billion by 2032, growing at a CAGR of 7.86% from 2024-2032.

To Get more information on Artificial Insemination Market - Request Free Sample Report

This report on the Artificial Insemination Market provides insights in the form of detailed statistical metrics, differentiating it from traditional analysis. It contains region-specific rates of infertility, patterns of procedural utilization, and trends in donor sperm use, providing granular insights into global drivers of demand. Additionally, it analyzes the cost burden on patients by contrasting procedure costs and out-of-pocket spending across regions. The report also delves into clinic-level adoption of insemination media and technologies, with emphasis on operational change and innovation penetration.

U.S. Artificial Insemination Market Analysis

The U.S. Artificial Insemination Market was valued at USD 0.48 billion in 2023 and is expected to reach USD 0.49 billion by 2032, growing at a CAGR of 7.51% from 2024-2032. The United States is dominant in the North American Artificial Insemination Market with its highly established fertility centers, increasing incidence of infertility, and high levels of adoption of assisted reproductive technology. Strongly developed regulatory bodies and growing knowledge of advanced reproduction facilities also explain why the United States leads in the region.

Artificial Insemination Market Dynamics

Drivers

-

Rising Global Infertility Rates Fueling Demand for Artificial Insemination is propelling the market growth.

Infertility is rising to a growing concern worldwide, with an estimated one in six individuals affected, according to the World Health Organization (WHO) in 2023. The uptick has given rise to an added demand for assisted reproductive technologies (ART), including artificial insemination. Lifestyle elements of heightened stress levels, obesity, delayed pregnancies, and rising rates of reproductive disorders like PCOS and endometriosis are key drivers. As natural conception grows more difficult for so many, couples are now resorting to intrauterine and intracervical insemination options as cost-friendly and less invasive alternatives to in vitro fertilization (IVF). Fertility clinics and fertility centers all over the globe are extending their services to offer artificial insemination, and donor sperm banks further aid in fuelling the expansion of this market segment. Public health awareness campaigns and healthcare reimbursement in several countries are also contributing to the normalization and facilitation of treatment uptake.

-

Advancements in AI-compatible fertility Devices and Media are driving the market growth.

Advances in technology are driving efficiency and success rates in artificial insemination procedures, making them more attractive to clinicians and patients alike. Advances include precision-controlled insemination catheters, AI-optimized sperm selection, and improved insemination media. For instance, in October 2024, Cook Medical released its NestVT Vitrification Device in the U.S., improving cryopreservation and transfer procedures. In the same manner, firms such as Vitrolife and CooperSurgical are investing in IVF platforms digitalized to normalize fertility treatment protocols. These instruments not only increase the success rate of insemination procedures but also minimize the possibility of complications. Along with growing automation in fertility clinics and increasing adoption of digital health platforms, these technologies guarantee more tailored, data-driven reproductive healthcare. The intersection of medical devices, software, and diagnostic capabilities is likely to keep transforming the artificial insemination space.

Restraint

-

Limited Access and Affordability in Low- and Middle-Income Countries are restraining the market from growing.

As impressive as technological leaps and increased international awareness have become, access to artificial insemination continues to be markedly restricted throughout most low- and middle-income countries (LMICs). Procedures are unaffordable in many places due to high charges, inadequate facilities, and a lack of insurance coverage. In most settings, artificial insemination is out of pocket with no coverage in the public system, leaving citizens to pay with their finances, which most cannot afford. Furthermore, insufficient access to trained reproductive health experts and fertility centers within rural and low-income regions constrains market reach. Stigma and insufficient awareness of infertility therapies also discourage uptake of artificial insemination within such areas. Variation in healthcare provision between countries poses a deficit of treatment options to impede fast global market development and to prevent fair delivery of fertility care. Overcoming this challenge demands collaborative policy and investment action.

Opportunities

-

Expansion of Fertility Services in Emerging Markets presents a significant opportunity for market growth.

Growing economies pose a tremendous growth prospect for the artificial insemination market on account of growing awareness of infertility, enhanced healthcare infrastructure, and increased disposable income. Asia Pacific nations, Latin American countries, and regions of the Middle East are experiencing expanding demand for assisted reproductive technologies (ART), facilitated by steady cultural acceptability and support from the government. In addition to this, there is fertility tourism on the rise as patients get cheaper and superior treatments from elsewhere, particularly India, Thailand, and Mexico. Private providers and fertility chains are quickly expanding within these markets to provide specialized procedures and low-budget packages. As urbanization accelerates and the availability of fertility clinics increases, such markets will be crucial in fueling the global use of artificial insemination solutions and so constitute a strategic area for market growth and investment.

Challenges

-

Ethical, Religious, and Legal Concerns Surrounding Artificial Insemination are challenging the market's progress.

The market for artificial insemination still grapples with ethical and legal issues that differ by region and culture. Religious and societal attitudes in many countries shape attitudes toward assisted reproduction, tending to resist or ban outright procedures involving donor sperm or single-parent fertility treatment. Legal systems also diverge widely, with some countries having no regulations on parental rights, donor anonymity, or embryo use. These differences are expected to confuse patients and constrain global cooperation in fertility services. Moreover, controversies surrounding the commodification of reproduction and the selective genetic screening of offspring add further challenges. Such issues tend to lead to limiting policies, diminished public funding, and low public acceptance, which may compromise the expansion of the market. Solving these challenges involves an even-handed response consisting of stakeholder consultation, education of the public, and regulatory transparency to ensure ethical and inclusive development.

Artificial Insemination Market Segmentation Analysis

By Type

The Intrauterine Insemination (IUI) segment dominated the artificial insemination market with a 70.14% market share in 2023 because of its high success rate, affordability, and less invasiveness as compared to other insemination methods. IUI is the process of directly placing washed and concentrated sperm into a woman's uterus at the time of ovulation, which enhances the chances of fertilization by shortening the distance sperm need to travel. It is commonly recommended as a first-line treatment for unexplained infertility, mild male factor infertility, and cervical mucus problems, and is thus a popular choice among both patients and physicians. In addition, IUI is frequently reimbursed by insurance in most developed economies, and the treatment can be conducted in hospitals and outpatient facilities with comparatively low operating expenses. With its equilibrium of efficacy, accessibility, and affordability, IUI remains the preeminent form in the artificial insemination market.

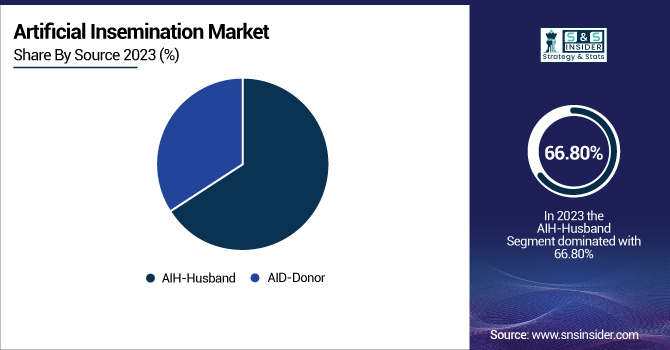

By Source

The AIH-Husband (Artificial Insemination by Husband) segment dominated in the artificial insemination market with a 66.80% market share in 2023, largely because of its general acceptance, fewer ethical and legal issues, and greater use among couples with mild to moderate male infertility. AIH procedures are widely opted for in conventional marital unions where donor sperm is not utilized based on religious, cultural, or emotional grounds. The procedure also does away with the intricacies involving donor screening, consent, and anonymity, which are usually involved with AID (Artificial Insemination by Donor).

Moreover, breakthroughs in semen processing and techniques for enhancing sperm motility have increased AIH efficiency and viability. AIH is usually recommended by fertility clinics as a first-line treatment option where male partners are infertile but possess viable sperm, requiring support with timing and delivery of the sperm. All these factors combined to contribute to the segment's large market share in 2023.

By End Use

In 2023, the Fertility Clinics & Other Facilities segment dominated the artificial insemination market with a 54.12% market share because of the growing demand for professional and medically controlled reproductive treatments. These clinics provide specialized facilities, sophisticated equipment, and skilled medical personnel, making success rates much higher than at home insemination. Patients more and more prefer clinical environments where they undergo detailed diagnostic testing, individualized treatment plans, and appropriate monitoring throughout the insemination process. Fertility clinics have widened their services to include psychological counseling, genetic screening, and cryopreservation, allowing patients to get a one-stop solution. Increased awareness regarding fertility treatment, the improvement of insurance coverage for various countries, and increased social acceptance of assisted reproductive technologies have also motivated individuals to undergo treatment from clinics.

Regional Insights

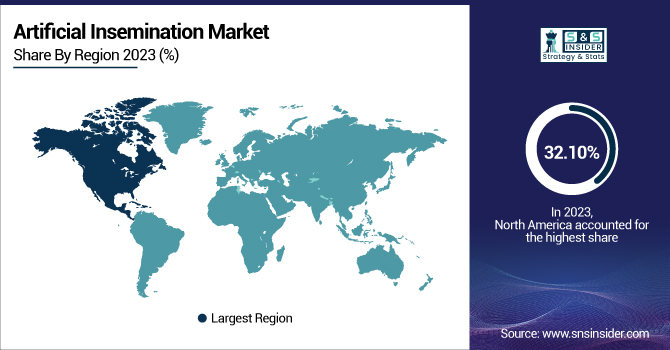

North America dominated the Artificial Insemination Market with a 32.10% market share in 2023 because of its well-developed healthcare infrastructure, high fertility treatment awareness, and extensive presence of top-ranked fertility clinics and ART (Assisted Reproductive Technology) service providers. The region also enjoys favorable government policies, conducive reimbursement structures, and rising infertility rates fueled by lifestyle issues and late parenthood. Advances in cryopreservation, insemination devices, and sperm analysis have further supported the dominance of the region. In addition, rising social acceptability of artificial insemination and access to donor sperm banks have increased the availability of treatment solutions to various populations, such as same-sex couples and single parents.

Asia Pacific is the fastest-growing region in the Artificial Insemination market with 7.51% market share in 2023 due to a growing population base, improving awareness of infertility, and increased access to fertility services. India, China, and Japan are experiencing growing demand for ART as a result of lifestyle changes, urban tension, and late family planning. The region is also favored with low treatment prices compared to the West, attracting medical tourism. Government programs to promote reproductive health and growing private investments in fertility clinics are fueling market growth. With cultural barriers further receding, increasingly more people are turning to clinical assistance for conception, driving market momentum.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Market Players

-

CooperSurgical, Inc. (SpermTrack, IUI Catheter)

-

Vitrolife AB (SpermGrad, SpermAir)

-

Cook Medical, Inc. (MediCult IUI Catheter, Cook Soft-Pass IUI Catheter)

-

Hamilton Thorne, Inc. (ZANDA IUI, CEROS II)

-

FUJIFILM Irvine Scientific, Inc. (IUI Medium, Sperm Washing Medium)

-

Rocket Medical plc (IUI Catheter Set, Rocket Sperm Collection Container)

-

Genea Biomedx (Gavi, Grow)

-

Labotect GmbH (Labocat IUI Catheter, Labotect SpermPrep)

-

MedGyn Products, Inc. (IUI Catheter, Sperm Prep Kit)

-

Thermo Fisher Scientific Inc. (SpermFreeze, CryoMed Controlled-Rate Freezer)

-

Kitazato Corporation (IUI Catheter, Cryotop)

-

Biotech Trading Partners (Fertility Buffer Medium, AI Transfer Pipette)

-

Zeiss Medical Technology (AxioCam, IVF Workstation)

-

Gynétics Medical Products N.V. (Gynétics IUI Catheter, Embryo Transfer Catheter)

-

ReproTech, Ltd. (Sperm Storage Vials, Cryo Transport Containers)

-

TSI Medical (TSI AI Catheter, SpermPrep Cup)

-

Origio a/s (SpermFilter, Origio Media)

-

Nidacon International AB (PureSperm, SpermFilter)

-

Andrology Solutions Ltd. (AI Fertility Straw, SpermWash)

-

IMV Technologies (AI Gun, Semen Straw Filling Machine)

Suppliers (All these suppliers provide specialized reproductive media, insemination catheters, and laboratory-grade consumables essential for artificial insemination procedures.) in the Artificial Insemination Market.

-

Thermo Fisher Scientific

-

FUJIFILM Irvine Scientific

-

Vitrolife AB

-

Nidacon International AB

-

Cook Medical

-

IMV Technologies

-

CooperSurgical, Inc.

-

Origio a/s

-

Labotect GmbH

-

Rocket Medical plc

Recent Developments

-

May 2024 – Vitrolife AB (publ) reported the purchase of 100% of the shares in eFertility (STB Zorg B.V.), a strategic step to increase the standardisation and digitalisation of IVF clinics worldwide. The purchase supports the Vitrolife Group's ambition to strengthen its digital presence in reproductive health technologies.

-

October 2024 – Cook Medical launched the NestVT Vitrification Device in the United States, providing a robust solution for embryo and oocyte vitrification, cryo-storage, and relocation. Coinciding with the product launch, Cook Medical also announced its intention to become a whole IVF partner by extending its reach through simulation training and educational assistance during the IVF journey.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.17 Billion |

| Market Size by 2032 | US$ 4.29 Billion |

| CAGR | CAGR of 7.86 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Intrauterine Insemination, Intracervical Insemination, Intravaginal Insemination, Intratubal Insemination) • By Source (AIH-Husband, AID-Donor) • By End Use (Fertility Clinics & Other Facilities, Home) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | CooperSurgical, Inc., Vitrolife AB, Cook Medical, Inc., Hamilton Thorne, Inc., FUJIFILM Irvine Scientific, Inc., Rocket Medical plc, Genea Biomedx, Labotect GmbH, MedGyn Products, Inc., Thermo Fisher Scientific Inc., Kitazato Corporation, Biotech Trading Partners, Zeiss Medical Technology, Gynétics Medical Products N.V., ReproTech, Ltd., TSI Medical, Origio a/s, Nidacon International AB, Andrology Solutions Ltd., IMV Technologies, and other players. |