Early-Warning Radar Market Report Scope & Overview:

To get more information on Early-Warning Radar Market - Request Free Sample Report

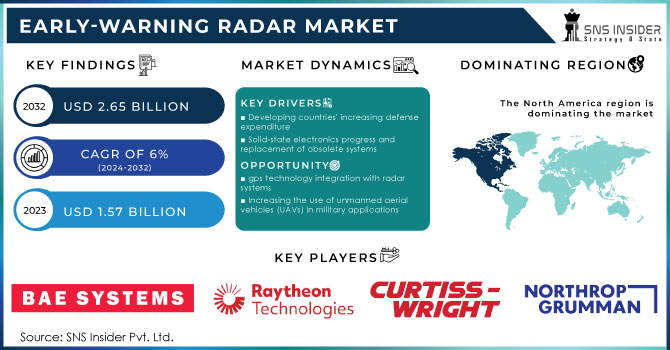

The Early-Warning Radar Market size was valued at USD 1.57 Billion in 2023 and is projected to reach USD 2.65 Billion by 2032, growing at a CAGR of 6% over the forecast period from 2024 to 2032.

Early warning radars are mainly found in a variety of configurations such as airborne radars, grenade launchers, and roaming radars. These radars operate in short, medium, and long distances in 2D, 3D, and 4D. The main uses of warning radars include attack, defense, surveillance, and conflict prevention, and are widely used in the navy, air force, and army.

Because of rising defence budgets in developing countries, developments in solid-state technology, and changes in outdated systems, the worldwide early warning radar industry is expanding rapidly. However, the high cost of radar development and the acquisition of radar jamming techniques are some of the factors that are expected to hamper global market growth during forecasting.

In addition, a growing number of local conflicts, terrorist attacks, and global security issues have resulted in increased government spending on the development of robust electronic systems and the replacement of obsolete systems. Therefore, governments like the US, China, India, France, Brazil, Iran, and Israel plan to use advanced programs to deal with the ongoing ongoing war. In addition, the authorities in these countries are conducting extensive research to develop advanced technologies and to invest heavily in military development programs. These factors are help to grow the market.

MARKET DYNAMICS

KEY DRIVERS

-

Developing countries' increasing defense expenditure

-

Solid-state electronics progress and replacement of obsolete systems

RESTRAINTS

-

Huge maintenance costs and High development expenses

OPPORTUNITIES

-

gps technology integration with radar systems

-

Increasing the use of unmanned aerial vehicles (UAVs) in military applications

IMPACT OF COVID-19

The COVID-19 epidemic has had a significant influence on the defence, aerospace, aviation, and other related businesses. The global spread of the COVID-19 virus, which has resulted in lockdown scenarios, has resulted in an unprecedented number of border closures. This interruption is likely to have an impact on the defence industry's supply chain and operations until mid-2021. However, the pandemic has demonstrated that rigorous coordination between all border and defence organizations is necessary to achieve effective security measures. Furthermore, demand for defense-related products such as Early Warning Radar systems will be unaffected because defense-related project expenditures were set aside prior to the pandemic, and the programme are important to national defence.

The global Early Warning Radar market is growing as a result of ongoing innovation. Most Early Warning Radar companies in the post-pandemic age work with a sense of urgency and consumer emphasis. Efforts to reduce costs across the value chain in order to market products at competitive pricing. Furthermore, long-term success will be determined by continuing innovation and customer-focused tactics, as well as upgrading and expanding manufacturing. The study provides high-quality, vital facts and analysis to assist decision-makers in developing solid business strategies.

As a result, defence companies in the early warning radar industry are creating cutting-edge radar systems that can aid in the effective interception of approaching aircraft or the launch of surface-to-air missiles. The demand for technologically sound radar systems is increasing as several countries create meticulously constructed fighters and bombers that reduce the return a radar will receive from the aircraft, resulting in a significant reduction in its detection range.

Because most countries are vulnerable to potential security threats, defence contractors in the early warning radar market must improve their skills in new passive radar systems that detect electromagnetic emissions in the atmosphere and other radio communications. Because stealth is critical for aircraft survival, defence contractors are developing radar systems that can detect aircraft by analysing how signals bounce off airborne objects.

KEY MARKET SEGMENTATION

By Application

-

Attack

-

Defense

-

Surveillance

-

Others

By Range

-

Short Range

-

Medium Range

-

Long Range

By Type

-

Air-Interception Radars

-

Bombing Radars

-

Navigation Radars

-

Others

By Dimension

-

2D

-

3D

-

4D

By End Use

-

Navy

-

Army

-

Air Force

REGIONAL ANALYSIS:

North America is estimated to account for ~ US $ 601 million by the end of 2028, the first radar market on the market. As North America has the potential to grow significantly in the defense sector, stakeholders are increasing investment in the U.S. defense zone. Therefore, they increase their focus on the development of missile defense systems in the U.S. defense system. There is a growing need for these systems, as they provide integrated and horizontal structures to destroy missiles and their weapons, before they can achieve their goals.

Ballistic arrow protection systems provide standard location monitoring and satellite tracking. However, it is unclear whether the geostationary-based systemic sensors are able to detect and detect different temperature-generated signals of hyper-sonic boost-glide weapons in the skip-glide phase of its flight in space. This ambiguity poses a destructive challenge when HGV poses a threat to existing early warning systems. Therefore, participants in the pre-market warning radar market developed state-of-the-art warfare management software to reduce the risk of ballistic missile defense systems.

Need any customization research on Early-Warning Radar Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are BAE Systems, Curtiss-Wright Corporation, Elbit Systems Ltd., General Dynamics Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies, Saab AB, Thales Group, Ultra Electronics, and other players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.57 Million |

| Market Size by 2032 | US$ 2.65 Million |

| CAGR | CAGR of 6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Attack, Defense, Surveillance, Collision Avoidance and Others) • By Range (Short Range, Medium Range and Long Range) • By Type (Air-Interception Radars, Bombing Radars, Navigation Radars and Others) • By Dimension (2D, 3D and 4D) • By End Use (Navy, Army and Air Force) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | BAE Systems, Curtiss-Wright Corporation, Elbit Systems Ltd., General Dynamics Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies, Saab AB, Thales Group, Ultra Electronics, and other players. |

| DRIVERS | • Developing countries' increasing defense expenditure • Solid-state electronics progress and replacement of obsolete systems |

| RESTRAINTS | • Huge maintenance costs and High development expenses |