Collision Avoidance Sensors Market Size:

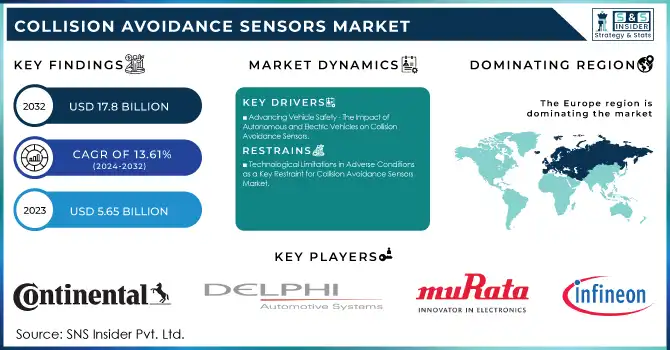

The Collision Avoidance Sensors Market Size was valued at USD 5.65 billion in 2023 and is expected to grow to USD 17.8 billion by 2032 and grow at a CAGR of 13.61% over the forecast period of 2024-2032.

To get more information on Collision Avoidance Sensors Market - Request Sample Report

The collision avoidance sensors market is experiencing rapid growth, driven by the increasing demand for automotive safety features. As consumers seek advanced safety systems like automatic emergency braking (AEB), lane departure warning (LDW), and adaptive cruise control (ACC), the adoption of collision avoidance sensors in vehicles has become widespread. The demand for these features is further fueled by strict government regulations that require the integration of safety technologies to reduce accidents and enhance driver and passenger protection. Manufacturers are also leveraging advanced sensor technologies such as radar, LIDAR, and ultrasonic sensors to improve the performance and reliability of collision avoidance systems. The development of innovative solutions, such as the ToF (Time-of-Flight) sensors for 3D mapping and echolocation sensors for enhanced collision detection, is expanding the capabilities of these systems. As automotive technology continues to evolve, the integration of Advanced Driver-Assistance Systems (ADAS) is becoming increasingly prevalent, creating new opportunities for collision avoidance sensors. Additionally, the rise in the production of electric vehicles (EVs) and autonomous vehicles is further driving market demand, as these vehicles require advanced collision avoidance systems for safe operation. The increasing focus on reducing road accidents and improving road safety is propelling manufacturers to develop cost-effective, scalable, and reliable collision avoidance sensors. As a result, companies are forging strategic partnerships to drive innovation and meet the growing demand for collision avoidance systems in various automotive, aerospace, maritime, and industrial applications. With sensor technology advancing rapidly, the market for collision avoidance sensors is expected to continue expanding, offering more advanced safety solutions and driving the adoption of these technologies globally.

Collision Avoidance Sensors Market Dynamics

Drivers

-

Advancing Vehicle Safety - The Impact of Autonomous and Electric Vehicles on Collision Avoidance Sensors

With 94% of road accidents attributed to driver error, largely due to distractions and inadequate attention, the push for autonomous vehicles (AVs) and electric vehicles (EVs) is reshaping road safety. These vehicles are built on the foundation of advanced collision avoidance sensors, which are integral for ensuring the safety and functionality of both AVs and EVs. As AVs become increasingly reliant on LiDAR, radar, ultrasonic sensors, and cameras for continuous environmental monitoring, the demand for collision avoidance technology is growing exponentially. These sensors allow AVs to detect potential hazards and make real-time decisions, significantly reducing the risk of accidents. Moreover, the rise in sensor fusion—integrating data from multiple sensors to form a comprehensive understanding of the surrounding environment—has led to more accurate and effective collision avoidance systems. Despite the promise of AVs, the growing incidence of rear-end collisions—which accounted for 42.7% of all accidents, a leading cause of multiple vehicle collisions (MVCs)—highlight the continued need for advancements in safety systems. Multiple collisions are responsible for almost 20% of all traffic collisions and 18% of the deaths on U.S. motorways. As seen from recent testing, AVs are particularly susceptible to rear-end accidents, underscoring the necessity for rigorous risk analysis and advanced sensor technologies. The increasing penetration of EVs and AVs into the market, coupled with innovations in semiconductor technology, is catalyzing the development of more reliable, efficient, and precise collision avoidance sensors. As these technologies evolve, the demand for collision avoidance systems continues to accelerate, driving further advancements in the collision avoidance sensors market, ensuring safer driving experiences for the future.

Restraints

-

Technological Limitations in Adverse Conditions as a Key Restraint for Collision Avoidance Sensors Market

Collision avoidance systems, while advancing rapidly, face significant limitations in adverse weather conditions, such as heavy rain, fog, snow, and low-light environments. Sensors like LiDAR, radar, and cameras, which are essential components of these systems, can experience reduced performance under such conditions. For example, LiDAR sensors may struggle with reflectivity in fog or snow, while cameras may be hindered by reduced visibility caused by rain or dirt on the lenses. Radar sensors, though somewhat more resilient, can still face challenges with accuracy in environments where objects are difficult to distinguish. These technological limitations impact the overall reliability and effectiveness of collision avoidance systems, which, in turn, influences consumer confidence and adoption rates. As a result, vehicle manufacturers are faced with the challenge of developing sensors that can perform optimally in a wide range of environmental conditions, especially in regions where adverse weather is common. These limitations also create a barrier to the widespread deployment of autonomous vehicles, as the sensors' inability to perform under such conditions could compromise vehicle safety. To overcome these hurdles, extensive research and development are needed to improve sensor capabilities and integrate them with more advanced technologies, such as sensor fusion, to enhance their reliability in challenging weather scenarios. Until such advancements are made, these limitations will continue to be a key restraint in the collision avoidance sensors market. This challenge is compounded by the increasing reliance on sensor-driven systems in electric and autonomous vehicles, further highlighting the need for continued innovation in collision avoidance technologies.

Collision Avoidance Sensors Market Segment Analysis

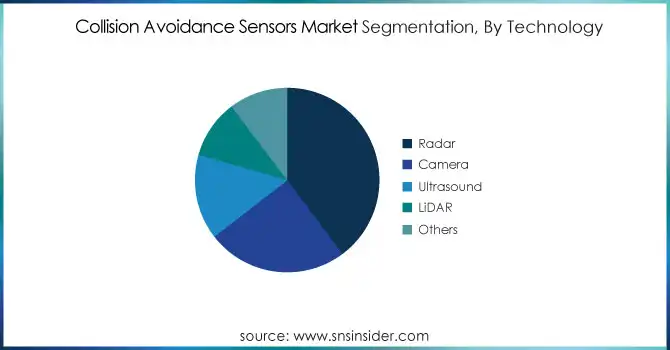

By Technology

The radar segment is leading the Collision Avoidance Sensors Market, holding around 40% of the market share in 2023. Radar sensors are essential for detecting objects and obstacles, particularly in adverse weather conditions like fog, rain, and snow, where other sensor technologies such as LiDAR or cameras may struggle. Due to their robustness and reliability, radar sensors are extensively used in advanced driver-assistance systems (ADAS) and autonomous vehicles (AVs), providing real-time data for collision avoidance, lane departure warning, and adaptive cruise control. Their ability to detect objects at long ranges and under diverse conditions makes them critical for improving vehicle safety. As the adoption of electric and autonomous vehicles rises, the demand for radar-based collision avoidance systems is expected to increase, further driving market growth.

By End-Use

The automotive segment dominates the Collision Avoidance Sensors Market with a significant share in 2023. This is driven by the increasing adoption of advanced driver-assistance systems (ADAS) in vehicles, including both traditional and electric models, alongside the rapid growth of autonomous vehicles (AVs). Collision avoidance sensors, such as radar, LiDAR, ultrasonic sensors, and cameras, are essential in enhancing vehicle safety by detecting obstacles, pedestrians, and other vehicles in real time. These technologies enable key safety features like automatic emergency braking (AEB), lane-keeping assistance, and adaptive cruise control, which reduce accidents and improve overall road safety. As consumer demand for safer and more automated driving experiences rises, the automotive sector is expected to continue leading the market's growth.

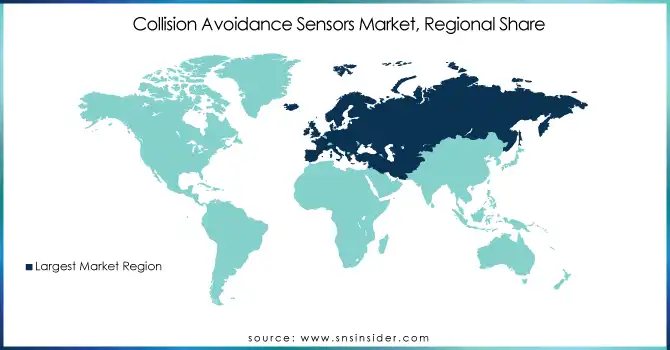

Collision Avoidance Sensors Market Regional Overview

Europe is the dominant region in the Collision Avoidance Sensors Market, holding a significant share in 2023. This dominance can be attributed to the region's strong automotive industry, which is increasingly adopting advanced safety technologies in both traditional and electric vehicles. Countries like Germany, France, the UK, and Sweden are at the forefront, with leading automotive manufacturers, such as Volkswagen, BMW, Mercedes-Benz, and Volvo, integrating collision avoidance sensors into their vehicles. Additionally, Europe has stringent safety regulations, which have pushed manufacturers to adopt these technologies for compliance and to enhance consumer safety. The region's commitment to reducing road accidents and fatalities, along with growing investments in autonomous vehicle development, continues to drive the demand for smart sensor systems. With a robust automotive ecosystem and high demand for safety features, Europe is expected to maintain its leading position in the market.

North America is the fastest-growing region in the Collision Avoidance Sensors Market, expected to experience significant expansion from 2024 to 2032. The United States and Canada are driving this growth, primarily due to the region's technological advancements and the rapid adoption of autonomous vehicles (AVs). Leading automotive manufacturers, such as General Motors, Ford, and Tesla, are integrating cutting-edge collision avoidance technologies into their vehicles, while the U.S. government's stringent safety regulations further encourage this adoption. Additionally, the increasing demand for electric vehicles (EVs), coupled with a focus on improving road safety and reducing traffic fatalities, has accelerated the need for advanced sensors like LiDAR, radar, and cameras. With a strong focus on innovation, regulatory incentives, and substantial investments in research and development, North America is poised to continue its rapid growth in the collision avoidance sensors market.

Get Customized Report as per Your Business Requirement - Request For Customized Report

KEY PLAYERS

Some of the major players in Collision Avoidance Sensors with product in bracket:

-

Continental AG (Automotive sensors, radar sensors, collision warning systems, ADAS components)

-

Delphi Automotive LLP (Automotive sensors, radar systems, advanced driver-assistance systems)

-

NXP Semiconductors (Automotive radar sensors, microcontrollers, vehicle network solutions, safety systems)

-

Infineon Technologies AG (Radar sensors, microcontrollers, power semiconductors for automotive applications)

-

Murata Manufacturing Co., Ltd (MEMS sensors, motion sensors, safety sensors for automotive applications)

-

Panasonic Corporation (Automotive sensors, radar systems, camera modules, collision avoidance systems)

-

Robert Bosch GmbH (Radar sensors, camera systems, collision avoidance technologies, ADAS solutions)

-

Sensata Technologies, Inc. (Pressure sensors, temperature sensors, collision avoidance sensors for automotive applications)

-

Joyson Safety Systems (Safety electronics, collision avoidance systems, sensors for automotive safety)

-

Texas Instruments Incorporated (Radar sensors, microcontrollers, analog semiconductors, automotive safety solutions)

-

Aptiv PLC (Advanced driver-assistance systems, radar sensors, camera systems, LiDAR, and other safety technologies)

-

Valeo SA (LiDAR sensors, radar sensors, camera modules, collision avoidance systems, ADAS)

-

Autoliv Inc. (Safety electronics, airbags, radar sensors, advanced collision detection systems)

-

Trico Products Corporation (Wiper systems, automotive safety sensors, collision avoidance systems)

-

Toshiba Corporation (Automotive radar sensors, image sensors, ADAS solutions, power semiconductors)

-

ZF Friedrichshafen AG (Radar sensors, LiDAR, camera systems, collision avoidance, ADAS components)

-

Garmin Ltd. (Radar sensors, GPS-based safety solutions, collision warning systems)

-

Omron Corporation (Proximity sensors, vision sensors, collision avoidance technologies, safety systems for automotive)

-

STMicroelectronics (Radar sensors, LiDAR, automotive microcontrollers, safety solutions)

-

Honeywell International Inc. (Pressure sensors, temperature sensors, radar systems, automotive collision avoidance technologies)

List of suppliers that provide raw materials and components for collision avoidance sensors:

-

3M Company

-

DuPont

-

Sumitomo Electric Industries, Ltd.

-

LG Chem

-

Samsung SDI

-

Vishay Intertechnology

-

SABIC

-

Laird Technologies

-

Murata Manufacturing Co., Ltd.

-

KYOCERA Corporation

RECENT DEVELOPMENT

-

On October 2024, NOVOSENSE and Continental formed a strategic partnership to develop advanced automotive-grade pressure sensor chips for applications like airbags and collision detection.

-

On December 2024, Infineon Technologies introduced the RASIC™ CTRX8191F, a 28nm radar MMIC designed for 4D and HD imaging radars in autonomous vehicles. The radar enhances performance with a superior signal-to-noise ratio, enabling detection up to 380 meters, and supports rapid prototyping through the CARKIT development kit.

-

January 2024, Texas Instruments unveiled three new chips at CES 2024 to enhance ADAS and battery management systems. These chips are designed to support the evolution towards Software Defined Vehicles (SDV) and accelerate the transition to electric vehicles.

| Report Attributes | Details |

| Market Size in 2023 | USD 5.65 Billion |

| Market Size by 2032 | USD 17.8 Billion |

| CAGR | CAGR of 13.61% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Radar, Camera, Ultrasound, LiDAR, Others) • By Application(Adaptive Cruise Control (ACC), Blind Spot Detection (BSD), Forward Collision Warning System (FCWS), Lane Departure Warning System (LDWS), Parking Assistance, Others) • By End-Use (Automotive, Aerospace & Defense, Maritime, Rail, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Continental AG, Delphi Automotive LLP, NXP Semiconductors, Infineon Technologies AG, Murata Manufacturing Co., Ltd, Panasonic Corporation, Robert Bosch GmbH, Sensata Technologies, Inc., Joyson Safety Systems, Texas Instruments Incorporated, Aptiv PLC, Valeo SA, Autoliv Inc., Trico Products Corporation, Toshiba Corporation, ZF Friedrichshafen AG, Garmin Ltd., Omron Corporation, STMicroelectronics, Honeywell International Inc. |

| Key Drivers | • Advancing Vehicle Safety - The Impact of Autonomous and Electric Vehicles on Collision Avoidance Sensors. |

| Restraints | • Technological Limitations in Adverse Conditions as a Key Restraint for Collision Avoidance Sensors Market. |