Educational Robot Market Report Scope & Overview:

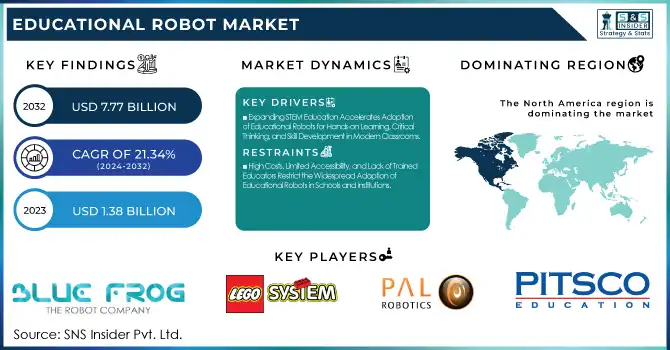

The Educational Robot Market was valued at USD 1.38 billion in 2023 and is expected to reach USD 7.77 billion by 2032, growing at a CAGR of 21.34% from 2024-2032. This report includes a comprehensive analysis of technology adoption rates, investment and funding trends, customer preferences and demand, and impact metrics, providing insights into the market's growth drivers and future potential. The increasing demand for innovative learning solutions, advancements in robotics and AI, and the shift towards STEM education are key factors driving market growth. Additionally, rising investments and growing customer interest in interactive and personalized educational tools are further fueling the market's expansion.

To Get more information on Educational Robot Market - Request Free Sample Report

Educational Robot Market Dynamics

Drivers

-

Expanding STEM Education Accelerates Adoption of Educational Robots for Hands-on Learning, Critical Thinking, and Skill Development in Modern Classrooms

The increased emphasis on science, technology, engineering, and math (STEM) education is driving the demand for more sophisticated learning solutions that increase participation and real-world understanding. Educational robots are being integrated more into the classroom to enhance experiential learning, critical thinking, and problem-solving abilities. Robotics is being implemented by schools and institutions to make STEM more interactive and accessible, stimulating students to learn coding, programming, and engineering skills. Governments and educational authorities are also encouraging robotics-based education through funding and curriculum inclusion. Moreover, technological developments in artificial intelligence (AI) and machine learning (ML) are continually enhancing robot functions, making them increasingly responsive to individualized learning experiences, thus solidifying their position in contemporary education systems.

Restraints

-

High Costs, Limited Accessibility, and Lack of Trained Educators Restrict the Widespread Adoption of Educational Robots in Schools and Institutions

The initial cost of high-priced educational robots, such as procurement, maintenance, and software updates, is a major hindrance to mass adoption, particularly for financially constrained schools and developing countries. Affordability is a challenge for most institutions, thereby reducing access to robotics-based learning resources. Furthermore, the unavailability of skilled teachers who are knowledgeable in robotics and programming is another limiting factor to effective application. Integration into current curricula can also be challenging, necessitating extensive adaptation processes. In addition, data privacy and cybersecurity concerns related to AI-powered robots could hinder adoption in some areas. Although technological innovation continues to enhance affordability and user-friendliness, cost and accessibility are the most significant obstacles to market growth.

Opportunities

-

AI Integration, Personalized Learning, and Rising Demand in Emerging Markets Drive Growth Opportunities for Educational Robots in Modern Education

The growing emphasis on personalized learning represents a significant opportunity, as education robots powered by AI have the capability to be responsive to unique student requirements, improving engagement and learning results. Increasing uptake in developing markets, fueled by government plans and investments in digital learning, is expanding customer numbers. Developments in AI and machine learning are allowing robots to become more intuitive and interactive, further enhancing their attractiveness. Furthermore, increasing the need for learning about coding and robotics at an early age is opening up new paths for expansion for the market. The inclusion of cloud-based applications and remote learning platforms is also improving accessibility, and educational robots are becoming a critical component of contemporary digital education systems.

Challenges

-

Curriculum Complexity, Lack of Trained Educators, and Resistance to Change Hinder the Seamless Integration of Educational Robots in Classrooms

Integrating educational robots into current curricula is a major challenge, as schools and institutions have to reorganize teaching methods to accommodate robotics-based learning. Most teachers struggle to adjust lesson plans to incorporate hands-on robotics exercises without compromising on academic standards. The absence of well-structured guidelines and standardized frameworks adds to the challenge, necessitating extra time and resources for curriculum design. Further, the lack of qualified teachers versed in programming and robotics impedes effective deployment, diminishing their potential contribution to student learning. Resistance to technology from established schools and instructors likewise hinders deployment, as many are reluctant to substitute traditional modes of instruction for dynamic robotic responses. These complications of integration serve to limit greater utilization of schooling robots in class.

Educational Robot Market Segment Analysis

By Product

Non-humanoid learning robots accounted for 62% of revenues in 2023 with their affordability, ease of implementation, and large usage in STEM schooling. They find extensive application across schools in experiential learning and computer-programming instruction through robotic kits, coding systems, and AI-facilitated learning aids. Their multi-capacity applications of teaching programming, problem-solving skills, and basic robotics skills led to their suitability for adoption across schools. Besides, their lower cost of manufacturing and maintenance than humanoid robots also makes them highly competitive in the market.

The humanoid segment will expand at the fastest CAGR of 22.67% during 2024-2032, propelled by developments in AI, machine learning, and human-like interaction abilities. Such robots are more and more employed for individualized learning, special education, and language training and provide more interactive and immersive experiences. Their capacity to replicate human movements and facial expressions increases student interaction, making them perfect for social and emotional learning. With advancing technology and decreasing costs, the use of humanoid robots in education is likely to grow tremendously.

By Component

The hardware segment led the educational robot market with a 64% revenue share in 2023 because of the high demand for robotic kits, sensors, actuators, and controllers utilized in schools. The initial expenses of production and acquisition of physical robotic systems are among the factors driving this segment's top-line leadership. Educational institutions prefer to invest in robust and engaging robotic systems for improving hands-on learning. Furthermore, increasing incorporation of AI-based robotic platforms continues to bolster demand for sophisticated hardware components in the market.

The software segment would witness the fastest CAGR of 22.38% during 2024 to 2032, as AI, machine learning, and cloud-based learning platforms gain higher adoption. The trend towards adaptive and personalized learning solutions is triggering demand for sophisticated software that enriches robotic capabilities. Interactive coding environments, simulation software, and cloud-based educational software are gaining popularity, facilitating more available and scalable learning models. Regular software upgrades and developments in AI further drive the strong growth of this segment.

By Application

The secondary education segment led the market for educational robots with a 40% revenue share in 2023 owing to the rising emphasis on learning STEM, coding, and robotics at middle schools and high schools. Schools are incorporating robotics in courses to boost problem-solving, programming, and engineering capabilities. The need for sophisticated robotic kits and AI-based learning solutions is greater in secondary education, as students work on more advanced projects. Moreover, government policy encouraging STEM education further propels uptake in this segment.

The primary education segment is set to expand at the fastest CAGR of 22.79% from 2024 to 2032, propelled by growing focus on early child STEM education and interactive learning. Schools are increasingly bringing robotics into schools at an early age to create fundamental coding and problem-solving abilities. The ease of availability of simple, easy-to-use robotic kits designed for young students is also driving adoption faster. Also, growing investments in education technology and gamified learning solutions are further making robotics accessible in primary school environments.

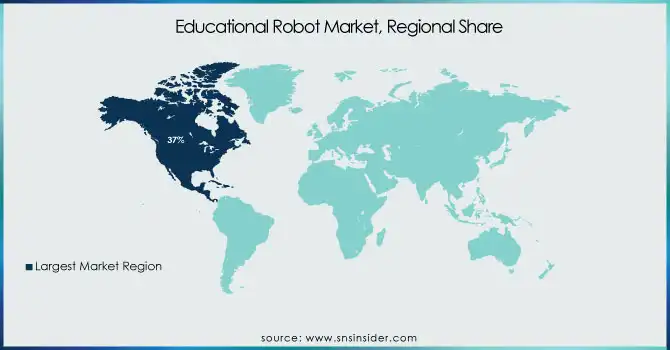

Regional Analysis

North America led the educational robot market with a 37% revenue share in 2023 based on the prevalent presence of superior educational institutions, significant investment in EdTech, and extensive usage of STEM-based education. Government programs and financing for robotics integration in schools further propel market expansion. The region also enjoys the presence of the major market players, which facilitates ongoing innovation. Also, the increase in demand for AI-driven learning robots in institutions of higher learning and research adds to North America's market lead.

Asia Pacific will grow with the fastest CAGR of 23.06% during the forecast period from 2024 to 2032, triggered by growing digital education investments, government policies boosting STEM education, and fast adoption of EdTech. China, Japan, and South Korea are at the forefront of robotics learning, incorporating AI-driven learning technology into education programs. Growing need for affordable and engaging learning products and solutions, in addition to increasing student base, is driving growth in the market. Growing knowledge of coding and robotics learning across emerging markets is also propelling growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Aisoy Robotics (Aisoy 1, Aisoy 2)

-

Blue Frog Robotics (Buddy, Buddy Developer Edition)

-

LEGO Systems A/S (LEGO Mindstorms Robot Inventor, LEGO Education SPIKE Prime)

-

Modular Robotics (Cubelets Robot Blocks, Cubelets Snap Together Robots)

-

PAL Robotics (REEM-C, TALOS)

-

Pitsco Education LLC (Moss Robotics, TETRIX Robotics)

-

ROBOTIS Inc. (ROBOTIS MINI, BIOLOID Premium Kit)

-

SoftBank Robotics Group (Pepper, NAO)

-

RM Educational Resources Ltd. (Pro-Bot, Blue-Bot)

-

Learning Resources (Botley 2.0, Code & Go Robot Mouse)

-

Educational Insights (Artie 3000, Code & Go Robot Mouse)

-

Universal Robots (UR3e, UR5e)

-

PROBOTICS AMERICA (Pioneer, Rebotics)

-

ABB Group (YuMi, ABB Robotics)

-

SoapBoxLabs (SoapBox Engine, SoapBox SDK)

-

YASKAWA ELECTRIC CORPORATION (MOTOMAN, YASKAWA Robotics)

-

Seiko Epson Corporation (Epson Robots, Epson SCARA Robots)

-

KUKA (KUKA Robotics, KUKA LBR iiwa)

-

KinderLab Robotics (KIBO, KIBO 21)

-

Robolink (RoboLink CoDrone, RoboLink Rokit Smart)

-

Hanson Robotics (Sophia, Han)

-

Sanbot Innovation Technology (Sanbot Elf, Sanbot Max)

-

HYULIM ROBOT (HYULIM, AMR Robot)

-

FANUC CORPORATION (FANUC LR Mate, FANUC M-20iA)

-

UBTECH Robotics (Jimu Robot, Alpha 1S)

Recent Developments:

-

On August 6, 2024, LEGO® Education launched the FIRST® LEGO® League 2024-2025 season with the theme "SUBMERGED℠", focusing on ocean exploration. This STEM competition encourages students aged 4-16 to build, code, and research real-world challenges.

-

On January 7, 2025, KinderLab Robotics announced "Exploring with KIBO", a new 60-hour curriculum for grades 3-5, expanding its screen-free robotics education program. The curriculum builds on KIBO’s success in early childhood learning, integrating computational thinking with subjects like math, science, and English.

-

2024: RM Educational Resources collaborated with Brooke Weston Trust to enhance IT infrastructure across schools, improving cybersecurity, network upgrades, and cloud-based systems. The initiative aims to streamline school operations and digital learning.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.38 Billion |

| Market Size by 2032 | USD 7.77 Billion |

| CAGR | CAGR of 21.24% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Humanoid, Non-Humanoid) • By Application (Primary Education, Secondary Education, Higher Education, Others) • By Component (Hardware, Software) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Aisoy Robotics, Blue Frog Robotics, LEGO Systems A/S, Modular Robotics, PAL Robotics, Pitsco Education LLC, ROBOTIS Inc., SoftBank Robotics Group, RM Educational Resources Ltd., Learning Resources, Educational Insights, Universal Robots, PROBOTICS AMERICA, ABB Group, SoapBoxLabs, YASKAWA ELECTRIC CORPORATION, Seiko Epson Corporation, KUKA, KinderLab Robotics, Robolink, Hanson Robotics, Sanbot Innovation Technology, HYULIM ROBOT, FANUC CORPORATION, UBTECH Robotics. |