Electric Vehicle Battery Recycling Market Report Scope & Overview

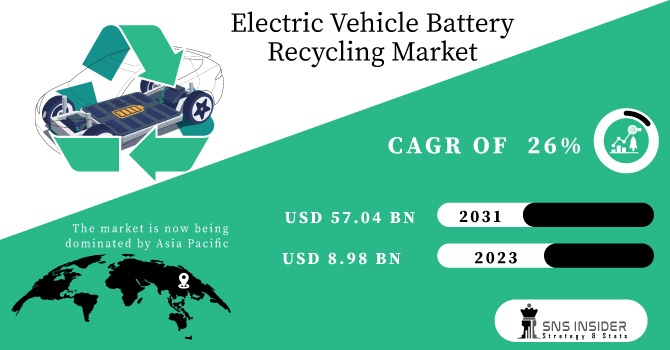

The Electric Vehicle Battery Recycling Market size was valued at USD 8.98 billion in 2023 and is expected to reach USD 57.04 billion by 2031 and grow at a CAGR of 26% over the forecast period 2024-2031.

The growth of Electric Vehicle Battery Recycling Market is driven by the environmental worries, stricter battery recycling rules, and concerns about running out of resources. Discarded batteries contain hazardous materials that can contaminate soil and water if not disposed of properly. Recycling these batteries allows us to extract valuable metals and minerals like lithium, cobalt, and nickel. These recovered materials can then be used in the production of new batteries, significantly reducing the need for virgin materials. This focus on recycled materials has a positive impact on the environment. Mining for new battery components is an energy-intensive process that generates significant CO2 emissions. By utilizing recycled metals, we can lower the overall environmental footprint associated with battery production. The rise of electric vehicles (EVs) has further highlighted the importance of battery recycling. Unlike traditional gasoline-powered cars, EVs rely on large, rechargeable batteries to power their motors. These batteries, though highly efficient, eventually reach the end of their usable life and need to be replaced.

Get More Information on Electric Vehicle Battery Recycling Market - Request Sample Report

MARKET DYNAMICS:

KEY DRIVERS:

-

Rising Demand for Recycled Materials and Batteries Fuels Growth in Electric Vehicle Battery Recycling Market

The growing demand for recycled materials and batteries is expected to fuel innovation in recycling technologies. Rising costs of raw materials and consumer preference for eco-friendly products are creating new opportunities in the battery recycling market. This shift towards recycled materials is driven by a global focus on sustainability, environmental responsibility, and the scarcity of natural resources. This trend is expected to significantly impact the electric vehicle battery recycling sector, as it becomes increasingly important to recover valuable materials from spent batteries.

RESTRAINTS:

-

Complexities in Extracting Materials from Used Batteries Limit Recycling Efficiency

Extracting valuable materials from used electric vehicle batteries presents a significant hurdle for the recycling industry. Unlike traditional manufacturing processes with well-defined components, used batteries are a complex mix of materials. This intricate composition makes separation and purification difficult, resulting in lower recycling efficiency. Recovering a higher percentage of these valuable resources, such as lithium and cobalt, is crucial for a sustainable and cost-effective electric vehicle battery lifecycle. Researchers are actively developing new techniques to overcome these problems and unlock the full potential of battery recycling.

-

Safety Concerns Around Storage and Transportation of Spent Batteries Hinder Market Growth

OPPORTUNITIES:

-

Rising Battery Demand Creates Lucrative Market for Recycled Materials in Electric Vehicle Battery Recycling

-

Technological Advancements Promise More Efficient and Cost-Effective Electric Vehicle Battery Recycling

CHALLENGES:

-

Safety Concerns Around Handling Spent Batteries Limit Market Growth

-

Immature Technology Restricts Profitability of Electric Vehicle Battery Recycling

IMPACT OF RUSSIA-UKRAINE WAR

The war in Russia-Ukraine has disrupted the Electric Vehicle Battery Recycling Market. Disruptions to the global supply chain, particularly for key battery materials like nickel around 50%, have caused a bad effect. This price increase makes recycling less economically attractive in the short term, as the cost of recovering materials may not offset the cost of purchasing them new. The Russia is a major producer of some battery metals, and sanctions or export restrictions could further limit access to these resources. The price volatility of raw materials underscores the need for a more secure and sustainable supply chain. This could incentivize investment in research and development of more efficient recycling technologies, allowing for greater recovery of valuable materials from spent batteries. Thus, the geopolitical situation could push countries towards self-sufficiency in battery metals, accelerating the development of domestic recycling infrastructure and creating new opportunities within the Electric Vehicle Battery Recycling Market.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown can disrupt the electric vehicle battery recycling market in a few key ways. A decrease in consumer spending can lead to a decline in electric vehicle sales. This can translate to fewer new electric vehicles being sold, directly impacting the flow of used batteries entering the recycling stream. The economic downturns often lead to limited budgets, impacting investments in new technologies. The electric vehicle battery recycling industry is still relatively young, and advancements in recycling technology are crucial for improving efficiency and profitability. With less capital available, research and development efforts might slow down, hindering the development of more efficient recycling processes. The economic slowdowns can put pressure on commodity prices, including the very materials recovered through battery recycling. Thus, the price of lithium, a key component in electric vehicle batteries, might fall due to lower demand.

KEY MARKET SEGMENTS:

By Battery Chemistry Type:

-

Lithium Iron Phosphate

-

Lithium Manganese Oxide

-

Lithium Nickel Manganese Cobalt

-

Lithium Titanate Oxide

-

Lithium Nickel Cobalt Aluminium Oxide

Lithium Iron Phosphate (LFP) is the dominating sub-segment in the Electric Vehicle Battery Recycling Market by battery chemistry type holding around 40-50% of market share. LFP batteries are widely used in electric vehicles due to their safety, long lifespan, and good thermal stability. This high adoption rate translates to a larger volume of LFP batteries reaching the end of their life, making them the dominant segment in recycling.

By Process:

-

Pyrometallurgy Process

-

Hydrometallurgy Process

-

Physical/Mechanical Process

Pyrometallurgy Process is the dominating sub-segment in the Electric Vehicle Battery Recycling Market by process holding around 60-65% of market share. Pyrometallurgy is a high-temperature process that efficiently recovers various metals from batteries. However, it can be energy-intensive and may raise environmental concerns.

By Sources:

-

Passenger

-

Commercial

-

E-bikes

E-bikes is the dominating sub-segment in the Electric Vehicle Battery Recycling Market by sources. E-bikes are experiencing a significant surge in popularity due to their affordability and convenience. This rapid growth translates to a large volume of used e-bike batteries entering the recycling stream, making them the current leader in this segment.

REGIONAL ANALYSIS:

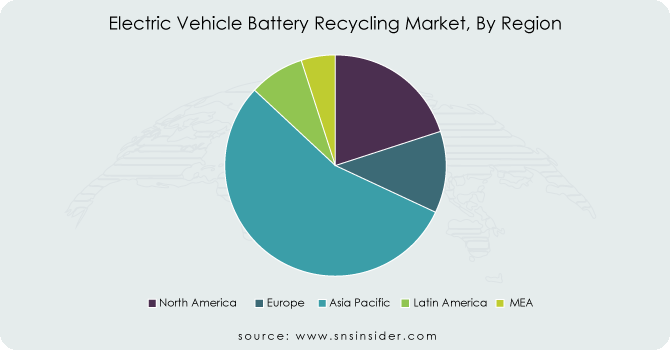

The Asia Pacific is the dominating region in the Electric Vehicle Battery Recycling Market holding around 40-45% of market share, fueled by the growing electric vehicle market in China, Japan, and South Korea. This translates to a massive influx of used batteries in need of recycling. The supportive government initiatives and a well-established battery production base solidify Asia's leadership.

Europe is the second highest region in this market, driven by stringent regulations on battery waste and a strong societal focus on sustainability. Their growing electric vehicle market further emphasizes the need for robust recycling capabilities.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are ERAMET, Contemporary Amperex Technology Co., Limited, Glencore , Stena Recycling, Ace Green Recycling, Inc., Li-Cycle Corp. (Canada), Fortum, Umicore N.V.(Belgium), Neometals Ltd, Redwood Materials Inc. and other key players.

Battery Solutions (US)-Company Financial Analysis

RECENT DEVELOPMENTS:

-

In Sept. 2022: Umicore and PowerCo join forces to build a European production hub for battery materials. Starting in 2025, the venture will supply PowerCo's factories and could expand into battery recycling using Umicore's expertise.

-

In Nov. 2022: Li-Cycle has partnered with Vietnamese battery manufacturer Vines Energy Solutions, a subsidiary of Vingroup. This deal grants Vines access to Li-Cycle's industry-leading battery recycling technology.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 8.98 Billion |

| Market Size by 2031 | US$ 57.04 Billion |

| CAGR | CAGR of 26% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Battery Chemistry Type (Lithium Iron Phosphate, Lithium Manganese Oxide, Lithium Nickel Manganese Cobalt, Lithium Titanate Oxide, Lithium Nickel Cobalt Aluminum Oxide) • By Sources (Passenger, Commercial, E-bikes) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ERAMET, Contemporary Amperex Technology Co., Limited, Glencore , Stena Recycling, Ace Green Recycling, Inc., Li-Cycle Corp. (Canada), Fortum, Umicore N.V.(Belgium), Neometals Ltd, Redwood Materials Inc |

| Key Drivers | •The global industry for recycling electric vehicle batteries is exploding. •Development of transportation infrastructure. |

| RESTRAINTS | •The global industry for recycling electric vehicle batteries is exploding. •Development of transportation infrastructure. |