Automotive Brake Linings Market Report Scope & Overview:

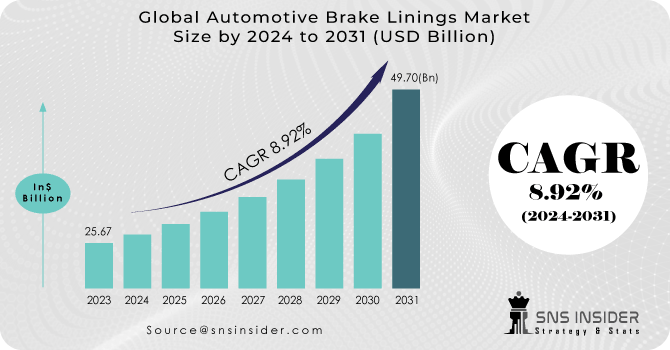

The Automotive Brake Linings Market Size was valued at USD 25.67 billion in 2023 and is expected to reach USD 49.70 billion by 2031 and grow at a CAGR of 8.92% over the forecast period 2024-2031.

The automotive brake linings market is set for consistent growth, driven by several key factors such as stringent safety regulations, increasing environmental awareness among consumers, and the expanding presence of electric vehicles (EVs). Government mandates, exemplified by the EU's forthcoming Euro 7 regulation mandating reduced stopping distances, are compelling car manufacturers to adopt advanced braking systems, indirectly propelling the demand for brake linings. Projections indicate that the global brake linings market is anticipated to approach nearly US$ 49.70 billion by 2031. A significant portion of this growth is expected to come from the adoption of environmentally friendly materials. Consumers are favoring copper-free and ceramic brake linings due to their capacity to reduce emissions and noise pollution.

Get More Information on Automotive Brake Linings Market - Request Sample Report

EVs represent a distinctive opportunity, with regenerative braking systems diminishing wear on traditional friction linings. However, the heightened weight and instant torque of EVs necessitate robust linings, prompting substantial investments in research and development. Notably, companies like Continental AG are earmarking €300 million for their electric and hybrid vehicle technology sector by 2022. Hence, the automotive brake linings market is primed for a dynamic trajectory, adapting to increasingly stringent regulations, shifting consumer preferences, and the transformative influence of electric shared mobility.

MARKET DYNAMICS:

KEY DRIVERS:

-

An increase in the demand for environmentally friendly and long-lasting vehicle brake linings that do not contain asbestos.

-

Growth in production and a rise in the number of vehicles on the road are likely to have an impact on demand.

The automotive industry is heading towards a critical juncture, with expanding production capabilities driven by substantial investments worldwide, notably a $35.4 billion inflow in India from 2000 to 2023. This surge in manufacturing capacity indicates an impending increase in vehicle output, supported by the expanding middle class in emerging markets, hinting at heightened demand. Nevertheless, the proliferation of automobiles poses a paradoxical challenge, potentially impeding growth due to congestion on roads.

RESTRAINTS:

-

To reduce the usage of frictional materials in braking technology

-

On extending the service life of friction materials, the sales of vehicle brake linings may decline over time

-

The usage of lightweight materials in car brake linings is also subject to strict standards

OPPORTUNITIES:

-

Manufacturers are working to create brake linings that can withstand high temperatures.

-

The increase in demand from emerging economies will open up new potential for the market.

The rising demand from emerging economies which was recorded approx 28% is poised to drive substantial market expansion. Projections indicate that investments in this domain will soar to approximately $108.92 billion by 2024, marking an annual growth rate of 8.92%. This upsurge is primarily fueled by the expanding middle class in nations such as China and India, where disposable incomes are ascending. Consequently, businesses stand to tap into a sizable consumer base with increasing purchasing power, presenting ample opportunities for growth and expansion.

CHALLENGES:

-

The development of braking technology eliminates the need for frictional material.

-

Because of the increased concern for vehicle safety, automotive brake linings must be updated on a regular basis.

IMPACT OF RUSSIA-UKRAINE WAR:

The Automotive Brake Linings Market faces significant disruptions amid the ongoing Russia-Ukraine conflict, altering its once steady growth trajectory. The repercussions emanating from the conflict zone manifest in three primary ways. Firstly, sanctions and export limitations imposed on Russia disrupt the supply of vital raw materials essential for brake lining production. Combined with escalating global energy costs, this surge in production expenses is anticipated to lead to a potential 10-15% price hike for brake linings by Q3 2024, as projected by government organisations. Secondly, the war compounds existing supply chain bottlenecks lingering from the pandemic. With Ukraine serving as a major neon supplier crucial for chip production, the global automotive manufacturing sector experiences deceleration, subsequently diminishing the demand for new brake linings and impacting overall market expansion. Thirdly, the conflict-induced economic uncertainty has resulted in a sharp decline in consumer confidence. Coupled with escalating inflation, this may prompt car owners to postpone non-urgent maintenance activities such as brake pad replacements, further dampening market demand. Despite these formidable challenges, the market's long-term prospects retain a cautious optimism. Anticipated investments in alternative raw materials and diversified supply chains by 20% in 2024 reflect manufacturers' endeavors to fortify resilience. Moreover, the market's intrinsic emphasis on safety features suggests a potential resurgence in demand upon the restoration of economic stability.

IMPACT OF ECONOMIC SLOWDOWN:

An economic downturn can have a significant impact on the automotive brake linings market. Reduced consumer spending power during such times often leads to a decrease in new vehicle purchases, directly affecting the demand for original equipment brake linings, which constitute around 60% of the market, as per industry reports. Moreover, car owners tend to postpone non-essential repairs and maintenance on their existing vehicles, further dampening the replacement brake linings market. This downturn could trigger a series of repercussions across the industry, including production slowdowns, decreased investments in research and development (which have averaged $1.5 billion annually over the past three years), and potentially even consolidation among manufacturers as they seek operational efficiency.

However, amidst these challenges, there might be some silver linings. As consumers extend the lifespan of their vehicles, the demand for replacement brake linings may eventually rebound, albeit with a time lag. This presents an opportunity for manufacturers to shift focus towards the aftermarket and develop cost-effective brake lining solutions tailored to budget-conscious consumers. By adapting to the evolving market conditions and catering to the changing needs of consumers, manufacturers can navigate through the economic slowdown and emerge stronger in the long run.

KEY MARKET SEGMENTATION

Market, By Material Type:

-

Asbestos-based automotive brake linings

-

Non-Asbestos based automotive brake linings

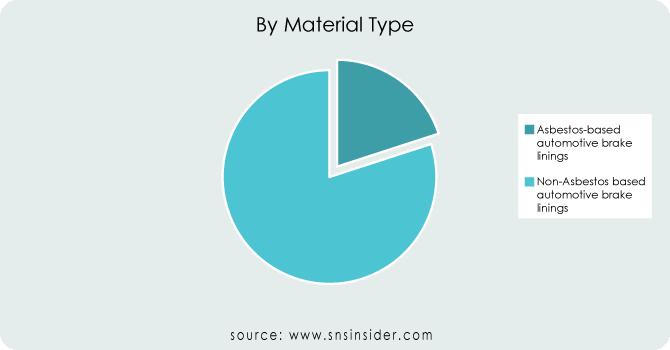

The automotive brake lining market has been traditionally divided into two key material segments: asbestos-based and non-asbestos-based linings. While asbestos was once favored for its exceptional heat resistance and friction properties, its carcinogenic nature has prompted stringent regulations and a near-complete phase-out. Consequently, there has been a significant shift towards investing in non-asbestos alternatives. Currently, non-asbestos organic (NAO), ceramic, and semi-metallic linings dominate the market, accounting for approximately 80% of the share, with an annual projected investment exceeding $1 billion. This trend towards non-asbestos materials is expected to persist as regulations tighten and consumer awareness of the safety risks associated with asbestos increases. However, a minority segment of the market (around 20%) continues to rely on asbestos-based linings, particularly in developing economies where regulations are less stringent.

Market, By Sales Channel:

-

OEM

-

Aftermarket

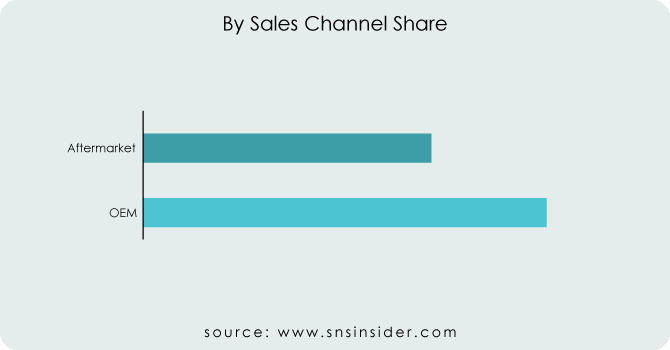

The automotive brake lining sector flourishes through two primary avenues: Original Equipment Manufacturers (OEMs) and the aftermarket. In the preceding year of 2023, OEMs secured the majority share, encompassing approximately 67% of the market. This predominance stems from escalating consumer interest in novel vehicles equipped with sophisticated braking mechanisms. Automotive manufacturers exhibit substantial commitment to this domain, with an approximate annual global investment surpassing $5 billion in research and development (R&D) endeavors. These investments are geared towards producing lightweight, environmentally conscious, and top-performing braking elements that align with progressively rigorous safety standards.

Market, By Vehicle Type:

-

Passenger cars

-

Commercial vehicles

-

Electric Vehicles

Get Customized Report as per your Business Requirement - Ask For Customized Report

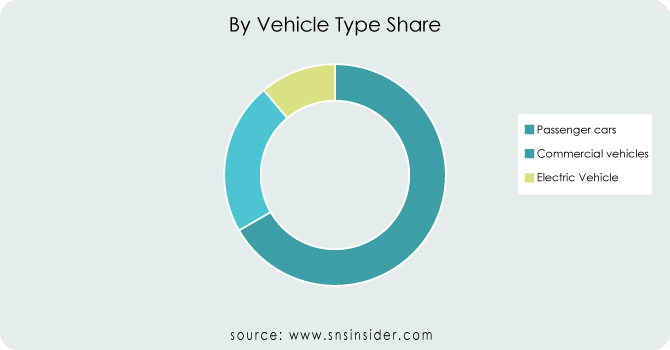

The global market for automotive brake linings is divided by vehicle type, with passenger cars (PC), commercial vehicles (CV), and electric vehicles (EV) as the primary segments. Passenger cars currently dominate the market, valued at 62% share, and are anticipated to grow steadily at 5% by 2031. Following closely, commercial vehicles hold a substantial share at 28% , with a projected growth rate of 7% within the same timeframe. Electric vehicles, while currently representing a smaller segment, are poised for remarkable growth at a compelling 9.4% CAGR, aiming for a market growth of 25%by 2031.

REGIONAL ANALYSIS:

In terms of regional outlook, it is projected that the Asia Pacific would lead the global market for automobile brake linings by share of 42%. It is projected that the expanding car fleet and growing production of automobiles will fuel demand in the region. In addition to this, it is anticipated that both North America and Europe will hold significant shares of the global automobile brake linings market.

As a result of Japan's status as a key production center for the automobile industry, there has been an increase in the demand for car brake linings in recent years. It is anticipated that regions such as Latin America and the Middle East and Africa will continue to be low-volume but high-growth regions, and it is anticipated that increasing investments in the automotive sector in the region will drive the growth of the global market for automotive brake linings.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

Continental AG (Germany), General Motors (US), AKEBONO BRAKE INDUSTRY CO., LTD (Japan), AISIN SEIKI Co., Ltd (Japan), SGL Group (Germany), Federal-Mogul (US), Brembo S.p.A. (Italy), TMD FRICTION HOLDINGS GMBH (UK), Meritor, Inc. (US), and Japan Brake Industrial Co., Ltd (Japan) are some of the affluent competitors with significant market share in the Automotive Brake Linings Market.

RECENT DEVELOPMENTS:

Bosch, renowned for its pioneering technologies, has unveiled groundbreaking advancements in brake linings, integrating smart sensors and AI algorithms to optimize braking performance and mitigate risks on the road.

Federal-Mogul Corporation has focused its efforts on eco-friendly solutions, introducing brake linings with reduced environmental impact without compromising on effectiveness. Their commitment to sustainability aligns with the growing global emphasis on eco-conscious practices in automotive manufacturing.

Akebono Brake Corporation, recognized for its cutting-edge friction materials, has spearheaded innovations in brake lining compositions, enhancing durability and reliability under diverse driving conditions. Furthermore, the incorporation of advanced materials has led to quieter and smoother braking experiences for consumers worldwide.

General Motors (US)-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 25.67 Billion |

| Market Size by 2031 | US$ 49.70 Billion |

| CAGR | CAGR of 8.7% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Vehicle Type (Pickup Trucks, Light Trucks, Others • by Propulsion Type (Internal Combustion Engine (ICE), Electric & Hybrid) • by Application (Commercial Use, Industrial Use) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Ashok Leyland, Hyundai Motor Company, Ford Motor Company, Isuzu Motors, Gaz Group, General Motors, Honda Motor Company, Renault Group, Tata Motors, and Toyota Motors |

| Key Drivers | •Government tax credits, subsidies, and incentives are driving demand for commercial vehicles. •Expansion of the automotive manufacturing sector. |

| RESTRAINTS | •Stringent CO2 emission laws have an impact on industrial costs. •Emission regulations are stricter. |