Connected Motorcycle Market Key Insights:

Get More Information on Connected Motorcycle Market - Request Sample Report

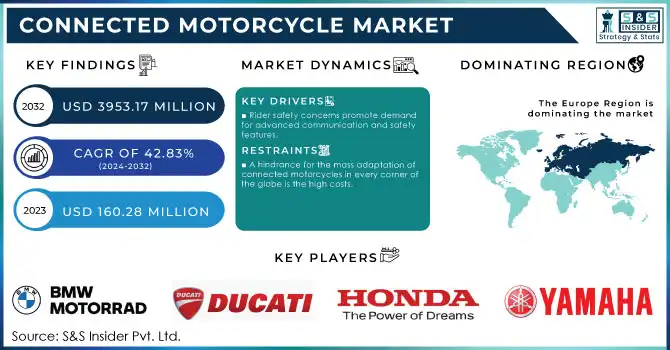

The Connected Motorcycle Market Size was valued at USD 160.28 Million in 2023 and will reach USD 3953.17 Million by 2032 and grow at a CAGR of 42.83% over the forecast period of 2024-2032.

The Connected Motorcycles Market is in constant evolution, based on the new government policies, technologies developed in the market, and launch of new products. Governments of major regions, such as Japan, China, the USA, France, and Germany, are increasingly supporting policies that should spur the increased integration of smart and connected technologies in motorcycles to improve road safety as well as environmental sustainability.

The Japanese Government has implemented policies in favor of the development of Intelligent Transportation Systems, especially to reduce road accidents. The focus here is on Vehicle-to-Everything (V2X), through which motorcycles can converse with other nearby vehicles and infrastructure for enhanced safety and smooth traffic flow. Connected vehicle technology is also deep-rooted in China. The Chinese government, under the banner of the Ministry of Industry and Information Technology (MIIT), has indicated that it will roll out V2X infrastructure across its cities by 2025 and is motivating connectivity in motorcycles for its smart city and intelligent transportation project.

In the USA, the National Highway Traffic Safety Administration (NHTSA) has also been working on regulations meant to enhance vehicle-to-vehicle (V2V) and vehicle-to-anything (V2X) communication standards, which include motorcycles. The policy is expected to make the riders safer by improving the number of collision events and the riders' awareness of potential hazards. France, on the other hand, has tried to integrate smart mobility technology in motorcycles. It introduced Advanced Rider Assistance Systems (ARAS) as a tool to mitigate the threat of road safety. For instance, the country is now encouraging the development of smart roads and urban infrastructure that will interact with connected motorcycles, thereby placing a stronger emphasis on the country's connected vehicle safety and innovation.

Technologically current developments in the connected motorcycle market are changing the riding experience. Among the major manufacturers, BMW and Ducati already have the V2V systems while Yamaha has real-time navigation and safety features such as collision avoidance and adaptive cruise control. Most of these improve rider safety and comfort and make their lives easier. The fifth one, and also another game-changer, is connectivity through 5G. The motorcycle's interaction with the surrounding environment is quicker and more efficient; smart helmet systems which can provide real-time traffic updates, availability of augmented reality displays for a super-premium feel.

Connected Motorcycle Market Dynamics

KEY DRIVERS:

-

Rider safety concerns promote demand for advanced communication and safety features.

Connected motorcycles feature high-end safety systems, such as Vehicle-to-Vehicle (V2V) communications, collision detection, and even adaptive cruise control, which reduce accident risks by a huge percentage. Governments of Japan and the USA are promoting adoption of Vehicle-to-Everything (V2X) technology to make motorcycles safer. Such features are regulation-driven, but at the same time, highly in demand by consumers who will not compromise on safety.

-

Smart infotainment integration also enhances the appeal of connected motorcycles.

To the modern consumer, connected motorcycles are the future of very smart infotainment features in automobiles. Many motorcycle owners reported that the level of technological and connectivity- capabilities when purchasing a new motorcycle had importance, survey indicates. Infotainment systems integrated into connected motorcycles include some of the features such as GPS navigation, hands-free calling, and streaming music. The primary reason for almost 30% market for connected motorcycles is infotainment, with companies such as BMW and Ducati seeing proposed models come out fitted with Bluetooth integration and smart helmet displays. Convenience leads this younger, more tech-savvy crowd to this integrated, seamless riding experience, hence the force that fuels further growth in this sector. Government initiatives for smart city projects, mainly in Europe, where the development of smart cities is advancing urban connectivity, lead to a higher sale of connected motorcycles among consumers.

RESTRAIN:

-

A hindrance for the mass adaptation of connected motorcycles in every corner of the globe is the high costs.

Some of the major issues in the connected motorcycle market are the high costs related to integrating advanced connectivity technologies. These include development and installation of systems such as V2X, 5G-based communication modules, and advanced safety features like ARAS or Advanced Rider Assistance Systems. Therefore, the price for a connected motorcycle is 25 percent more than that of a standard motorcycle, which may not attract easily price-sensitive consumers. Such high-end value proposition such as bike-to-infrastructure connectivity is more of an after-sales offering in countries like Asia-Pacific, where most of the bikes are meant for easy movement.

Besides, the V2I infrastructure remains relatively undeveloped in most counties. Connected motorcycles are unlikely to find much acceptance in emerging markets, as governments do not have a reason to build smart road networks. Unless there are significant subsidies or cost reductions, the high price of connected motorcycles would also keep the customers away and slow down the growth in the market. Furthermore, many bikers would not be willing to pay for technologies they believe are not needed for their daily rides, which is unlike the car manufacturers whose safety technologies have gained much popularity.

Connected Motorcycle Market Segment Analysis

BY CONNECTIVITY TYPE

The Embedded segment held a dominant position in the market in 2023, with an approximate share of 66.94% of the total share. Embedded systems offer fully factory-installed, all-in-one connectivity solutions within the motorcycle itself. High-end motorcycle companies, like BMW and Harley-Davidson, prefer this connectivity because it is fully embedded with features that allow GPS navigation, real-time diagnostics, and V2X communication to be hosted within the operating system of the vehicle. This means that the rider is surrounded by seamless interaction with the machine itself without ever requiring external devices or connections. The strong preference comes from convenience, better performance, and security in having been part of the motorcycle's ecosystem from the start.

Tethered connectivity is estimated to capture the highest growth rate in the forecast period from 2024 to 2032, with a CAGR of 43.52%. Tethered solutions are cheaper and allow riders to use a wide scope of features without requiring fully integrated hardware. Depending on the features of smartphone technology being constantly upgraded, tethered solutions will allow constant improvement and enhancements in the experience of riding. The requirement for flexible connectivity options, which allows riders to get direct smartphone assists to navigate, listen to music, or access emergency services without relying on already-installed systems, will drive it further.

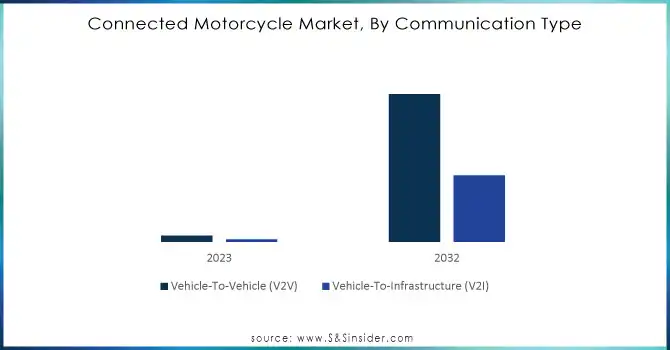

BY COMMUNICATION TYPE

The V2V communication segment accounted for the largest market share in 2023, at 71%. V2V communication allows motorbikes to communicate with other vehicles on the road, exchanging speed, direction, and braking patterns with respect to accident reduction and road safety improvement. The USA and Germany governments are emphasizing the establishment of V2V communication as an essential safety feature for motorcycles and cars alike. Ducati and BMW are luxury motorcycle models that employ V2V communication to enable superior inbuilt safety features, including collision avoidance and lane change warnings.

V2I communication segment is less significant but expected to grow with the fastest rate at a CAGR of 44.25% during the forecast period from 2024 to 2032. It is motorcycle-to-infrastructure communication, through which motorcycles interact with traffic signals, road signs, etc., in order to optimize the flow of traffic and reduce congestion. The rise in smart city projects that are being rolled out in Europe and Asia-Pacific will drive up the demand for V2I technology. As more cities start investing in smart infrastructure, V2I communication will be a prominent feature for motorcycle navigation through urban locations. The incorporation of 5G networks will further enhance the efficiency and effectiveness of V2I communication, which will contribute to becoming one of the core growth drivers in the coming years.

Need Any Customization Research On Connected Motorcycle Market - Inquiry Now

BY SERVICE

In 2023, the Infotainment segment accounted for 29% of the entire market. Infotainment services like connectivity using smartphones, navigation systems, and entertainment make up an essential feature on contemporary motorcycles. While on the other hand, comfort and entertainment services on the way have been high in demand from users, thus the trend for such trendy infotainment systems in products has forced producers like Honda and Yamaha lately.

Vehicle Management and Telematics Segment is expected to grow at the fastest rate and represent the most rapid growth during the forecast period. This segment deals with the timeliness of data shared between riders and fleet operators on motorcycle performance, fuel consumption, and predictive maintenance alerts. The growing adoption of IoT technologies in motorcycles will allow for the collection and analytics of real-time data, which will contribute to optimization of motorcycle performance for each rider and a consequent reduction in costs from unscheduled maintenance. Telematics solutions for motorcycles are in increasing demand within fleet management solutions, especially in delivery and rental applications. As businesses seek efficiency improvement, along with lowering operational costs, the integration of telematics and vehicle management systems is expected to gather enormous growth.

Connected Motorcycle Market Regional Overview

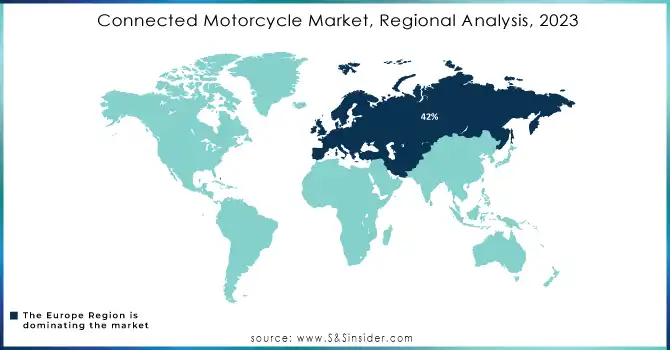

Europe dominated the connected motorcycle market in 2023 with a market share of 42% of the total market. It is mainly due to the strong support of smart transportation systems from the government, the presence of key motorcycle manufacturing companies such as BMW and Ducati, and the pervasive use of advanced rider assistance systems (ARAS). Countries such as Germany and France were also the first among the rest to introduce V2X technology and develop smart infrastructures supporting connected motorcycles. Strict safety standards are compelling manufacturers to implement connected technologies in motorcycles while safety standards of vehicles under rules continue going to greater heights in the European Union.

Going forward, the Asia-Pacific region is seen to expand at the fastest growth rate during the forecast period from 2024 to 2032. Growth in this region will be spurred by increasing demands for motorcycles in countries such as India, China, and Japan, in which motorcycles are mainly used as a mode of transportation. Other factors that drive the connected motorcycle market in the region are its focus on developing smart cities and very fast speed adoption of the 5G network. China and Japan are investing heavily into V2X infrastructure, which is getting ready for mass adaptation of smart bikes in urban and semi-urban cities.

Major Players in Connected Motorcycle Market

Some of the major players in the Connected Motorcycle Market are

-

BMW Motorrad (Connected Ride, ARAS systems)

-

Ducati (Adaptive Cruise Control, Ducati Link App)

-

Harley-Davidson (LiveWire, H-D Connect Service)

-

Honda Motor Co. (Smartphone Voice Control, My Honda+ app)

-

Yamaha Motor Co. (TMAX Tech Max, V2X prototypes)

-

Kawasaki (Rideology App, Bosch ARAS)

-

KTM (MyRide Connectivity, Adaptive Cruise Control)

-

Suzuki (Suzuki MySpin, V2V communication systems)

-

Piaggio (Vespa MIA, Piaggio Fast Forward)

-

Triumph Motorcycles (My Triumph Connectivity System, TFT display)

-

Zero Motorcycles (Zero App, Bosch 10th Gen ABS)

-

Indian Motorcycle (Ride Command, Bluetooth integration)

-

Hero MotoCorp (Hero Connect, Vehicle Tracking Systems)

-

Royal Enfield (Tripper Navigation, Bluetooth integration)

-

Bajaj Auto (Bajaj Ride, Connected Services Platform)

-

TVS Motor Company (SmartXonnect, Telemetry-based systems)

-

Aprilia (Aprilia Multimedia Platform, V4-MP connectivity)

-

CFMoto (CF Connect App, Bosch IMU)

-

Husqvarna Motorcycles (Ride Husqvarna App, Connected Dashboards)

-

Vespa (Vespa MIA, Mobile Connectivity)

MAJOR SUPPLIERS

-

Bosch (ARAS systems, ABS modules)

-

Continental (Telematics units, V2X modules)

-

Denso (V2X communication systems, sensors)

-

NXP Semiconductors (Chips for connectivity, V2X controllers)

-

Infineon Technologies (Microcontrollers, power electronics)

-

Qualcomm (5G chips, telematics solutions)

-

Garmin (GPS modules, navigation systems)

-

Harman International (Infotainment systems, Bluetooth modules)

-

Valeo (Advanced rider assistance systems, safety sensors)

-

ZF Friedrichshafen (Motorcycle stability systems, communication modules)

RECENT TRENDS

-

June 2024: The new lineup from BMW Motorrad features maps, navigation, and real-time traffic via TomTom's power. This allows an innovative riding experience through the integration of built-in in-line navigation. Alternatively, a mobile app is also available: this can be accessed worldwide in both Android and iOS.

-

September 2023: Ducati reiterates its commitment to guaranteeing the maximum level of safety for the world's motorcycle users. The Bologna based manufacturer was one of the key protagonists during the Demo Event organised by the Connected Motorcycle Consortium at the Lausitzring (Germany) in order to confirm the efficacy of the motorbike-car connectivity systems developed within this cycle of research from the consortium.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 160.28 Million |

| Market Size by 2032 | US$ 3953.17 Million |

| CAGR | CAGR of 42.83 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Communication Type (Vehicle-to-Vehicle (V2V) and Vehicle-to-Infrastructure (V2I)), • By Network Type (Cellular and Dedicated Short Range Communication (DSRC)), • By Connectivity Type (Embedded, Tethered), • By Application (Approach Indication, Intersection Movement Assist, Collision Warning, Emergency Brake Light, Traffic Warning, Weather Advisory, Optimal Signal Speed Advisory, Lane Change Warning, Road Repair Warning) • By Service (Driver Assistance, Infotainment, Safety, Vehicle Management and Telematics, Insurance) • By End User (Commercial, Private) • By Calling Service (Emergency call (eCall), Breakdown call (bCall), Information call (iCall)) • By Propulsion (ICE, Electric) • By Vehicle Type (Sport, Tour, Roadster, Heritage, Adventure, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BMW Motorrad, Ducati, Harley-Davidson, Honda Motor Co., Yamaha Motor Co., Kawasaki, KTM, Suzuki, Piaggio, Triumph Motorcycles, Zero Motorcycles, Indian Motorcycle, Hero MotoCorp, Royal Enfield, Bajaj Auto, TVS Motor Company, Aprilia, CFMoto, Husqvarna Motorcycles, Vespa. |

| Key Drivers | • Rider safety concerns promote demand for advanced communication and safety features. • Smart infotainment integration also enhances the appeal of connected motorcycles. |

| Restraints | • A huge hindrance for the mass adaptation of connected motorcycles in every corner of the globe is the high costs. |