Electrolyzer Test System Market Report Scope & Overview:

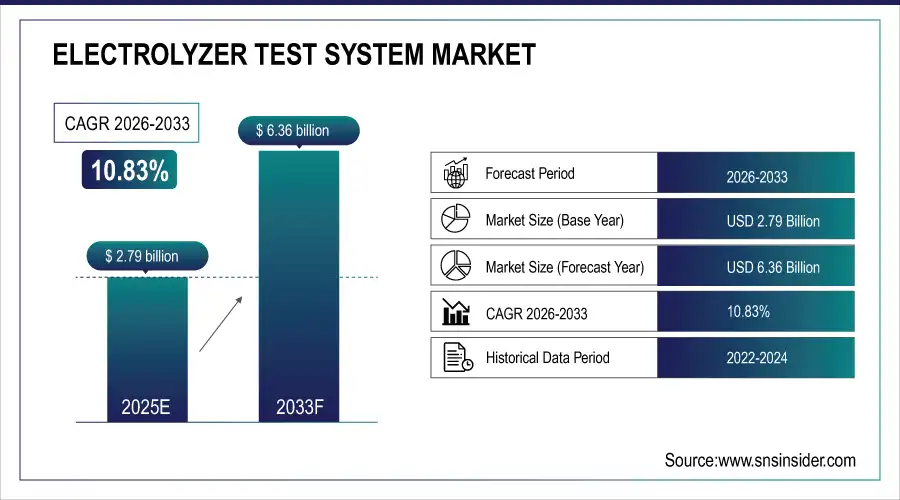

The Electrolyzer Test System Market Size was valued at USD 2.79 billion in 2025E and is expected to reach USD 6.36 billion by 2033, growing at a CAGR of 10.83% over the forecast period of 2026-2033.

The Electrolyzer Test System Market is experiencing strong growth, driven by rising demand for hydrogen production and renewable energy integration. Increasing focus on green hydrogen projects and government-backed sustainability goals is fueling investments in testing technologies. These systems evaluate electrolyzer efficiency, durability, and performance, ensuring reliability across industrial, energy, and transportation applications.

In the U.S., planned electrolyzer capacity could expand from 116 MW today to 4,524 MW, with annual hydrogen output reaching ~0.72 million metric tons via electrolysis.

Market Size and Forecast:

-

Electrolyzer Test System Market Size in 2025E: USD 2.79 Billion

-

Electrolyzer Test System Market Size by 2033: USD 6.36 Billion

-

CAGR: 10.83% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Electrolyzer Test System Market - Request Free Sample Report

Key Electrolyzer Test System Market Trends

-

Growing adoption of green hydrogen projects globally is driving demand for advanced electrolyzer testing systems to ensure performance and durability.

-

Increasing R&D investment by governments and private players is boosting innovation in PEM, Alkaline, and Solid Oxide electrolyzer testing technologies.

-

Rising focus on standardization and safety testing protocols to meet international hydrogen production standards.

-

Integration of digital twins, IoT sensors, and AI-based diagnostics in test systems for real-time monitoring and predictive maintenance.

-

Expanding deployment of electrolyzer test systems in pilot-scale hydrogen plants and industrial decarbonization projects.

-

Shift toward modular and automated testing platforms enabling cost-effective and scalable evaluation of electrolyzer performance.

-

Growing participation from research institutions and academia to improve system efficiency and lifecycle assessment.

U.S. Electrolyzer Test System Market Insights

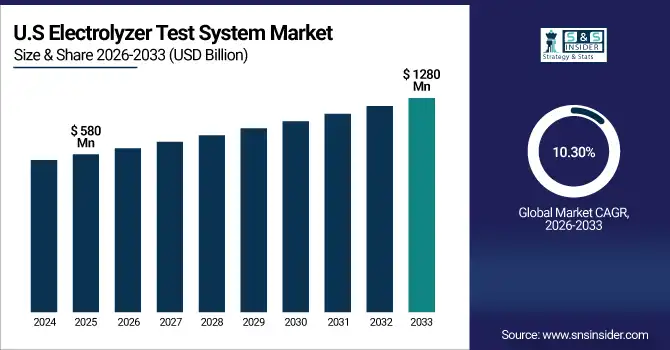

The U.S. Electrolyzer Test System Market size was USD 580 million in 2025 and is expected to reach USD 1280 million by 2033 growing at a CAGR of 10.30% over the forecast period of 2026-2033. the U.S. Electrolyzer Test System Market is witnessing notable expansion due to the rising focus on green hydrogen and decarbonization initiatives. This surge is primarily caused by increased federal funding through programs like the U.S. Department of Energy’s Hydrogen Shot, which targets a 40% reduction in hydrogen production costs by 2030. As a result, manufacturers are investing in advanced testing technologies such as AI-integrated monitoring and digital twin simulation to enhance system efficiency, safety, and performance reliability.

Electrolyzer Test System Market Growth Driver

-

Growing Government Support for Green Hydrogen Projects Accelerates Electrolyzer Test System Market Growth

Increased global focus on decarbonization and clean hydrogen initiatives has significantly accelerated the adoption of electrolyzer test systems. Governments across major economies are investing heavily in green hydrogen production infrastructure, creating strong demand for advanced testing and validation systems. This growth is primarily driven by the need to ensure safety, efficiency, and performance reliability in electrolyzer operations. In the U.S., the Department of Energy (DOE) has announced multi-billion-dollar initiatives under the Hydrogen Shot program to make green hydrogen cost-competitive. Such initiatives require high-precision testing systems to validate performance under different operational conditions. Consequently, manufacturers are focusing on AI-enabled diagnostics, real-time monitoring, and automation-based test benches to meet emerging standards and performance requirements.

In March 2025, the U.S. Department of Energy launched the Hydrogen Infrastructure Acceleration Program, supporting projects aimed at improving electrolyzer system efficiency. This led to a 25% increase in demand for advanced test benches, particularly among domestic hydrogen system manufacturers such as Plug Power and Nel Hydrogen, emphasizing the market’s growing potential.

Electrolyzer Test System Market Restraint

-

High Initial Setup Costs and Calibration Complexity Restrain Electrolyzer Test System Market Expansion

Despite growing demand, high setup and calibration costs continue to challenge widespread adoption of electrolyzer test systems. Developing and maintaining precision-based testing infrastructure requires substantial capital investment, especially for SMEs and research facilities. Additionally, integrating multi-sensor diagnostics, data acquisition systems, and real-time analytics increases overall system complexity. The lack of standardized global protocols further complicates calibration, resulting in inconsistencies in testing outcomes. These technical and cost barriers hinder small-scale adopters from entering the market, limiting scalability and cross-industry deployment. As a result, manufacturers are seeking partnerships or government subsidies to mitigate cost constraints and promote wider accessibility.

In January 2025, several U.S.-based hydrogen start-ups postponed electrolyzer testing projects due to equipment setup costs exceeding USD 500,000. This delay slowed prototype validation timelines, reducing innovation velocity in early-stage green hydrogen technology development across academic and industrial research sectors.

Electrolyzer Test System Market Opportunity

-

Rising Integration of AI and IoT Creates New Opportunities for Intelligent Electrolyzer Test System Development

The increasing incorporation of Artificial Intelligence (AI) and Internet of Things (IoT) technologies in test systems is unlocking new opportunities for innovation. Smart electrolyzer test benches now leverage predictive analytics and cloud-based data management to optimize performance monitoring and reduce system downtimes. The shift toward digital twins and real-time simulations enables faster fault detection, predictive maintenance, and adaptive control strategies. This cause-effect relationship highlights how digital transformation in industrial testing is strengthening precision and operational efficiency. The trend is further fueled by rising R&D investments from both government and private sectors in digital hydrogen infrastructure, driving next-generation testing capabilities.

In June 2025, Siemens Energy launched an AI-integrated test system designed to predict electrolyzer degradation with 95% accuracy. This innovation demonstrated how combining IoT sensors with machine learning can enhance efficiency, reduce maintenance costs, and ensure consistent performance validation across diverse hydrogen production environments.

Electrolyzer Test System Market Segment Highlights:

• By Type: Alkaline Electrolyzer Test Systems – 37.5% share (largest); PEM Test Systems fastest-growing; SOE Test Systems steady growth; Others (AEM/Hybrid) moderate growth.

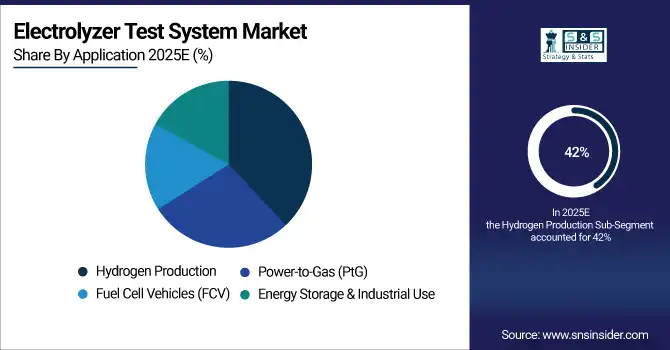

• By Application: Hydrogen Production – 42% share (largest); Power-to-Gas (PtG) fastest-growing; Fuel Cell Vehicles (FCV) steady growth; Energy Storage & Industrial Use moderate growth.

• By End-Use Industry: Energy & Utilities – 40% share (largest); Chemical & Industrial Gases fastest-growing; Transportation steady growth; Research & Academia moderate growth.

Electrolyzer Test System Market Segment Analysis

By Type

The Alkaline Electrolyzer Test Systems segment holds the largest market share at 37.5%, driven by its technological maturity, cost-effectiveness, and long operational lifespan, making it ideal for large-scale hydrogen production and industrial testing. Proton Exchange Membrane (PEM) Test Systems are the fastest-growing segment, fueled by rising adoption of green hydrogen projects, compact designs, and better efficiency at variable loads. Solid Oxide Electrolyzer (SOE) Test Systems witness steady growth due to their high-temperature operation and suitability for industrial applications, while AEM/Hybrid Systems maintain moderate growth as innovation continues but commercialization remains limited.

By Application

The Hydrogen Production segment holds the largest market share at 42%, driven by the rapid expansion of industrial-scale hydrogen plants and government-backed green hydrogen initiatives. Power-to-Gas (PtG) is the fastest-growing application, fueled by the integration of renewable energy with electrolyzers to store excess power as hydrogen. Fuel Cell Vehicles (FCV) show steady growth as demand rises for hydrogen-powered mobility solutions, while Energy Storage & Industrial Use maintains moderate growth due to limited adoption of high-capacity hydrogen storage and niche industrial applications.

By End-Use Industry

The Energy & Utilities segment leads with 40% market share, reflecting the increasing adoption of electrolyzer test systems in utility-scale hydrogen generation and renewable integration projects. Chemical & Industrial Gases is the fastest-growing end-use industry, driven by demand for high-purity hydrogen in industrial and chemical processes. Transportation shows steady growth due to rising fuel cell vehicle deployments, while Research & Academia maintains moderate growth, primarily for pilot projects, prototype validation, and experimental R&D studies.

Electrolyzer Test System Market Regional Analysis

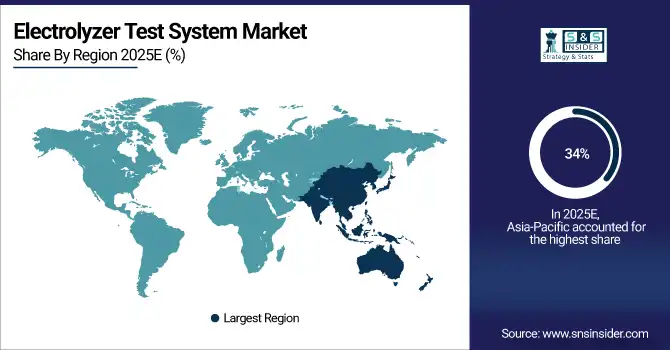

Asia-Pacific Electrolyzer Test System Market Insights

Asia-Pacific leads with a 34.00% share in 2025 and is the fastest-growing region, driven by rapid industrialization, urbanization, and expansion of green hydrogen infrastructure. China, India, Japan, and South Korea are major contributors, supported by government policies promoting renewable energy, hydrogen production, and electrolyzer testing programs. Adoption of advanced PEM, Alkaline, and Solid Oxide test systems is increasing, fueled by rising demand in industrial, energy, and transportation sectors. Flexible financing, private-sector investments, and technological innovation further accelerate regional growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Electrolyzer Test System Market Insights

North America accounts for 28.00% of the market in 2025, led by robust industrial infrastructure, early adoption of green hydrogen projects, and supportive government incentives. The U.S. dominates regional growth through investments in electrolyzer facilities, R&D centers, and commercial hydrogen plants. Integration of AI-enabled diagnostics, digital twin simulations, and modular test systems enhances system reliability. Availability of financing, private-sector investments, and federal programs like the DOE Hydrogen Shot support widespread adoption across energy, transportation, and industrial sectors.

Europe Electrolyzer Test System Market Insights

Europe holds 24.00% of the market in 2025, supported by mature industrial and automotive infrastructure, renewable energy initiatives, and strong government-backed modernization programs. Germany, France, and the U.K. are key contributors, investing in PEM, Alkaline, and hybrid electrolyzer testing for industrial and transport applications. Safety regulations, energy transition policies, and hydrogen roadmap initiatives drive demand for high-precision test systems, with banks and NBFCs collaborating to facilitate adoption across research, energy, and industrial sectors.

Latin America and Middle East & Africa (MEA) Electrolyzer Test System Market Insights

Latin America accounts for 9.00%, and MEA for 5.00% of the market in 2025, emerging as high-potential regions. Brazil and Mexico lead LATAM, investing in hydrogen production, industrial energy, and transportation applications. In MEA, UAE, Saudi Arabia, and Egypt focus on industrial expansion, renewable energy, and EV adoption. Government incentives, foreign investments, and strategic infrastructure projects drive the adoption of electrolyzer test systems, supported by leasing programs, technology partnerships, and R&D collaborations.

Competitive Landscape for Electrolyzer Test System Market:

AVL List GmbH

AVL List GmbH provides advanced testing systems and solutions for electrolyzers and fuel cell technologies.

-

In September 2025, AVL List launched a modular PEM electrolyzer test platform in Germany, integrating AI-based diagnostics to improve efficiency, durability, and performance monitoring of industrial hydrogen systems.

Green Light Innovation

Green Light Innovation specializes in electrolyzer test systems and hydrogen energy monitoring solutions.

-

In August 2025, Green Light Innovation introduced an automated Alkaline electrolyzer test system in the U.S., enhancing operational reliability, real-time data analytics, and predictive maintenance capabilities.

HORIBA FuelCon GmbH

HORIBA FuelCon develops hydrogen test benches and electrolyzer monitoring solutions.

-

In July 2025, HORIBA FuelCon unveiled a solid oxide electrolyzer testing system in Japan, enabling high-temperature performance evaluation and long-term reliability analysis for industrial hydrogen projects.

Electrolyzer Test System Market Key Players

Some of the Electrolyzer Test System Companies

-

AVL List GmbH

-

Green Light Innovation

-

HORIBA FuelCon GmbH

-

iASYS Technology Solutions

-

SANY Hydrogen

-

KNF Neuberger, Inc.

-

Equilibrium

-

Thasar

-

Entech Industrial Solution Co., Ltd.

-

KEWELL

-

Siemens Energy AG

-

Nel Hydrogen

-

Thyssenkrupp nucera

-

John Cockerill

-

Plug Power Inc.

-

Bosch Manufacturing Solutions (BMG)

-

Marposs

-

ATS Industrial Automation

-

Skyre, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 2.79 Billion |

| Market Size by 2033 | USD 6.36 Billion |

| CAGR | CAGR of10.83% from 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type: (Alkaline Electrolyzer Test Systems, Proton Exchange Membrane (PEM) Test Systems, Solid Oxide Electrolyzer (SOE) Test Systems, Others (AEM / Hybrid Systems)) • By Application: (Hydrogen Production, Power-to-Gas (PtG), Fuel Cell Vehicles (FCV), Energy Storage & Industrial Use) • By End-Use Industry: (Energy & Utilities, Chemical & Industrial Gases, Transportation, Research & Academia) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | AVL List GmbH, Green Light Innovation, HORIBA FuelCon GmbH, iASYS Technology Solutions, SANY Hydrogen, KNF Neuberger, Inc., Equilibrium, Thasar, Entech Industrial Solution Co., Ltd., KEWELL, Siemens Energy AG, Nel Hydrogen, Thyssenkrupp nucera, John Cockerill, Plug Power Inc., Bosch Manufacturing Solutions (BMG), Marposs, ATS Industrial Automation, Skyre, Inc. |