Electronic Grade Sulfuric Acid Market Report Scope & Overview

The Electronic Grade Sulfuric Acid Market size was worth USD 368.63 million in 2024 and is expected to reach USD 585.95 million by 2032 and grow at a CAGR of 5.96% over the forecast period of 2025-2032.

To Get more information on Electronic Grade Sulfuric Acid Market - Request Free Sample Report

The electronic grade sulfuric acid market analysis indicates, the growth of automation in manufacturing drives the market growth. It is due to an upsurge in automation in the manufacturing processes. As sectors, especially the semiconductor, PCB, and electronics industries, adopt automated operations, so is the pressure on precision and consistency of production processes. The major applications for these types of chemicals are in the fields of automated manufacturing, such as the steps involved in producing solar cells, where high-purity chemicals, such as electronic grade sulfuric acid are critical to performance, in the efficacy of steps that are critical in cleaning, etching, or chemical vapor deposition processes.

The American Chemistry Council, in its report, "Chemistry in Semiconductors and Electronics" states that, the production of one semiconductor chip requires about 500 types of process chemicals. They are essential in each process step of chip manufacturing, such as cleaning, etching, and doping. One such class of chemicals is electronic grade sulfuric acid, which is prominent for its high purity.

Moreover, these are mainly used in cleaning and etching processes that need to ensure the removal of contaminants and the formation of desired circuit patterns. It also emphasizes that chemical products make up an average of 9% − 14% of all materials purchased to create components for electronic devices, illustrating the importance of a strong supply chain for chemicals, such as electronic-grade sulfuric acid, and it drives the market growth in electronics manufacturing.

Market Dynamics:

Drivers:

-

Increased automation in electronics and chip manufacturing drives the market growth.

Automation in manufacturing these products is a necessity, as semiconductor fabrication processes become increasingly complex and require tighter tolerances. For this reason, highly specialized automated systems call for ultra-clean environments and exactness in the chemical composition of the gases for minimizing defects and improving the performance. The ultrahigh purity nature of electronic grade sulfuric acid is very important in the cleaning and etching of the silicon wafer, since those steps have to comply with harsh requirements from the industry.

The capital expenditures on robotic equipment in the U.S. were 12.96 billion in 2022, according to the U.S. Census Bureau, or 1.1% of total capital expenditures on equipment. Of the total robotic equipment expenditures, the manufacturing sector was the largest investor with USD 7.29 billion investments.

This massive investment signifies further dependency on a manufacturing enterprise on automation for improved productivity and precision. Automation in various modern industries, such as semiconductor and electronics manufacturing, requires the use of highly pure chemicals, including, electronic grade sulfuric acid, as it is essential to critical processes, such as wafer cleaning and etching.

Restraints:

-

Limited Supply of Ultra-Pure Chemicals May Hamper Market Expansion.

Availability of ultra-pure chemicals, such as electronic grade sulfuric acid is a key restraint observed in the growth of the market. Due to the increasing sophistication and complexity of semiconductor and electronics manufacturing processes, the demand for high-purity chemicals that meet rigorous industry guidelines has skyrocketed. However, synthesizing these ultra-pure chemicals is a highly resource and labor-intensive process that entails building a specialized facility, using extensive filtration, and applying strict quality control protocols. Production capacities of such chemical compounds are limited, and all it takes are a few disruptions in supply chains or production facilities to create a shortage.

Trends:

-

Rising Demand for 5G and AI Technologies Trends Boost Market Growth.

High demand for 5G and AI tech significantly drives the electronic grade sulfuric acid market growth. With 5G and AI continuing to disrupt industries globally, driving speedy communication, intelligent devices, and high-quality data processing, the market demands even more advanced semiconductor components. These elements are vital in 5G infrastructure, AI systems, and demand complex and accurate manufacturing processes. In their quest to produce chips that are faster, smaller, and more powerful, semiconductor manufacturers are embracing a host of emerging technologies and processes, many of which will require ultra-high-purity chemicals, like electronic grade sulfuric acid.

Electronic grade sulfuric acid companies are focused on an expansion strategy to increase their business and market growth as well. For instance, in March 2025, Taiwan Semiconductor Manufacturing Company (TSMC) announced its intention to expand its planned expenditure on advanced semiconductor manufacturing in the U.S. to USD 165 billion. That includes three new fab sites for one advanced packaging facility, and a mega R&D center slated to open, emphasizing the industrial capability to sustain AI and other leading-edge applications. This expansion drives the electronic grade sulfuric acid market trends in the market.

Moreover, over the next decade, tens of thousands of high-paying and high-tech jobs, and more than USD 200 billion of indirect economic output for Arizona and the U.S. will be driven by TSMC's investment.

Segmentation Analysis:

By Grade

Parts per trillion (ppt) held the largest electronic grade sulfuric acid market share, around 67%, in 2024. It is owing to the rising demand for high purity sulfuric acid for advanced semiconductor and electronics manufacturing. For instance, in semiconductor fabrication, tiny contaminations cause chips and electronic components to become defective. Thus, high accuracy and purity of chemicals are required. The use of high-purity and electronic-grade sulfuric acid means that no impurities are added during the etching and cleaning processes of wafers.

Parts per billion (ppb) held a significant market share due to its ability to achieve extreme levels of purity, which is required for various semiconductor and electronic manufacturing processes, albeit slightly less stringent than parts per trillion (ppt) grades. For the most sophisticated and sensitive semiconductor uses, pbb-grade sulfuric acid is employed as several technologies demand high-purity chemical substances, including PCB manufacturing and specific industrial applications.

By Application

In 2024, the semiconductors segment held the largest market share of approximately 42%. The segment’s growth is driven by the significant need of ultra-pure chemicals in manufacturing semiconductor devices. The manufacturing process of semiconductors is complex, as there are multiple steps, such as wafer cleaning, etching, and doping, which need to be performed using specific chemicals free of contamination for the desired functionality and performance of the final product. Electronic grade sulfuric acid plays a distinct role in cleaning and etching silicon wafers, which are the main component of semiconductor devices.

PCB panels held a significant market share it is due to increase the increasing demand in chemical industry. PCBs are manufactured utilizing numerous highly complex processes, including etching, cleaning, and surface preparation, all of which need ultra-high purity chemicals to avoid contamination during PCB manufacturing for the final reliability product. The etching process of PCB panels uses commercial electronic grade sulfuric acid capable of producing micro patterns on the copper layers, making up the circuitry. With the growing volume of advanced electronic products that are less cumbersome and more sophisticated, the demand for high-tech and high-precision PCBs is indispensable.

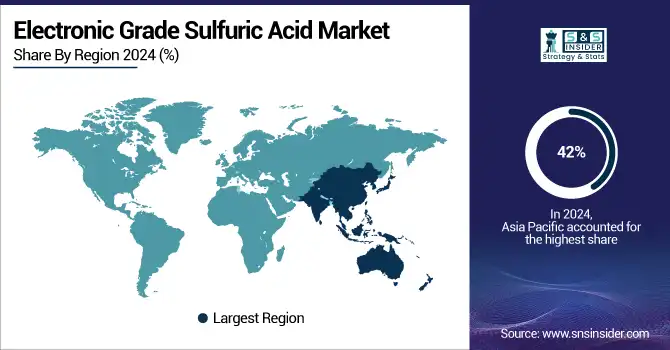

Regional Analysis:

Asia Pacific held the largest market share of around 42% in 2024. The region’s expansion is driven by the global leadership of the Asia Pacific in semiconductor and electronics manufacturing. China, Japan, South Korea, and Taiwan are among the largest producers of semiconductors, printed circuit boards (PCBs), and other electronic components globally, contributing to high demand for electronic grade sulfuric acid industry and other high-purity chemicals. The demand for ultra-pure chemicals has greatly improved due to the increasing industrialization, technology, and investments for advanced manufacturing facilities in these countries.

In 2024, Asia Union launched a new environmental protocol to prevent chemical waste output from the purification of sulfuric acid used to manufacture semiconductor cleanroom environments, enabling companies to run cleaner, further lowering their long-term impact while sustaining their semiconductor production processes.

North America held a significant market share and is the fastest-growing segment during the forecast period. The growth is attributed to the robust semiconductor manufacturing, electronics, and high-technology sectors in the region. The U.S., in particular, has some of the largest semiconductor manufacturers globally, including Intel, Micron Technology, and Applied Materials, which all use high-purity chemicals, including electronic grade sulfuric acid, in their fabrication. Moreover, the investments in developing next-gen technologies like 5G, AI, and IoT are also fueling the demand for more advanced semiconductor components, and hence increasing the consumption of ultra-pure chemicals in North America.

U.S held the largest market share, around 75%, in 2024, with the highest CAGR of 6.83% in the forecast period.

The U.S. accounted for the biggest share of the electronic grade sulfuric acid market on account of massive investment on the semiconductor front and technological advancements. A major reason for this increase is the CHIPS and Science Act, which was enacted in August 2022 and authorized USD 52.7 billion to support domestic semiconductor manufacturing.

Within a year of this legislation, more than USD 166 billion in semiconductor and electronics investments have been announced, demonstrating the nation's effort to bring back the leadership of semiconductor industry back to the U.S. Demand for high-purity chemicals such as electronic grade sulfuric acid will continue to grow as semiconductor manufacturing becomes more process-intensive, further entrenching the U.S. as a leader in these technologies.

Europe held a significant market share over the forecast period, driven by the strong industrial base, advanced technology, and several semiconductor manufacturers and electronics companies. Europe, for instance, has long been a global player in the semiconductor space, especially with German, French, and Netherlands-based electronics and semiconductor powerhouses including ASML and STMicroelectronics. Such companies are dependent on high-purity chemicals, including electronic grade sulfuric acid, used in manufacturing processes, including wafer cleaning, etching, and surface preparation.

Meanwhile, Europe has been prioritizing the diversification of semiconductor imports, setting up the European Semiconductor Alliance to achieve a 20% share of global semiconductor demand by 2030. Continued demand for key materials, such as electronic grade sulfuric acid to support this drive for increased self-sufficiency in semiconductor manufacturing is also helping to deliver a larger share of the European market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major companies operating in the market are BASF SE, Dow Chemical Company, Honeywell International Inc., PVS Chemicals Inc., Trident Group, Kanto Chemical Co., Inc., Chemtrade Logistics Inc., Reagent Chemicals & Research, Moses Lake Industries, Inc. (MLI), and Asia Union Electronic Chemical Corporation (AUECC).

Recent Developments:

-

In May 2023, MECS Inc. signed an agreement with Taiwan-based SAR Technology Inc. to provide proprietary technology and equipment for a new spent acid regeneration plant. The facility is meant to supply high-purity sulfuric acid for Taiwan's semiconductor business.

-

In 2023, MYCON commenced construction of the electronic-grade sulfuric acid plant at Plainview (Texas). The project is a joint venture with Dongjin Semichem Co. Ltd., Samsung C&T America Inc., and Martin Resource Management to provide high purity sulfuric acid for the semiconductor and electronic manufacturing industries globally.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 368.63 Million |

| Market Size by 2032 | USD 585.95 Million |

| CAGR | CAGR of5.96% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Grade (Parts per trillion (ppt), Parts per billion (ppb)) • By Application (Semiconductors, PCB Panels, Pharmaceuticals) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | BASF SE, Dow Chemical Company, Honeywell International Inc., PVS Chemicals Inc., Trident Group, Kanto Chemical Co., Inc., Chemtrade Logistics Inc., Reagent Chemicals & Research, Moses Lake Industries, Inc. (MLI), Asia Union Electronic Chemical Corporation (AUECC) |