Lithium Mining Market Report Scope and Overview:

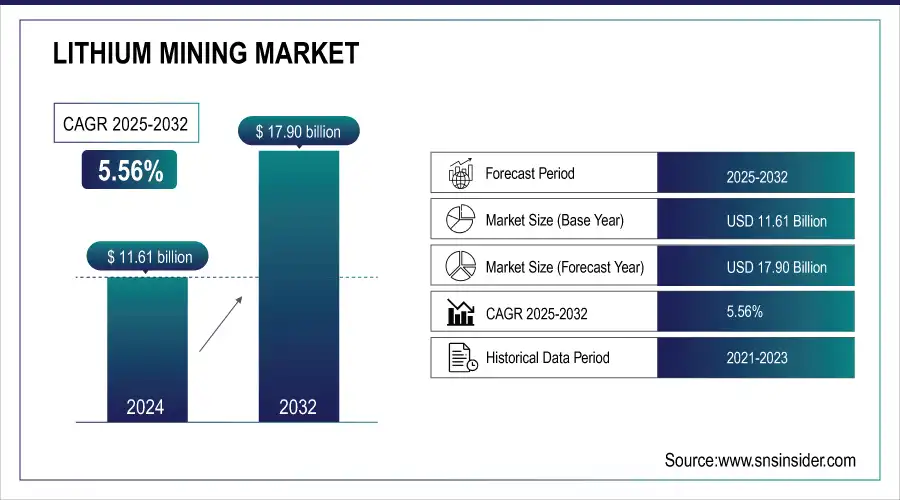

The Lithium Mining Market size was valued at USD 11.61 billion in 2024 and is expected to reach USD 17.90 by 2032 at a CAGR of 5.56% from 2025 to 2032.

The increasing development of renewable energy sources such as wind and solar has posed a significant demand for energy storage solutions. lithium-ion batteries have emerged as the preferred choice for grid storage systems due to their high energy storage system, energy density, long cycle life, and declining costs. According to the issue of EIA, such batteries are essential for storing excessive energy produced during the highest production of renewable energy, ensuring the supply of electricity in terms of lower renewable energy output.

Get PDF Sample Report on Lithium Mining Market - Request Sample Report

For instance, in 2023, the U.S. government announced a significant increase in funding for energy storage projects, allocating over USD 3 billion through the Department of Energy's Office of Energy Efficiency and Renewable Energy to support the development of advanced battery storage technologies. These figures and government-sponsored programs demonstrate the vital role lithium-ion batteries play in promoting the expansion of renewable energy sources, increasing demand for lithium, and propelling the market for lithium mining.

Lithium Mining Market Highlights:

-

Rising demand for electric vehicles is driving lithium consumption, as lithium-ion batteries are essential for powering EVs and supporting longer driving ranges.

-

Technological innovations in battery chemistry and design are boosting demand, with higher energy density and faster-charging capabilities enhancing electric vehicles and consumer electronics.

-

Growth in portable electronics, including smartphones, laptops, tablets, and smart devices, contributes significantly to the lithium mining market.

-

Government initiatives, such as the U.S. Inflation Reduction Act, provide incentives for EV adoption and domestic lithium production, supporting market expansion.

-

Increasing industrialization, urbanization, and renewable energy adoption stimulate demand for energy storage solutions, further driving lithium consumption.

-

High production costs, especially for hard rock lithium mining and processing, act as a key restraint to market growth.

Moreover, a remarkable increase in the demand for lithium has been caused by technological innovations in battery technology, which aim to improve the performance and increase the capabilities of lithium-ion batteries. It provides high power and fast charging features that require less time for charging, which is essential for the advantage of electric vehicles and the improvement of modern consumer electronics. There have been numerous examples of automakers, including Tesla, and researchers at MIT and other institutions pursuing new battery chemistries and designs to accommodate the increasing energy density that allows electric vehicles to travel longer and farther on a single charge. It shows that this factor is a driving force in the increase in the lithium mining market, as no other metals or elements can fully replace the current demand for lithium in the batteries of the next generation.

For instance, in 2023, Panasonic, a key supplier of batteries to Tesla, announced its plans to mass-produce a new type of lithium-ion battery with 20% higher energy density. This new battery aims to extend the range of electric vehicles while maintaining safety and reliability.

Additionally, the proliferation of portable electronic devices such as smartphones, laptops, and tablets continues to drive the demand for lithium-ion batteries, contributing to the growth of the lithium mining market.

Lithium Mining Market Drivers:

- Rising demand for electric vehicles drives the market growth.

The rising demand for electric vehicles is a major driver of growth in the lithium mining market, as lithium-ion batteries are essential for powering EVs. Recent developments by key players and supportive government policies underscore this trend. In 2023, Tesla continued to lead the EV market by ramping up production of its Model Y and introducing the Cybertruck, both of which rely on advanced lithium-ion batteries. This expansion aligns with the broader push for electrification across the automotive industry. For example, Ford launched the all-electric F-150 Lightning in 2022, marking a significant shift toward electric trucks and SUVs, which are more battery-intensive and thus require more lithium.

The rising sales of low-cost consumer electronics such as smartwatches, TVs, smartphones, smart gadgets, and handheld devices, as well as production-intensive industrial verticals in China, Japan, and the United States, are the primary drivers of lithium mining industry growth.

Governments are also playing a crucial role in driving this demand. In 2022, the U.S. government passed the Inflation Reduction Act, which includes substantial incentives for EV buyers and manufacturers to accelerate the transition to electric mobility. The act also includes provisions to boost domestic lithium production, reflecting the strategic importance of securing lithium supply chains.

The growing demand for electricity and the resulting stimulation of power grid growth as a result of increased industrialization and urbanisation are providing attractive opportunities for the lithium mining business. Developing countries and industrial market participants are concentrating on exploiting renewable energy resources and working on energy storage on a continuous basis. Such characteristics necessitate lithium at every level, creating a lucrative possibility for the lithium mining industry's total growth.

Lithium Mining Market Restraints:

- High production costs hamper the market growth.

High production costs are a significant restraint on the growth of the lithium mining market, primarily due to the complex and resource-intensive processes involved in extracting and processing lithium. The extraction of lithium from hard rock sources, such as spodumene, or brine deposits in salt flats, requires advanced technology, extensive infrastructure, and significant energy input, all contributing to high operational expenses. For instance, hard rock mining, which is more prevalent in Australia, involves extensive drilling, blasting, and chemical processing to isolate lithium, making it more costly than brine extraction.

Lithium Mining Market Segment Analysis:

By Source

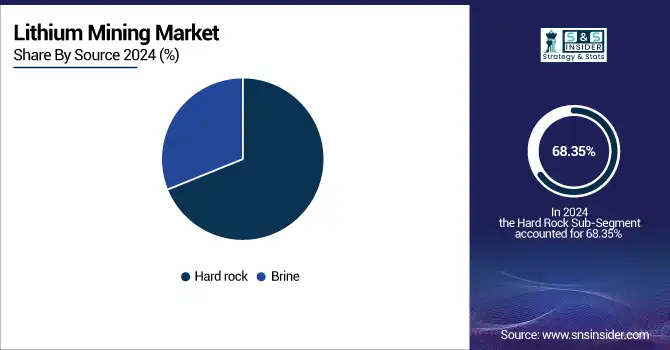

Hard rock sources held the largest market share at around 68.35% in 2024. Hard rock mining, primarily concentrated in Australia, has seen significant growth due to its higher lithium concentration, faster processing time, and the ability to meet the increasing demand for lithium-ion batteries. This type of mining is more consistent and predictable compared to brine extraction, which is largely concentrated in South America. Brine extraction involves a lengthy process of evaporating lithium-rich brine, which can take several months to years, making it less responsive to the rapid market demands.

By Type

In the lithium market, lithium hydroxide is currently the leading type in terms of demand and production. Lithium hydroxide is preferred for its suitability in producing high-energy-density batteries, which is essential for electric vehicles and advanced energy storage systems. It has become the dominant form due to its superior performance in lithium-ion batteries, especially in high-nickel cathodes which are increasingly used in EV batteries to enhance energy density and extend driving range. While lithium carbonate was traditionally more common and remains significant, the shift towards hydroxide is driven by its ability to meet the evolving requirements of modern battery technologies.

By Application

Batteries held the largest market share around 32.65% in 2024. The surge in demand for lithium-ion batteries, driven by the growing adoption of electric vehicles (EVs), renewable energy storage solutions, and portable electronics, has made this sector the dominant consumer of lithium. Lithium-ion batteries are favored for their high energy density, long cycle life, and lightweight properties, which are crucial for EVs and energy storage systems. Although lithium is used in various other applications such as ceramics and glass, lubricants and grease, polymers, flux powders, and air conditioning equipment, none match the scale of battery applications.

Lithium Mining Market Regional Analysis:

Asia-Pacific Lithium Mining Market Trends:

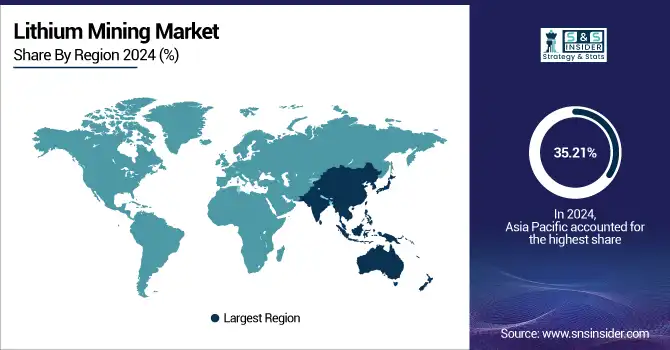

Asia Pacific held the highest market share in the Lithium Mining market around 35.21% in 2024. This is due to dominance results from the numerous presences of both lithium-ion battery and vehicle manufacturing companies in the region. The interest in electric vehicles in China, Japan, and South Korea serves as a major factor for lithium consumption. China also plays a leading role in lithium metal production. More than that, several refining facilities are located in the region. Another factor of Asia-Pacific leadership is the increasingly effective government’s policy in promoting green energy and supporting technology growth.

Get Customized Report as per Your Business Requirement - Request For Customized Report

North America Lithium Mining Market Trends:

North America is a prominent region in the Lithium Mining market due to the presence of major lithium mining companies and growing investments in battery production and electric vehicle manufacturing. The rising adoption of electric vehicles in the U.S. and Canada serves as a key factor for lithium consumption. The region also hosts significant lithium extraction and refining facilities. Additionally, supportive government initiatives promoting clean energy, sustainable transportation, and technological innovation strengthen North America’s position.

Europe Lithium Mining Market Trends:

Europe shows strong growth in the Lithium Mining market driven by increasing focus on electric mobility and renewable energy storage solutions. Countries such as Germany, France, and Norway are heavily investing in battery manufacturing and lithium supply chains. Several lithium refining and processing facilities are located in the region. Government policies supporting decarbonization, emission reduction targets, and incentives for electric vehicle adoption further contribute to Europe’s leadership.

Latin America Lithium Mining Market Trends:

Latin America is an important region in the Lithium Mining market due to its abundant lithium reserves, particularly in the Lithium Triangle of Chile, Argentina, and Bolivia. Mining investments and export-oriented strategies drive lithium production in the region. Several refining and extraction facilities support operations. Government policies facilitating mining operations and attracting foreign investment help strengthen Latin America’s role in the lithium market.

Middle East & Africa Lithium Mining Market Trends:

Middle East & Africa is developing its presence in the Lithium Mining market with emerging lithium projects and collaborations with global battery manufacturers. Countries such as Morocco, Namibia, and Egypt are expanding lithium resources. Several refining and extraction facilities are being established. Government initiatives promoting industrial growth, renewable energy, and infrastructure development further support the region’s growth in lithium mining.

Lithium Mining Market Key Players:

-

Jiangxi Ganfeng Lithium

-

Albemarle Corporation

-

Tianqi Lithium

-

Mineral Resources Limited

-

FMC Corporation

-

Nemaska Lithium Inc.

-

Pilbara Minerals

-

Wealth Minerals Limited

-

Arcadium Lithium (formerly Allkem and Livent)

-

Rio Tinto

-

Zijin Mining

-

CMOC Group

-

Huayou Cobalt

-

Sinomine Resource Group

-

Piedmont Lithium

-

Sigma Lithium

-

Standard Lithium

-

Millennial Lithium Corp.

Lithium Mining Market Competitive Landscape:

Albemarle Corporation, established in 1994, is a leading U.S.-based specialty chemicals company specializing in lithium, bromine, and refining catalysts. The company operates globally, supplying lithium compounds for batteries, electric vehicles, and energy storage. Albemarle’s integrated operations span mining, refining, and chemical production, driving innovation in sustainable technologies.

- In 2024, Albemarle announced the expansion of its lithium production capabilities with a new lithium hydroxide plant in the United States. This facility is set to bolster its ability to supply the growing demand for high-performance batteries used in electric vehicles and renewable energy storage

Jiangxi Ganfeng Lithium, established in 2000, is a leading Chinese lithium producer with integrated operations across mining, refining, and battery materials. The company supplies lithium for electric vehicles, energy storage, and electronics globally. Ganfeng is recognized for its sustainable practices, strategic partnerships, and strong presence in both upstream and downstream lithium markets.

- In 2023, Ganfeng Lithium launched a new lithium extraction project in Argentina. This venture aims to increase the company's lithium brine production capacity and diversify its supply chain to support the growing global market for lithium.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 11.61 Billion |

| Market Size by 2032 | USD 17.90 Billion |

| CAGR | CAGR of 5.56% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source (Brine and Hard Rock) • By Type (Chloride, Hydroxide, Carbonate, and Concentrate) • By Application (Batteries, Ceramics and Glass, Lubricants & Grease, Polymer, Flux Powder, Air Conditioning Equipment, and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Jiangxi Ganfeng Lithium, Albemarle Corporation, Tianqi Lithium, Sociedad Química y Minera (SQM), Mineral Resources Limited, FMC Corporation, Nemaska Lithium Inc., Pilbara Minerals, Wealth Minerals Limited, Lithium Americas Corp., Arcadium Lithium (formerly Allkem and Livent), Rio Tinto, Zijin Mining, CMOC Group, Huayou Cobalt, Sinomine Resource Group, Piedmont Lithium, Sigma Lithium, Standard Lithium, Millennial Lithium Corp. |