End User Experience Monitoring Market Report Scope & Overview:

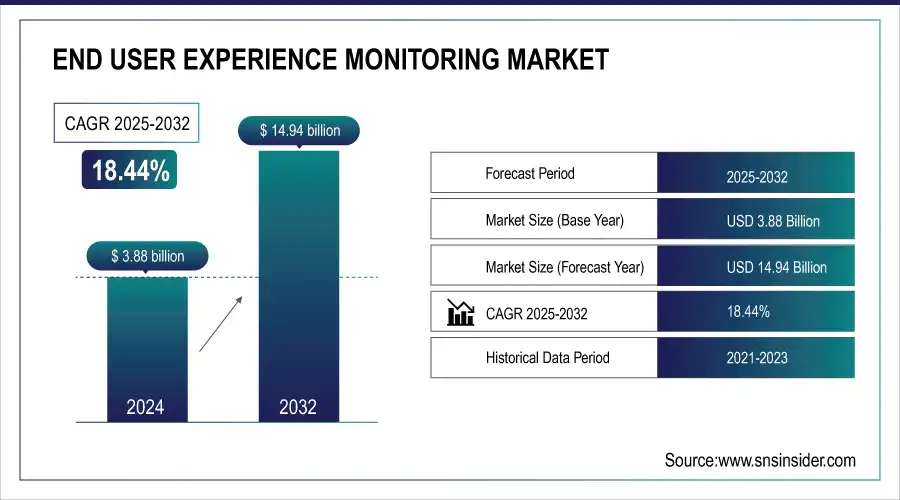

End User Experience Monitoring Market size was valued at USD 3.88 billion in 2024 and is expected to reach USD 14.94 billion by 2032, growing at a CAGR of 18.44% from 2025-2032.

To Get more information On End User Experience Monitoring Market - Request Free Sample Report

End User Experience Monitoring Market is growing with increasing need for intelligent digital experience, increased utilization of cloud-based applications, and preemptive performance management requirements. Organizations are focusing on user satisfaction, which is driving investment in monitoring solutions to detect issues in real-time and enhance operational efficiency on digital channels.

For example, a survey conducted by the International Association for Privacy Professionals discovered a 25% improvement in employee productivity among organizations that employed EUEM tools.

Furthermore, a worldwide survey indicates that 62% of the workforce prefers a flexible work environment, again pointing to the necessity for strong EUEM solutions to facilitate flexible workplace arrangements and ensure high productivity.

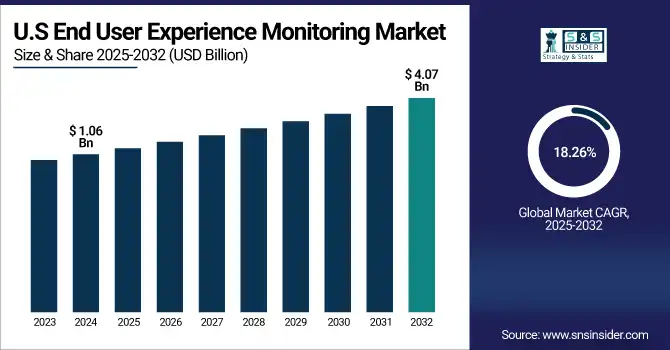

U.S. End User Experience Monitoring Market was valued at USD 1.06 billion in 2024 and is expected to reach USD 4.07 billion by 2032, growing at a CAGR of 18.26% from 2025-2032.

The U.S. End User Experience Monitoring Market is growing with escalating dependency on online services, rising adoption of the cloud, and the demand for real-time performance insights to deliver maximum customer satisfaction and optimal application delivery.

The U.S. Digital Service (USDS) has partnered with federal agencies to improve digital services, resulting in a 53% increase in customer satisfaction for 180 million annual visitors to SSA.gov.

Additionally, AWS has invested more than USD 108 billion in U.S. cloud computing infrastructure, adding almost USD 38 billion to the national GDP and enabling an average of almost 30,000 jobs annually in local communities.

Market Dynamics

Drivers

-

Increasing need for real-time performance data across digital channels is fueling end user experience monitoring solution adoption.

Firms now are focusing on end-to-end digital experiences, and IT executives are spending on real-time monitoring solutions that track application response times, performance, and availability. Customers now anticipate seamless, fast-to-load services on any device, and businesses require end-to-end visibility into the user experience. End user experience monitoring provides accurate insights that enable IT organizations to automatically detect bottlenecks before impacting users. This demand is further triggered by the growing presence of SaaS applications, remote working scenarios, and sophisticated multi-cloud configurations, which render such solutions inevitable to guarantee uninterrupted user satisfaction and business efficiency.

According to a 2023 U.S. Federal CIO Council report, 90% of agencies consider digital experience a top priority, with many adopting real-time monitoring tools to improve service delivery and reduce downtime.

53% of mobile site users leave behind a page which loads in more than 3 seconds, prompting companies to spend on performance monitoring for quicker app responsiveness, according to a Google/SOASTA survey.

Besides, the U.S. Bureau of Labor Statistics also indicated that 24% of all employed individuals worked from home at least part-time in 2023, a rise from 5.7% in 2019, compelling businesses to implement tools guaranteeing the user experience in diverse environments.

Restraints

- Privacy issues and compliance concerns restrict end user experience monitoring to a point where it is applicable in regulated sectors.

Monitoring solutions typically involve gathering and processing sensitive user interaction data, which poses privacy issues and possible regulatory risk. Organizations within industries such as healthcare, finance, and government have stringent compliance requirements like HIPAA, GDPR, or CCPA. The threat of user data exposure under monitoring particularly without anonymization or encryption can initiate legal obligations and reputation loss. As data residency and consent mandates become tighter, businesses hesitate to roll out tools that track user behavior, particularly if third-party vendors are involved. Such regulatory impediments pose a severe constraint on market expansion.

Opportunities

-

Artificial intelligence and machine learning creation broaden experience monitoring technology capabilities to create possibilities for advanced analytics and predictive analysis.

Embedding AI and ML capabilities within end-user monitoring solutions makes it possible to detect anomalies in real time, analyze root causes, and forecast user actions. With this technology, IT organizations can not only focus on resolving problems more quickly but also anticipate and avoid interference before they impact users. Vendors are now integrating intelligent analytics into dashboards to provide dynamic insights beyond flat performance metrics. This transformation improves digital experience management decision-making and brings new possibilities to serve industries where uptime and user satisfaction are paramount.

Microsoft Azure AI services report that integrating AI-powered monitoring tools reduces incident detection time by up to 70%, significantly improving system reliability and user experience.

IBM's AI-powered analytics systems enable IT departments to achieve real-time, dynamic insights that improve decision making, and their early adopter base reportedly improved the speed of issue resolution by 40%.

Google Cloud AI solutions facilitate predictive maintenance and anomaly detection, which allow businesses to minimize downtime by 20-30% and enhance customer satisfaction through seamless digital services.

Challenges

-

Lack of standardized metrics and benchmarks hinders performance comparison effectively across end user experience monitoring solutions.

Vendors may use different methodologies, and definitions further complicate the side-by-side comparison of how well multiple tools perform. One thing may be a better user experience in the context of a solution, but not be directly comparable in terms of quantification to another entity. This is missing from industry standards which creates vagueness in procurement, slows adoption, and complicates the analysis of investment return results. Marketing Firms also cannot successfully assess which measure actually indicates user opinion or business impact, thus complicating the task of connecting investments and business results. Without standardization, monitoring efforts shall be siloed and not as beneficial.

Segment Analysis

By Component

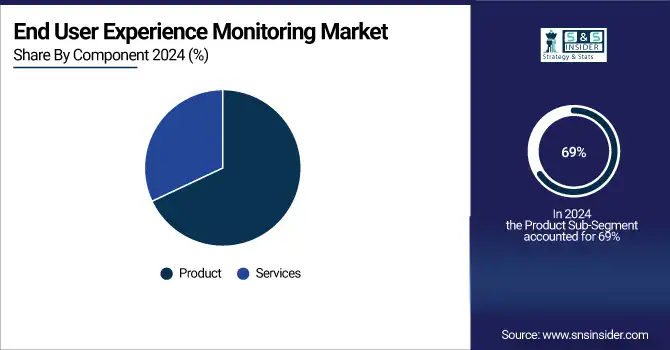

Product segment led the End User Experience Monitoring Market in 2024 with a 69% share of revenue as a result of high demand for standalone, scalable platforms that provide powerful monitoring capabilities out-of-the-box. Enterprises made capital investment a priority in trustworthy, configurable tools that offer fine-grained performance visibility and interoperate smoothly with their current IT infrastructures. The fact that these platforms could be owned and controlled by them, independent of third-party service providers, also helped the segment lead the market.

The services segment will record the highest CAGR of 19.89% during 2025-2032 based on increasing demand for professional and managed services to streamline deployment, integration, and optimization of monitoring platforms. Organizations without in-house technical competence increasingly turn to outsourced experience management from specialized vendors. As digital infrastructures continue to grow in complexity, bespoke consulting, analytics, and support services are regarded as imperative to leverage the maximum value and effectiveness of monitoring investments.

By Access Type

The web segment dominated the End User Experience Monitoring Market in 2024 with a 57% revenue contribution because browser-based applications have a commanding presence in industries. Because most of the interactions between customers and organizations are web-based, organizations invested in real-time web and portal performance monitoring. High traffic volumes, e-commerce growth, and business needs for constant uptime compelled enterprises to spend heavily on web monitoring solutions to deliver persistent and responsive digital experiences to end users.

The mobile sector is expected to register the highest CAGR of 19.85% during the forecast period 2025-2032 driven by the transition to mobile-first use cases among consumers and businesses. Ubiquitous use of smartphones, mobile apps, and mobile banking has generated a need for monitoring solutions that deliver visibility into app performance, latency, and user experience. As 5G grows in popularity and user expectations rise, organizations are looking to optimize mobile experiences for differentiation.

By End Use

The Banking, Financial Services, and Insurance (BFSI) sector led the End User Experience Monitoring Market in 2024 with a 29% revenue market, driven by the sector's desire for secure, high-performing online platforms. With customer trust depending on continuous availability of banking and transaction services online, BFSI companies invested heavily in monitoring tools to catch issues early. Regulatory pressure and competition from fintech also further pushed the industry to think about bringing seamless user experience.

Healthcare and Life Sciences is expected to grow at the highest CAGR of 20.67% during the forecast period from 2025 to 2032, driven by digital transformation in patient care, telemedicine, and clinical systems. Greater dependence on digital platforms for accessing health data, diagnosis, and remote consultations requires high-performance, dependable interfaces. Monitoring tools are increasingly becoming indispensable to maintain uptime, data integrity, and compliance, particularly as healthcare providers strive to enhance patient outcomes through effective digital interactions.

By Organization Size

Large companies dominated the End User Experience Monitoring Market in 2024 with a 65% revenue share because they have the technical and financial resources to implement advanced, enterprise-grade monitoring systems. Such entities have complex digital ecosystems with vast user bases and high-critical demand for service delivery. Their efforts to preserve brand reputation, reduce downtime, and optimize satisfaction take the form of immense investment in end-to-end monitoring across global operations and multi-cloud environments.

SMEs is expected to grow at the fastest CAGR of 17.71% from 2025-2032 due to increasing availability of inexpensive, cloud-based monitoring software that is specifically geared towards small organizations. SMEs are increasingly showing interest in user experience monitoring while they trudge through digital transformation in a technology-enabled market. The scalability of platforms, the simplicity of design, and the flexibility of pricing make these products affordable for SMEs to accelerate performance and customer engagement without massive IT investments.

By Deployment Mode

Cloud segment held the largest share in the End User Experience Monitoring Market in 2024 with a share of 63% in terms of revenue and is anticipated to register the highest CAGR of 19.43% during 2025-2032. This will be catalyzed by the omnipresent use of cloud-native applications and services among industries. With organizations moving to hybrid and multi-cloud environments, there is a constant need for monitoring solutions that are every bit as agile and scalable. Cloud monitoring solutions provide real-time analytics, seamless integration, and lower capital cost and hence, are well-suited for large corporates and SMEs who want to provide the best user experience in rapidly changing digital ecosystems.

Regional Analysis

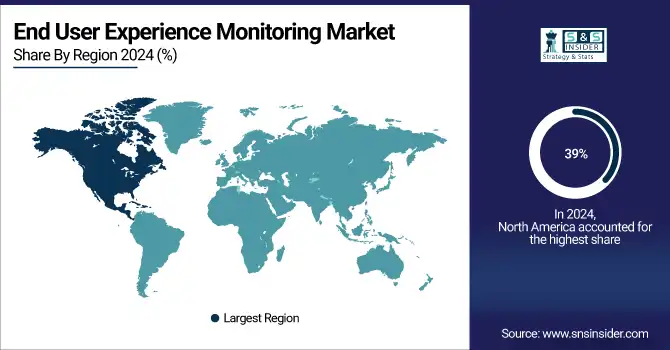

North America led the End User Experience Monitoring Market with the largest revenue share of around 39% in 2024 owing to the existence of sophisticated IT infrastructure, high digital transformation initiative adoption, and a vast pool of enterprises intent on enhancing customer satisfaction. Market growth was further propelled by autonomous investments on AI, analytics and cloud technologies enabling organizations to proactively monitor and optimize end-user experiences.

Get Customized Report as per Your Business Requirement - Enquiry Now

The US is leading the End User Experience Monitoring Market share due to technology adoption, strong digital infrastructure along with high consumer demand for customer-centric solutions.

Asia Pacific is expected to command the highest CAGR of about 20.50% over the forecast period from 2025 to 2032 due to increased digitalization in emerging economies, growing smartphone and internet penetration rates, and growing IT and telecom sectors. Rising demand for improved customer experience in industries like e-commerce, BFSI, and retail, and initiatives by the government towards smart cities and digital infrastructure fuel Asia Pacific's high end user experience monitoring solution consumption.

China leads the Asia Pacific End User Experience Monitoring Market owing to its accelerated digitalization, skilled consumer base, and high investment in modern IT infrastructure.

Europe is the leader in the End User Experience Monitoring Market because of advanced technology adoption in nations such as the UK and Germany. Increased focus on improving customer satisfaction and stringent regulations on data protection fuel market growth across the region as well.

Germany dominates the European End User Experience Monitoring Market due to the strong industrial base, advanced IT infrastructure, and early drive towards digital technology adoption.

Middle East & Africa End User Experience Monitoring market is increasing due to increasing digital adoption and expanding IT infrastructure in the Gulf region. Latin America sees steady growth driven by enhanced smartphone adoption and the need for better customer experience in key industries.

Key Players

BMC Software, CA Technologies, Catchpoint, Datadog, Dynatrace, IBM Corporation, Lakeside Software, Lumen Technologies, New Relic, Nexthink, Oracle Corporation, Riverbed, SAP SE

Recent Developments:

-

In January 2025, Dynatrace advanced AI observability by introducing enhanced LLM model analytics, enabling organizations to monitor and optimize generative AI initiatives for better performance and compliance

-

In May 2025, Nexthink introduced VDI Experience with real-time monitoring, AI-driven insights, and enhanced dashboards to optimize virtual desktop environments and improve digital employee experiences.

-

In July 2024, New Relic launched the first fully-integrated, AI-driven Digital Experience Monitoring solution, offering end-to-end visibility across mobile, web, and AI applications to enhance user experiences.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.88 Billion |

| Market Size by 2032 | USD 14.94 Billion |

| CAGR | CAGR of 18.44% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Product, Services) • By Access Type (Web, Mobile) • By Deployment Mode (Cloud, On-premise) • By Organization Size (SMEs, Large Enterprises) • By End Use (Government and Public Sector, Consumer Goods and Retail, Healthcare and Life Sciences, Banking, Financial Services, and Insurance (BFSI), IT and Telecommunications, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | BMC Software, CA Technologies, Catchpoint, Datadog, Dynatrace, IBM Corporation, Lakeside Software, Lumen Technologies, New Relic, Nexthink, Oracle Corporation, Riverbed, SAP SE |