Enterprise Information Archiving Market Size & Overview:

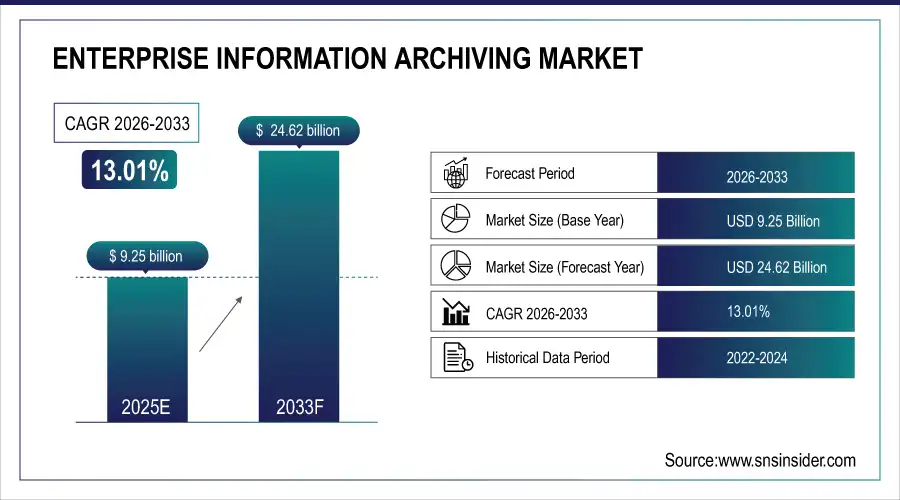

The Enterprise Information Archiving Market was valued at USD 9.25 billion in 2025E and is expected to reach USD 24.62 billion by 2033, growing at a CAGR of 13.01% from 2026-2033

The Enterprise Information Archiving Market growth is driven by increasing regulatory compliance requirements, rising data volumes, and the need for secure, long-term storage. Adoption of cloud-based and hybrid archiving solutions enhances accessibility, scalability, and operational efficiency. Integration of AI, analytics, and automated data management streamlines workflows and legal discovery. Growing focus on data security, digital transformation, and hybrid work models further accelerates the market’s expansion globally.

Enterprise Information Archiving Market Size and Forecast

-

Market Size in 2025E: USD 9.25 Billion

-

Market Size by 2033: USD 24.62 Billion

-

CAGR: 13.01% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information on Enterprise Information Archiving Market - Request Sample Report

Enterprise Information Archiving Market Trends

-

Rising need for secure storage, compliance, and retrieval of business-critical data is driving the enterprise information archiving (EIA) market.

-

Growing adoption of cloud-based and hybrid archiving solutions is enhancing scalability, accessibility, and disaster recovery.

-

Expansion of email, messaging, and collaboration platforms is boosting demand for integrated archiving systems.

-

Increasing regulatory and legal compliance requirements are shaping adoption trends across industries.

-

Focus on advanced analytics, AI, and automated classification is improving data management and insights.

-

Rising cybersecurity concerns and data protection mandates are fueling secure archiving solutions.

-

Collaborations between software vendors, cloud providers, and enterprises are accelerating innovation and deployment globally.

Enterprise Information Archiving Market Growth Drivers:

-

Increasing adoption of cloud-based and hybrid storage solutions is driving growth in the Enterprise Information Archiving Market.

Enterprises are migrating from traditional on-premises storage to cloud-based or hybrid archiving environments to ensure scalability, flexibility, and remote accessibility. Cloud-based EIA solutions allow organizations to store large volumes of structured and unstructured data securely while providing easy retrieval and compliance management. Integration with AI and analytics tools helps optimize data indexing, categorization, and searchability. Furthermore, hybrid deployments reduce IT infrastructure costs and simplify maintenance. These benefits, coupled with growing digital transformation initiatives, are encouraging organizations across industries to adopt EIA solutions at an accelerated pace.

Enterprise Information Archiving Market Restraints:

-

High implementation and maintenance costs are limiting the widespread adoption of Enterprise Information Archiving solutions globally.

Deploying advanced EIA systems involves significant investment in hardware, software, and integration with existing IT infrastructure. Small and medium enterprises often face budget constraints and may perceive enterprise-grade archiving solutions as expensive. Continuous updates, storage scaling, and system management also contribute to ongoing costs, making it challenging for cost-sensitive organizations to adopt. Additionally, integrating EIA solutions with legacy systems or multiple data sources can increase implementation complexity and operational overhead. These financial and technical barriers act as a major restraint, particularly in developing regions and among smaller enterprises.

Enterprise Information Archiving Market Opportunities:

-

Integration of AI, analytics, and machine learning in archiving solutions presents significant growth opportunities for Enterprise Information Archiving Market.

Advanced technologies enable organizations to automate data classification, indexing, and compliance monitoring, reducing manual effort and improving accuracy. AI-driven search and predictive analytics enhance retrieval efficiency and legal discovery processes. Enterprises can gain actionable insights from archived data for decision-making and risk mitigation. Integration with cloud platforms and hybrid architectures allows scalable storage and flexible access. These technological enhancements create opportunities for EIA vendors to provide innovative, value-added services, expand market share, and capture enterprises seeking intelligent, automated, and secure information archiving solutions globally.

Enterprise Information Archiving Market Segment Analysis

By Type, Content Type dominated the Market, Services projected to grow at the fastest CAGR

The content type segment dominated the market and held the largest share at more than 68.88% in 2025. The content type segment in EIA solutions is growing mainly due to wide range of digital communication channels evolving in the organizations. With the rapid adoption of emails, social media channels, instant messaging, collaboration tools, and cloud-based applications by businesses, the number of data formats and sources also increases. This requires EIA solutions to support and handle multiple types of content and to ensure that the information is captured, saved, and retrieved entirely.

During the forecast period, the services segment is expected to grow at the highest CAGR of 13.61% during the forecast period. Increasing demand for specialized services is driving growth in both these categories, as Enterprise Information Archiving Market observes specialised and value added services creating their need as per different industry needs. Enhanced data migration, e-discovery, legal hold management, advanced analytics that allow for more effective utilization of archived data.

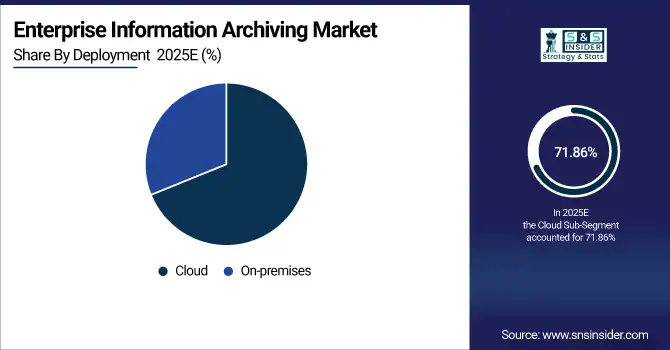

By Deployment, Cloud segment led the EIA Market, On-Premises deployment projected to grow at the fastest CAGR

In 2023, the Cloud segment dominated the market and represented significant revenue share of 71.86%. Cloud for EIA solutions is proliferating due to the greater requirement for scalability, flexibility, and cost-effectiveness. More organizations are relying on cloud-based EIA solutions to obtain their advantages such as lower infrastructure costs, automatic scaling, and remote access. Cloud has made it easy to scale storage and computing resources in line with increasing data volumes without incurring huge capital outlays on hardware. Moreover, deploying in the cloud also allows for an easier integration with other cloud applications and services, increasing organizational agility.

The on-premises segment is projected to grow at a CAGR of more than 13.52%. On-premises deployment of EIA solutions due to requirement for better control, security and compliance is gaining traction. On-premise solutions are ideal for organizations that have strict regulatory requirements or hold sensitive data because they allow for complete control over the data infrastructure. On-premises can provide organizations with specific custom security protocols along with direct supervision of how the organization handles its data, thus making sure that it is compliant with strict industry regulations and internal policies.

By Enterprise Size, Large Enterprises led the EIA Market, SMEs are expected to experience the highest growth

The large enterprises segment reached the largest market share of over 67% in 2025. However, at larger enterprises, the key drivers are regulatory compliance, efficient data management, and risk mitigation. For instance, most large organizations are heavily regulated by frameworks like GDPR, HIPAA, SOX, etc., so they have to pay careful attention to data retention and protection. EIA solutions prevent these enterprises from violating regulations by streamlining archiving features, safely storing data, and offering clear audit trails.

The small & medium enterprises segment is projected to register the highest growth rate during the forecast period. The need for affordable data management, scalability and competitive edge provides SMEs the impetus to opt for enterprise information archiving (EIA) solutions. Cost-effective and scalable solutions are a must for SMEs, as they often operate with tight budgets and limited IT resources. Cloud-based EIA systems provide the option for SMEs to adjust their data management capabilities to their growth or changing requirements with no huge capital investment.

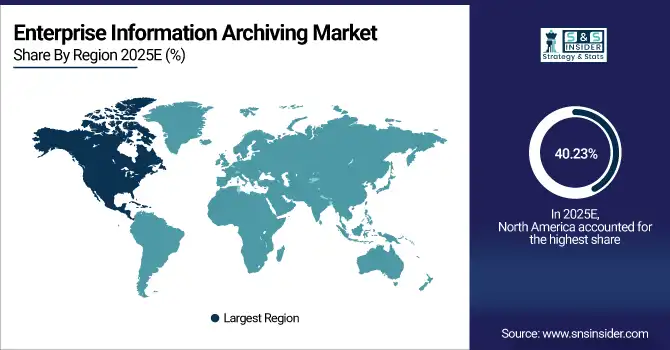

Enterprise Information Archiving Market Regional Analysis

North America dominated the market and represented significant revenue share of over 40.23% in 2025

North America dominated the market and represented significant revenue share of over 40.23% in 2025. While the market in North America is dominated by compliance-driven business sectors like BFSI and healthcare. Market growth is primarily driven by the need for advanced EIA solutions among organizations to fulfill the compliance of strict data protection and data privacy laws such as GDPR and HIPAA.

Do You Need any Customization Research on Enterprise Information Archiving Market - Enquire Now

Asia Pacific Enterprise Information Archiving Market Insights

The Asia Pacific enterprise information archiving market size is anticipated to witness over 14.79% growth from 2026 to 2033 due to the growing adoption of cloud solutions in the region. With the growing adoption of digital technologies and the proliferating volume of digital data, the Enterprise Information Archiving Market is growing rapidly in the Asia Pacific region. The investment in IT infrastructure in the countries like China, Japan, and India, in turn, is fuelling the demand for scalable and cost-effective EIA solutions. Moreover, the increasing awareness regarding data management and regulatory compliance is also aiding in the growth of the market in this region.

Europe Enterprise Information Archiving Market Insights

Europe’s Enterprise Information Archiving Market is expanding due to increasing regulatory compliance requirements and the need for secure, long-term data storage. Organizations are adopting cloud-based and hybrid EIA solutions to improve workflow efficiency, streamline data management, and ensure legal and audit readiness. Rising concerns over data security, integration of AI-driven analytics, and the shift toward digital transformation and hybrid work models are further driving market growth across key European countries.

Middle East & Africa and Latin America Enterprise Information Archiving Market Insights

The Middle East & Africa and Latin America Enterprise Information Archiving Market is growing as organizations focus on secure, compliant, and cost-effective data management. Rising adoption of cloud-based and hybrid archiving solutions enables efficient storage, retrieval, and regulatory compliance. Increasing awareness of data security, legal requirements, and digital transformation initiatives is driving demand. Enterprises are also embracing AI and analytics integration, enhancing operational efficiency and accelerating market growth across these regions.

Enterprise Information Archiving Market Competitive Landscape:

Commvault Systems, Inc.

Commvault Systems, Inc. is a leading provider of data management, protection, and information archiving solutions for enterprises. The company specializes in unified backup, cloud, and on-premises data security, enabling organizations to manage, protect, and recover critical information efficiently. Through innovative platforms, Commvault helps enterprises enhance data resilience, streamline archiving, and strengthen cyber-recovery and compliance across complex hybrid and multi-cloud environments.

-

2025: Launched the “Cloud Unity” platform release, unifying data security, cyber‑recovery, identity resilience, and archiving across cloud, hybrid, and on‑prem environments enhancing enterprise archiving and data‑resilience capabilities.

-

2024: Released “Commvault Cloud Platform Release 2024” with improved cloud‑console management, unified data views, and automation Simplifying archiving and backup for hybrid‑cloud enterprises.

Microsoft

Microsoft Corporation is a global technology leader offering cloud computing, AI, productivity software, and enterprise solutions across industries. Its Azure cloud platform, enterprise data tools, and advanced AI capabilities position the company as a key enabler of digital transformation in regulated sectors such as healthcare, life sciences, finance, and government. Microsoft focuses on secure data management, scalable cloud infrastructure, and responsible AI innovation to support next-gen analytics, automation, and enterprise information archiving needs.

-

March 2024: Microsoft entered a strategic collaboration with NVIDIA to accelerate generative AI and cloud-computing adoption in healthcare and life sciences. The partnership supports the rising use of AI in enterprise information archiving by enhancing data management, automating workflows, and enabling predictive analytics across highly regulated environments.

Barracuda Networks

Barracuda Networks is a cybersecurity and data-protection company delivering email security, cloud backup, archiving, network protection, and threat-intelligence solutions for enterprises of all sizes. Known for its strong presence in cloud-first environments, Barracuda provides scalable tools for compliance, ransomware protection, and secure storage of unstructured data. Its enterprise information archiving solutions help organizations preserve, search, and secure communication data while supporting regulatory requirements and cloud-migration strategies across diverse industries.

-

February 2024: Barracuda Networks expanded its cloud-first security and archiving portfolio in the United States through a new partnership with Ingram Micro. The collaboration strengthens Barracuda’s position in the Enterprise Information Archiving Market by broadening distribution and enhancing access to cloud-based archiving, security, and data-protection solutions driven by the industry’s shift to cloud platforms.

Key Players

-

Microsoft – Microsoft 365 Compliance Center

-

Google – Google Vault

-

IBM – IBM Cloud Pak for Data

-

Barracuda Networks – Barracuda Message Archiver

-

Mimecast – Mimecast Cloud Archive

-

Veritas Technologies – Veritas Enterprise Vault

-

ZL Technologies – ZL Unified Archive

-

Proofpoint – Proofpoint Enterprise Archive

-

Symantec – Veritas Enterprise Vault

-

Veeam Software – Veeam Backup & Replication

-

Commvault – Commvault Data Platform

-

Sophos – Sophos Email Archiving

-

Dell Technologies – Dell EMC Elastic Cloud Storage

-

Opentext – OpenText Archive Center

-

X1 Search – X1 Social Discovery

-

Micro Focus – Micro Focus Content Manager

-

Actiance – Actiance Archiving

-

Skyhigh Security – Skyhigh Cloud Security Archive

-

GFI Software – GFI Archiver

-

Nutanix – Nutanix Objects

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 9.25 Bn |

| Market Size by 2033 | USD 24.62 Bn |

| CAGR | CAGR of 13.01% from 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Content Type, Services) • By Deployment (On-premises, Cloud) • By Organization Size (Large Enterprises, Small & Medium Enterprises) • By End-Use (BFSI, Government & Defense, IT & Telecom, Healthcare & Life Sciences, Retail & E-commerce, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Microsoft, Google, IBM, Barracuda Networks, Mimecast, Veritas Technologies, ZL Technologies, Proofpoint, Symantec, Veeam Software, Commvault, Sophos, Dell Technologies, OpenText |

| Key Drivers | • Integration of machine learning for content classification and blockchain for tamper-resistant storage boosts operational efficiency. • Businesses are prioritizing EIA solutions to support seamless digital workflows and manage data effectively. • The growing volume of digital data from emails, social media, and mobile communications is driving demand for scalable storage solutions. |

| Market Restraints | • Managing diverse and evolving global regulations adds complexity and operational challenges. • Difficulty in integrating EIA solutions with outdated or incompatible IT infrastructure limits deployment. • Poor indexing or retrieval mechanisms in some EIA systems hinder efficient access to archived information. |