Endpoint Protection Platform Market Report Scope & Overview:

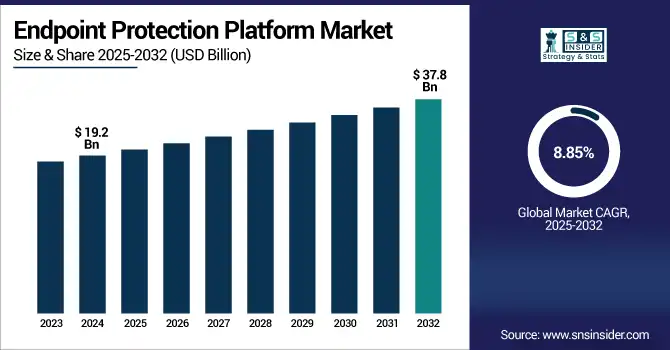

The endpoint protection platform market size was valued at USD 19.2 billion in 2024 and is expected to reach USD 37.8 billion by 2032, growing at a CAGR of 8.85% during 2025-2032.

To Get more information on Endpoint Protection Platform Market- Request Free Sample Report

Endpoint protection platform market growth is driven by the rising cyberattacks, increasing adoption of bring-your-own-device policies, and a growing number of organizational remote work setups are accelerating the growth of the endpoint protection platform market. With endpoints being the most common target for attacks including ransomware, phishing, and malware, businesses are ensuring they have a stout protection platform that encompasses live threat intelligence, adaptive response, and advanced analytics. Innovations, such as the integrated solution combining NeXgen Antivirus, Firewall, and EDR are in high demand, especially among SMEs lacking security infrastructure. Cloud-based deployment models are gaining momentum due to features like on-demand scalability and cost efficiency. In addition to that, enterprises are being compelled to improve endpoint security by compliance regulations like GDPR and HIPAA.

In the U.S., the endpoint protection platform market trend is fueled by growing ransomware attacks, the need for regulatory compliance for data protection, and increasing adoption of remote workforce. The market was valued at USD 5.3 billion in 2024 and is projected to reach USD 10.3 billion by 2032, growing at a CAGR of 8.6% during the forecast period. Advancements in AI-driven threat detection and cloud-native EPP solutions are further accelerating market expansion.

Market Dynamics:

Drivers:

-

Increase in Cyberattacks Leads to Higher Demand for Advanced Endpoint Protection Solutions

Some of the major challenges of the endpoint protection platform (EPP) market include the growing frequency and complexity of cyberattacks, such as ransomware, zero-day, and fileless malware. Fileless malware is also increasingly focusing on vulnerable endpoints, such as employee laptops, mobile devices, and IoT systems in enterprises across industries. As a result, traditional antivirus solutions have become inadequate. This is why organizations are prioritizing advanced EPP solutions that come with threat detection, real-time monitoring, behavioral analytics, and machine learning capabilities. In addition, compliance mandates, such as the GDPR, HIPAA, and the CCPA require stricter endpoint security. The urgent requirement of protecting mission-critical data and compliance is causing SMBs and large enterprises to invest heavily in next-gen endpoint protection platforms.

According to IBM’s 2024 X-Force Threat Intelligence Index, ransomware attacks accounted for 23% of all cyber incidents in 2023–2024, making it the top attack type for two consecutive years.

Restraints:

-

High Deployment and Operational Costs Hinder Adoption Among Small and Medium Enterprises

A few of the advancements in the field of endpoint protection platforms are beneficial, but high CAPEX and operational costs can hinder the adoption of these services in emerging economies and for SMEs. Numerous EPPs necessitate continuous expenditure in computer software certificates, specialized workers, frequent updates, and servicing. Deploying endpoint protection programs is also challenging for many organizations. Comprehensive EPP systems can be resource-heavy and difficult to integrate into the existing IT infrastructure. Many organizations with small IT budgets can find endpoint security lower on their priority list when there are more pressing operational needs. Those concerns about cost are compounded when the enterprise operates in several regions with differing compliance requirements. However, limited budgets may restrict its widespread adoption and slow down-market penetration in some price-sensitive verticals.

A 2024 Cisco Cybersecurity Readiness Report found that 64% of SMEs lack dedicated in-house cybersecurity staff, leading to lower EPP adoption due to complexity and ongoing maintenance demands.

Opportunities:

-

Rise in Remote Work and BYOD Culture Creates Demand for Scalable Cloud-Based EPP Platforms

The worldwide transition to home and hybrid workflows, coupled with increasing acceptance of BYOD policies, is providing significant growth opportunities for the EPP market. Endpoint systems have been more vulnerable due to the increased touchpoints, with employees accessing enterprise systems from personal laptops, mobile phones, and tablets on insecure networks. The identified trend has escalated the need for EPP cloud solutions, which offer central visibility, allow for 24/7 threat monitoring, and enable secure remote device management. Around this change, vendors are taking advantage to provide more scalable, lightweight, and easy-to-use platforms based on distributed environments. The enduring nature of the hybrid work culture means the need for advanced endpoint protection will not only persist but grow in various sectors, including healthcare, financial services, and IT services.

Challenges:

-

Rapidly Evolving Cyber Threats Outpace Traditional Detection Capabilities, Straining EPP Effectiveness

Among the key challenges for the growth of the endpoint protection platform market is the changing landscape of threats that is evolving beyond the conventional detection mechanisms. More sophisticated techniques are being employed, and evasive practices are being adopted by cybercriminals that can slip past signature-based detection engines with polymorphic malware, living-off-the-land attacks, and social engineering schemes. All the advanced machine learning-based EPP tools might struggle with false positives or miss the zero-day threats if it is not refreshed regularly with good threat intelligence. It requires both continuous R&D and security patches to be developed and deployed rapidly, and data to be shared in real-time, all of which come as challenges for many organizations to sustain. EPP vendors and enterprises alike continue to face the uphill battle of providing proactive and adaptive endpoint security, as threats continue to become ever more evasive and targeted.

Segmentation Analysis:

By Component:

The solution segment led the market in 2024 and held 59% of the endpoint protection platform market share, as enterprises focused on integrated threat prevention, detection, and response capabilities to support technological investments. The need for a centralized management system that can coordinate multiple nodes and their integration with AI-based antivirus and EDR solutions drives its dominance against the increasing number of threats. This segment is expected to hold the majority of endpoint resilience throughout 2032, as organizations are ready to increase spending further on cybersecurity.

In September 2024, Lenovo integrated SentinelOne's Singularity Platform, including Purple AI, into its ThinkShield enterprise line, enabling automated, pre-installed protection on PCs and servers, addressing over 921 password attacks per second.

The services segment is projected to register the fastest CAGR, due to the growing requirement for managed security, consulting, and integration support. When skill shortages continue to plague SMEs and hybrid enterprises, they are outsourcing EPP Management more. Additional growth drivers include 24/7 need for threat detection, remediation post-attack, and compliance, with long-term services engagements.

By Deployment:

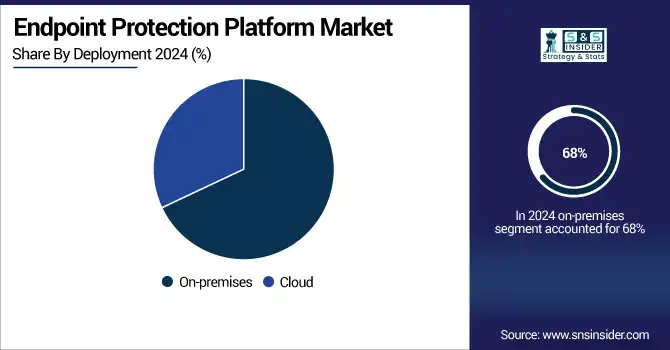

The on-premises segment led the endpoint protection platform market in 2024 and accounted for 68% of revenue share, owing to high penetration of on-premises endpoint protection platforms in the highly regulated sectors, such as government, finance, and defense, that require complete control over data. On-premise deployment is still favored for enterprises with legacy systems and stringent compliance requirements.

The cloud segment is expected to register the fastest CAGR during the forecast period. Owing to the scalability, efficiency, and easy-deployment capabilities. With the expansion of remote working, BYOD, and hybrid IT models, there is increased demand for flexible, cloud-native EPP. Due to their capabilities around real-time updates, AI-driven threat analytics, and centralized visibility, cloud platforms such as Azure and AWS now serve as the preferred choice for enterprises.

By Enterprise Size:

Large enterprises dominated the endpoint protection platform market in 2024 and accounted for a significant revenue share, as they have large digital ecosystems, high budgets for cybersecurity solutions, and they need only multilayered and state-of-the-art protection. These organizations are driven by high-risk exposure and compliance scrutiny to invest in complete EPP solutions that have built-in threat intelligence, EDR, and analytics capabilities. Investment trends in defending complex endpoint environments will likely continue to drive this segment forward.

SMEs are projected to witness the fastest CAGR during the forecast period, fueled by the greater awareness of cyber risks and the move towards more affordable, cloud-based EPP solutions. Managed security services and subscription models have made this more available to smaller firms in the last couple of years. SMEs are speeding up upgrades of endpoint security to prevent data breaches and downtime as remote work adoption and BYOD are on the rise.

BY End-User:

The BFSI segment dominated the endpoint protection platform market in 2024 and accounted for a significant revenue share, owing to the regulatory environment, high-value data, and the frequency of cybercriminal attacks. To prevent fraud, endpoint protection solutions are well invested by banks and financial institutions to fulfil compliance (PCI-DSS) and secure remote transactions. That dominance will remain in the face of the global expansion of digital banking and financial digitization.

The healthcare and life sciences segment is expected to register the fastest CAGR, driven by the increasing number of ransomware attacks on hospitals, the highly sensitive nature of patient data, and high adoption of telehealth and connected devices. Factors such as regulatory compliance, such as HIPAA, and the immediate push to secure endpoints within decentralized care models are propelling the EPP of this much-needed critical infrastructure sector.

Regional Analysis:

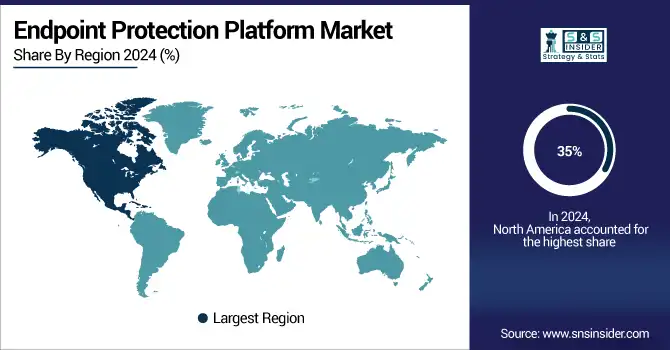

North America dominated the endpoint protection platform market in 2024 and accounted for 35% of revenue share, due to its mature cybersecurity ecosystem with a high incidence of cyberattacks, stringent regulations, such as CCPA and HIPAA, and heavy IT spending by domestic enterprises. With early adoption of advanced endpoint security technology in the region, along with a significant presence of EPP vendors and cloud in the region, the region will continue to lead through 2032.

According to an endpoint protection platform market analysis, the Asia Pacific is projected to register the fastest CAGR, due to digitalization, a growing threat landscape, and an expanding SME ecosystem in countries such as India, China, and Southeast Asia. In the region, growing awareness of endpoint vulnerabilities, government-led cybersecurity orders, and increasing investment in cloud infrastructure uptake are widening the adoption of scalable and cost-effective EPP solutions in various industries.

Europe’s growth in the endpoint protection platform market is driven by an increasing number of data breach cases from organizations are leading to stringent guidelines in terms of cyber security. The market will grow gradually as companies spend on near real-time threat detection and endpoint hardening in hybrid work settings.

Germany leads the European market due to the strong industrial structures, high levels of cybersecurity awareness among the public, and the substantial support of the government for IT security. Over the years, the threats to manufacturing and the healthcare domain have been witnessing an uncomfortable rise, and thus the German enterprises are welcoming AI-driven EPP tools.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The leading endpoint protection platform companies are Microsoft Corporation, Broadcom Inc. (Symantec Enterprise Division), CrowdStrike Holdings, Inc., Trellix, Trend Micro Incorporated, Sophos Ltd., SentinelOne, Inc., Bitdefender LLC, ESET, spol. s r.o., Cisco Systems, Inc., Kaspersky Lab, VMware, Inc. (Carbon Black), Check Point Software Technologies Ltd., Palo Alto Networks, Inc., F-Secure Corporation, Fortinet, Inc., Avast Software s.r.o., BlackBerry Limited (Cylance), Malwarebytes Inc., Cybereason Inc., and others.

Recent Developments:

-

In July 2025, Microsoft was recognized as a Leader in the 2025 Gartner Magic Quadrant for Endpoint Protection Platforms for its vision and execution.

-

In June 2025, Microsoft introduced a private preview for decoupling antivirus and EDR tools including those from CrowdStrike, Bitdefender, Trend Micro, and ESET, from the Windows kernel to improve OS stability and security.

|

Report Attributes |

Details |

|

Market Size in 2024 |

US$ 19.2 Billion |

|

Market Size by 2032 |

US$ 37.8 Billion |

|

CAGR |

CAGR of 8.85% From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Solution, Services) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, ASEAN Countries, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar,Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America) |

|

Company Profiles |

Microsoft Corporation, Broadcom Inc. (Symantec Enterprise Division), CrowdStrike Holdings, Inc., Trellix, Trend Micro Incorporated, Sophos Ltd., SentinelOne, Inc., Bitdefender LLC, ESET, spol. s r.o., Cisco Systems, Inc., Kaspersky Lab, VMware, Inc. (Carbon Black), Check Point Software Technologies Ltd., Palo Alto Networks, Inc., F-Secure Corporation, Fortinet, Inc., Avast Software s.r.o., BlackBerry Limited (Cylance), Malwarebytes Inc., Cybereason Inc. and others in the report |