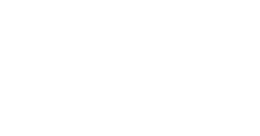

Cyber Insurance Market Key Insights:

The Cyber Insurance Market size was valued at USD 15.3 Billion in 2023. It is expected to grow to USD 97.3 Billion by 2032 and grow at a CAGR of 22.8% over the forecast period of 2024-2032.

The number of cyber threats, in particular incidents of ransomware and phishing schemes, has gained momentum in raising organizations’ need for strong cyber protection. The growth has been reinforced by numerous attacks, with studies providing striking figures on ransomware. For instance, the FBI’s Internet Crime Complaint Center noted a 62% rise in ransomware cyber incidents from 2020 to 2021. Consequentially, the caused losses exceeded USD 6.9 billion in 2021 alone.

Get more information on Cyber Insurance Market - Request Sample Report

At the same time, major data breaches have also highlighted the potential financial implications for organizations, serving as drivers for the demand for cyber insurance. Therefore, cyber insurance protects businesses from the devastating financial consequences of a cyber incident, encompassing data recovery, legal, and reputation costs, with a growing need made evident by the evolving threats.

Current business procedures have been greatly changed with the shift to cloud and digital operations, which have become more efficient and flexible. However, this transformation has also notably increased business vulnerability to cyber risks. The emergence of the global COVID-19 pandemic has made remote work commonplace and, thus, has also widened the attack surface for cyber threats.

Moreover, Because of the expansion of technology and trends such as the Internet of Things (IoT), cloud technologies, machine learning, artificial intelligence, and big data, organizations of all sizes are exposed to cyberattacks.

This condition is reported by the U.S. Cybersecurity & Infrastructure Security Agency Since the beginning of the Coronavirus Disease pandemic, businesses have seen a 400% increase in cyber-reporting as more employees are working from home with less secure networks and vulnerable work devices”. This increase in cyber vulnerabilities suggests that the adoption of cyber insurance policies is necessary for coping with the potential losses. Thus, the given fact perspective can be used for reflecting on the importance of decent cybersecurity policies in the current human environment.

Drivers

-

Rising Cybersecurity attacks and crimes such as data breaches among enterprises drive market growth.

Rising cyberattacks and crimes, particularly data breaches, are significant factors driving the growth of the cyber insurance market. According to the FBI's Internet Crime Complaint Center (IC3), the total losses attributed to cybercrime in the United States exceeded $6.9 billion in 2021, reflecting a 62% increase in reported ransomware incidents compared to the previous year. Additionally, the Identity Theft Resource Center (ITRC) reported that there were 1,862 data breaches in the U.S. in 2021, marking a 68% increase over the previous year. This alarming trend highlights the growing threat landscape faced by enterprises, prompting organizations to seek cyber insurance as a proactive measure to manage financial risks associated with potential data breaches and cyberattacks.

Moreover, a survey conducted by the Ponemon Institute found that the average cost of a data breach for U.S. companies was approximately USD 4.24 million in 2021. The potential financial ramifications of cyber incidents are compelling businesses to invest in cyber insurance to protect against these escalating threats, thereby driving market growth. The need for coverage has never been more pronounced, given the increasing sophistication of cybercriminals and the critical importance of safeguarding sensitive information in today's digital economy.

Restraint

-

The high cost of technology may hamper the market growth.

The high cost of technology is an essential obstacle in the expansion of the cyber insurance market. As businesses better understand the importance of protecting themselves from cyber threats, they require more than basic insurance protection. In particular, it implies that companies constantly have to invest in new technology to mitigate and control the risks. However, investments in up-to-date hardware and software may exceed a reasonable level and produce minimal or insufficient results. Implementation and effective usage of cybersecurity measures, such as firewalls, intrusion detection systems, and encryption technologies, would demand considerable financial investment. Finally, it is still necessary for companies, particularly SMEs, to access some operational costs, like staff training and compliance with regulations.

Opportunities

-

Blockchain and risk analytics software adoption

-

Without a middleman, transactions and settlements move at a quicker pace.

-

Insurers' need for first-party coverage has increased as a result of their increased internet presence

Market Segmentation Analysis

By Insurance Type

The standalone segment held the largest market share around 60% in 2023. Because of its extensive coverage policy, the standalone category is probably going to take the largest market share. A single type of insurance protects an organization from lawsuits brought for breaches of security or privacy that allege a failure to protect sensitive information. A variety of asset risks are also covered by standalone insurance, such as business interruption, data loss or destruction, and money transfer loss.

The tailored segment is projected to record the highest CAGR in the forecast period. It is because so many customized solutions are available, that the bespoke segment is expected to grow at the fastest rate over the projection period. Because tailored insurance covers potential industry risks, it is becoming more and more popular in industries like telecom, IT, BFSI, and healthcare.

By Coverage Type

The first-party coverage segment is leading by a market share of around 56% in 2023. First-party insurance covers cases in which the victims are directly involved in the incident. This helps businesses receive financial support and helps mitigate the impact of data breaches or cyber-attacks. The first-party segment is expected to expand, due to an increase in online theft, hacking activities, extortion, and data destruction.

The liability/third-party coverage segment is anticipated to record the highest CAGR over the forecast period. Liability insurance is gaining prominence, as it has become a requisite for comprehensive risk management programs intended to protect enterprises from network protection failure. The liability coverage offered is tailored to the specific requirements of business clients. Other benefits include coverage for losses from business interruption, data breach and restoration costs, forensic assistance in defending claims from third parties, and coverage not included in general liability policies. Hence, many companies that handle confidential data of clients are opting for third-party coverages.

By Enterprise Size

Large Enterprise held the largest market share around 62% in 2023. The first reason is that large enterprises have more computers and applications, which in return make more tasks they should solve at the same time. The employees of large companies have to solve more operations related to their functions. From this perspective, large enterprises are obvious targets for cyberattacks due to a higher volume of data, which also means they have a higher risk of breach.

In turn, larger entities will spend more on cybersecurity and insurance because they have bigger budgets. At the same time, they will aim to cover more risks of possible negative outcomes, which means they will buy more expensive insurance policies.

By End-User

BFSI held the highest revenue share in 2023. The fact is that the BFSI industry is very vulnerable to cyber threats and that the loss of data is maximum for the financial industry. BFSI is most critical for insurance as it is directly associated with national growth and the livelihood of people. The banking and insurance industry has all the customer-related and country-economy-related data. Moreover, it has transactions and shares transfer data to other countries, which need to be protected at any cost. The cyber threats that target BFSI include data breaches, ransomware, fraud, etc. These cybercrimes of BFSI lead to heavy financial losses and the loss of customer trust. Therefore, to safeguard through insurance coverage against all these threats is a necessity. Moreover, BFSI is also more regulated than other industries. They also need to comply with PCI DSS and other national and international regulations.

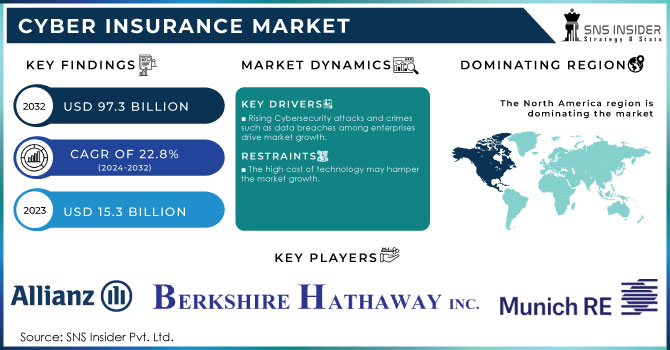

Regional Analysis

North America dominated the cyber insurance market since the region has the most developed digital infrastructure, a high prevalence of cyber threats, and a relatively strict regulating framework. The U.S. has been experiencing a significant number of cyber incidents, which has encouraged businesses to turn to holistic insurance programs to cover financial risks. According to the U.S. GAO, 70 percent of North American organizations experienced a cyberattack in 2021. The country also hosts many large companies and financial institutions that process huge amounts of sensitive data, making them desirable targets of hackers. Moreover, the U.S. legal framework including the CCPA, state-level regulation of data protection, and other acts have made the country one of the biggest markets in the world. North America also has the best-established cybersecurity practices and the largest number of insurance holders, further attracting specific attention from service providers. Thus, the region remains the most developed area in terms of cyber insurance, with unprecedented growth rates dictated by necessity and legal requirements.

Need any customization research on Cyber Insurance Market - Enquiry Now

Key Players

-

Allianz (Allianz Cyber Protect)

-

American International Group, Inc. (AIG) (CyberEdge)

-

Aon plc (Cyber Solutions)

-

AXA (AXA Cyber Secure)

-

Berkshire Hathaway Inc. (Cyber Liability Insurance)

-

Lloyd’s of London Ltd. (Cyber Cover)

-

Lockton Companies, Inc. (Lockton Cyber Risk Solutions)

-

Munich Re (Cyber Re)

-

The Chubb Corporation (Cyber Enterprise Risk Management)

-

Zurich (Security and Privacy Protection)

-

Beazley plc (Beazley Breach Response)

-

CNA Financial Corporation (CNA CyberPrep)

-

Travelers Companies, Inc. (CyberRisk)

-

Hiscox Ltd. (Hiscox CyberClear)

-

Liberty Mutual Insurance (Liberty Cyber Suite)

-

Sompo International (Cyber Solutions Plus)

-

Tokio Marine HCC (NetGuard Plus)

-

Hartford Steam Boiler (HSB) (HSB Total Cyber™)

-

QBE Insurance Group (Cyber Event Protection)

-

Argo Group (Argo Cyber Suite)

Recent Developments:

-

In 2023 Allianz expanded its Cyber Protect product with enhanced coverage for ransomware attacks, specifically targeting mid-sized businesses in Europe and North America.

-

In 2023 Lloyd’s updated its Cyber Cover policies to exclude coverage for state-backed cyberattacks, following increased geopolitical tensions and cyber warfare incidents.

-

In 2023, Chubb enhanced its Cyber Enterprise Risk Management policy to include proactive threat intelligence services, aiming to mitigate ransomware attacks before they occur.

| Report Attributes | Details |

| Market Size in 2023 | USD 16.8 Bn |

| Market Size by 2032 | USD 119.86 Bn |

| CAGR | CAGR of 24.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Company Size (Large Companies and Small & Medium-sized Companies) • by Component (Solution and Service) • by Coverage Type (First-party Coverage and Third-party Coverage) • by Industry Vertical (BFSI, IT & Telecom, Retail & E-commerce, Healthcare, Manufacturing, Government & Public Sector, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Allianz, American International Group, Inc., Aon plc, AXA, Berkshire Hathway Inc, Lloyd’s of London Ltd, Lockton Companies, Inc, Munich Re, The Chubb Corporation, and Zurich. |

| Key Drivers | • Policymakers and regulatory organizations have made steps to bolster defenses. • Firms' proactive actions to prevent losses. |

| Market Opportunities | • Blockchain and risk analytics software adoption • Without a middleman, transactions and settlements move at a quicker pace |

Frequently Asked Questions

Ans:- The study includes a comprehensive analysis of worldwide Cyber Insurance Market trends, as well as present and future market forecasts.major drivers, opportunities, and constraints,Porter's five forces analysis aids etc.

Ans:- The key market players are Allianz, American International Group, Inc., Aon plc, AXA, Berkshire Hathway Inc, Lloyd’s of London Ltd, Lockton Companies, Inc, Munich Re, The Chubb Corporation, and Zurich.

Ans:- The primary growth tactics of Cyber Insurance market participants include merger and acquisition, business expansion, and product launch.

Ans:- Blockchain and risk analytics software adoption and Insurers' need for first-party coverage have increased due to their increased internet presence.

Ans:- The Cyber Insurance Market size was valued at USD 16.8 Bn in 2023.