Offshore Pipeline Market Key Insights:

Get More Information on Offshore Pipeline Market - Request Sample Report

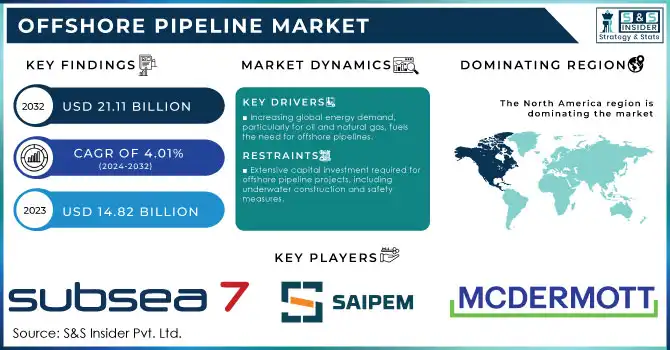

The Offshore Pipeline Market size was valued at USD 14.82 Billion in 2023 and is projected to reach USD 21.11 Billion by 2032, with a growing at a compound annual growth rate (CAGR) of 4.01% over the forecast period of 2024 to 2032.

The Increasing need for natural gas has led to the discovery of new gas fields and the use of cost-effective subsea pipelines for gas exports, Drive the growth of offshore pipeline market. These pipelines are Important for transporting oil and gas from offshore fields to onshore facilities, ensuring a steady energy supply amid Growing global energy demand.

The U.S. shale gas boom has significantly Increase the gas production, highlighting the importance of offshore pipelines in transporting shale gas to consumers efficiently. Despite their benefits, offshore pipeline projects require substantial capital due to underwater construction complexities, safety measures, and compliance with environmental rules, Creating challenges during economic downturns. Nonetheless, their reliability and efficiency make natural gas an appealing energy option for industries and households, driving further demand.

Market Dynamics

Drivers

-

Increasing global energy demand, particularly for oil and natural gas, fuels the need for offshore pipelines.

-

The presence of vast offshore energy reserves drives the development and expansion of offshore pipeline infrastructure.

-

Advancements in pipeline construction, installation techniques, and materials enhance efficiency and reliability.

-

Regions with strategic locations for energy production and transportation, such as Asia Pacific, drive market growth.

As the world's population grows and economies expand, the demand for energy, especially oil and natural gas, continuously increases. Offshore pipelines play a Important role in meeting this increasing demand by providing a safe and efficient means of transporting these valuable resources from offshore production sites to onshore processing facilities and markets. This need is further Driven by the depletion of onshore reserves and the discovery of vast offshore energy deposits. The offshore pipelines offer advantages such as lower transportation costs, reduced environmental impact compared to other transportation methods Such as tankers, and the ability to transport large volumes over long distances without significant pressure drops. This makes them a preferred choice for energy companies looking to meet the growing global energy demand reliably and sustainably.

Restraints

-

Extensive capital investment required for offshore pipeline projects, including underwater construction and safety measures.

-

Economic downturns can challenge funding and investment in large-scale offshore pipeline projects.

-

Challenges in installing pipelines in deep waters or complex subsea configurations can hinder project progress.

Opportunities

-

Growth opportunities in emerging markets with increasing energy demand and infrastructure development.

-

Integration of offshore pipelines with renewable energy projects, such as offshore wind farms, presents new opportunities.

-

Continued innovations in pipeline technologies, such as pipeline monitoring systems and automation, create growth avenues.

-

Expansion of liquefied natural gas (LNG) trade globally drives demand for pipelines to transport LNG from production sites to export terminals.

The Growing in offshore oil and gas ventures is driving substantial investments in pipeline infrastructure, particularly in North America. With the US experiencing a boost in shale oil and gas output, there's a Increase in Dependance on constructing new pipelines to meet Increasing demand. Maintaining pipeline integrity is Important to mitigate transportation risks, ensure structural robustness, and safeguard personnel and assets. These services play a Major role in averting geo-hazard incidents along the pipeline route and shielding against corrosion.

Challenges

-

Addressing environmental impact concerns related to pipeline construction, operation, and potential accidents.

-

Compliance with evolving environmental, safety, and regulatory standards adds complexity and costs to pipeline projects.

-

Mitigating security risks, such as piracy and geopolitical tensions, along offshore pipeline routes.

-

Competition from alternative energy sources Such as renewables and the development of alternative transportation methods Creates challenges to the growth of offshore pipelines.

Impact of Russia-Ukraine War:

The Russia-Ukraine war has had a significant impact on the offshore pipeline market, particularly in terms of energy supply disruptions and market volatility. Approximately 40% of Europe's natural gas imports come from Russia, with many of these supplies transported through pipelines that traverse Ukraine. The conflict has increased concerns about energy security, result to increased investment in alternative energy sources and infrastructure such as offshore pipelines. The geopolitical tensions have also prompted reassessments of existing pipeline routes and the exploration of new offshore gas fields to diversify supply chains and reduce Dependance on Russian imports. This situation underscores the importance of resilient and diversified energy infrastructure, including offshore pipelines, to mitigate the impacts of geopolitical uncertainties on global energy markets.

Impact of Recession:

The economic downturn had a notable impact on the offshore pipeline market, with a decrease in investment. Global spending on oil and gas projects reduced by around 30% compared to the previous year, leading to a slowdown in offshore pipeline construction and development activities. The downturn resulted in a reduction in new offshore exploration and production projects, further Reduce demand for pipeline infrastructure. This downturn also forced companies to reassess their capital allocation strategies, prioritize cost-cutting measures, and delay certain pipeline projects to weather the economic challenges. Despite these challenges, the downturn also created opportunities for cost optimization, technological innovation, and strategic collaborations within the offshore pipeline sector. Companies focused on enhancing operational efficiency, leveraging digital solutions, and exploring alternative financing models to navigate the downturn and position themselves for recovery.

Key Market Segmentation

By Line Type

-

Export Line

-

Transport Line

-

Others

By Installation Technique

-

S LAY

-

J LAY

-

TOW IN

The offshore pipeline market is categorized by installation type into S-lay, J-lay, and Tow-in methods. S-lay is ideal for shallow to medium water depths and favorable sea conditions, offering shorter project timelines due to its simplicity. J-lay is used in deep waters with a specialized vessel using a J-shaped pipe-laying system, suitable for complex subsea configurations like connecting multiple wells. Tow-in is a cost-effective approach for medium to long-distance pipelines, as they are assembled onshore and towed to the installation site, eliminating the need for expensive offshore vessels.

By Product Type

-

Oil

-

Gas

-

Refined Products

By Diameter

-

Below 24 inches

-

Above 24 inches

In 2023, the Above 24 inches diameter segment hold the largest revenue share, of more than 73.5%. These pipes are efficient for transporting large volumes of oil and gas, with minimal friction loss, enabling longer-distance transport without significant pressure drops. The below 24 inches pipes are suitable for moderate volumes, making them cost-effective for offshore projects. They are easier to handle and install, allowing for faster deployment and commissioning of offshore pipelines.

By Depth of Operation

-

Shallow Water

-

Deep Water

Regional Analysis

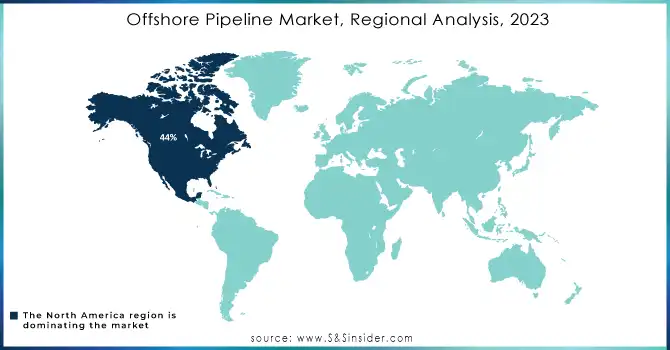

North America Region Dominates market with holding more than 44% revenue share in 2023, primarily due to its rich offshore energy reserves, notably in the Gulf of Mexico. These vast resources drive the demand for offshore pipelines, essential for transporting oil and gas to processing hubs and markets, bolstering market expansion. In contrast, Asia Pacific is poised for consistent growth, Driven by strategic geographical positioning, rising LNG imports, and industrial development. The region's burgeoning population fuels energy demand, particularly in densely populated coastal areas, highlighting the critical role of offshore pipelines in meeting these growing energy needs and driving market demand in the foreseeable future.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

- Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The major players are Subsea 7, Saipem, National Petroleum Construction Company, McDermott, Sapura Energy Berhad, Kent, John Wood Group PLC, Fugro, Tenaric, Jesco, Technip, and other players

Recent Developments:

-

In May of 2023, Saipem, a leading global provider of engineering and drilling services, was awarded two new offshore contracts. The total value of these contracts is approximately 850 million USD.

-

Meanwhile, Sapura Energy Berhad, a Malaysian oil and gas company, was also awarded a new contract in 2023. The contract was given by Chevron Thailand Exploration and Production Ltd and Chevron Offshore (Thailand) Ltd, and it involves a work order for the Year 2023 Pipelines Transportation, Installation, and Removal Campaign in Thailand. The scope of work includes engineering, procurement, construction, installation, and removal of wellhead platforms and pipelines. The project is expected to be completed by the end of calendar year 2023.

-

TotalEnergies entered a contract with McDermott in September 2022 for the Begonia project off the coast of Angola. The contract covered engineering, procurement, supply, construction, installation, pre-commissioning, and assistance with commissioning and start-up (EPSCI) for the project.

| Report Attributes | Details |

| Market Size in 2023 | US$ 14.82 Bn |

| Market Size by 2032 | US$ 21.11 Bn |

| CAGR | CAGR of 4.01% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Line Type (Export Line, Transport Line, and Others) • By Installation Technique (S LAY, J LAY, TOW IN) • By Product Type (Oil, Gas, and Refined Products) • By Diameter (Below 24 inches and Above 24 inches) • By Depth of Operation (Shallow Water and Deep Water) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Subsea 7, Saipem, National Petroleum Construction Company, McDermott, Kent, Sapura Energy Berhad, John Wood Group PLC, Fugro, Tenaric, Jesco, Technip |

| Key Drivers | • Need for reliable and efficient transportation of oil and gas resources • Growing demand for oil and gas |

| Market Opportunities | • Development of new technology and innovative solutions • Exploration of the new offshore region |