The Enterprise Collaboration Market size was valued at US$ 60.16 Billion in 2023 and is estimated to reach over US$ 158.8 Billion in 2031 with an increasing CAGR of 12.9% From 2024-2031.

To Get More Information on Enterprise Collaboration Market - Request Sample Report

The enterprise collaboration market is experiencing an increase in demand, fuelled by a several of factors. This growth is driven by the increasing popularity of remote and hybrid work models. A 2023 study revealed that over 70% of employees globally now prefer a hybrid work arrangement, highlighting the need for seamless communication and collaboration tools. Governments are also playing a significant role in promoting market growth. Initiatives like India's Digital India program, which aims to transform the nation into a digitally empowered society and workforce, are driving the adoption of collaboration platforms in government agencies and encouraging similar initiatives within private enterprises.

Additionally, the rising emphasis on project management and information security across industries is creating demand for integrated collaboration solutions that offer features like real-time communication, document sharing, task management, and robust security protocols. This demand is particularly pronounced in sectors like healthcare, where secure communication and collaboration between geographically dispersed medical teams are paramount. As the global workforce continues to embrace remote and hybrid models, and governments prioritize digital transformation, the enterprise collaboration market is poised for sustained growth, presenting vast opportunities for solution providers who can deliver secure, user-friendly, and feature-rich collaboration platforms.

Drivers

The requirement for a project and task management system is expanding

There is a growing demand for real-time and remote collaboration tools in today's business landscape.

Enterprise collaboration tools play a crucial role in facilitating seamless communication among staff members, ultimately leading to increased productivity and operational effectiveness. By leveraging enterprise collaboration platforms, businesses can effectively achieve their objectives.

Enterprise collaboration tools offer a wide range of capabilities, such as the ability to review official emails, calendars, and contacts. These tools also provide data synchronization and collaboration solutions that span across different enterprises. Moreover, video conferencing has emerged as a powerful tool that fosters more engaging dialogue and encourages the sharing of innovative ideas among employees.

Restrains

Infrastructure and connectivity challenges.

Opportunities

Many companies are shifting their focus towards Collaboration software and increasing investments in that.

Increasing the use of AI and ML to enhance collaborative abilities

Modern technologies like AI and ML are being included into enterprise collaboration systems to enhance collaborative capabilities. AI-based business collaboration solutions can keep an eye on shared material and staff activities. This is done to speed up work completion and provide staff with anticipated business information. Businesses can utilize video analytics to learn more about a range of business applications, including consumer behavior, staff retention, office utilization, performance optimization, and more by combining visual analytics with production checkpoints.

Challenges

Low internet speed has an impact on the level of service

Ukraine or nearby regions play a significant role in the supply chains of collaboration software or hardware providers, disruptions can occur. This could lead to delays in product availability and increased costs, impacting businesses' ability to adopt or upgrade collaboration tools. Cybersecurity risks tend to rise during times of international conflict. Enterprises may need to invest more in cybersecurity measures to protect their collaboration platforms and data from potential threats, including state-sponsored cyberattacks. As geopolitical tensions rise, data privacy and compliance become more complex issues. Enterprises may need to navigate a web of regulations and international agreements, potentially impacting how they store and share data through collaboration tools.

Enterprises that have significant customer bases or partners in the affected regions may see changes in customer behavior. This could affect their collaboration needs and preferences. Companies might need to allocate more resources to crisis management and contingency planning during times of geopolitical instability. This could divert resources away from IT projects, including collaboration initiatives. On the flip side, the demand for collaboration tools could grow as businesses look for ways to adapt to new market dynamics and challenges brought about by the conflict.

Impact of Recession

Companies may prioritize cost-cutting measures, including reevaluating and consolidating their collaboration toolset. This can drive organizations to seek more cost-effective solutions, potentially benefiting providers that offer affordable and efficient collaboration platforms. Recessions can accelerate trends like remote work and digital transformation. Businesses may adopt collaboration tools to enable remote workforces and streamline operations, which could boost the market for certain collaboration technologies. Certain features of collaboration tools, such as video conferencing, document sharing, and project management, may see increased demand during a recession as companies seek efficient ways to collaborate remotely.

The impact of a recession on the Enterprise Collaboration Market can vary by industry. Some industries, like technology and healthcare, may continue to invest in collaboration tools to support innovation and adapt to changing circumstances. Others, like travel and hospitality, may cut back 6% on such investments. During challenging economic times, customer support and service become paramount. Companies may invest in collaboration tools that improve customer service and satisfaction, such as chatbots, virtual agents, and omnichannel communication solutions. As collaboration tools handle sensitive information, organizations may place greater emphasis on security and compliance during a recession. Vendors that can demonstrate robust security measures and compliance features may see increased demand.

By Component:

Segmenting the enterprise collaboration market by component reveals valuable insights into how businesses facilitate teamwork. The largest share, likely around 40-50%, goes towards solutions like file sharing and video conferencing that form the backbone of real-time interaction. Project management and analytics tools, encompassing around 20-25%, empower teams to organize tasks, track progress, and measure success. The remaining 25-30% encompasses services like managed services, which ensure smooth operation of these tools, and professional services, which provide consulting and implementation support to get the most out of them.

By Deployment Mode:

Traditionally, on-premises solutions held a dominant share of 65%, favoured by companies seeking granular control and data security. However, the cloud segment roughly 35% is experiencing explosive growth due to factors like scalability, cost-efficiency, and automatic updates. This shift indicates a growing comfort level with cloud security and a preference for flexible, on-demand solutions.

By Application:

Communication tools, including instant messaging and email, hold the largest market share at roughly 40%, due to their fundamental role in everyday information exchange. Coordination tools, featuring task management and scheduling functions, account for approximately 30%, as they streamline workflows and boost team productivity. Video conferencing tools, although a vital component for remote collaboration, capture around 25% of the market share. This segment is experiencing significant growth due to the rise of geographically dispersed teams. The remaining 5% is attributed to niche applications that address specific collaboration needs.

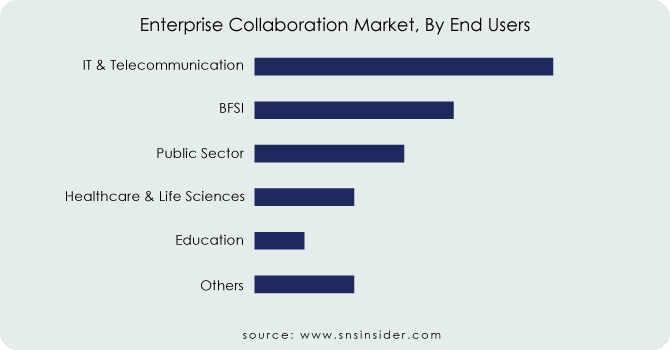

By End Users:

The IT and Telecommunication sector prioritizes secure communication and streamlined workflows. In contrast, the BFSI (Banking, Financial Services and Insurance) segment demands robust data security and regulatory compliance features. Public sector agencies focus on efficient communication and citizen engagement tools. Healthcare and Life Sciences require collaboration platforms that prioritize patient data privacy. The education sector seeks tools that enhance remote learning and faculty-student interaction. Energy, Utilities, Retail, Consumer Goods, and Manufacturing industries all have distinct collaboration needs, driven by factors like supply chain management or remote team coordination. Travel and Hospitality businesses necessitate communication tools that facilitate seamless guest experiences. Finally, "Others" encompass a diverse range of enterprises, each with unique collaboration requirements.

By Component

Solution

Services

By Deployment Mode

On-premises

Cloud

By Organization Size

SMEs

Large Enterprises

By Application

Communication Tools

Coordination Tools

Conferencing Tools

By End Users

IT and Telecommunication

BFSI

Public Sector

Healthcare and Life Sciences

Education

Energy and Utilities

Retail and Consumer Goods

Manufacturing

Travel and Hospitality

Others

Do You Need any Customization Research on Enterprise Collaboration Market - Enquire Now

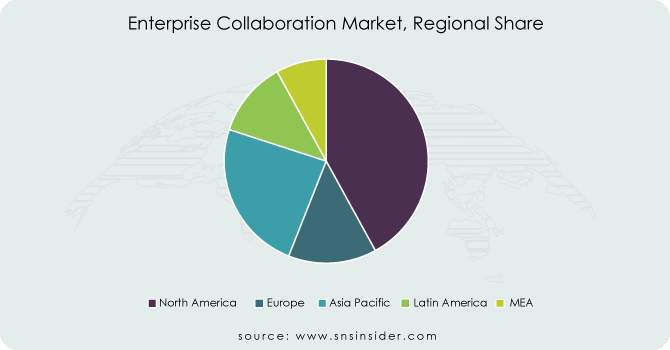

In 2023, the market in North America accounted for the greatest revenue share. Growing initiatives and developments by significant market participants in these nations, as well as increased cooperation between these businesses, are drivers boosting the industry's revenue growth in this area. EY and Microsoft Corp. announced the expansion of their strategic relationship in 2021, with the goal of better integrating EY's business innovation with Microsoft's cloud technologies and generating long-term value for their respective clients. Over the following five years, this is predicted to increase growth potential by an additional USD 16.1 billion. The focus of the improved collaboration will be the launch of innovative products and platforms that assist companies in using digital transformation to address societal and corporate concerns on a broad scale. Future growth for the APAC Enterprise Collaboration Market is anticipated to be significant, With an 11.5% growth rate in the forecast period. The region's adoption of enterprise collaboration solutions is being driven by government programs to support the digital infrastructure. The region also has the highest percentage of students, and as technology advances, there is an increase in demand for distance learning and eLearning. As a result, the market for enterprise collaboration is driven to address the diverse educational needs of the APAC region's nations, including Australia and New Zealand (ANZ), Japan, China, Singapore, and India.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

The major players in the market are VMware, Citrix, Adobe, IBM, Google, Slack, Microsoft, Cisco, Facebook, Igloo, Salesforce, SAP, Atlassian, Jive, Huawei Technologies Co. Ltd., Mitel Networks, and others.

June 29, 2023 - VMware, Inc. said that it is teaming up with AMD, Samsung, and members of the RISC-V Keystone community to streamline the creation and management of private computing applications in conjunction with the private Computing Summit 2023. By collaborating on and making contributions to the open-source Certifier Framework for Confidential Computing project, these business and community leaders will cooperate to make the move to usable confidential computing easier.

30 August 2022: VMware Explore- Enterprise VMware vSphere workloads may now be swiftly and affordably modernized in Microsoft Azure thanks to an expanded partnership between VMware, Inc. (NYSE: VMW) and Microsoft. Azure VMware Solution will be available for purchase by customers as a component of VMware Cloud Universal, a flexible program for acquiring and consuming IT services for implementing multi-cloud and digital transformation strategies.

Microsoft and Morgan Stanley worked together in June 2021 to hasten the company's digital transformation. Morgan Stanley will receive Microsoft Azure from Microsoft, which offers data protection and aids with the company's transition to the cloud.

In May 2021, Google and SpaceX collaborated to give secure global connectivity via Starlink, a high-speed connection that spans the infrastructure of Google Cloud. Businesses would have easy access to the cloud thanks to this.

Adobe bought Workfront, a top supplier of Collaborative Work Management Tools, in December 2020. For firms looking to increase efficiency, the companies would offer a unified system to facilitate planning, collaboration, and management.

| Report Attributes | Details |

| Market Size in 2023 | US$ 60.16 Bn |

| Market Size by 2031 | US$ 158.8 Bn |

| CAGR | CAGR of 12.9% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Deployment Mode (On-premises, Cloud) • By Organization Size (SMEs, Large Enterprises) • By Application (Communication Tools, Coordination Tools, Conferencing Tools) • By End Users (IT and Telecommunication, BFSI, Public Sector, Healthcare and Life Sciences, Education, Energy and Utilities, Retail and Consumer Goods, Manufacturing, Travel and Hospitality, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | VMware, Citrix, Adobe, IBM, Google, Slack, Microsoft, Cisco, Facebook, Igloo, Salesforce, SAP, Atlassian, Jive, Huawei Technologies Co. Ltd., Mitel Networks |

| Key Drivers | • The requirement for a project and task management system is expanding • There is a growing demand for real-time and remote collaboration tools in today's business landscape. |

| Market Restraints | • Infrastructure and connectivity challenges. |

Ans: The market is expected to grow to USD 158.8 billion by the forecast period of 2031.

Ans. The CAGR of the Enterprise Collaboration Market for the forecast period 2024-2031 is 12.9%.

Ans: There are three options available to purchase this report,

A. Single User License USD 4650

Features: A non-printable PDF to be accessed by just one user at a time

1. No Excel would be delivered along with the PDF

2. 1 complimentary analyst briefing session of 30 minutes to be provided post-purchase and delivery of the study

3. 1 complimentary update to be provided after 6 months of purchase

4. Additional 80 analyst hours of free customization to add extra slices of information that might be missing from the stud

B. Enterprise User License: USD 6,450

Features:

1. A printable/ sharable and downloadable PDF

2. No limit over the number of users

3. An Excel spreadsheet would be delivered along with the PDF

4. 2 complimentary analyst briefing sessions of 30 minutes each to be provided post-purchase and delivery of the study

5. 2 complimentary updates to be provided within 1 year of purchase

6. Additional 100 analyst hours of free customization to add extra slices of information that might be missing from the study.

C: Excel Datasheet: USD 2,325

1. ME sheet is provided in Excel format.

2. 1 complimentary analyst briefing session of 30 minutes to be provided post-purchase and delivery of the study

Ans. The major players in the market are VMware, Citrix, Adobe, IBM, Google, Slack, Microsoft, Cisco, Facebook, Igloo, SAP, Atlassian, Jive, Huawei Technologies Co. Ltd., Mitel Networks, and others.

Ans:

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Enterprise Collaboration Market Segmentation, By Component Type

9.1 Introduction

9.2 Trend Analysis

9.3 Solution

9.4 Services

10. Enterprise Collaboration Market Segmentation, By Deployment Type

10.1 Introduction

10.2 Trend Analysis

10.3 On-Premises

10.4 Cloud

11. Enterprise Collaboration Market Segmentation, By Organization Size

11.1 Introduction

11.2 Trend Analysis

11.3 SMEs

11.4 Large Enterprise

12. Enterprise Collaboration Market Segmentation, By Application Type

12.1 Introduction

12.2 Trend Analysis

12.3 Communication Tools

12.4 Coordination Tools

12.5 Conferencing Tools

13. Enterprise Collaboration Market Segmentation, By End Users

13.1 Introduction

13.12 Others

14. Regional Analysis

14.1 Introduction

14.2 North America

14.2.1 Trend Analysis

14.2.2 North America Enterprise Collaboration Market Segmentation, By Country

14.2.3 North America Enterprise Collaboration Market Segmentation, By Component Type

14.2.4 North America Enterprise Collaboration Market Segmentation, By Deployment Type

14.2.5 North America Enterprise Collaboration Market Segmentation, By Organization Size

14.2.6 North America Enterprise Collaboration Market Segmentation, By Application Type

14.2.7 North America Enterprise Collaboration Market Segmentation, By End Users

14.2.8 USA

14.2.8.1 USA Enterprise Collaboration Market Segmentation, By Component Type

14.2.8.2 USA Enterprise Collaboration Market Segmentation, By Deployment Type

14.2.8.3 USA Enterprise Collaboration Market Segmentation, By Organization Size

14.2.8.4 USA Enterprise Collaboration Market Segmentation, By Application Type

14.2.8.5 USA Enterprise Collaboration Market Segmentation, By End Users

14.2.9 Canada

14.2.9.1 Canada Enterprise Collaboration Market Segmentation, By Component Type

14.2.9.2 Canada Enterprise Collaboration Market Segmentation, By Deployment Type

14.2.9.3 Canada Enterprise Collaboration Market Segmentation, By Organization Size

14.2.9.4 Canada Enterprise Collaboration Market Segmentation, By Application Type

14.2.9.5 Canada Enterprise Collaboration Market Segmentation, By End Users

14.2.10 Mexico

14.2.10.1 Mexico Enterprise Collaboration Market Segmentation, By Component Type

14.2.10.2 Mexico Enterprise Collaboration Market Segmentation, By Deployment Type

14.2.10.3 Mexico Enterprise Collaboration Market Segmentation, By Organization Size

14.2.10.4 Mexico Enterprise Collaboration Market Segmentation, By Application Type

14.2.10.5 Mexico Enterprise Collaboration Market Segmentation, By End Users

14.3 Europe

14.3.1 Trend Analysis

14.3.2 Eastern Europe

14.3.2.1 Eastern Europe Enterprise Collaboration Market Segmentation, By Country

14.3.2.2 Eastern Europe Enterprise Collaboration Market Segmentation, By Component Type

14.3.2.3 Eastern Europe Enterprise Collaboration Market Segmentation, By Deployment Type

14.3.2.4 Eastern Europe Enterprise Collaboration Market Segmentation, By Organization Size

14.3.2.5 Eastern Europe Enterprise Collaboration Market Segmentation, By Application Type

14.3.2.6 Eastern Europe Enterprise Collaboration Market Segmentation, By End Users

14.3.2.7 Poland

14.3.2.7.1 Poland Enterprise Collaboration Market Segmentation, By Component Type

14.3.2.7.2 Poland Enterprise Collaboration Market Segmentation, By Deployment Type

14.3.2.7.3 Poland Enterprise Collaboration Market Segmentation, By Organization Size

14.3.2.7.4 Poland Enterprise Collaboration Market Segmentation, By Application Type

14.3.2.7.5 Poland Enterprise Collaboration Market Segmentation, By End Users

14.3.2.8 Romania

14.3.2.8.1 Romania Enterprise Collaboration Market Segmentation, By Component Type

14.3.2.8.2 Romania Enterprise Collaboration Market Segmentation, By Deployment Type

14.3.2.8.3 Romania Enterprise Collaboration Market Segmentation, By Organization Size

14.3.2.8.4 Romania Enterprise Collaboration Market Segmentation, By Application Type

14.3.2.8.5 Romania Enterprise Collaboration Market Segmentation, By End Users

14.3.2.9 Hungary

14.3.2.9.1 Hungary Enterprise Collaboration Market Segmentation, By Component Type

14.3.2.9.2 Hungary Enterprise Collaboration Market Segmentation, By Deployment Type

14.3.2.9.3 Hungary Enterprise Collaboration Market Segmentation, By Organization Size

14.3.2.9.4 Hungary Enterprise Collaboration Market Segmentation, By Application Type

14.3.2.9.5 Hungary Enterprise Collaboration Market Segmentation, By End Users

14.3.2.10 Turkey

14.3.2.10.1 Turkey Enterprise Collaboration Market Segmentation, By Component Type

14.3.2.10.2 Turkey Enterprise Collaboration Market Segmentation, By Deployment Type

14.3.2.10.3 Turkey Enterprise Collaboration Market Segmentation, By Organization Size

14.3.2.10.4 Turkey Enterprise Collaboration Market Segmentation, By Application Type

14.3.2.10.5 Turkey Enterprise Collaboration Market Segmentation, By End Users

14.3.2.11 Rest of Eastern Europe

14.3.2.11.1 Rest of Eastern Europe Enterprise Collaboration Market Segmentation, By Component Type

14.3.2.11.2 Rest of Eastern Europe Enterprise Collaboration Market Segmentation, By Deployment Type

14.3.2.11.3 Rest of Eastern Europe Enterprise Collaboration Market Segmentation, By Organization Size

14.3.2.11.4 Rest of Eastern Europe Enterprise Collaboration Market Segmentation, By Application Type

14.3.2.11.5 Rest of Eastern Europe Enterprise Collaboration Market Segmentation, By End Users

14.3.3 Western Europe

14.3.3.1 Western Europe Enterprise Collaboration Market Segmentation, By Country

14.3.3.2 Western Europe Enterprise Collaboration Market Segmentation, By Component Type

14.3.3.3 Western Europe Enterprise Collaboration Market Segmentation, By Deployment Type

14.3.3.4 Western Europe Enterprise Collaboration Market Segmentation, By Organization Size

14.3.3.5 Western Europe Enterprise Collaboration Market Segmentation, By Application Type

14.3.3.6 Western Europe Enterprise Collaboration Market Segmentation, By End Users

14.3.3.7 Germany

14.3.3.7.1 Germany Enterprise Collaboration Market Segmentation, By Component Type

14.3.3.7.2 Germany Enterprise Collaboration Market Segmentation, By Deployment Type

14.3.3.7.3 Germany Enterprise Collaboration Market Segmentation, By Organization Size

14.3.3.7.4 Germany Enterprise Collaboration Market Segmentation, By Application Type

14.3.3.7.5 Germany Enterprise Collaboration Market Segmentation, By End Users

14.3.3.8 France

14.3.3.8.1 France Enterprise Collaboration Market Segmentation, By Component Type

14.3.3.8.2 France Enterprise Collaboration Market Segmentation, By Deployment Type

14.3.3.8.3 France Enterprise Collaboration Market Segmentation, By Organization Size

14.3.3.8.4 France Enterprise Collaboration Market Segmentation, By Application Type

14.3.3.8.5 France Enterprise Collaboration Market Segmentation, By End Users

14.3.3.9 UK

14.3.3.9.1 UK Enterprise Collaboration Market Segmentation, By Component Type

14.3.3.9.2 UK Enterprise Collaboration Market Segmentation, By Deployment Type

14.3.3.9.3 UK Enterprise Collaboration Market Segmentation, By Organization Size

14.3.3.9.4 UK Enterprise Collaboration Market Segmentation, By Application Type

14.3.3.9.5 UK Enterprise Collaboration Market Segmentation, By End Users

14.3.3.10 Italy

14.3.3.10.1 Italy Enterprise Collaboration Market Segmentation, By Component Type

14.3.3.10.2 Italy Enterprise Collaboration Market Segmentation, By Deployment Type

14.3.3.10.3 Italy Enterprise Collaboration Market Segmentation, By Organization Size

14.3.3.10.4 Italy Enterprise Collaboration Market Segmentation, By Application Type

14.3.3.10.5 Italy Enterprise Collaboration Market Segmentation, By End Users

14.3.3.11 Spain

14.3.3.11.1 Spain Enterprise Collaboration Market Segmentation, By Component Type

14.3.3.11.2 Spain Enterprise Collaboration Market Segmentation, By Deployment Type

14.3.3.11.3 Spain Enterprise Collaboration Market Segmentation, By Organization Size

14.3.3.11.4 Spain Enterprise Collaboration Market Segmentation, By Application Type

14.3.3.11.5 Spain Enterprise Collaboration Market Segmentation, By End Users

14.3.3.12 Netherlands

14.3.3.12.1 Netherlands Enterprise Collaboration Market Segmentation, By Component Type

14.3.3.12.2 Netherlands Enterprise Collaboration Market Segmentation, By Deployment Type

14.3.3.12.3 Netherlands Enterprise Collaboration Market Segmentation, By Organization Size

14.3.3.12.4 Netherlands Enterprise Collaboration Market Segmentation, By Application Type

14.3.3.12.5 Netherlands Enterprise Collaboration Market Segmentation, By End Users

14.3.3.13 Switzerland

14.3.3.13.1 Switzerland Enterprise Collaboration Market Segmentation, By Component Type

14.3.3.13.2 Switzerland Enterprise Collaboration Market Segmentation, By Deployment Type

14.3.3.13.3 Switzerland Enterprise Collaboration Market Segmentation, By Organization Size

14.3.3.13.4 Switzerland Enterprise Collaboration Market Segmentation, By Application Type

14.3.3.13.5 Switzerland Enterprise Collaboration Market Segmentation, By End Users

14.3.3.14 Austria

14.3.3.14.1 Austria Enterprise Collaboration Market Segmentation, By Component Type

14.3.3.14.2 Austria Enterprise Collaboration Market Segmentation, By Deployment Type

14.3.3.14.3 Austria Enterprise Collaboration Market Segmentation, By Organization Size

14.3.3.14.4 Austria Enterprise Collaboration Market Segmentation, By Application Type

14.3.3.14.5 Austria Enterprise Collaboration Market Segmentation, By End Users

14.3.3.15 Rest of Western Europe

14.3.3.15.1 Rest of Western Europe Enterprise Collaboration Market Segmentation, By Component Type

14.3.3.15.2 Rest of Western Europe Enterprise Collaboration Market Segmentation, By Deployment Type

14.3.3.15.3 Rest of Western Europe Enterprise Collaboration Market Segmentation, By Organization Size

14.3.3.15.4 Rest of Western Europe Enterprise Collaboration Market Segmentation, By Application Type

14.3.3.15.5 Rest of Western Europe Enterprise Collaboration Market Segmentation, By End Users

14.4 Asia-Pacific

14.4.1 Trend Analysis

14.4.2 Asia-Pacific Enterprise Collaboration Market Segmentation, By country

14.4.3 Asia-Pacific Enterprise Collaboration Market Segmentation, By Component Type

14.4.4 Asia-Pacific Enterprise Collaboration Market Segmentation, By Deployment Type

14.4.5 Asia-Pacific Enterprise Collaboration Market Segmentation, By Organization Size

14.4.6 Asia-Pacific Enterprise Collaboration Market Segmentation, By Application Type

14.4.7 Asia-Pacific Enterprise Collaboration Market Segmentation, By End Users

14.4.8 China

14.4.8.1 China Enterprise Collaboration Market Segmentation, By Component Type

14.4.8.2 China Enterprise Collaboration Market Segmentation, By Deployment Type

14.4.8.3 China Enterprise Collaboration Market Segmentation, By Organization Size

14.4.8.4 China Enterprise Collaboration Market Segmentation, By Application Type

14.4.8.5 China Enterprise Collaboration Market Segmentation, By End Users

14.4.9 India

14.4.9.1 India Enterprise Collaboration Market Segmentation, By Component Type

14.4.9.2 India Enterprise Collaboration Market Segmentation, By Deployment Type

14.4.9.3 India Enterprise Collaboration Market Segmentation, By Organization Size

14.4.9.4 India Enterprise Collaboration Market Segmentation, By Application Type

14.4.9.5 India Enterprise Collaboration Market Segmentation, By End Users

14.4.10 Japan

14.4.10.1 Japan Enterprise Collaboration Market Segmentation, By Component Type

14.4.10.2 Japan Enterprise Collaboration Market Segmentation, By Deployment Type

14.4.10.3 Japan Enterprise Collaboration Market Segmentation, By Organization Size

14.4.10.4 Japan Enterprise Collaboration Market Segmentation, By Application Type

14.4.10.5 Japan Enterprise Collaboration Market Segmentation, By End Users

14.4.11 South Korea

14.4.11.1 South Korea Enterprise Collaboration Market Segmentation, By Component Type

14.4.11.2 South Korea Enterprise Collaboration Market Segmentation, By Deployment Type

14.4.11.3 South Korea Enterprise Collaboration Market Segmentation, By Organization Size

14.4.11.4 South Korea Enterprise Collaboration Market Segmentation, By Application Type

14.4.11.5 South Korea Enterprise Collaboration Market Segmentation, By End Users

14.4.12 Vietnam

14.4.12.1 Vietnam Enterprise Collaboration Market Segmentation, By Component Type

14.4.12.2 Vietnam Enterprise Collaboration Market Segmentation, By Deployment Type

14.4.12.3 Vietnam Enterprise Collaboration Market Segmentation, By Organization Size

14.4.12.4 Vietnam Enterprise Collaboration Market Segmentation, By Application Type

14.4.12.5 Vietnam Enterprise Collaboration Market Segmentation, By End Users

14.4.13 Singapore

14.4.13.1 Singapore Enterprise Collaboration Market Segmentation, By Component Type

14.4.13.2 Singapore Enterprise Collaboration Market Segmentation, By Deployment Type

14.4.13.3 Singapore Enterprise Collaboration Market Segmentation, By Organization Size

14.4.13.4 Singapore Enterprise Collaboration Market Segmentation, By Application Type

14.4.13.5 Singapore Enterprise Collaboration Market Segmentation, By End Users

14.4.14 Australia

14.4.14.1 Australia Enterprise Collaboration Market Segmentation, By Component Type

14.4.14.2 Australia Enterprise Collaboration Market Segmentation, By Deployment Type

14.4.14.3 Australia Enterprise Collaboration Market Segmentation, By Organization Size

14.4.14.4 Australia Enterprise Collaboration Market Segmentation, By Application Type

14.4.14.5 Australia Enterprise Collaboration Market Segmentation, By End Users

14.4.15 Rest of Asia-Pacific

14.4.15.1 Rest of Asia-Pacific Enterprise Collaboration Market Segmentation, By Component Type

14.4.15.2 Rest of Asia-Pacific Enterprise Collaboration Market Segmentation, By Deployment Type

14.4.15.3 Rest of Asia-Pacific Enterprise Collaboration Market Segmentation, By Organization Size

14.4.15.4 Rest of Asia-Pacific Enterprise Collaboration Market Segmentation, By Application Type

14.4.15.5 Rest of Asia-Pacific Enterprise Collaboration Market Segmentation, By End Users

14.5 Middle East & Africa

14.5.1 Trend Analysis

14.5.2 Middle East

14.5.2.1 Middle East Enterprise Collaboration Market Segmentation, By Country

14.5.2.2 Middle East Enterprise Collaboration Market Segmentation, By Component Type

14.5.2.3 Middle East Enterprise Collaboration Market Segmentation, By Deployment Type

14.5.2.4 Middle East Enterprise Collaboration Market Segmentation, By Organization Size

14.5.2.5 Middle East Enterprise Collaboration Market Segmentation, By Application Type

14.5.2.6 Middle East Enterprise Collaboration Market Segmentation, By End Users

14.5.2.7 UAE

14.5.2.7.1 UAE Enterprise Collaboration Market Segmentation, By Component Type

14.5.2.7.2 UAE Enterprise Collaboration Market Segmentation, By Deployment Type

14.5.2.7.3 UAE Enterprise Collaboration Market Segmentation, By Organization Size

14.5.2.7.4 UAE Enterprise Collaboration Market Segmentation, By Application Type

14.5.2.7.5 UAE Enterprise Collaboration Market Segmentation, By End Users

14.5.2.8 Egypt

14.5.2.8.1 Egypt Enterprise Collaboration Market Segmentation, By Component Type

14.5.2.8.2 Egypt Enterprise Collaboration Market Segmentation, By Deployment Type

14.5.2.8.3 Egypt Enterprise Collaboration Market Segmentation, By Organization Size

14.5.2.8.4 Egypt Enterprise Collaboration Market Segmentation, By Application Type

14.5.2.8.5 Egypt Enterprise Collaboration Market Segmentation, By End Users

14.5.2.9 Saudi Arabia

14.5.2.9.1 Saudi Arabia Enterprise Collaboration Market Segmentation, By Component Type

14.5.2.9.2 Saudi Arabia Enterprise Collaboration Market Segmentation, By Deployment Type

14.5.2.9.3 Saudi Arabia Enterprise Collaboration Market Segmentation, By Organization Size

14.5.2.9.4 Saudi Arabia Enterprise Collaboration Market Segmentation, By Application Type

14.5.2.9.5 Saudi Arabia Enterprise Collaboration Market Segmentation, By End Users

14.5.2.10 Qatar

14.5.2.10.1 Qatar Enterprise Collaboration Market Segmentation, By Component Type

14.5.2.10.2 Qatar Enterprise Collaboration Market Segmentation, By Deployment Type

14.5.2.10.3 Qatar Enterprise Collaboration Market Segmentation, By Organization Size

14.5.2.10.4 Qatar Enterprise Collaboration Market Segmentation, By Application Type

14.5.2.10.5 Qatar Enterprise Collaboration Market Segmentation, By End Users

14.5.2.11 Rest of Middle East

14.5.2.11.1 Rest of Middle East Enterprise Collaboration Market Segmentation, By Component Type

14.5.2.11.2 Rest of Middle East Enterprise Collaboration Market Segmentation, By Deployment Type

14.5.2.11.3 Rest of Middle East Enterprise Collaboration Market Segmentation, By Organization Size

14.5.2.11.4 Rest of Middle East Enterprise Collaboration Market Segmentation, By Application Type

14.5.2.11.5 Rest of Middle East Enterprise Collaboration Market Segmentation, By End Users

14.5.3 Africa

14.5.3.1 Africa Enterprise Collaboration Market Segmentation, By Country

14.5.3.2 Africa Enterprise Collaboration Market Segmentation, By Component Type

14.5.3.3 Africa Enterprise Collaboration Market Segmentation, By Deployment Type

14.5.3.4 Africa Enterprise Collaboration Market Segmentation, By Organization Size

14.5.3.5 Africa Enterprise Collaboration Market Segmentation, By Application Type

14.5.3.6 Africa Enterprise Collaboration Market Segmentation, By End Users

14.5.3.7 Nigeria

14.5.3.7.1 Nigeria Enterprise Collaboration Market Segmentation, By Component Type

14.5.3.7.2 Nigeria Enterprise Collaboration Market Segmentation, By Deployment Type

14.5.3.7.3 Nigeria Enterprise Collaboration Market Segmentation, By Organization Size

14.5.3.7.4 Nigeria Enterprise Collaboration Market Segmentation, By Application Type

14.5.3.7.5 Nigeria Enterprise Collaboration Market Segmentation, By End Users

14.5.3.8 South Africa

14.5.3.8.1 South Africa Enterprise Collaboration Market Segmentation, By Component Type

14.5.3.8.2 South Africa Enterprise Collaboration Market Segmentation, By Deployment Type

14.5.3.8.3 South Africa Enterprise Collaboration Market Segmentation, By Organization Size

14.5.3.8.4 South Africa Enterprise Collaboration Market Segmentation, By Application Type

14.5.3.8.5 South Africa Enterprise Collaboration Market Segmentation, By End Users

14.5.3.9 Rest of Africa

14.5.3.9.1 Rest of Africa Enterprise Collaboration Market Segmentation, By Component Type

14.5.3.9.2 Rest of Africa Enterprise Collaboration Market Segmentation, By Deployment Type

14.5.3.9.3 Rest of Africa Enterprise Collaboration Market Segmentation, By Organization Size

14.5.3.9.4 Rest of Africa Enterprise Collaboration Market Segmentation, By Application Type

14.5.3.9.5 Rest of Africa Enterprise Collaboration Market Segmentation, By End Users

14.6 Latin America

14.6.1 Trend Analysis

14.6.2 Latin America Enterprise Collaboration Market Segmentation, By country

14.6.3 Latin America Enterprise Collaboration Market Segmentation, By Component Type

14.6.4 Latin America Enterprise Collaboration Market Segmentation, By Deployment Type

14.6.5 Latin America Enterprise Collaboration Market Segmentation, By Organization Size

14.6.6 Latin America Enterprise Collaboration Market Segmentation, By Application Type

14.6.7 Latin America Enterprise Collaboration Market Segmentation, By End Users

14.6.8 Brazil

14.6.8.1 Brazil Enterprise Collaboration Market Segmentation, By Component Type

14.6.8.2 Brazil Enterprise Collaboration Market Segmentation, By Deployment Type

14.6.8.3 Brazil Enterprise Collaboration Market Segmentation, By Organization Size

14.6.8.4 Brazil Enterprise Collaboration Market Segmentation, By Application Type

14.6.8.5 Brazil Enterprise Collaboration Market Segmentation, By End Users

14.6.9 Argentina

14.6.9.1 Argentina Enterprise Collaboration Market Segmentation, By Component Type

14.6.9.2 Argentina Enterprise Collaboration Market Segmentation, By Deployment Type

14.6.9.3 Argentina Enterprise Collaboration Market Segmentation, By Organization Size

14.6.9.4 Argentina Enterprise Collaboration Market Segmentation, By Application Type

14.6.9.5 Argentina Enterprise Collaboration Market Segmentation, By End Users

14.6.10 Colombia

14.6.10.1 Colombia Enterprise Collaboration Market Segmentation, By Component Type

14.6.10.2 Colombia Enterprise Collaboration Market Segmentation, By Deployment Type

14.6.10.3 Colombia Enterprise Collaboration Market Segmentation, By Organization Size

14.6.10.4 Colombia Enterprise Collaboration Market Segmentation, By Application Type

14.6.10.5 Colombia Enterprise Collaboration Market Segmentation, By End Users

14.6.11 Rest of Latin America

14.6.11.1 Rest of Latin America Enterprise Collaboration Market Segmentation, By Component Type

14.6.11.2 Rest of Latin America Enterprise Collaboration Market Segmentation, By Deployment Type

14.6.11.3 Rest of Latin America Enterprise Collaboration Market Segmentation, By Organization Size

14.6.11.4 Rest of Latin America Enterprise Collaboration Market Segmentation, By Application Type

14.6.11.5 Rest of Latin America Enterprise Collaboration Market Segmentation, By End Users

15. Company Profiles

15.1 VMware

15.1.1 Company Overview

15.1.2 Financial

15.1.3 Products/ Services Offered

15.1.4 SWOT Analysis

15.1.5 The SNS View

15.2 Citrix

15.2.1 Company Overview

15.2.2 Financial

15.2.3 Products/ Services Offered

15.2.4 SWOT Analysis

15.2.5 The SNS View

15.3 Adobe

15.3.1 Company Overview

15.3.2 Financial

15.3.3 Products/ Services Offered

15.3.4 SWOT Analysis

15.3.5 The SNS View

15.4 IBM

15.4.1 Company Overview

15.4.2 Financial

15.4.3 Products/ Services Offered

15.4.4 SWOT Analysis

15.4.5 The SNS View

15.5 Google

15.5.1 Company Overview

15.5.2 Financial

15.5.3 Products/ Services Offered

15.5.4 SWOT Analysis

15.5.5 The SNS View

15.6 Slack

15.6.1 Company Overview

15.6.2 Financial

15.6.3 Products/ Services Offered

15.6.4 SWOT Analysis

15.6.5 The SNS View

15.7 Microsoft

15.7.1 Company Overview

15.7.2 Financial

15.7.3 Products/ Services Offered

15.7.4 SWOT Analysis

15.7.5 The SNS View

15.8 Cisco

15.8.1 Company Overview

15.8.2 Financial

15.8.3 Products/ Services Offered

15.8.4 SWOT Analysis

15.8.5 The SNS View

15.9 Facebook

15.9.1 Company Overview

15.9.2 Financial

15.9.3 Products/ Services Offered

15.9.4 SWOT Analysis

15.9.5 The SNS View

15.10 Igloo

15.10.1 Company Overview

15.10.2 Financial

15.10.3 Products/ Services Offered

15.10.4 SWOT Analysis

15.10.5 The SNS View

15.11 Salesforce

15.11.1 Company Overview

15.11.2 Financial

15.11.3 Products/ Services Offered

15.11.4 SWOT Analysis

15.11.5 The SNS View

15.12 SAP

15.12.1 Company Overview

15.12.2 Financial

15.12.3 Products/ Services Offered

15.12.4 SWOT Analysis

15.12.5 The SNS View

15.13 Others

15.13.1 Company Overview

15.13.2 Financial

15.13.3 Products/ Services Offered

15.13.4 SWOT Analysis

15.13.5 The SNS View

16. Competitive Landscape

16.1 Competitive Benchmarking

16.2 Market Share Analysis

16.3 Recent Developments

16.3.1 Industry News

16.3.2 Company News

16.3.3 Mergers & Acquisitions

17. Use Case and Best Practice

18. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Insight Engines Market size was USD 1.4 billion in 2022 and is expected to Reach USD 9.5 billion by 2030 and grow at a CAGR of 27.2 % over the forecast period of 2023-2030.

The Geospatial Analytics Market size was valued at USD 71.89 billion in 2022 and is expected to grow to USD 186.43 billion by 2030 and grow at a CAGR of 12.65 % over the forecast period of 2023-2030.

The Property Management Market size was valued at USD 19.87 billion in 2022 and is expected to grow to USD 43.21 billion by 2030 and grow at a CAGR of 10.2 % over the forecast period of 2023-2030.

Wireless Microphone Market size was valued at USD 1.82 billion in 2022 and is expected to grow to USD 3.76 billion by 2030 and grow at a CAGR of 9.52 % over the forecast period of 2023-2030.

The Algorithmic Trading Market size was valued at USD 16.9 billion in 2022 and is expected to grow to USD 42.74 billion by 2030 and grow at a CAGR of 22.3 % over the forecast period of 2023-2030.

The Smart Parking Market was valued at USD 6.3 billion in 2022 and is predicted to expand to USD 31.73 billion by 2030, growing at a CAGR of 22.4% between 2023 and 2030.

Hi! Click one of our member below to chat on Phone