Project Management Software Market Size Analysis:

The Project Management Software Market was worth USD 7.29 billion in 2023 and is predicted to be worth USD 27.29 billion by 2032, growing at a CAGR of 15.8% between 2024 and 2032. Growing demand for business software for reducing organizational disparities and chaos is drive Project Management Software market growth. Project management software helps organizations plan, schedule, and track project performance to make workflow more rational. It allows organizations' internal teams to work and communicate on a virtual platform for updates, follow-ups, deadlines, etc. This software is necessary for overseeing many projects and tasks, and helps the company manage resources better; hence improving workflows. As projects advance, project management software aids in creating notes, tracking progress, and facilitating communication among teams.

Get more information on Project Management Software Market - Request Free Sample Report

It even throws reminders about outstanding tasks and deadlines in a manner that alleviates difficulties, thereby enhancing the productivity of the organization as well. 77% of organizations have adopted project management software by 2024, representing an uptake in digitalization for different industry verticals as evident from the promotional strategy analysis. According to our recent study, 64% of companies using project management software experience a measurable increase in team productivity and project efficiency. Approximately 82% of users on a project management software, also prefer cloud-based system capabilities as opposed to fixed-in-system services for their flexible, scalable and remote access advantages.

An increasing number of industries such as BFSI, IT, and Telecommunications, Engineering & Construction; have begun adopting project management software in order to improve internal communication processes, resource utilization, and overall efficiency. It is particularly useful for companies that have hybrid or remote workforces, as it facilitates communication and doc management using data rooms. However the market has limited growth prospects as data privacy and security issues sometimes hamper its adoption after all, this is sensitive information being stored by such software However, integration of technologies such as AI, ML, blockchain, and more investment in cybersecurity may minimize the gap. Companies are partnering with each other strategically and launching new products to strengthen their offerings like Monday. com's collaboration with Appfire in February 2023.

Drivers

-

Organizations are seeking to improve efficiency and productivity, driving the adoption of project management software to streamline processes and enhance collaboration.

-

The rise of cloud-based solutions offers scalability, accessibility, and cost-effectiveness, encouraging businesses to implement project management software with cloud capabilities.

-

The shift towards remote and hybrid work models has heightened the need for digital project management tools that facilitate collaboration and project tracking from anywhere.

-

Project management software increasingly integrates with other enterprise tools like CRM, ERP, and communication platforms, enhancing functionality and appeal.

Organizations across various sectors are increasingly focused on enhancing efficiency and productivity to maintain competitive advantage. The adoption of project management software has become a crucial part of this strategy. For example, the Project Management Institute reports that enterprises using such tools see a 25% increase in projects delivered on time/within budget and enjoy a 15 percent improvement in team productivity. Most of it is simply from the fact that software can make our workflows more efficient, enable us to collaborate in real time and help keep track of everything we are working on. Recent examples highlight this trend, Microsoft Teams integration with the industry-leading project management tool, Microsoft Project enables real-time collaboration and communication alongside best-in-class project tracking functionalities. Uptake for productivity tools has been so strong that Asana, a popular project management tool, saw user engagement increase by 40% after adding new capabilities to automate redundant work and boost visibility across teams. These advancements are indicative of the larger trend that organizations have and continue to move towards more digital-based solutions for increased project execution effectiveness, resource management benefitting from enhanced process efficiencies as well, responding better too an overarching goal of optimizing these operations in order leverage a competitive advantage.

The increased remote and hybrid work setting has also accelerated growth in the need for project management software built to support virtual collaboration. In 2024, recent survey estimates that only 30% of all organizations will have adopted hybrid work strategies and 60% of those businesses report that effective project management tools are critical to their remote work success. One of the aspects this transition has highlighted is that software solutions facilitating project management for remote teams and people working from different locations to better coordinate and collaborate projects effectively.

Restraints

-

The initial investment and ongoing maintenance costs associated with sophisticated project management software can be a barrier for small and medium-sized enterprises.

-

The complexity of advanced project management tools may require significant time and resources for training, which can deter organizations from adopting these solutions.

Data security is one of the key restraints to the growth for Project Management Software Market. There is also the fact that project management applications are handling Sensitive details of projects, monetary information as well home data so security breaches represent a high degree of risk. New reports show a significant increase in cyber threats that are going after software solutions, with 30% of breaches comprising stolen credentials. For example, a leading project management software company was targeted in the initial months of 2024 suffered under intense pressure due to an data breach exposing user data due to a vulnerability in its cloud infrastructure. This highlights the problems companies have to ensure protection of project data. This way, every enterprise is more and more worried about data leaks or cyber-attacks mouthing other additional reasons to continue doing so. In an era marked by more frequent and sophisticated cyberattacks, data security is a high-priority concern for companies seeking to adopt new project management software.

Segment Analysis

By Component

In 2023, solution segment dominated the market and accounted market share of more than 65%. Project management solutions are tools that enable an organization to manage organizational projects, including scheduling, planning and launching them while you can then maintain every aspect of the project such as resources & task managing along with document handling. With the help of these solutions companies and stakeholders can control cost, manage budget resources quality as well monitor performance. This technique is to deliver the best project on time with minimizes risks.

On the other hand, strong growth is anticipated in services segment at a CAGR of around 17% over the forecast period. Project management software services include integration, deployment, support and maintenance. As a growing number of businesses turn to project management software, there's more need for deployment and integration opportunities. Also, support and maintenance services are important which can help customers to resolve errors or problems faces during different task.

Need any customization research on Project Management Software Market - Enquire Now

By Enterprise Size

Large enterprise segment led the market by held largest revenue share more than 63% in 2023. Large organizations handling multiple projects and tasks with a range of resources require project management software to utilize their scarce capital, schedule various activities, plan the execution phase and manage other associated components. Furthermore, the software enables effective inter-organization communication as there are diverse teams spread across countries in an organization. These are major factors accelerating market adoption for project management software across large enterprises.

The SMEs segment is projected to register the highest CAGR during forecast period. The project management software has become crucial for small as well mid-size enterprises to plan, schedule and use resources effectively through its advanced features. In addition, it eliminates the days and costs which are typically tied up doing this manually with a single digitally driven platform. These benefits are presumed to enhance the demand for project management software in SMEs during the forecast period.

By End-use

The IT and telecom segment dominated the market in 2023, accounted share of more than 18.9%. These industries are evolving fast that this is also drive the need to have upgraded project management software. IT and telecom have large teams, huge operational data sets along with the cross-functional project development activities. The software can solve and streamline communication among teams, update the project status for evaluation, and allocate resources with real-time tracking on a centralized platform in these sectors. Large-scale IT enterprises will continue driving further demand for project management software in this segment.

On the other hand, manufacturing segment is expected to be growing at a CAGR of 16.6% during the forecast period. Project Management software is more and more recognized in the manufacturing industry as necessary for effective planning, scheduling, task management, and document management for doing projects on time and within budget. It eliminates the time, cost and errors in manual recording workbook method traditionally used to do manufacturing operations.

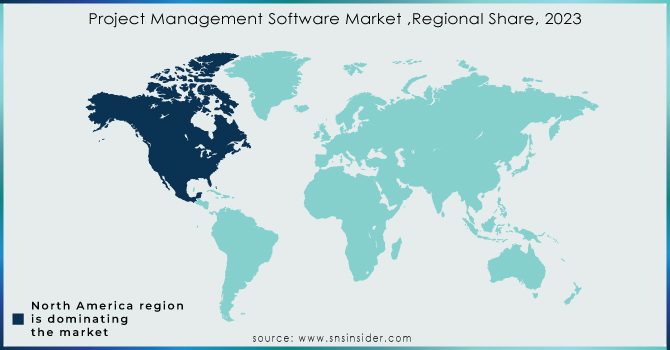

Regional analysis

In 2023, North America accounted for a major share of the project management software market to held more than 38% share. Moreover, a significant increase in the adoption of business software including ERP will drive growth for this market within these regions over others specifically IT and telecom, BFSI, and healthcare industries. Growing demand for free time management solutions in these sectors is anticipated to drive market growth across North America. Moreover, leading players operating in the region like Microsoft Corporation, Oracle Corporation LiquidPlanner Inc., and Smartsheet Inc. are making strategic moves and expanding their offerings, further supporting market growth.

APAC is also projected to have the highest CAGR during the forecast period. Increased implementation of next-generation technologies such as artificial intelligence (AI), machine learning (ML), and internet-of-things throughout the IT & telecom, manufacturing, healthcare, and transport & logistics among other industries in North America has created a need for project management software. The expansion of the digital segment in India has also been boosted by government initiatives such as the Digital India program. In addition, the increasing need for cost-efficient and dependable project management software among SMEs and standalone businesses in APAC to manage day-to-day operations is anticipated to support the demand for these solutions regionally.

Key Players

The major players are Broadcom Inc., Oracle Corporation, LiquidPlanner, inc., Atlassian Corporation Plc., Microsoft Corporation, Adobe Inc., Plainview, Inc., SAP SE, ServiceNow, Planisware, Zoho Corporation, Monday.com, Pvt. Ltd., Smartsheet, inc., Teamwork.com, Asana Inc., and others in the final report.

Recent Development

-

In June 2023, Microsoft Community Hub introduced the Project Blog, offering users a platform to access best practices, news, and trends directly from the Project team.

-

In October 2022, ServiceNow acquired Era Software to help businesses turn data-driven insights into actionable strategies. The purchase is intended to bring greater precision and control in the way innovation occurs allowing leading enterprises of today do even more with their technology investments while fully embracing digital transformation.

-

In August 2022, Linarc launched a comprehensive cloud-based construction project management software designed to improve collaboration and efficiency in mid to large-scale projects. This software offers real-time updates and predictive analytics, ensuring complete transparency through detailed reports and quick-reference dashboards. These tools keep teams informed about detailed work assignments with documents, photos, and visual cues, ensuring safety, productivity, and task completion.

| Report Attributes | Details |

| Market Size in 2023 | US$ 7.29 Bn |

| Market Size by 2032 | US$ 23.29 Bn |

| CAGR | CAGR of 15.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Solution (Activity Scheduling, Project Portfolio Management, Resource Management, Issue Tracking, Document Management, Others) • By Enterprise Size (Large Enterprise, Small & Medium Enterprises (SMEs)) • By Service (Integration & Deployment, Support & Maintenance) • By End-Use (Manufacturing, BFSI, IT & Telecom, Healthcare, Engineering & Construction, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Broadcom Inc., Oracle Corporation, LiquidPlanner, inc., Atlassian Corporation Plc., Microsoft Corporation, Adobe Inc., Plainview, Inc., SAP SE, ServiceNow, Planisware, Zoho Corporation, Monday.com, Pvt. Ltd., Smartsheet, inc., Teamwork.com, Asana Inc. |

| Key Drivers | • The capacity to integrate and connect several systems • Increased End-User Awareness and Sophistication |

| Market Restraints | • Significant Initial Investment • High cost required for Maintenance of PMS. |