Task Management Software Market Size & Overview:

Get more information on Task Management Software Market - Request Free Sample Report

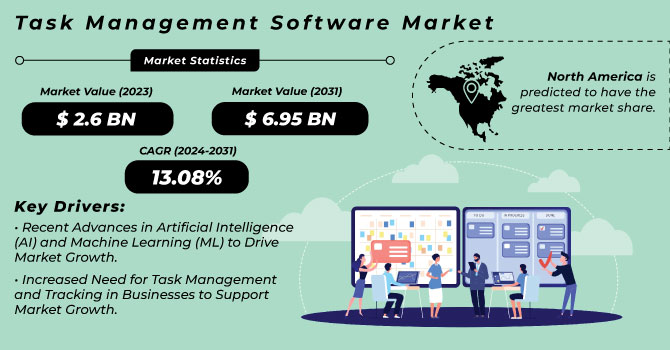

Task Management Software Market size was valued at USD 3.3 Billion in 2023 and is expected to grow to USD 9.17 Billion by 2032 and grow at a CAGR of 12.04% over the forecast period of 2024-2032.

The task management software market has experienced rapid growth due to the increasing demand for efficient business solutions and digital transformation initiatives, particularly driven by government policies supporting technological innovation. The recently published statistics by the US Bureau of Labor Statistics (BLS) show that in 2023, digital employment increased by of 12.5% due to a transition towards automation and software across markets. The increase in online jobs is directly correlated to the increase in demand for task management software that businesses use to power workflow efficiency, monitor employee productivity, and cut down operational costs. In developed nations, governmental incentives to invest in productivity-boosting technologies that enhance productivity. As an illustration, the Office of Management and Budget in the U.S. Government also initiated a Federal IT Modernization Program in 2022 to boost digital infrastructure investments they plan to make into software solutions as well including task management solutions.

Similarly, the UK Government Digital Strategy 2023 also introduces a framework that encourages businesses to utilize task management and various other digital tools with an estimation of approximately more than 1.3 million businesses would transform their manner of operation digitally by 2025. The government’s initiative to reduce paperwork and enhance process automation in public sectors also bolsters the task management software market. The integration of digital tools in industries such as healthcare, education, and manufacturing is also on the rise and with this, businesses look for task management solutions. In recent years, task management software has seen significant advancements, allowing businesses to enhance productivity and minimize errors. It facilitates organizations to save resources in carrying out daily operations and future strategies through automation of task scheduling, reminding, and following up on each activity smoothly. Streamlining these processes helps companies identify and eliminate human error while allowing employees to focus on more valuable work. Task management software also assists in analysing a massive amount of business data, which leads to better decision-making and increases the effectiveness of task analysis.

Task Management Software Market Dynamics

Drivers

- Recent Advances in Artificial Intelligence (AI) and Machine Learning (ML) to Drive Market Growth.

Artificial Intelligence (AI) and Machine Learning (ML) have technology-driven modern advancements, which results in significant growth of the task management software market. By automating repetitive processes, minimizing errors, and making the entire process faster and more efficient, AI and ML technologies are transforming the way organizations care for business tasks. A survey conducted by the U.S. Bureau of Labor Statistics in 2023 showed that organizations using AI-based solutions achieved a 15% improvement in task efficiency, with automated systems taking over routine tasks like scheduling, follow-ups, and data analysis. For instance, the integration of natural language processing (NLP) with software platforms is creating breakthrough innovations such as intelligent virtual assistants that can now automatically prioritize tasks and communicate updates. Such functionality has become a necessity for organizations looking to optimize operations and avoid manual labour. Furthermore, ML-based predictive analytics assist businesses with insights into future bottlenecks and inefficiencies by analysing historical task data.

In addition, recent advancements in AI have improved the accuracy of scheduling and resource allocation for tasks resulting in minimize delays and more timely project completion. According to a recent 2023 study, 78% of businesses utilizing AI for task management reported a noticeable reduction in project delays. Such innovations not only improve operational efficiency but also enable them to work on the higher value factor which leads towards long-term strategic objectives.

- Increased Need for Task Management and Tracking in Businesses to Support Market Growth

Businesses are more interested in workforce management as their teams get larger. This reduces the requirement for task management tools for team cooperation and communication. Organizations and teams can use task management software to keep track of team members who are working on a single job or a number of functions, providing a full view of the operations and assisting teams in managing their time and prioritizing tasks properly. Furthermore, task management software provides firms with a single picture of tasks and advancements, removing uncertainty and miscommunication among teams. Managing all jobs assists organizations in saving time, minimizing information loss, and tracking work to keep on track.

- The growing acceptance of Bring Your Own Device (BYOD), corporate mobility, and cloud-based solutions among small and medium-sized enterprises (SMEs)

Restrains

- Enterprises are concerned about the security of cloud-based task management tools and software.

Enterprises are becoming more and more worried about the security that cloud-based task management tools and software offer. With organizations leveraging the cloud to store sensitive business data and run some critical operations, the chances of data breaches, unauthorized access, and cyberattacks are high risks. In a 2023 report, the U.S. Cybersecurity & Infrastructure Security Agency (CISA) noted an increase of 18% in cyberattacks targeting cloud platforms over the previous year exposing growing vulnerabilities to information located within a cloud-based solution.

Cloud security questions encompass data encryption, the ability to meet regulatory standards, and the development of secure access controls a key consideration for industries such as finance and healthcare that deal with sensitive information. Businesses are wary of third-party cloud providers’ ability to protect their information, fearing data loss or exposure due to inadequate security protocols. While cloud providers continue to enhance security measures, enterprises remain cautious, balancing the benefits of cloud-based task management with the need for robust security assurances.

Opportunities

-

Growing digitalization and continually developing IT infrastructure to fulfill the individual needs of customers have offered multiple opportunities for significant businesses.

-

Recent AI and machine learning developments, and Integration of task management software with third-party applications.

Task Management Software Market Segment analysis

By Component

The software segment led the market and accounted for the largest market share 67% in 2023, because of flexibility, marketplace, scalability, and integration with many other enterprise software tools. As per the report published by the U.S. Census Bureau, about 72% of small and medium-sized enterprises (SMEs) in the U.S. used task management software as of 2023, which played a significant role in leading the segment. This growth is primarily fueled by the requirement of organizations to monitor different tasks, teams, and projects at one time allowing them to track in real-time as well as communication. Regions such as Europe and North America have encouraged the development of digital transformation through tax incentives, adding to the high demand for this software. In addition, several government sectors are also adopting task management solutions to improve internal processes thus, contributing towards the segment growth. With the software segment continuously advancing with new-generation AI-driven features, it is still expected to dominate the market in the future.

By Deployment Type

In 2023, the cloud deployment segment held the largest share of this market owing to an increasing inclination towards cloud-based solutions. According to government figures from the National Institute of Standards and Technology (NIST), cloud adoption across industries rose by 17% in 2023 with many organizations moving their business operations to cloud platforms. The move is primarily driven by the cloud's ability to offer access to task management software from anywhere, better data security, and lower IT infrastructure costs. Finally, the cloud-based solution provides flexibility in terms of scaling operations and gives businesses a chance to pay for only those services that they use making them appealing to both SMEs and large enterprises. Governments across Europe and Asia-Pacific have implemented policies promoting cloud adoption, including the European Commission’s “Digital Decade” strategy, which aims to ensure 75% of businesses use cloud services by 2030. As cloud computing continues to gain traction, cloud-deployed task management solutions will maintain their leading market share.

By End-use

In 2023, the Banking, Financial Services, and Insurance (BFSI) segment held the largest revenue share of about 22%. As per U.S. Department of Treasury, the pace of digitalization in banking services rose by 15% in 2023 as banks are utilizing task management tools to streamline operations, handle clients better, and comply with regulatory requirements. The European Central Bank also noted that 70% of the European banks had also implemented task management solutions to improve internal processes. The BFSI sector is responsible for millions of transactions every day, along with extensive documentation and compliance requirements leading to the need for task management software to ensure optimum work efficiency with minimal risk of human error. Although the task management software market in the financial sector is experiencing saturated growth due to strict consumer protection regulations imposed by governments, the digital transformation of this industry will continue driving demand for task management software.

Regional Analysis

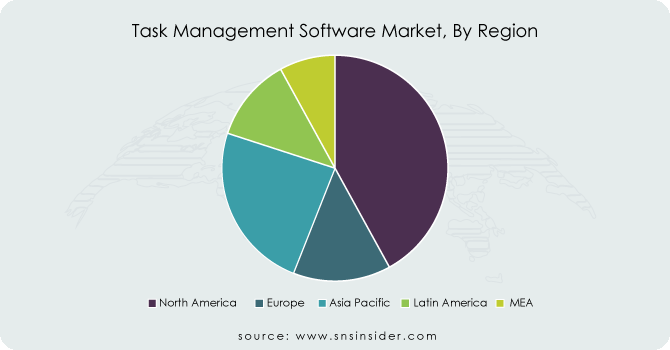

In 2023, North America dominated and accounted for 38% of the task management software market. The region’s dominance is driven by the high adoption rate of advanced digital technologies, a mature IT infrastructure, and significant investments in cloud-based software solutions. The U.S. Federal Reserve reported that IT spending in the USA reached above USD 200 billion in 2023, of which a significant portion goes to software development and cloud investments. Task management software is further fuelled by the U.S. government, focusing on ensuring digital transformation via the Federal IT Modernization program. Besides, having major software companies like Microsoft, Atlassian, and Trello further strengthens North America’s leadership in the market.

The APAC region is anticipated to record the highest growth rate during the period of projection due to the fast pace of digitalization among businesses found in China, India and Japan. China's digital economy expanded by 16% in 2023, and the soaring interest in cloud-based software solutions has been included in this growth, based on data from the Ministry of Industry and Information Technology (MIIT) in China. The Digital India initiative by the Indian government has also driven the implementation of task management software in both the public and most private sectors.

Need any customization research on Task Management Software Market - Enquiry Now

Key Players

Key Service Providers/Manufacturers:

-

Asana (Asana, Work Management)

-

Trello (Trello, Kanban Boards)

-

Monday.com (Monday.com, Work Operating System)

-

Wrike (Wrike, Project Management)

-

Smartsheet (Smartsheet, Work Execution Platform)

-

ClickUp (ClickUp, Productivity Platform)

-

Basecamp (Basecamp, Project Management Tool)

-

Jira (Jira Software, Agile Project Management)

-

Notion (Notion, All-in-One Workspace)

-

Microsoft (Microsoft Planner, Project for the Web)

Users of Task Management Software

-

IBM

-

Wells Fargo

-

CitiGroup

-

Accenture

-

Coca-Cola

-

Amazon

-

Salesforce

-

Pfizer

-

Procter & Gamble

-

Dell Technologies

Recent Developments

-

July 2023: Microsoft has integrated AI-enabled capabilities into its task management solution Microsoft Planner, improving the process of automating tasks and collaborating in real-time with the enterprise across different sectors.

-

In May 2023, Project management software provider Monday. com Ltd. unveiled a new product aimed at centralizing software development tracking and accelerating collaboration between developers, engineers, and administrators. The new package, dubbed a Work Operating System (Work OS) enables organizations to deploy work management and collaboration solutions in minutes. It helps in managing projects with different employees and teams by using standard workflow and communication tools.

| Report Attributes | Details |

| Market Size in 2023 | USD 3.3 Billion |

| Market Size by 2032 | USD 9.17 Billion |

| CAGR | CAGR of 14.04% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services, Consulting, Integration and Implementation, Support and Maintenance) • By Deployment (Cloud, On-Premises) • By Organization Size (SMEs, Large Enterprises) • By Business Function (Marketing, Human Resource, Finance, Others) • By End-User (Banking, Financial Services, and Insurance (BFSI), IT and Telecommunications, Retail, Healthcare, Manufacturing, Travel and Hospitality, Media and Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Asana, Trello, Monday.com, Wrike, Smartsheet, ClickUp, Basecamp, Jira, Notion, Microsoft |

| Key Drivers | • Recent Advances in AI and Machine Learning (ML) to Drive Market Growth • Increased Need for Task Management and Tracking in Businesses to Support Market Growth • The growing acceptance of Bring Your Own Device (BYOD), corporate mobility, and cloud-based solutions among small and medium-sized enterprises (SMEs) |

| Market Restraints | • Enterprises are concerned about the security of cloud-based task management tools and software |