Enterprise Content Management Market Size & Overview:

To Get More Information on Enterprise Content Management Market - Request Sample Report

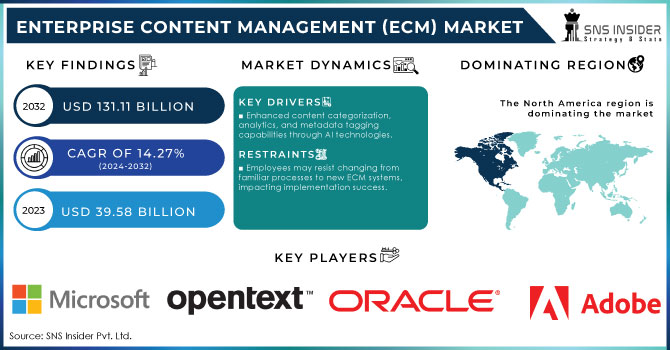

The Enterprise Content Management (ECM) Market was valued at USD 39.58 billion in 2023 and is expected to reach USD 131.11 billion by 2032, growing at a CAGR of 14.27% from 2024-2032.

The Enterprise Content Management (ECM) market is growing due to the increasing need for organized data, compliance with regulations, and secure content management within enterprises. ECM systems enable businesses to efficiently store, manage, and retrieve documents and data, improving workflow automation and collaboration. Key drivers of this market include the rise of digital transformation efforts, increased adoption of cloud services, and a greater demand for workflow automation. For instance, According to a 2023 survey, 90% of businesses are engaged in some form of digital transformation, with 68% prioritizing the digitization of their document management processes as a key objective. The shift towards remote and hybrid work has underscored the need for robust ECM systems to support seamless collaboration among distributed teams.

The adoption of ECM solutions is particularly notable across healthcare, BFSI (banking, financial services, and insurance), and government sectors, which require stringent document security and regulatory compliance that ECM systems provide. Additionally, the integration of AI and machine learning into ECM platforms is enhancing features like content categorization, predictive analytics, and automated metadata tagging, allowing businesses to derive more value from unstructured data and further driving ECM adoption.

According to recent statistics, over 80% of businesses prioritize digital document management to enhance operational efficiency. The adoption of cloud-based ECM solutions has also increased significantly, with over 60% of enterprises favoring them for scalability and cost-efficiency. The market is also expanding among small and medium-sized enterprises (SMEs), driven by affordable SaaS-based ECM options. This trend is democratizing access to ECM technologies, further contributing to market growth.

However, challenges such as high implementation costs, data privacy issues, and difficulties in integrating ECM with legacy systems still pose barriers to market expansion. Despite these challenges, advancements in cloud technology and growing regulatory demands for data storage are expected to drive the growth of the ECM market. Furthermore, an increased focus on improving customer experience and operational efficiency is prompting organizations to invest in ECM solutions.

Enterprise Content Management Market Dynamics

Drivers

-

Enhanced content categorization, analytics, and metadata tagging capabilities through AI technologies.

-

Sectors like healthcare and BFSI require high-level security, compliance, and data management.

-

Rising preference for cloud-based ECM solutions due to scalability, flexibility, and cost-effectiveness.

Cloud-based Enterprise Content Management (ECM) solutions are increasingly popular due to their scalability, flexibility, and cost-effectiveness. Unlike traditional on-premises systems, cloud-based ECM allows businesses to easily adjust their content management capacity to meet growth or changing data requirements, which is particularly advantageous for rapidly expanding companies or those experiencing seasonal variations in data volume. These solutions also offer enhanced flexibility in deployment and accessibility, enabling users to manage and collaborate on documents from any location with internet connectivity. This capability is vital in today's landscape of remote and hybrid work, as it ensures employees can efficiently handle content no matter where they are, thereby boosting overall productivity.

| Feature | Cloud-Based ECM | On-Premises ECM |

|---|---|---|

| Scalability | Highly scalable based on need | Limited by hardware infrastructure |

| Cost | Subscription-based, lower upfront | High initial investment |

| Accessibility | Accessible from anywhere | Restricted to internal networks |

| Maintenance | Managed by vendor | Requires in-house maintenance |

| Deployment Speed | Quick and straightforward | Time-consuming with hardware setup |

| Data Security | Vendor-provided, variable levels | Full in-house control |

Cost-efficiency is another significant benefit. Cloud-based ECM minimizes the need for substantial hardware investments and reduces ongoing maintenance costs associated with on-premises systems. By utilizing a subscription or pay-as-you-go model, companies only pay for the services they actually use, making cloud ECM an attractive option, especially for small and medium-sized enterprises (SMEs) seeking robust ECM solutions without incurring hefty upfront expenses.

Overall, cloud-based ECM solutions are transforming how organizations manage their content, making it easier, faster, and more economical to handle large volumes of data.

Restraints

-

Employees may resist changing from familiar processes to new ECM systems, impacting implementation success.

-

Risks related to data breaches and compliance with regulations can hinder organizations from fully embracing cloud-based ECM systems.

In the Enterprise Content Management (ECM) market, concerns regarding data breaches and regulatory compliance pose significant challenges to the adoption of cloud-based solutions. As organizations increasingly shift their content management processes to the cloud, ensuring the security of sensitive information becomes essential. Data breaches can result in unauthorized access to confidential documents, exposing companies to financial losses, reputational damage, and legal liabilities. The rise in cyberattacks has heightened awareness among businesses about the potential vulnerabilities associated with cloud storage and management systems.

Furthermore, adherence to regulations like GDPR and HIPAA mandates strict controls over data handling and storage. Organizations are required to protect personally identifiable information (PII) and maintain thorough audit trails to demonstrate compliance. Failing to comply can lead to substantial fines and legal consequences, making the decision to adopt cloud-based ECM systems more complicated.

Enterprise Content Management Market Segment Analysis

By Component

The software segment dominated the market and represented over 61.9% of revenue in 2023. The growing need for effective document management and collaboration tools is driving the expansion of ECM software. As organizations face the challenges associated with managing large volumes of digital content, there is a heightened focus on adopting ECM solutions that offer advanced document management features, version control, access controls, and seamless collaboration capabilities.

The services segment is anticipated to achieve the highest CAGR of 15.6% during the forecast period. This significant growth is largely driven by the rising demand for data management consulting and risk management services. Organizations are increasingly seeking ECM solutions that go beyond traditional content management functions, looking for expertise in strategic consulting, risk assessment, and data governance.

By Deployment

The cloud-based segment dominated the market and accounted for 58.3% of the revenue share. Cloud-based ECM offers advantages such as disaster recovery, flexibility, and reduced network traffic, enabling organizations to enhance user experience and operational efficiency. As businesses strive to leverage cloud technologies to streamline their content management strategies and increase agility, the demand for cloud-based ECM solutions is rising, contributing to market growth. The growing emphasis on remote work environments and the necessity for seamless access to content from any location is driving the adoption of cloud-based ECM solutions. As organizations adapt to remote collaboration and flexible work arrangements, the need for ECM solutions that support remote access, facilitate seamless collaboration, and promote efficient content management is surging.

The on-premise segment is projected to see substantial growth in CAGR throughout the forecast period. Organizations, especially those in highly regulated industries like finance and healthcare, prioritize keeping sensitive data on-premises to maintain control over security protocols and ensure compliance with industry regulations. By managing ECM solutions internally, companies can implement customized security measures, limit access to sensitive information, and reduce the risks of data breaches or non-compliance.

By Enterprise Size

The Small and Medium Enterprise (SME) segment dominated the market in 2023 and represented over 58.9% of revenue share, as these businesses increasingly acknowledge the importance of effective ECM solutions for optimizing operations, enhancing productivity, and ensuring compliance with regulations. As SMEs expand their operations and increase their digital footprint, they seek scalable ECM systems that can evolve with their needs while keeping costs manageable.

The large enterprise segment is expected to experience the fastest CAGR during the forecast period. This growth is fueled by the extensive data that needs to be organized, the necessity of adhering to various regulations, the demand for collaboration tools among dispersed teams, and the continuous need for robust security measures. Cloud-based ECM solutions are especially appealing to data-heavy organizations because they offer scalability, cost-efficiency, and simplified deployment.

By Application

In 2023, the BFSI sector accounted for the largest share of market revenue. As financial institutions confront increasingly stringent data security, privacy, and compliance regulations, the demand for robust enterprise content management solutions has risen sharply to ensure compliance and mitigate risks. This trend is driving the adoption of ECM systems within the BFSI segment, which provides essential features like secure document storage, audit trails, and compliance monitoring.

On the other hand, the healthcare industry is anticipated to experience the fastest CAGR during the forecast period. With stringent regulations such as HIPAA (Health Insurance Portability and Accountability Act) designed to protect patient information, healthcare organizations are increasingly adopting ECM solutions to maintain compliance while protecting sensitive data from breaches and unauthorized access.

Regional Analysis

In 2023, the North American enterprise content management market captured the largest revenue share, amounting to 41.8%. The growing volume of digital content and the need for effective information management have intensified the importance of ECM in the region. Organizations are increasingly compelled to comply with data privacy regulations like GDPR and HIPAA, resulting in heightened demand for ECM solutions that offer secure storage, retrieval, and management of sensitive information while ensuring adherence to these regulatory standards.

The Asia Pacific region is expected to experience the highest CAGR throughout the forecast period. As businesses in this area continue to digitize their operations, the demand for ECM systems is steadily rising. This growth is bolstered by the growing adoption of cloud-based ECM solutions that offer scalability, flexibility, and cost-effectiveness. In Japan, the enterprise content management market is poised for rapid growth in the coming years. The extensive use of mobile devices and the increasing volume of digital content are driving the demand for ECM solutions. As employees rely more on smartphones, tablets, and laptops to access and share information on the move, ECM systems with mobile-friendly interfaces and applications enable secure and convenient access to vital business content.

Need any customization research on Enterprise Content Management (ECM) market - Enquiry Now

Key Players

The major key players are

-

Microsoft - (SharePoint, OneDrive)

-

OpenText - (Content Suite, Documentum)

-

IBM - (FileNet, IBM Watson Content Hub)

-

Box - (Box Content Cloud, Box Governance)

-

DocuWare - (DocuWare Cloud, DocuWare On-Premises)

-

Alfresco - (Alfresco Content Services, Alfresco Process Services)

-

M-Files - (M-Files Intelligent Information Management, M-Files Cloud)

-

Hyland - (OnBase, Nuxeo)

-

Laserfiche - (Laserfiche Cloud, Laserfiche Avante)

-

SAP - (SAP Document Management, SAP Business Workflow)

-

Oracle - (Oracle WebCenter Content, Oracle Content and Experience Cloud)

-

Adobe - (Adobe Document Cloud, Adobe Experience Manager)

-

Everteam - (Everteam Records Management, Everteam Content Services)

-

Nuxeo - (Nuxeo Platform, Nuxeo Content Services)

-

Zoho (Zoho WorkDrive, Zoho Docs)

-

ScribbleLive (ScribbleLive Content Hub, ScribbleLive Studio)

-

Liferay (Liferay Digital Experience Platform, Liferay DXP Cloud)

-

IntelliChief (IntelliChief Document Management, IntelliChief Workflow)

-

Doxillion (Doxillion Document Converter, Doxillion File Converter)

-

FileTrail (FileTrail Records Management, FileTrail Content Management)

Recent Developments

In January 2024, Microsoft revealed plans to expand its Copilot feature, with the goal of making its capabilities accessible to a broader audience of individuals and businesses. This initiative underscores Microsoft’s dedication to boosting productivity and collaboration by leveraging innovative AI technologies.

In April 2024, Hyland, a prominent global provider of intelligent content solutions, introduced Hyland Experience Automate (Hx Automate). This service is among the first to be offered on the next-generation, cloud-based platform, Hyland Experience (Hx). Hx Automate is designed to integrate seamlessly with existing Hyland platforms, enabling customers to take advantage of the latest innovations from Hyland Experience while optimizing the value of their current solutions.

| Report Attributes | Details |

| Market Size in 2022 | US$ 39.58 Billion |

| Market Size by 2030 | US$ 131.11 Billion |

| CAGR | CAGR of 14.27% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Enterprise Type (Large Enterprises, Small & Medium Enterprises) • By Application (BFSI, IT and Telecommunication, Media and Entertainment, Government, Healthcare, Manufacturing, Retail, Education, Others) • By Deployment (On-Premise, Cloud) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Microsoft, OpenText, IBM, Box, DocuWare, Alfresco, M-Files, Hyland, Laserfiche, SAP, Oracle, Adobe, Everteam, Nuxeo, Zoho, ScribbleLive, Liferay, IntelliChief, Doxillion, FileTrail |

| Key Drivers | • Enhanced content categorization, analytics, and metadata tagging capabilities through AI technologies. • Sectors like healthcare and BFSI require high-level security, compliance, and data management. • Rising preference for cloud-based ECM solutions due to scalability, flexibility, and cost-effectiveness. |

| Market Restraints | • Employees may resist changing from familiar processes to new ECM systems, impacting implementation success. • Risks related to data breaches and compliance with regulations can hinder organizations from fully embracing cloud-based ECM systems. |