Enterprise Network Infrastructure Market Report Scope & Overview:

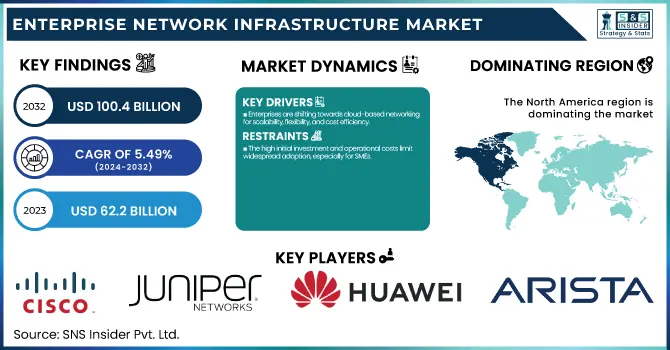

The Enterprise Network Infrastructure Market was valued at USD 62.2 Billion in 2023 and is expected to reach USD 100.4 Billion by 2032, growing at a CAGR of 5.49% from 2024-2032.

To Get more information on Enterprise Network Infrastructure Market - Request Free Sample Report

This report consists of key insights into the Enterprise Network Infrastructure Market, highlighting trends and advancements shaping the industry. The adoption of emerging networking technologies is accelerating, with enterprises increasingly integrating SD-WAN, 5G, and cloud-based solutions to enhance efficiency and scalability. Network infrastructure expansion varies by region, with North America and Asia-Pacific leading investments in connectivity upgrades and data center modernization. Cybersecurity incidents in enterprise networks have risen significantly between 2020 and 2024, underscoring the urgent need for robust security frameworks. Additionally, AI and automation are revolutionizing network management, improving operational efficiency, minimizing downtime, and strengthening security measures. The report provides fresh insights into AI-driven automation and its role in shaping next-generation enterprise networks.

Enterprise Network Infrastructure Market Dynamics

Drivers

-

Enterprises are shifting towards cloud-based networking for scalability, flexibility, and cost efficiency.

Most businesses are moving to a more cloud-based solution, as hybrid working is becoming the norm. With SD-WAN, cloud-managed network services and virtualization becoming more commonplace in businesses to enable flexibility, scalability, and cost efficiency. These network functionalities cater to this need and are further driving the growth of the market as enterprises demand secure and seamless connectivity of their remote offices with cloud applications. AI is also being used in network security, where machine learning algorithms analyze traffic patterns to detect and respond to potential security threats. Digital transformation continues to be prioritized among enterprises, which is leading to an uptick in investments in cloud networking solutions as a key driver influencing the growth of the enterprise network infrastructure market.

Restraints

-

The high initial investment and operational costs limit widespread adoption, especially for SMEs.

While enterprise network infrastructure solutions offer enhanced connectivity and security, the initial investment and ongoing maintenance costs can be prohibitively high. Deploying high-performance networking hardware, software-defined solutions, and cybersecurity frameworks requires significant capital expenditure. Additionally, network upgrades and continuous monitoring demand skilled IT personnel, adding to operational costs. Small and medium-sized enterprises often struggle to afford these expenses, limiting widespread adoption. Furthermore, integrating legacy systems with modern network infrastructure can be complex and costly. These financial and technical challenges pose a significant restraint, particularly for budget-conscious businesses looking to upgrade their networking capabilities.

Opportunities

-

AI-driven automation enhances network efficiency, security, and performance, creating growth opportunities.

AI and automation are becoming common in enterprise networking and enticing greater growth opportunities. By doing so, AI-based solutions empower service providers to optimize network performance by predicting and addressing potential failures, improving security with real-time threat detection, and automating basic maintenance tasks. This translates to reduced operational costs, enhanced efficiency, and decreased downtime. Furthermore, AI analytics enable unparalleled insights within network traffic patterns, allowing enterprises to proactively deal with workload management and resource allocation. Looking ahead, as businesses continue to pursue intelligent, self-healing networks, vendors prioritizing the development of AI-driven automation solutions are positioned for substantial growth, while carving out new opportunities for innovation and differentiation in the service they deliver.

Challenges

-

Increasing cyber threats and evolving regulatory requirements pose security and compliance challenges.

As enterprise networks expand rapidly, so too do cybersecurity threats, presenting a significant challenge for businesses. Cyberattacks are becoming more advanced like ransomware, fishing, DDoS attack, etc. Which needs the enterprises to make sure to implement all the strong security framework. However, ensuring end-to-end protection across hybrid and multi-cloud environments is a complicated process. Ensuring compliance with ever-evolving data protection regulations like GDPR, CCPA, and industry-specific security requirements is yet another challenge. Noncompliance can lead to expensive fines and reputational harm. All in all, enterprises need to be persistent in updating their security strategies and investing in AI-enabled threat detection and zero-trust architecture solutions to minimize risk and maintain regulatory compliance.

Enterprise Network Infrastructure Market Segmentation Analysis

By Technology

In 2023, the routers & switches segment dominated the market and accounted for a significant revenue share. Routers are used to move data packets across the network and are positioned in conjunction with two or more networks. So routers and switches are none other than necessary components of the enterprise network and switches, connect the devices on the network and use packet switching to communicate with them. The growing number of enterprise users and developed broadband infrastructure are anticipated to fuel this segment. Thereby, the demand for the router and switch segment is adding to the market revenue.

The enterprise telephony segment is expected to register the fastest CAGR during the forecast period. Enterprise telephony is electronically transmitting voice, fax, and other information within an enterprise's premises with growing geographic business extensions around the globe by SMEs and large enterprises. Enterprise telephony provides a worry-free communication and socialized environment for employees from all industries.

By Enterprise Size

In 2023, the large enterprises segment dominated the market and accounted for 73% of revenue share. Large enterprises are investing more in network security to safeguard themselves against cyber threats. This includes the installation of intrusion detection and prevention systems, network segmentation, and multi-factor authentication. Big companies are starting to look into 5G networking, which offers faster speeds and lower latency than earlier generations of wireless technology.

The SME segment is expected to register the fastest CAGR during the forecast period. These are sub-billion-dollar, sub-thousand-person enterprises. This growth of the market can be attributed to the growing number of small and medium enterprises, which are focusing on expanding their business and pushing them to adopt several unique and innovative solutions.

By Industry

In 2023, the information technology & telecommunications segment dominated the market and accounted for a significant revenue share. The significant spike in data traffic is expected to accelerate growth in IT and telecom infrastructure. Moreover, IT and telecom companies adopt a robust IT and telecom infrastructure with the growing penetration of smartphones in rural areas and the increasing digital literacy rate in emerging and developing countries, especially China and India.

The healthcare segment is expected to achieve the fastest CAGR throughout the forecast period. The public awareness of health problems is rising, but citizens are more worried about their health every day. People create applications and platforms above the data. Businesses actively track the medical history of their patients to provide them with better healthcare services. Consequently, healthcare organizations and businesses are adopting digital platforms and service providers for the exchange of information and collaboration across enterprise networks.

Regional Landscape

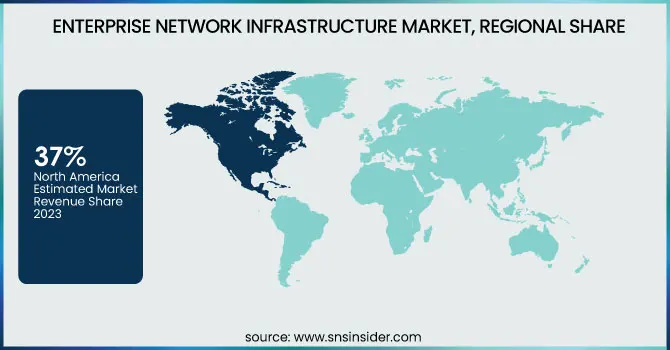

North America dominated the market and held more than 37% of the global revenue in 2023, as the regional multinational companies quickly adopted the advanced technologies. The increasing work-from-home process is increasing routers and switches adoption, which will continue as expansion and drive the growth of North America enterprise network infrastructure. If the demand for wireless access points highlights business enterprises that are defining their business infrastructure.

The enterprise network infrastructure in Asia-Pacific is expected to register the fastest CAGR during the forecast period, due to the presence of emerging economies such as China, Japan India. With high-bandwidth applications in demand, businesses are now taking advantage of enterprise networking solutions to tackle existing bandwidth shortage problems.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players along with their products are

-

Cisco – Cisco Catalyst Switches

-

Juniper Networks – Juniper MX Series Routers

-

Huawei – Huawei CloudFabric

-

Arista Networks – Arista 7500R Series

-

Hewlett Packard Enterprise (HPE) – Aruba CX Switches

-

Dell Technologies – Dell PowerSwitch

-

Extreme Networks – ExtremeCloud IQ

-

Nokia – Nokia SR Linux

-

VMware – VMware NSX

-

Palo Alto Networks – Prisma SD-WAN

-

Fortinet – Fortinet Secure SD-WAN

-

Check Point Software – Check Point Quantum Security Gateways

-

CommScope – RUCKUS ICX Switches

-

Broadcom – Broadcom Ethernet Switches

-

Netgear – Netgear ProSAFE Switches

Recent Developments

- In February 2024, the U.S. Department of Justice filed an antitrust lawsuit to block HPE's proposed $14 billion merger with Juniper Networks. The merger would have combined the second and third-largest providers of wireless networking solutions, potentially reducing competition in a market dominated by Cisco Systems. The Justice Department expressed concerns that the merger could lead to higher prices and reduced innovation.

- In January 2024, Nvidia's advancements in artificial intelligence significantly boosted the demand for advanced network technology. Companies like Broadcom, Cisco, Arista Networks, and Marvell Technology benefited from supplying the necessary network chips, lasers, and switches to integrate thousands of processors into single AI systems. This development underscored the critical role of networking infrastructure in supporting large-scale AI deployments.

|

Report Attributes |

Details |

|

Market Size in 2023 |

US$ 62.2 Billion |

|

Market Size by 2032 |

US$ 100.4 Billion |

|

CAGR |

CAGR of 5.49 % From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Technology (Routers & Switches, Wireless LAN, Enterprise Telephony, Storage Area Network, Infrastructure Firewalls), |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Cisco, Juniper Networks, Huawei, Arista Networks, Hewlett Packard Enterprise (HPE), Dell Technologies, Extreme Networks, Nokia, VMware, Palo Alto Networks, Fortinet, Check Point Software, CommScope, Broadcom, Netgear |