Data Center Generator Market Report Scope & Overview:

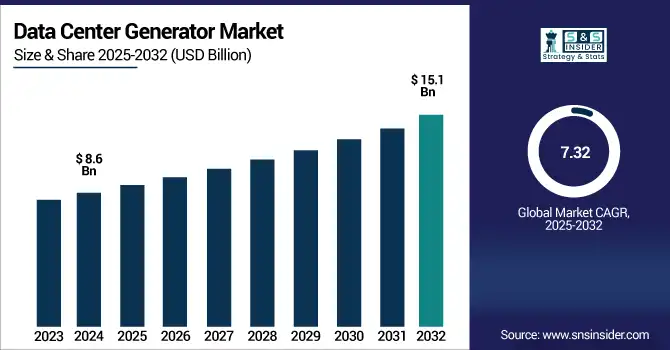

The Data Center Generator Market size was valued at USD 8.6 billion in 2025E and is expected to reach USD 15.1 billion by 2033, growing at a CAGR of 7.32% during 2026-2033.

With the demand for continuous power in hyper-scale and colocation data centers, driving the growth of the data center generator market. Their market growth is also being driven by the increase in data traffic, cloud computing, and digital transformation of industries. Some of the Key data center generator market Trends are eco-friendly gas generators, renewable energy sources integration, and edge data center deployment. The diesel generators are still in the foreground, but the hybrid ones are gaining ground.

Data Center Generator Market Size and Forecast:

-

Market Size in 2025: USD 8.6 Billion

-

Market Size by 2033: USD 15.1 Billion

-

CAGR: 7.32% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Data Center Generator Market - Request Free Sample Report

Key trends in the Data Center Generator Market:

-

Increasing demand for reliable and uninterrupted power supply in hyperscale and colocation data centers.

-

Expansion of cloud services and digital transformation initiatives driving higher backup power requirements.

-

Growth in edge computing and modular data centers requiring flexible generator solutions.

-

Adoption of advanced diesel and gas generators with enhanced fuel efficiency and lower emissions.

-

Rising emphasis on power redundancy and resiliency to minimize costly downtime.

-

Integration of sustainable and low-carbon generator technologies in response to regulatory and ESG goals.

-

Increasing investments by cloud service providers and enterprises in robust power infrastructure.

-

Rising focus on predictive maintenance and smart generator monitoring systems for enhanced uptime.

The U.S. data center generator market was valued at USD 2.59 billion in 2025 and is projected to reach USD 4.43 billion by 2033, registering a CAGR of 6.99% during the forecast period. Market growth is driven by the increasing need for continuous and reliable power supply across hyperscale and colocation data centers, along with expanding digital infrastructure, cloud adoption, and mission-critical applications requiring zero downtime operations.

Data Center Generator Market Drivers:

-

Growing Demand for Data Reliability Drives Surge in Backup Generator Investments

The growing usage of data globally and increased dependency on cloud computing have raised the demand for high-availability data centers. Generators are essential for backup power to operations, especially during extended outages. As enterprises transition toward a hybrid and multi-cloud infrastructure and internet activity surges with IoT and streaming services, the need for continuous uptime has become an imperative. Consequently, data centre operators are spending a huge amount on diesel and gas generators to prevent any downtime, which would cause revenue loss and data disruption. A key driver for the data center generator market is the rising need for dependable and efficient backup solutions.

In the year leading up to September 2024, Siemens's data-center business experienced a 60% increase in orders, totalling over USD 4.0 billion, and a 50% rise in revenue, surpassing USD 2.2 billion.

Data Center Generator Market Restraints:

-

Strict Environmental Regulations Curb Diesel Generator Adoption

The most common restraint on the data center generator market is stringent environmental regulations pertaining to carbon emissions, especially for diesel-powered generators. Shortages of traditional fossil fuel backup power solutions are expected as governments and environmental agencies demand energy alternatives. Operators face high compliance costs in regions where emissions standards tighten so that they will have to either adopt cleaner, and likely costly alternatives, such as hydrogen or battery backup systems, or risk being weeded out.

Besides, growing pressure from society toward carbon footprint reduction may dissuade companies from investing in diesel generators and thus, restrain the market growth over the forecast period. Particularly, these environmental constraints require an evolution from brown to green technologies, but add complexity to purchase and operating decisions.

For instance, in 2023, the Indian government implemented the CPCB IV+ emission standards for diesel generators up to 800 kW, achieving a 90% reduction in particulate matter and nitrogen oxide emissions compared to previous norms.

Data Center Generator Market Opportunities:

-

Expansion of Hyperscale and Edge Data Centers Boosts Generator Demand

With the large-scale expansion of hyperscale data centers by the leading cloud providers, and the fast emergence of edge data centers driving the demand for latency-sensitive applications, the growth in the generator market has a major potential to seize.' Data centers need backup power, predicated on high reliability and scalability, along with a modular design.

Industries set to adopt AI, 5G, and real-time data analytics will create a need for distributed computing, which in turn will push demand for edge facilities in both remote and urban locations, and each of them will require solid backup systems. Indeed, this changing ecosystem presents generator manufacturers, especially those with efficient, low-maintenance, environmentally compliant, cost-effective solutions, with an opportunity for new revenue streams as they cater to next-generation data centres.

Data Center Generator Market Challenges:

-

Shift Toward Green Energy Solutions Challenges Conventional Generator Market

The worldwide transition towards greener energy has been challenging the traditional generator market, which largely functions on diesel fuel-powered systems. Renewable energy systems combined with Battery Energy Storage Systems (BESS) are a greener, quieter, and often more affordable long-term solution that seamlessly fits with data centers, which are increasingly turning to them. Improvements in lithium-ion batteries and falling prices make these options increasingly attractive.

Also, at the outset to become carbon neutral, firms are focusing on green solutions, which are reducing the demand for traditional generator sets. This means that generator manufacturers will adapt or die. Against that background, the industry's old hands have a daunting set of challenges, to ensure reliability and environmental compliance at a reasonable cost.

For Instance, in 2024, data centers led global clean energy procurement, contracting over 17 GW, surpassing all other sectors.

Data Center Generator Market Segmentation Analysis:

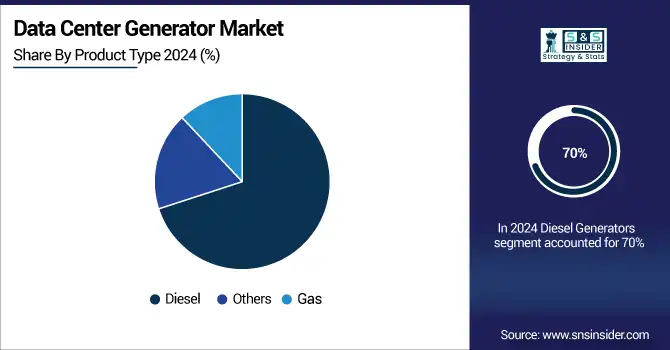

By Product Type: Diesel Generators Lead While Gas Generators Gain Momentum

The diesel generators segment dominated the market and accounted for 70% of the data center generator market share in 2025. Due to their great performance, quick start-up, and reliability when certain loads are high. In hyperscale data centers, these is common to provide uptime continuity during power failures. Despite pressure from environmentalists, their existing infrastructure and reliability will keep demand high for fuel. They will continue their leadership for the next few years due to their cleaner diesel technology innovations.

The gas generators segment is expected to register the fastest CAGR during the forecast period in 2026-2033, driven by emissions and operational cost benefits, and better regulatory positioning than diesel. They are becoming more popular in new sustainable data centers. Adopting green infrastructure globally and ever-increasing accessibility and affordability of natural gas will create rapid growth, specifically in areas with strong environmental regulations and carbon reduction targets.

By Capacity: Sub-1 MW Generators Dominate as 1–2 MW Segment Accelerates Growth

The <1 MW segment dominated the data center generator market and accounted for 54% of revenue share in 2025, as these are the preferred choice for edge and small to mid-sized data centers in urban and developing regions. These generators provide the most cost-effective and compact solutions for low-capacity backup power needs in a smaller footprint. The demand for sub-1 MW generators will continue to grow due to the expansion of distributed IT infrastructure and micro data centers, especially in the telecom and retail industries.

The segment 1 MW–2 MW is expected to grow at the fastest CAGR during the forecast period, as the medium-scale enterprise data centers and colocation facilities will be installed in the same capacity range. Such generators offer a performance vs. cost ratio perfect for a scalable IT infrastructure. This segment is expected to see a phenomenally high growth due to the rising requirement of modular data centers and hybrid clouds in the prediction period.

By Tier Standards: Tier III Data Centers Hold Majority Share, Tier IV Expands Rapidly

The Tier III data center segment dominated the data center generator market in 2025 and accounted for a significant revenue share, due to its cost-effectively than Tier IV. They are extremely common among enterprises and colocation providers who are weighing price against reliability. Ultimately, the increase in need for a scalable and resilient infrastructure due to hastened digital transformation is expected to propel the growth of Tier III deployments in both developed and emerging geographies.

The Tier IV segment is expected to register the fastest CAGR during the forecast period, which accounts for mission-critical applications' uptime and a fault-tolerant architecture. Sectors such as banking, healthcare, and hyperscale cloud providers now invest more in Tier IV data centers. As cyber threats grow and the appetite for service-level expectations rises, this market will grow quickly in parts of the world where infrastructure reliability and operational continuity take precedence.

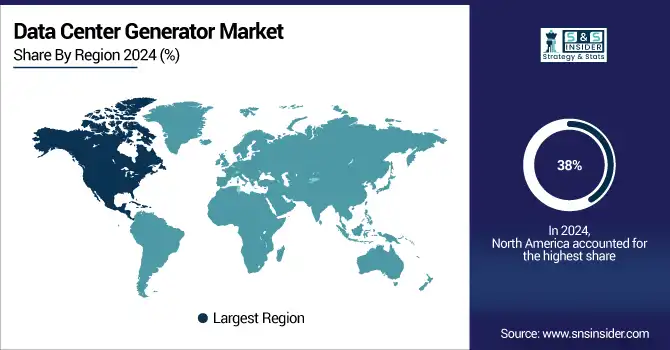

Data Center Generator Market Regional Insights

North America Dominates the Data Center Generator Market in 2025E

In 2025E, North America commands an estimated 39% share of the Data Center Generator Market, driven by the rapid expansion of hyperscale and colocation data centers and strong demand for uninterrupted power supply. Increasing cloud adoption, AI workloads, and digital transformation across enterprises significantly elevate power reliability requirements. Frequent grid outages caused by extreme weather events further strengthen the need for backup generators, positioning North America as the leading region in the global market.

United States Dominates North America

The United States leads the North American data center generator market due to its extensive hyperscale data center footprint and advanced digital infrastructure. Major cloud service providers such as AWS, Microsoft, and Google continue to expand facilities, increasing demand for high-capacity, reliable generator systems. Strict uptime standards, disaster recovery planning, and rising energy consumption from AI-driven workloads support sustained generator deployment. The presence of established generator manufacturers and favorable investment conditions further reinforce U.S. market dominance.

Asia-Pacific is the Fastest-Growing Region in the Data Center Generator Market in 2025E

Asia-Pacific is projected to grow at an estimated CAGR of 8.8%, making it the fastest-growing region in the Data Center Generator Market. Rapid digitalization, expanding cloud infrastructure, and increasing investments in hyperscale data centers are key growth drivers. Rising electricity demand and grid reliability concerns across emerging economies further accelerate generator adoption.

China Dominates Asia-Pacific

China dominates the Asia-Pacific data center generator market due to large-scale investments in cloud computing, AI, and government-backed digital infrastructure projects. The rapid expansion of hyperscale and edge data centers across Tier I and Tier II cities increases the demand for reliable backup power solutions. Additionally, growing internet penetration, e-commerce expansion, and smart city initiatives contribute to sustained generator demand. Strong domestic manufacturing capabilities and supportive government policies further solidify China’s leadership in the region.

Europe Data Center Generator Market Insights, 2025

In 2025, Europe held a significant share of the Data Center Generator Market, driven by increasing investments in data sovereignty, cloud services, and digital transformation initiatives. Strict regulatory requirements related to uptime, energy security, and emissions encourage the adoption of efficient and compliant generator solutions. Europe’s focus on sustainable infrastructure and resilience planning supports steady market growth.

Germany Dominates Europe

Germany leads the European market due to its strong industrial base, expanding colocation data centers, and emphasis on infrastructure reliability. High demand from financial services, manufacturing, and government sectors supports generator adoption.

Middle East & Africa and Latin America Data Center Generator Market Insights, 2025

In 2025, the Middle East & Africa data center generator market experienced steady growth, supported by rapid urbanization, expanding cloud infrastructure, and rising investments in smart cities. Countries such as the UAE and Saudi Arabia lead the region due to hyperscale data center developments and power reliability concerns. Latin America also showed moderate growth, driven by increasing digital adoption and data center expansion in Brazil and Mexico. Grid instability and rising demand for reliable power backup solutions continue to support generator market growth across both regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Data Center Generator Market Key Players:

-

Caterpillar Inc.

-

Cummins Inc.

-

Generac Power Systems, Inc.

-

Kohler Co. (Rehlko)

-

Rolls-Royce Power Systems (MTU Onsite Energy)

-

ABB Ltd.

-

Atlas Copco AB

-

Aggreko plc

-

HITEC Power Protection

-

Himoinsa

-

Aksa Power Generation

-

Mitsubishi Heavy Industries

-

INNIO Group

-

Deutz AG

-

Kirloskar Oil Engines Ltd.

-

Yanmar Holdings Co., Ltd.

-

Perkins Engines Company Limited

-

Wartsila Corporation

-

Doosan Portable Power

-

FG Wilson

Competitive Landscape for the Data Center Generator Market:

Caterpillar Inc.

Caterpillar Inc. is a global leader in power generation solutions, offering a comprehensive portfolio of diesel and gas generators designed for mission-critical applications, including large-scale data centers. The company provides high-capacity generator sets, integrated power systems, and advanced control technologies that ensure reliability, fast startup, and operational resilience. Caterpillar’s solutions are widely deployed in hyperscale and colocation data centers due to their proven performance under high-load conditions. With a strong global dealer network and end-to-end lifecycle support, Caterpillar plays a vital role in ensuring continuous power availability and uptime across data center infrastructures worldwide.

-

In 2024, Caterpillar expanded its data center generator portfolio with enhanced fuel-efficient and low-emission diesel generator sets designed to meet stricter environmental regulations while maintaining high reliability.

Cummins Inc.

Cummins Inc. is a prominent global manufacturer of power generation systems, delivering diesel and gas generators tailored for data center backup and prime power applications. The company is known for its robust engine technology, advanced digital monitoring systems, and scalable generator solutions that support hyperscale, colocation, and enterprise data centers. Cummins’ generators are valued for rapid response times, high fuel efficiency, and compliance with global emissions standards. Its vertically integrated capabilities, from engines to power controls, enable customized solutions that address growing power density and redundancy requirements in modern data centers.

-

In 2025, Cummins introduced next-generation gas generator solutions optimized for data centers, focusing on lower carbon emissions and reduced operational costs.

Generac Power Systems, Inc.

Generac Power Systems, Inc. is a leading provider of backup power solutions, with a strong presence in small to mid-sized, edge, and modular data centers. The company offers a wide range of diesel and natural gas generators, transfer switches, and power management systems designed for fast deployment and scalability. Generac’s strength lies in compact, cost-effective generator solutions that support distributed IT infrastructure and growing edge data center networks. Its focus on innovation and flexible power architectures makes Generac a key player in addressing evolving data center resiliency and uptime requirements.

-

In 2024, Generac expanded its commercial and industrial generator lineup to support modular data center deployments with improved remote monitoring and load management capabilities.

Kohler Co. (Rehlko)

Kohler Co., operating its energy business under the Rehlko brand, is a well-established provider of data center power solutions, offering diesel and gas generators engineered for high reliability and mission-critical performance. The company serves hyperscale, colocation, and enterprise data centers with integrated power systems, paralleling controls, and customized configurations. Kohler’s generators are recognized for their durability, quick start-up, and compliance with global standards. Through continuous innovation and global service capabilities, Kohler supports data center operators in maintaining uninterrupted operations and long-term power resilience.

-

In 2025, Kohler strengthened its Rehlko data center power portfolio by introducing advanced generator control systems to improve efficiency, redundancy, and real-time power management.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | US$ 8.6 Billion |

| Market Size by 2033 | US$ 15.1 Billion |

| CAGR | CAGR of 7.32% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Diesel, Gas, Others) • By Capacity (<1 MW, 1–2 MW, >2 MW) • By Tier Standards (Tier I & II, Tier III, Tier IV) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles |

Caterpillar Inc., Cummins Inc., Generac Power Systems, Inc., Kohler Co. (Rehlko), Rolls-Royce Power Systems (MTU Onsite Energy), ABB Ltd., Atlas Copco AB, Aggreko plc, HITEC Power Protection, Himoinsa, Aksa Power Generation, Mitsubishi Heavy Industries, INNIO Group, Deutz AG, Kirloskar Oil Engines Ltd., Yanmar Holdings Co., Ltd., Perkins Engines Company Limited, Wärtsilä Corporation, Doosan Portable Power, and FG Wilson. |