Enzyme-Linked Immunosorbent Assay (ELISA) Market Report Scope & Overview:

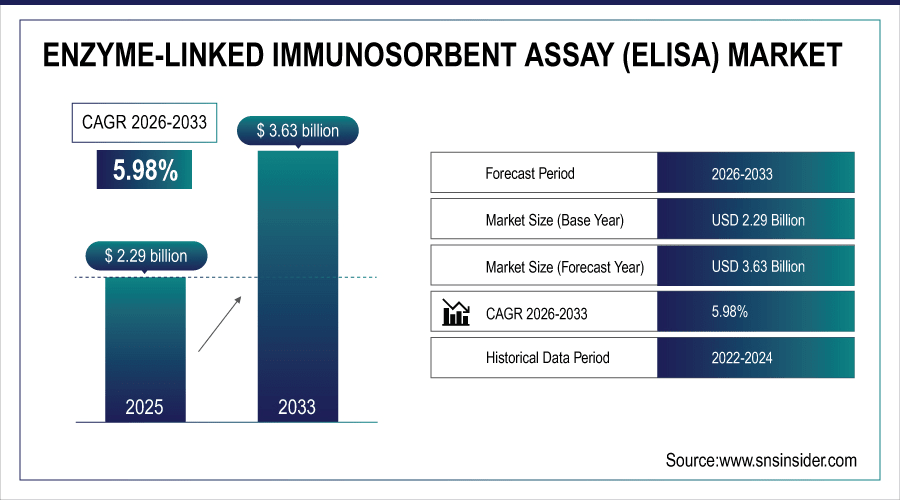

The Global Enzyme-Linked Immunosorbent Assay (ELISA) market was valued at USD 2.29 billion in 2025E and is projected to reach USD 3.63 billion by 2033, growing at a CAGR of 5.98% during the forecast period 2026–2033.

The world ELISA market is experiencing average growth due to increasing use in research and diagnostics. Over 50 million ELISA testing are performed every year in clinical, pharmaceuticals and food safety applications. The indirect and sandwich ELISA cover nearly 60% of the tests. Increasing incidence of infectious and chronic diseases, rising research activities, and demand for high-throughput immunoassays in less time with high accuracy are pushing the growth prospects for market expansion and long-term adoption across the world.

More than 50 million ELISA tests were conducted globally in 2025, with clinical diagnostics and research applications growing at nearly 6% year-on-year.

To Get More Information On Enzyme-Linked Immunosorbent Assay (ELISA) Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 2.29 Billion

-

Market Size by 2033: USD 3.63 Billion

-

CAGR: 5.98% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Enzyme-Linked Immunosorbent Assay (ELISA) Market Trends:

-

40% of all ELISA tests will be conducted in emerging markets by 2033 as access to low-cost diagnostics increases.

-

In 2025, about a quarter of ELISA uses were in food safety and environmental testing applications, likely to expand with tighter regulations.

-

ELISA test kits were nearly available in 60 % of the research labs across globe by 2025, and it increased to 80% by 2033 with more usage.

-

POCT ELISA tests represent 15% of total tests in 2025, expected to rise as rapid diagnostics become favoured.

-

Chronic and infectious disease monitoring, with repeat ELISA testing (50% of the total tests in 2025 and on an increase trajectory up to 2033).

U.S. Enzyme-Linked Immunosorbent Assay (ELISA) Insights:

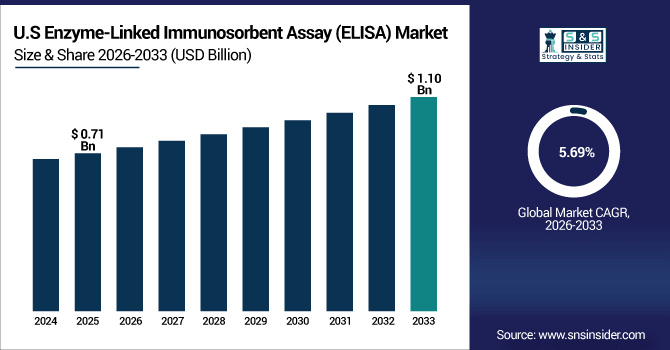

The U.S. Enzyme-Linked Immunosorbent Assay (ELISA) market was valued at USD 0.71 billion in 2025E and is projected to reach USD 1.10 billion by 2033 at a 5.69% CAGR. Over 7 million tests were performed in 2025, driven by clinical diagnostics, pharmaceutical research, and growing demand for accurate, high-throughput assays.

Enzyme-Linked Immunosorbent Assay (ELISA) Market Growth Drivers:

-

Increasing Prevalence of Infectious and Chronic Diseases Drives Widespread Adoption of ELISA Testing Globally.

Growing infectious and chronic diseases are changing the dynamics of ELISA market. Worldwide, 50 million assays were conducted by ELISA in 2025 and clinical diagnostics made up 60% of the overall use. And by 2033, testing would top 80 million annually as demand for early disease detection increases. Growing adoption in research, food safety and environmental monitoring is driving the development of kits and high-throughput assays globally.

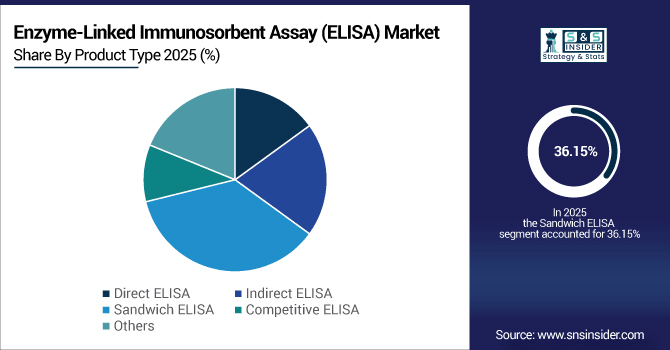

In 2026, sandwich ELISA tests are projected to account for 35% of global ELISA applications, making them the fastest-growing product category.

Enzyme-Linked Immunosorbent Assay (ELISA) Market Restraints:

-

Requirement for Skilled Personnel and Laboratory Infrastructure Limits ELISA Adoption in Emerging and Resource-Limited Markets.

It has been difficult to incorporate ELISA due to technical difficulty and infrastructure. In 2025, sufficient personnel trained to perform appropriate diagnostic tests accurately was unavailable in the laboratories of almost 40% of small laboratories worldwide. High setup and operational costs limit accessibility in resource-constrained regions, restricting market penetration. Frequent repeat testing for chronic disease monitoring, averaging 2–4 tests per patient annually, further strains laboratory capacity. These factors slow widespread adoption despite growing demand across clinical, research, and food safety applications.

Enzyme-Linked Immunosorbent Assay (ELISA) Market Opportunities:

-

Growing Demand for Early Detection of Infectious and Chronic Diseases Drives Widespread ELISA Adoption Globally.

Increasing need for early detection of disease is one of the key growth factors in the ELISA market. This year alone some 50 million ELISA tests were performed worldwide, including 60% of the overall application market for clinical diagnostics. However, by 2033, this opens up to greater than 80 million tests per annum through infectious and chronic disease analytics. The growth of point-of-care (POC) and high-throughput testing is driving kit innovation and increasing laboratory adoption around the globe.

By 2026, clinical diagnostic applications are projected to account for nearly 62% of all ELISA tests globally, driving market expansion.

Enzyme-Linked Immunosorbent Assay (ELISA) Market Segmentation Analysis:

-

By Product Type, Sandwich ELISA held the largest market share of 36.15% in 2025, while Competitive ELISA is expected to grow at the highest CAGR of 7.39%.

-

By Application, Clinical Diagnostics contributed the highest market share of 56.80% in 2025, while Pharmaceutical & Biotech Testing is anticipated to expand at the fastest CAGR of 7.68%.

-

By End User, Diagnostic Laboratories comprised 30.30% in 2025, while Pharmaceutical Companies are projected to grow at the fastest CAGR of 7.97%.

By Product Type, Sandwich ELISA Dominates While Competitive ELISA Grows Rapidly:

The sandwich ELISA was the most commonly used method, accounting for more than 18 million tests worldwide by 2025. Competitive ELISA (for small molecules & toxins) had nearly 7 million tests in 2025 and is forecast to pass 12 million tests by 2033. Growing need for accurate, high-throughput assays will further drive adoption in clinical, research and food safety labs globally.

By Application, Clinical Diagnostics Leads While Pharmaceutical & Biotech Testing Expands Fastest:

ELISA market is being led by clinical diagnostics with around 28 million tests being performed worldwide in 2025. Pharmaceutical and biotech, which includes drug discovery and quality control did almost 7.5 million tests in 2025, they are expected to do over 13 million tests by the year of 2033. An increasing incidence of chronic and infectious diseases, and stringent regulatory requirements are responsible for the rapid growth in diagnostic and research applications.

By End User, Diagnostic Laboratories Dominate While Pharmaceutical Companies Grow Fastest:

Diagnostic laboratories were the largest end-user field in which around 15 million ELISA tests are conducted across the world by the year 2025. For example, with ELISA used by pharmaceutical companies to facilitate drug development and maintain quality control, nearly 5 million tests were performed in 2025 and is expected that this number will exceed 9 million in the year 2033. Increasing research activities and demand for effective disease monitoring is likely to boost use of ELISA in the segment.

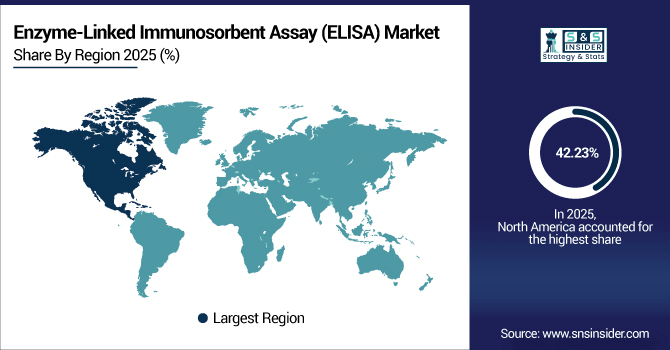

Enzyme-Linked Immunosorbent Assay (ELISA) Market Regional Analysis:

North America Enzyme-Linked Immunosorbent Assay (ELISA) Market Insights:

North America leads the global ELISA market with a 42.23% share in 2025, driven by advanced healthcare infrastructure and widespread diagnostic adoption. More than 21 million ELISA assays were used in the zone in 2025 for clinical diagnosis and research, as well as in finally preventing new medicines. Soaring investments in biotechnology, rising incidence of chronic and infectious disorders, and surging need for high-throughput, precise tests were also instrumental to strong uptake. Expansion is on the horizon as far out as 2033.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Enzyme-Linked Immunosorbent Assay (ELISA) Market Insights:

More than 7 million ELISA tests were carried out in the U.S. in 2025 in connection to more than 1,200 diagnostic and research labs. Growing needs for early disease detection, increased uptake of higher-throughput competitive and sandwich ELISA testing and prevalence of pharmaceutical testing is propelling growth and maintaining the U.S. as the largest ELISA market worldwide.

Asia-Pacific Enzyme-Linked Immunosorbent Assay (ELISA) Market Insights:

The Asia-Pacific ELISA market is projected to grow at a CAGR of 7.06% during 2026–2033, making it the fastest-growing region globally. 9 million ELISA tests were performed in 2025 for clinical diagnostics, research & pharmaceutical applications. The tests were performed in more than 1,000 laboratories throughout the region. Growth is being driven by increasing healthcare spending, growing burden of infectious diseases and expansion in the use of high-throughput tests.

China Enzyme-Linked Immunosorbent Assay (ELISA) Market Insights:

China is the biggest ELISA market in the APAC region and conducted nearly 4.2 million tests in 2025. High adoption is being driven by swift healthcare infrastructure development, rising incidence of infectious and chronic diseases and mounting pharmaceutical & biotechnology research. The full-fledged laboratories and increasing need for reliable diagnostics act as the major driving factors of the market.

Europe Enzyme-Linked Immunosorbent Assay (ELISA) Market Insights:

Europe’s ELISA market is witnessing steady growth, supported by over 4,500 laboratories and research centers in 2025 across Germany, France, and the United Kingdom. The area performed approximately 8.7 million ELISA analyses in clinical, pharmaceutical and food safety applications. Growth in research and development for pharmaceutical, clinical diagnostic services and biotechnology infrastructure investment are the factors keeping implementation of this technique high. Growing need for high-throughput, automated assay solutions raises Europe as a focal point of ELISA market innovations.

Germany Enzyme-Linked Immunosorbent Assay (ELISA) Market Insights:

Germany is the largest ELISA market for Europe, with more than 3.82 million procedures in 2025 and around 1,200 centralized laboratories. Growth is propelled by strong healthcare systems, high penetration of diagnostic technologies, and a vibrant pharmaceutical and biotech research. Growing need for precise and high-throughput assay systems also makes Germany the leading ELISA market in Europe.

Latin America Enzyme-Linked Immunosorbent Assay (ELISA) Market Insights:

The Latin America ELISA market is growing steadily, with Brazil dominating, supported by over 480 laboratories and research centers in 2025. Mexico and Argentina rank subsequent with the proliferation of clinical diagnostics, pharmaceutical research, and food safety applications. Rise in healthcare infrastructure, growing awareness of precise assays and rise in biotechnology-based projects drive the growth of the regional market.

Middle East and Africa Enzyme-Linked Immunosorbent Assay (ELISA) Market Insights:

The Middle East & Africa ELISA market is expanding steadily, with over 320 laboratories and research facilities in 2025. The highest adoption in the region is observed in Saudi Arabia, where advanced diagnostic infrastructure is available followed by South Africa. The growth is attributed to the rising healthcare expenditure, growing requirement of the accurate diagnostic and research assays, and increasing biotechnology processes in the region.

Enzyme-Linked Immunosorbent Assay (ELISA) Market Competitive Landscape:

Thermo Fisher Scientific leads the ELISA market with a comprehensive portfolio of high-throughput ELISA kits and automated platforms. It delivered more than 6.2 million ELISA applications across the world for clinical diagnostics, pharmaceutical, and research testing in 2025. It has its leadership based on extensive R&D, a solid global distribution network in 50+ countries, breakthrough multiplexing technologies and support services ensuring sound reliability for laboratories that need a precise and scalable ELISA solutions.

-

In July 2025, Thermo Fisher Scientific announced the acquisition of Solventum's purification and filtration business for approximately USD 4.1 billion.

Bio-Rad Laboratories dominates the ELISA market by providing reliable assay kits and detection systems widely used in research and diagnostics. In 2025, it supported more than 4.7 million ELISA tests around the world. Strong product quality, a broad portfolio designed for life sciences and key partnerships with universities and pharmaceutical companies will ensure Bio-Rad’s continued position as the ELISA solutions provider of choice in established markets but also growth regions.

-

In May 2025, Bio-Rad Laboratories expanded its portfolio by introducing new anti-idiotypic antibodies and SpyCatcher reagents.

Agilent Technologies holds a leading position in ELISA instrumentation and assay platforms, enabling precise and reproducible analyses. Agilent sponsored more than 3.8 million ELISAs worldwide in 2025. Its success is based on creative automation, integration with larger analytical workflows and excellent teamwork with biotech and pharma. Extensive technical support and training programs further support its use in clinical, research, and industrial laboratories.

-

In August 2025, Agilent Technologies expanded the Dako Omnis family with three new models to meet evolving pathology lab needs.

Enzyme-Linked Immunosorbent Assay (ELISA) Market Key Players:

Some of the Enzyme-Linked Immunosorbent Assay (ELISA) Market Companies are:

-

Thermo Fisher Scientific Inc.

-

Bio-Rad Laboratories, Inc.

-

Agilent Technologies, Inc.

-

Merck KGaA

-

PerkinElmer, Inc.

-

Abbott Laboratories

-

Roche Diagnostics

-

Danaher Corporation (Beckman Coulter)

-

bioMérieux S.A.

-

Abcam plc

-

Enzo Life Sciences, Inc.

-

R&D Systems (Bio-Techne)

-

Eurofins Scientific

-

ZEUS Scientific, Inc.

-

BioLegend, Inc.

-

Creative Diagnostics

-

Grifols

-

Dynex Technologies

-

Berthold Technologies

-

Tecan Group Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 2.29 Billion |

| Market Size by 2033 | USD 3.63 Billion |

| CAGR | CAGR of 5.98% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Direct ELISA, Indirect ELISA, Sandwich ELISA, Competitive ELISA, Others) • By Application (Clinical Diagnostics, Research Laboratories, Pharmaceutical & Biotech Testing, Food & Beverage Testing, Environmental Testing, Others) • By End User (Hospitals & Clinics, Diagnostic Laboratories, Research Institutions, Pharmaceutical Companies, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Agilent Technologies, Inc., Merck KGaA, PerkinElmer, Inc., Abbott Laboratories, Roche Diagnostics, Danaher Corporation (Beckman Coulter), bioMérieux S.A., Abcam plc, Enzo Life Sciences, Inc., R&D Systems (Bio-Techne), Eurofins Scientific, ZEUS Scientific, Inc., BioLegend, Inc., Creative Diagnostics, Grifols, Dynex Technologies, Berthold Technologies, Tecan Group Ltd. |