Artificial Intelligence in Accounting Market Key Insights:

To Get More Information on Artificial Intelligence in Accounting Market - Request Sample Report

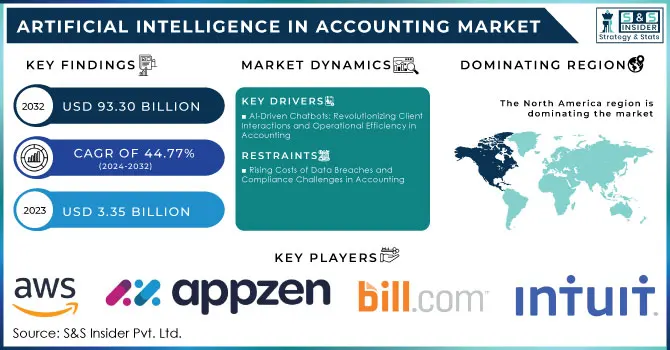

The Artificial Intelligence in Accounting Market size was valued at USD 3.35 billion in 2023 and is expected to reach USD 93.30 billion by 2032, growing at a CAGR of 44.77% Over the Forecast Period of 2024-2032.

From recent studies, it was found that 59% use AI for writing e-mails, while 36% resort to the same for workflow automation. And, in addition to these, 31% rely on AI for research work. This shows a sharp upshift in the utilization of AI to enhance business operations and efficiency in all accounting processes, with 65% of enterprises worldwide utilizing AI mainly for the automation of labor and repetitive work.

Accounting work automation goes beyond the automation of accounting tasks; it is transforming how professionals interact with their work. A survey shows that 83% of accountants have been impacted by AI, and many use such an application as ChatGPT to satisfy their various requirements, which range from the preparation of marketing materials to the summation of reports. In such improvement, one goes on to achieve better productivity coupled with time and resource use, where staff using AI technology managed to record a pronounced 80% increase in productivity from the use of such technology.

Looking forward, the horizon for AI in accounting is very vast with many opportunities. For example, firms that have shifted to AI applications are enjoying immediate benefits. In one example, it increased the customers' satisfaction level by 30%. More to that, J.P. Morgan cited that investment in generative AI models increased the market capitalization by USD 1.4 trillion and augmented corporate profits by 45% in just four months of 2023. The data points out a potential for AI not just to improve operational efficiency but also to fuel strategic growth in the accounting sector.

MARKET DYNAMICS

DRIVERS

- AI-Driven Chatbots: Revolutionizing Client Interactions and Operational Efficiency in Accounting

AI chatbots change the world of accounting and financial services, improving convenience and productivity. 57% of surveyed financial executives believe that operation costs in their business would be lower with the support of chatbots. There is considerable appeal in these technologies, as 40% are comfortable using the banking applications of chatbots, while 77% believe it will positively contribute to the future of banking. Chatbots can answer up to 80% of routine customer inquiries, which is a big advantage in terms of being available 24/7 to 65% of the users. This integration will improve customer service while allowing accounting and finance professionals to work on higher-level tasks that strengthen client relationships.

- Enhancing Regulatory Compliance and Fraud Detection: The Role of AI in Modern Accounting

New regulatory measures are constantly evolving, and hence, it is always high on the list for any accounting firm to remain in regulatory compliance. AI-based solutions shift the compliance landscape by checking automatically and keeping account firms abreast of these changes in real-time. According to reports, fraud detection accuracy increases by more than 50% with the use of AI compared to the older means. Also, 74% of worldwide organizations, currently using AI for the detection of financial crime. By identifying anomalies in transactions and marking suspicious activities, these smart systems greatly strengthen security. This integration not only help firms minimize risks but also ensures compliance, thus helping to win the confidence of clients and other stakeholders.

RESTRAINTS

- Rising Costs of Data Breaches and Compliance Challenges in Accounting

New regulatory measures are constantly evolving, and hence, it is always high on the list for any accounting firm to remain in regulatory compliance. AI-based solutions shift the compliance landscape by checking automatically and keeping account firms abreast of these changes in real time. According to reports, fraud detection accuracy increases by more than 50% with the use of AI compared to the older means. Also, 74% of worldwide organizations, currently using AI for the detection of financial crime. By identifying anomalies in transactions and marking suspicious activities, these smart systems greatly strengthen security. This integration not only helps firms minimize risks but also ensures compliance, thus helping to win the confidence of clients and other stakeholders.

SEGMENT ANALYSIS

BY COMPONENT

Solutions comprised the largest share of approximately 64% in the Artificial Intelligence in Accounting market in 2023. This is primarily attributed to the rising demand for all-inclusive AI-powered tools that can automate, make accounting more accurate, and help in better financial decision-making. Companies are increasingly spending on integrated solutions that enable automation, analytics, and real-time reporting to optimize operations. Meanwhile, the service segment would be the fastest-growing at the CAGR of 46.26% during the forecasting years from 2024 to 2032, by the growing need for continuously offered support and expertise concerning the implementation of AI-based technologies. With the proper utilization of AI, increasing professional services is crucial for integration, customization, and training

BY DEPLOYMENT

The Artificial Intelligence in Accounting market is led by the cloud segment with 63% share of revenues earned in 2023. This market is expected to experience the highest growth CAGR at 45.34% through the period from 2024 to 2032. Its dominance will be influenced mainly by cloud-based solutions that are booming because they allow scaling, flexibility, and lower costs for accounting firms. By using cloud technology, companies can now easily have direct access to the AI-based applications and tools anywhere with all the capabilities necessary to strengthen coordination and enable real-time analysis of data. The increasing attention paid toward cloud data safety and recovery just adds greater appeal, simply because organizations seek products whose reliability does not cause compromise on a requirement set - while maintaining complete confidentiality regarding financially sensitive details.

BY ORGANIZATION SIZE

Large enterprises have taken the major share of the Artificial Intelligence in Accounting market, having around 60% of the revenue in 2023. This is essential because large organizations have tremendous resources and can invest huge amounts of money in leading-edge AI technologies that ensure efficiency in operations, help simplify complex accounting processes, and provide better decision-making capabilities. Large companies look for more profound solutions that can process a bigger volume of data and that can offer advanced analytics by which they can compete strongly. On the other hand, it is projected that SMEs are going to grow at a CAGR of 46.73% during 2024-2032 as small and medium-sized enterprises realize that adopting AI would save time in doing routine work and thereby cut down on operation costs, which would level them up with larger peers for accurate financial reporting.

BY APPLICATION

Automated Bookkeeping was one of the leaders in the market for Artificial Intelligence in Accounting, holding revenue share at around 34% as of 2023. The primary reason is the fact that companies are always on the lookout to find efficient and automated methods to deal with the finance processes while reducing manual staff. Automated bookkeeping presents accurate information, saves time, and enables channeling energies into more strategic activity rather than getting busy performing mundane repetitive tasks. On the other hand, Fraud and Risk Management is likely to grow at the highest CAGR value of 46.66% in the period 2024-2032. This may be caused by the high awareness level of financial fraud by people and the need for powerful risk mitigation tactics. The demand for advanced AI technologies that can detect fraud and prevent it will continue increasing as organizations look out for protecting their assets in addition to maintaining compliance.

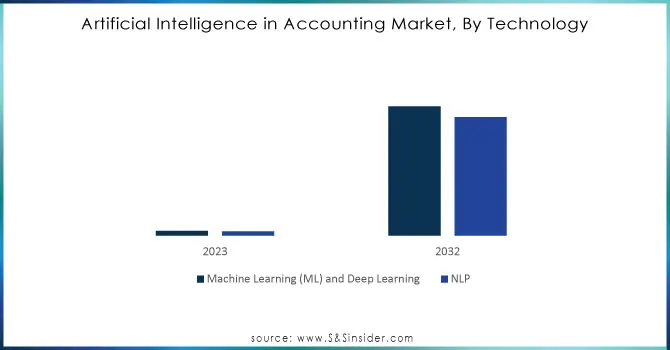

BY TECHNOLOGY

Machine Learning and Deep Learning are the leading technologies in Artificial Intelligence in Accounting, covering about 56% share. Such technologies allow an analysis of a large volume of data and automate complex procedures, bringing predictive analytics capabilities to make decisions with high efficiency and effectiveness. More importantly, ML and Deep Learning will be crucial for the advancement of pattern- and anomaly-based fraud detection and risk management in financial transactions. NLP is expected to grow at the highest CAGR of 45.61% between 2024 and 2032, mainly because it helps facilitate client interaction, automates the generation of reports, and makes financial information more accessible. As companies increasingly seek to unlock customer insights and streamline communication, NLP technologies in accounting will be in great demand.

Do You Need any Customization Research on Artificial Intelligence in Accounting Market - Inquire Now

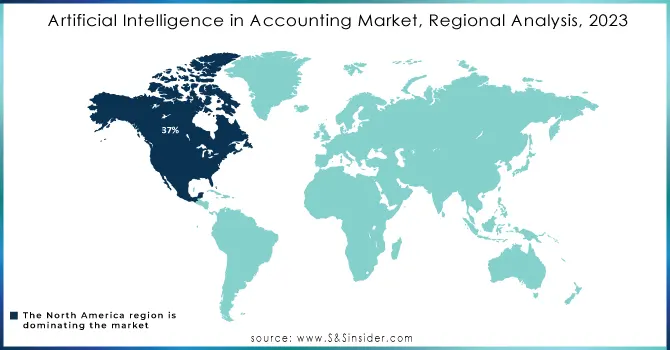

REGIONAL ANALYSIS

North America dominated the Artificial Intelligence in Accounting market, with about 37% revenue share in 2023. This is owing to the strong technological infrastructure, significant investment in AI research and development, and a strong presence of key players in the market. With enterprises increasingly looking at using AI-driven solutions to optimize operational efficiency, improve compliance, and cut costs, North America solidifies its leadership position

The AI accounting market in the Asia Pacific is projected to grow and hold a CAGR of nearly 47.86% in the period from 2024 to 2032. The factors encouraging such growth include the acceptance of digital transformation initiatives across various businesses in emerging economies, as well as governments offering support to AI innovation and investment. The growth in the recognition of the capability of AI in streamlining accounting activities and enhancing the quality of financial decisions is the driving force behind the rapid surge of the region in the global market.

LATEST NEWS-

-

FundGuard raises USD 100 million in march 2024. The funding has come from Key1 Capital and EUclidean Capital, along with the new investors. The step is taken to assist the AI-driven investment accounting platform in its vision to bring about streamlined investment accounting through artificial intelligence.

-

In 2024 partnership between OpenAI and PwC, aimed at reselling ChatGPT to businesses. Again, this reflects an upward trend in how AI is being used in a corporate setting, not just that, even the accounting and consulting where applications like ChatGPT will be able to ease analysis of data, servicing to customers, and many such operational efficiency.

KEY PLAYERS

- Amazon Web Services Inc. (Amazon QuickSight, AWS SageMaker)

- AppZen Inc. (Expense Audit, Invoice Audit)

- Bill.com, Inc. (Intelligent Business Payments, AI-Powered Invoice Processing)

- Deloitte Touche Tohmatsu Limited (Deloitte AI Platform, Audit Analytics)

- Ernst & Young LLP (EY Canvas, EY Helix)

- IBM Corporation (IBM Watson Analytics, IBM Cognos Analytics)

- Intuit Inc. (QuickBooks with AI, Intuit AI Tax Assistant)

- Kore.ai, Inc. (Kore Virtual Assistant, Kore.ai Conversational AI Platform)

- KPMG International Limited (KPMG Clara, KPMG Ignite)

- Microsoft Corporation (Dynamics 365 AI, Azure AI)

- MindBridge Analytics Inc. (MindBridge AI Auditor, MindBridge Insights)

- OneUp (OneUp AI Bookkeeping, OneUp Inventory Management)

- OSP Labs, Inc. (AI-Powered Financial Analytics, Automated Invoice Processing)

- PricewaterhouseCoopers LLP (PwC Audit AI, PwC Risk Assurance)

- Sage Group PLC (Sage Intacct, Sage AI Forecasting)

- SMACC GmbH (SMACC Expense Management, SMACC Invoice Automation)

- UiPath, Inc. (UiPath Automation Hub, UiPath AI Center)

- Vic.ai (Vic.ai Invoice Processing, Vic.ai Spend Intelligence)

- Xero Limited (Xero AI Reconciliation, Xero Analytics Plus)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.35 Billion |

| Market Size by 2032 | USD 93.30 Billion |

| CAGR | CAGR of 44.77% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Organization Size (Large Enterprises, Small and Medium-Sized Enterprises) • By Deployment (Cloud, On-premises) • By Technology (Machine Learning (ML) and Deep Learning, Natural Language Processing (NLP)) • By Application (Invoice Classification and Approvals, Automated Bookkeeping, Reporting, Fraud and Risk Management, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amazon Web Services Inc., AppZen Inc., Bill.com, Inc., Deloitte Touche Tohmatsu Limited, Ernst & Young LLP, IBM Corporation, Intuit Inc., Kore.ai, Inc., KPMG International Limited, Microsoft Corporation, MindBridge Analytics Inc., OneUp, OSP Labs, Inc., PricewaterhouseCoopers LLP, Sage Group PLC, SMACC GmbH, UiPath, Inc., Vic.ai, Xero Limited |

| Key Drivers | • AI-Driven Chatbots: Revolutionizing Client Interactions and Operational Efficiency in Accounting • Enhancing Regulatory Compliance and Fraud Detection: The Role of AI in Modern Accounting |

| RESTRAINTS | • Rising Costs of Data Breaches and Compliance Challenges in Accounting |