Intelligent Roadways Transportation System Market Size & Overview

Get More Information on Intelligent Roadways Transportation System Market - Request Sample Report

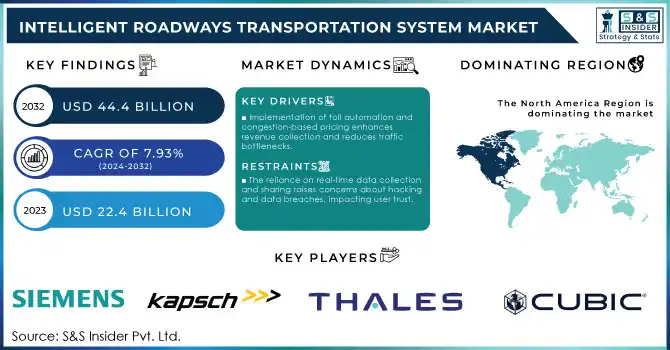

The Intelligent Roadways Transportation System Market was valued at USD 22.4 billion in 2023 and is expected to reach USD 44.4 billion by 2032, growing at a CAGR of 7.93% over 2024-2032.

The Intelligent Roadways Transportation System market is evolving rapidly, fueled by advancements in smart technologies, rising urbanization, and the growing demand for sustainable mobility solutions. These systems leverage AI, IoT, and big data to enhance transportation efficiency, reduce congestion, and improve safety. One key factor driving the market is the rise in road fatalities and congestion. For instance, in the U.S., road deaths increased by 7% in the first quarter of 2022 compared to the previous year. Advanced systems like intelligent traffic management and collision avoidance technologies are critical in addressing these challenges. Governments worldwide invest heavily in such systems to improve traffic conditions and reduce emissions. For example, the European Union's C-ITS initiatives aim to deploy vehicle-to-infrastructure communication to improve traffic efficiency and safety.

Another growth driver is the increasing adoption of smart city initiatives globally. Projects like Smart Columbus in the U.S. integrate intelligent transportation systems to enhance urban mobility. In Asia-Pacific, rapid urbanization is pushing governments to develop intelligent traffic control systems to accommodate growing populations and vehicular density. Statistically, the implementation of advanced traffic management systems has shown tangible benefits. Cities that deployed ITS solutions reported reductions in congestion by 20-30% and fuel consumption by up to 15%. Parking management solutions, a subset of intelligent systems, have been shown to reduce search times for parking by 43%, saving significant time and reducing emissions.

Furthermore, investments in smart mobility technologies are accelerating. Companies are developing innovative solutions such as automated toll collection, real-time traffic monitoring, and integrated ticketing systems to enhance user convenience and optimize network performance. In summary, the Intelligent Roadways Transportation System market is witnessing significant growth, driven by technological innovation, government support, and a focus on sustainable urban development. With continued advancements, these systems are expected to revolutionize how cities manage transportation, making roadways safer, greener, and more efficient.

| Year | Accident Reduction (%) | Contributing Technologies | Example Region |

|---|---|---|---|

| 2018 | 5% | Traffic signal optimization, collision warning systems | U.S., urban cities |

| 2019 | 7% | Automated traffic monitoring, dynamic speed control | Europe, highway routes |

| 2020 | 10% | Real-time navigation, vehicle-to-infrastructure (V2I) | Asia-Pacific, smart cities |

| 2021 | 12% | Advanced Driver Assistance Systems (ADAS), smart parking | North America, urban hubs |

| 2022 | 15% | AI-based traffic prediction, emergency response systems | Europe, metropolitan areas |

| 2023 | 18% | Integrated ITS platforms, augmented reality navigation | U.S., large metro areas |

Intelligent Roadways Transportation System Market Dynamics

Drivers

-

Rising use of V2X (vehicle-to-everything) technology supports intelligent traffic systems.

-

Implementation of toll automation and congestion-based pricing enhances revenue collection and reduces traffic bottlenecks.

-

Faster incident detection and management systems reduce response times and mitigate accident impacts.

In the Intelligent Roadways Transportation System market, rapid incident detection and management systems are pivotal for improving roadway safety and traffic efficiency. These systems employ cutting-edge technologies such as IoT-enabled sensors, AI-based analytics, and real-time monitoring tools to identify accidents, breakdowns, or other disruptions immediately. This capability allows traffic management centers to respond promptly by dispatching emergency services, redirecting vehicles, or issuing instant alerts to drivers. The ability to reduce response times is a transformative benefit. Traditional methods often rely on delayed manual reporting, which can intensify traffic jams and hinder emergency interventions. In contrast, intelligent systems continuously monitor traffic using high-resolution cameras, automated detection algorithms, and communication networks. For example, vehicle-to-infrastructure (V2I) technologies instantly relay incident details to relevant authorities, ensuring quicker deployment of assistance, such as tow trucks or medical teams. Beyond speeding up responses, these systems help mitigate secondary accidents and economic losses. By offering real-time alternate routes, they alleviate congestion and prevent additional collisions near incident sites. Furthermore, detailed alerts equip emergency responders with essential information, enabling them to arrive prepared and reduce fatalities effectively. Such systems also aid in urban planning and policymaking. Data collected through incident detection technologies is analyzed to pinpoint high-risk areas, facilitating targeted infrastructure upgrades and safety measures. Predictive analytics powered by AI can identify potential accident hotspots, enabling proactive interventions like enhanced traffic monitoring or improved road conditions.

These advancements contribute significantly to saving lives, optimizing traffic flow, and reducing financial impacts. As global adoption of intelligent transportation technologies rises, rapid incident detection and management systems are becoming central to creating safer, more efficient, and resilient road networks tailored to future mobility demands.

Restraints

-

The integration of advanced technologies like IoT, AI, and V2X communication requires significant investment in infrastructure, limiting adoption in developing regions.

-

The reliance on real-time data collection and sharing raises concerns about hacking and data breaches, impacting user trust.

-

The operation and maintenance of sophisticated ITS technologies demand skilled personnel, which is scarce in many regions.

The operation and maintenance of advanced Intelligent Transportation System (ITS) technologies require highly specialized skills, yet many regions, particularly in developing or underserved areas, face a scarcity of trained personnel. These technologies, encompassing real-time traffic monitoring, automated incident detection, and vehicle-to-infrastructure communication, rely on cutting-edge tools like AI, IoT, and data analytics. Their deployment and upkeep demand expertise in system design, programming, network management, and data interpretation to ensure optimal functionality. A lack of tailored training programs and technical education has made it challenging for many regions to cultivate the necessary workforce. This issue is especially pronounced in low-income or remote areas where educational and infrastructure resources are inadequate, leading to delays in implementation and inefficient operation of ITS systems. Furthermore, the rapid pace of innovation in the ITS market increases the need for continual skill enhancement. Employees must stay abreast of new technologies, software updates, and evolving industry standards, placing an added burden on workers and employers—especially in areas where opportunities for upskilling are limited.

Beyond technical proficiency, ITS professionals must understand regional transportation policies and challenges to tailor applications to local contexts. Addressing this skills gap requires significant investment in workforce development initiatives, such as establishing training centers, creating certification programs, and fostering international collaborations for knowledge exchange. To mitigate these challenges, governments and industry leaders are prioritizing public-private partnerships and capacity-building initiatives. Global ITS organizations frequently partner with academic institutions to develop specialized courses and certifications aimed at preparing a skilled workforce. These efforts are critical to overcoming the skills shortage and ensuring the long-term success of ITS technologies, enhancing transportation systems' efficiency and safety worldwide.

Intelligent Roadways Transportation System Market Segmentation Analysis

By Type

The Advanced Traffic Management System (ATMS) segment dominated the market with over 31.23% share in 2023. Traffic monitoring systems are likely to be propelling the adoption of pioneering government initiatives for the development of traffic infrastructures, that work to the advantage of the systems. ATMS integrates communications technology, data processing technology, and sensors to enable real-time management of transportation network operations, consistent with industry trends.

The Advanced Public Transportation System segment is projected to have the highest CAGR from 2024 to 2032. Moreover, the digital transformation strategies of the public transportation sector, such as the APTS aid in improving the productivity and quality of travel, along with supporting the comfort and overall customer experience, which in turn is driving the segment growth in the roadway ITS market.

By Application

In 2022, traffic management held the largest revenue share of over 29.75%. Perhaps one of the more visible fronts, the integration of advanced technology such as sensors, cameras, and other monitoring devices will make transportation networks more safe and sustainable. Traffic control authorities can seamlessly regulate traffic signals, and route diversions, and enhance vehicle passage during peak hours through the analysis and processing of real-time traffic data that includes traffic flow, congestion, and other incidents, thereby aiding the growth of the segment.

The automotive telematics segment is expected to reach the highest CAGR, between 2024 and 2032. Examples of intelligent transportation system applications involving auto telecoms include vehicle telematics; integrated global positioning system (GPS) systems; wireless auto telecom systems; on-board vehicle diagnostics; and black box technologies that capture or transmit vehicle usage patterns, including additional location, speed, maintenance, and vehicle-to-vehicle interaction data over time and internally. The data is analyzed in real-time for better safety, cost saving, and performance of drivers, which is expected to boost the potential for vehicle telematics solutions in the roadway intelligent transportation system market.

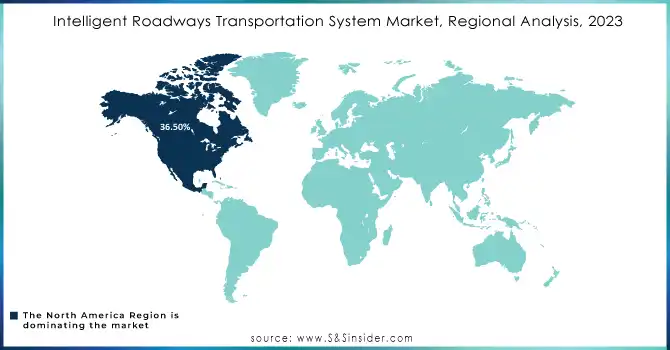

Intelligent Roadways Transportation System Market Regional Analysis

North America dominated the market and represented a revenue share more than of 36.50% in 2023, supported by the governments, smart city initiatives, and research activities in the region. Innovative technologies, especially AI and IoT, are being used by the region to enhance road safety and traffic management. A high level of infrastructure investments and public-private partnerships to modernize transportation networks is driving the North American market. Moreover, the very need of the region to reduce carbon emissions, and improve mobility underwrites its position in IRTS leadership.

Asia Pacific (APAC) will grow at the highest CAGR. APAC is expected to emerge as the fastest-growing region in the traffic management market due to rapid urbanization, high population growth, and smart city projects by different countries in the region such as China, India, and Japan which require effective traffic management solutions for dealing with congestion. With the deployment of 5G technology and the smart infrastructure that these regions enjoy immense growth prospects, we expect to see substantial investment in the ITS space in China as part of the Belt and Road Initiative.

Need any customization research on Intelligent Transportation System Market - Enquire Now

Key Players

The major key players along with products are

-

Siemens AG - Sitraffic Smart City

-

Kapsch TrafficCom - Kapsch Traffic Management Solutions

-

Thales Group - Thales Urban Traffic Management System

-

Cubic Corporation - Cubic Traffic Management Systems

-

Honeywell International Inc. - Honeywell Intelligent Transportation Solutions

-

Neology Inc. - Neology Traffic Solutions

-

Telenav, Inc. - Telenav Navigation Solutions

-

TomTom International - TomTom Traffic

-

IBM Corporation - IBM Intelligent Transportation Solutions

-

Swarco AG - Swarco Traffic Management Systems

-

Garmin Ltd. - Garmin Traffic Solutions

-

Daimler AG - Daimler Connected Vehicle Services

-

Aptiv PLC - Aptiv Advanced Driver Assistance Systems (ADAS)

-

Alstom - Alstom Urban Mobility Solutions

-

Ericsson - Ericsson Connected Vehicle Cloud

-

Iteris, Inc. - Iteris Vantage

-

Hitachi Ltd. - Hitachi Traffic Control Solutions

-

FLIR Systems - FLIR Traffic Management Solutions

-

Zebra Technologies Corporation - Zebra Real-Time Location Solutions

Recent Developments

-

March 24: Lanner showcased a robust line-up of intelligent traffic management systems and rugged in-vehicle computers designed for fleet monitoring and real-time traffic control. These solutions aim to enhance traffic efficiency through advanced data analytics and communication technologies.

-

June 2023: ZTE and Tianyi Transportation Technology unveiled a 5G+ intelligent connected vehicle system at the Mobile World Congress in Shanghai. This breakthrough integrates vehicle-road-cloud technology to accelerate autonomous driving commercialization.

-

January 2024: NEC has initiated a project to enhance public transportation systems in India, partnering with the Uttar Pradesh State Road Transport Corporation (UPSRTC) to implement an Intelligent Vehicle Location Tracking and Passenger Information System (VLT-PSIS). This system will include AIS 140-compliant tracking devices and emergency safety buttons across buses.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 22.4 Billion |

| Market Size by 2032 | US$ 44.4 Billion |

| CAGR | CAGR of 7.93% from 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Advanced Traveler Information System, Advanced Traffic Management System, Advanced Transportation Pricing System, Advanced Public Transportation System, Emergency Medical System)• By Application (Traffic Management, Road Safety and Security, Freight Management, Public Transport, Environment Protection, Automotive Telematics, Parking Management, Road Tolling Systems) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Siemens AG, Kapsch TrafficCom, Thales Group, Cubic Corporation, Honeywell International Inc, Neology Inc, Telenav, TomTom International, IBM Corporation, Swarco AG, Garmin Ltd, Daimler AG, Aptiv PLC, Alstom, Ericsson, Iteris, Hitachi Ltd, FLIR Systems, Zebra Technologies Corporation |

| Key Drivers | • Rising use of V2X (vehicle-to-everything) technology supports intelligent traffic systems. • Implementation of toll automation and congestion-based pricing enhances revenue collection and reduces traffic bottlenecks. • Faster incident detection and management systems reduce response times and mitigate accident impacts. |

| Market Restraints | • The integration of advanced technologies like IoT, AI, and V2X communication requires significant investment in infrastructure, limiting adoption in developing regions. • The reliance on real-time data collection and sharing raises concerns about hacking and data breaches, impacting user trust. • The operation and maintenance of sophisticated ITS technologies demand skilled personnel, which is scarce in many regions. |