Extrusion Coating Market Report Scope & Overview:

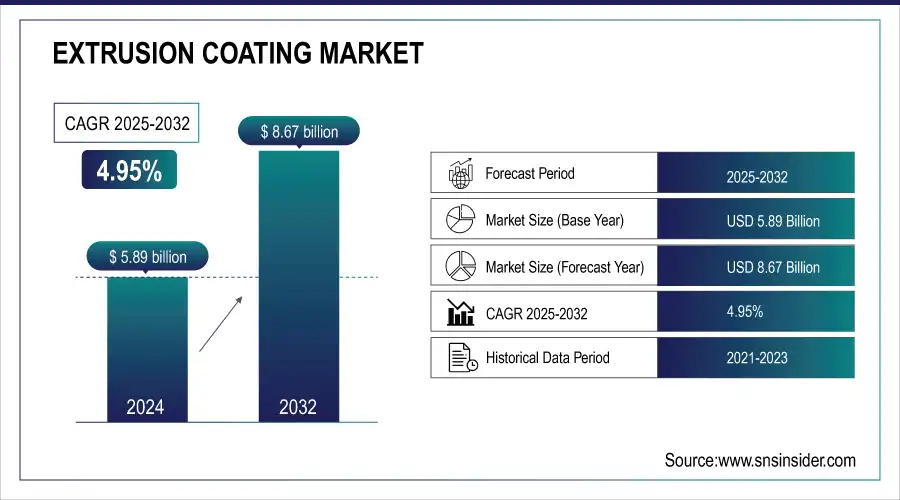

The Extrusion Coating Market Size was valued at USD 5.89 Billion in 2024 and is expected to reach USD 8.67 Billion by 2032, growing at a CAGR of 4.95% over the forecast period of 2025-2032.

The extrusion coating market is gaining increased traction on account of the growing requirement for sustainable and recyclable packaging materials. Due to the more and more stringent government rules concerning single-use plastics, the conscious consumers regarding green and environment-friendly products, and the lobbying of big corporations pushing toward biobased resins and recyclable substrates, more and more industries often require this technology. This change is driving creativity and increasing the use of extrusion coating in food, beverage, and consumer goods packaging, which drives the extrusion coating market growth.

To Get more information on Extrusion Coating Market - Request Free Sample Report

Key Extrusion Coating Market Trends:

-

Growing regulations on plastic waste are pushing manufacturers toward bio-based and recyclable extrusion coatings.

-

Adoption of Industry 4.0 technologies is enabling automation, real-time monitoring, and efficiency in extrusion coating lines.

-

Rising need for longer shelf life in packaged food is driving demand for multi-layer and high-barrier extrusion coatings.

-

Expansion of the healthcare sector is boosting usage of extrusion coatings in sterile and pharmaceutical packaging.

-

Growth of e-commerce and convenience foods is fueling the demand for flexible packaging with extrusion coatings.

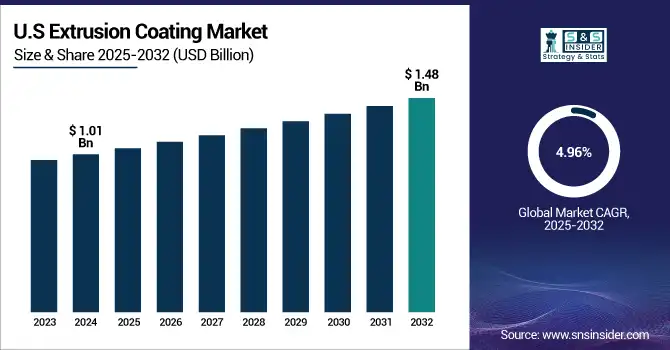

The U.S. Extrusion Coating Market size was valued at USD 1.01 Billion in 2024 and is projected to reach USD 1.48 Billion by 2032, growing at a CAGR of 4.96% during 2025-2032.

The U.S. Extrusion Coating Market analysis highlights the strong growth driven by the country’s food and beverage packaging industry, high penetration of flexible packaging formats, and growing demand for sustainable coating solutions. Rise in automation and multi-layer film technologies, combined with the implementation of strict environmental governance, are pushing market expansion, making the U.S. the revenue-generating muscle in North America

Extrusion Coating Market Growth Drivers:

-

Expanding Food & Beverage Packaging Industry Drives the Market Growth

The global food & beverage industry is growing, as the consumption of ready-to-eat food, dairy products, and beverages increases, so the demand for extrusion coatings increases. These types of coating are commonly used in such applications as milk cartons, juice boxes, and snack packaging because they provide moisture resistance, sealing, and a protective barrier. The U.S., China, and India are some of the largest contributors, with packaging standards and hygiene regulations prompting the increase in adoption. Food companies are also working more closely with coating makers to enhance product safety and to extend shelf life. This segment itself holds the leading application share in the extrusion coating market and will continue to hold its top position during the forecast time frame.

Extrusion Coating Market Restraints:

-

Recycling Challenges with Multi-Layer Structures May Hamper the Market Growth

Extrusion coating can provide a good barrier, but composite structures with dissimilar polymers can complicate recycling. It is difficult to separate these products in the process of recycling, which limits their acceptability in green markets. Regulatory scrutiny is intensifying, particularly in Europe, where there are growing efforts to mandate recyclability requirements, which means manufacturers are a dipping re-think to their coatings. This shift demands ample R&D investment and could restrict the penetration potential of traditional extrusion coatings in markets where strict compliance requirements are in place. Therefore, it is a challenge to long-term growth due to difficulties with recycling and disposal.

Extrusion Coating Market Opportunities:

-

Growth in Healthcare and Pharmaceutical Packaging Create an Opportunity for the Market

The healthcare sector is a lucrative growth opportunity for extrusion coatings as there is increasing demand for sterile and safe packaging. Medical pouches, blister packs, and pharmaceutical cartons use a high percentage of extrusion-coated materials due to their attainable high barrier properties and meeting the requirements for hygiene. Rise in global sales of biologics, vaccines, and OTC drugs is currently driving the demand for next-generation packaging forms. In addition, authorities are focusing on tamper-proof and contamination-free packages, which can be catered efficiently by the extrusion coatings.

For instance, in 2023, Sealed Air Corporation expanded its health care packaging sector by upgrading its extrusion coating technologies, which enabled it to generate more and more sterile-grade solutions for medical packaging.

Extrusion Coating Market Segmentation Analysis:

-

By Material, Low-Density Polyethylene led with around 45% share in 2024; Polypropylene (PP) is the fastest growing (CAGR 5.3%) due to its rising use in flexible packaging.

-

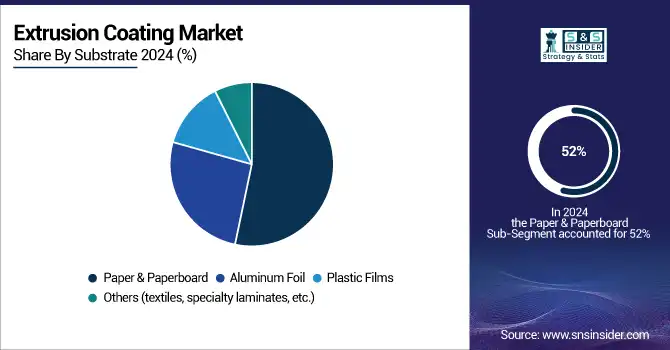

By Substrate, Paper & Paperboard dominated with 52% share in 2024; Plastic Films are the fastest growing (CAGR 5.4%) as flexible packaging gains wider adoption.

-

By Application, Liquid Packaging held a 40% share in 2024; Flexible Packaging is the fastest growing (CAGR 5.5%), driven by e-commerce and convenience food demand.

-

By End-Use Industry, Food & Beverage led with 48% share in 2024; Healthcare & Pharmaceutical is the fastest growing (CAGR 5.4%) owing to rising demand for sterile and safe packaging solutions.

By Substrate

Paper & Paperboard is dominating the market on account of its recyclability, printability, and sustainable nature and is indispensable in beverage cartons, ready-meal trays and snack packaging. Plastic Films, on the other hand, are growing at the highest CAGR due to their high barrier properties, light weight, and high use in frozen food, personal care, electronics, and other packaging applications.

By Material

LDPE is still the most commonly used material for extrusion coating as LDPE exhibits good adhesion to substrates, such as paperboard and aluminium foil. Available water resistance, heat sealability, and cost make it the base of liquid packaging cartons and food wrappings. For instance, LDPE coatings are employed in more than 70% of beverage cartons the world over to protect the product and to guarantee a long shelf life.

PP is becoming increasingly popular because it offers a combination of good toughness, lightweight performance, and recycling capability as manufacturers seek other options. This is all well-balanced, transparent, and chemically resistant to be suitable for flexible packaging, woven bags, and industrial sacks. Growing demand for eco-friendly and durable solutions in logistics and bulk packaging is driving PP faster.

By Application

The largest share held by liquid packaging is driven by extrusion coatings, which offer leak resistance, durability, and long shelf life in milk, juice, and beverage cartons and other liquid packaging. Conversely, Flexible Packaging is experiencing the fastest growth, driven by preference for light-weight, easily portable and resealable formats, such as snacks, confectionery and frozen meals, catering to contemporary ‘on the move’ consumer lifestyles.

By End-Use Industry

Food & Beverage holds a significant share in the extrusion coatings market as extrusion coatings provide secure, durable, and contamination-free food packaging of dairy products, snacks, and beverages, thereby matching growing global demand for packaged food. Healthcare & Pharmaceutical is the largest growing application sector due to enhanced use of extrusion-coated foils and films in blister packs, sterile wraps, and medical device packaging on account of tightened regulations and increased healthcare spending.

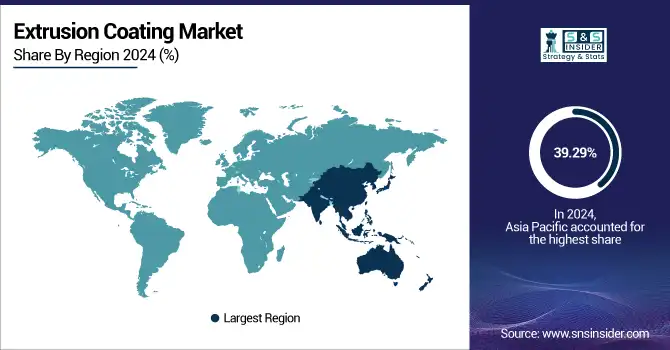

Extrusion Coating Market Regional Analysis:

Asia Pacific Extrusion Coating Market Insights:

Asia Pacific held the largest extrusion coating market share in 2024, around 39.29% 2024. It is due to its increasing consumer base, food & beverage sector, and manufacturing base. Demand for extrusion coatings for barrier protection and product safety is witnessing a significant increase in the emerging markets of China and India, and Indonesia, as a result of the growing demand for packaged food, e-commerce shipping materials, and flexible packaging. The region is supported by abundant and inexpensive raw materials and a government keen on industrial expansion, making it low-cost for production. Moreover, the region has witnessed a surge in the electronics and automotive industries, both of which use high-end coated films for insulation and protective packaging.

Get Customized Report as per Your Business Requirement - Enquiry Now

In 2024, ExxonMobil broadened its operations for extrusion coating in Asia to address increasing demand for packaging and industrial applications, which also further cemented the position of the region as the largest supplier and consumer of the same.

North America Extrusion Coating Market Insights:

North America continues to be at the forefront in the extrusion coating market, supported with superior technology adoptions, and concentration on innovations with the presence of modernized packaging, healthcare, and consumer goods industries. The U.S. and Canada are key consumers of sustainable packaging solutions, expendable in the wake of increasing legislations for single-use plastics that elicit companies to manufacture recyclable extrusion-coated materials. It is also home to major chemical and packaging players, which remain a driving force for automation and high-performance barrier technology investments. High disposable incomes and demand for easy, safe, and sustainable packaged products are boosting demand. One recent such development was in 2024, when Dow Chemical and ExxonMobil announced a Spanish-produced extrusion coating line in the U.S., featuring AI-driven quality control systems that are aimed at minimizing waste and maximizing efficiency, a significant move towards smarter production.

Europe Extrusion Coating Market Insights:

The extrusion coatings market in Europe is primarily pressured by rigorous governance supporting sustainability, consumer preference for green materials, coupled with sophisticated production techniques. This is particularly important in countries, such as Germany, France, and the U.K., where the requirement for recyclable packaging is placed at a premium, elevating the demand for extrusion coatings that combine high performance and sustainability. The European Union’s goals for the circular economy are also pressuring companies to redesign packaging to leave a lighter ecological footprint. Specialty coatings that enhance durability and insulation are in demand not just in packaging but in Europe’s automotive and electronics industries.

In 2024, Borealis AG collaborated with European packaging companies to develop recyclable extrusion coating solutions, continuing the region’s leading position in performance to sustainability.

Latin America (LATAM) and Middle East & Africa (MEA) Extrusion Coating Market Insights:

Latin America and the Middle East & Africa are developing extrusion coating markets, and increasing consumption of packaged products, urbanization, and industrialization are driving their growth. LATAM is still in strong demand in Brazil and Mexico within food and beverage and e-commerce in particular, while the Middle East, in the UAE and Saudi Arabia, is investing in modern packaging facilities as part of economic diversification. The demand for consumer goods and healthcare in South Africa also supports demand. Although acceptance of sustainable coatings is moving more slowly than that seen in the West, the movement toward modern packaging systems is there.

Borealis AG established an FFS packaging film plant in a joint venture with a Brazilian packaging company in 2024, and Dow Chemical rolled out a new line in the UAE for food and healthcare packaging, emphasizing the attractions of both regions for global investment to strengthen their packaging sectors.

Competitive Landscape for Extrusion Coating Market:

Dow Chemical Company is a global leader in material sciences, offering a wide portfolio of extrusion coating resins used in food packaging, liquid cartons, and industrial laminates. Their advanced polyethylene-based coatings are engineered to provide strong adhesion, moisture resistance, and flexibility across high-speed extrusion processes. Dow emphasizes recyclable and bio-based coatings that align with global sustainability goals, catering to packaging manufacturers seeking both performance and environmental responsibility.

-

In February 2024, Dow introduced a new sustainable extrusion coating resin designed for paper-based food and beverage packaging. This launch expands Dow’s recyclable solutions portfolio, enabling converters to reduce plastic content while maintaining durability. The new coating also supports wider sealing temperature ranges, helping packaging producers improve line efficiency.

ExxonMobil Corporation, headquartered in Texas, is a prominent supplier of extrusion coating polymers, particularly polyethylene and polypropylene grades used across consumer packaging and automotive films. Its product line focuses on delivering high stiffness, heat resistance, and superior barrier properties, making them well-suited for heavy-duty industrial and multilayer applications. ExxonMobil continues to expand in high-demand regions, emphasizing circular plastics and advanced recycling technologies for coating resins.

-

In March 2024, ExxonMobil expanded its polyethylene production capacity in Singapore, targeting the fast-growing Asia Pacific extrusion coating market. This expansion enhances supply reliability for converters in packaging and industrial sectors, while supporting the company’s long-term growth strategy in sustainable coatings.

Extrusion Coating Market Key Players:

Some of the Extrusion Coatings Companies are:

-

Akzo Nobel N.V.

-

Arkema Group

-

Borealis AG

-

Celanese Corporation

-

Chevron Phillips Chemical Company LLC

-

Davis-Standard, LLC

-

Dow Inc.

-

DuPont de Nemours, Inc.

-

Eastman Chemical Company

-

Exxon Mobil Corporation

-

Formosa Chemicals & Fibre Corp.

-

Kuraray Co., Ltd.

-

LyondellBasell Industries Holdings B.V.

-

NOVA Chemicals Corporation

-

PPG Industries, Inc.

-

Qenos Pty Ltd.

-

Reliance Industries Limited

-

Saudi Basic Industries Corporation (SABIC)

-

The Lubrizol Corporation

-

The Sherwin-Williams Company

| Report Attributes | Details |

| Market Size in 2024 | USD 5.89 Billion |

| Market Size by 2032 | USD 8.67 Billion |

| CAGR | CAGR of4.95% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material: Low-Density Polyethylene, Ethylene-Vinyl Acetate, Polypropylene, High-Density Polyethylene, Others (PET, ionomers, blends, etc.) • By Substrate: Paper & Paperboard, Aluminum Foil, Plastic Films, Others (textiles, specialty laminates, etc.) • By Application: Liquid Packaging, Flexible Packaging, Bags & Sacks, Photographic & Industrial Packaging, Others (envelopes, protective wraps, etc.) • By End-Use Industry: Food & Beverage, Consumer Goods, Industrial Packaging, Healthcare & Pharmaceutical, Others (electronics, agriculture, etc.) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Akzo Nobel N.V., Arkema Group, Borealis AG, Celanese Corporation, Chevron Phillips Chemical Company LLC, Davis-Standard, LLC, Dow Inc., DuPont de Nemours, Inc., Eastman Chemical Company, Exxon Mobil Corporation, Formosa Chemicals & Fibre Corp., Kuraray Co., Ltd., LyondellBasell Industries Holdings B.V., NOVA Chemicals Corporation, PPG Industries, Inc., Qenos Pty Ltd., Reliance Industries Limited, Saudi Basic Industries Corporation (SABIC), The Lubrizol Corporation, The Sherwin-Williams Company |