Eye Care Services Market Size & Trends:

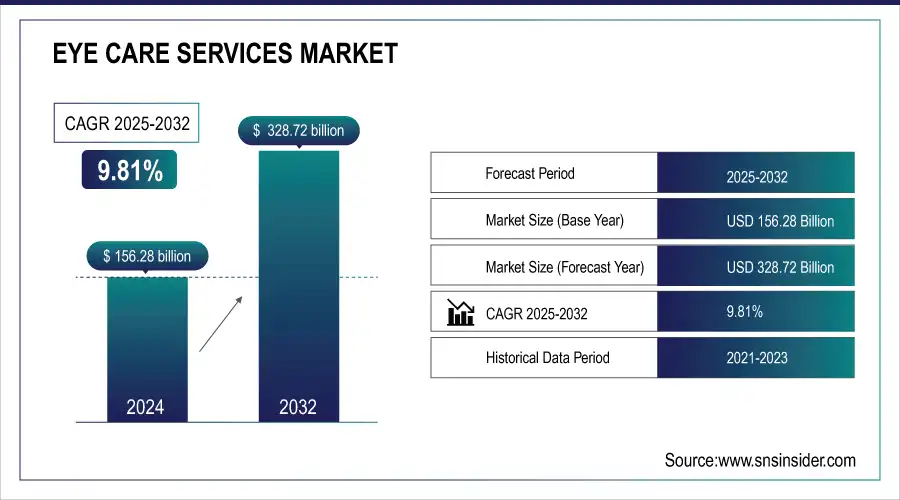

The Eye Care Services Market size was valued at USD 156.28 billion in 2024 and is expected to reach USD 328.72 billion by 2032, growing at a CAGR of 9.81% over the forecast period of 2025-2032.

To Get more information on Eye Care Services Market - Request Free Sample Report

The global eye care services market has been witnessing rapid growth owing to the increasing prevalence of vision disorders globally, including refractive errors, cataracts, and age-related macular degeneration. This can be attributed to the rising geriatric population, increasing screen time, and heightened awareness regarding eye health, which is resulting in the increased demand for routine eye check-ups, surgical procedures, and preventive care. Increasing access to specialized services in urban and rural populations, supported by technological advancements in diagnostics and treatment, continues to propel the market growth, especially in developed and emerging economies.

Market Size and Forecast

-

Market Size in 2024: USD 156.28 Billion

-

Market Size by 2032: USD 328.72 Billion

-

CAGR: 9.81% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Eye Care Services Market Trends

-

Rising prevalence of vision disorders and aging population is driving eye care services demand.

-

Increasing awareness of preventive eye health and regular screenings is boosting market growth.

-

Adoption of advanced diagnostic technologies, including OCT and digital imaging, is enhancing care quality.

-

Growing demand for cataract, glaucoma, and refractive surgeries is expanding service offerings.

-

Teleophthalmology and mobile eye care services are improving accessibility in remote areas.

-

Expansion of healthcare infrastructure and insurance coverage is facilitating wider adoption.

-

Collaborations between hospitals, eye care clinics, and technology providers are accelerating innovation and service delivery.

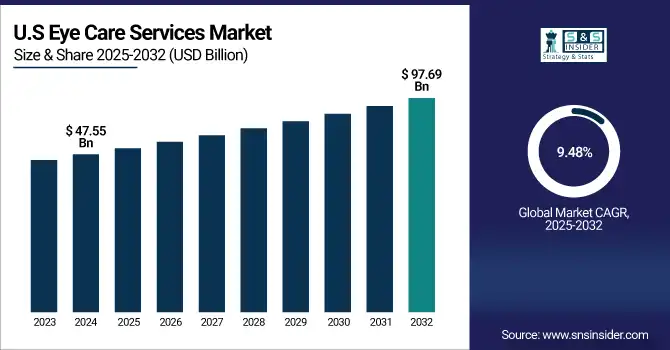

The U.S. eye care services market size was valued at USD 47.55 billion in 2024 and is expected to reach USD 97.69 billion by 2032, growing at a CAGR of 9.48% over the forecast period of 2025-2032.

The North American eye care services market is predominantly driven by the U.S., with advanced healthcare infrastructure, high awareness regarding vision health, and high availability of specialized eye care professionals. It is also a leader in new surgical technology and performs cataract and LASIK procedures in volume regularly.

Perfluorohexyloctane (Miebo/Evotears) was approved in the U.S. in 2023 and represents a growing class of novel preservative-free dry eye treatments.

In April 2024, the FDA cleared an autonomous handheld camera by AEYE Health. It allows for no-human-in-the-loop, highly accurate (sensitivity 92–93%) diabetic retinopathy screening in primary care, and can therefore augment accessibility.

Eye Care Services Market Growth Drivers:

-

Increasing Prevalence of Vision Problems Aids the Market Growth

The global prevalence of vision disorders is one of the key drivers of the eye care services market. As the global population continues to age, the incidence of various medical conditions, for instance, refractive errors (myopia, hyperopia, astigmatism), cataract, glaucoma, diabetic retinopathy, and age-related macular degeneration (AMD), is reported to be increasing. Moreover, owing to lifestyle diseases, such as diabetes and hypertension, vision complications also include retinal diseases. The increasing number of people experiencing vision loss or at risk of it has created an urgent need for early diagnosis, regular monitoring, and timely intervention, making both public and private eye-caring services a massive eye care services market growth.

More than 2.2 billion people around the world experience vision impairment or blindness, according to the World Health Organization (WHO), the leading causes include refractive errors, cataracts, and retinal diseases.

-

Technological Advancements in Diagnosis and Treatment are Accelerating the Market Growth

Ophthalmic technology is rapidly advancing, which is changing the delivery of eye care services market trends. Real-time high-resolution imaging of ocular structures, such as in OCT and fundus cameras, provides the means for earlier and more precise diagnosis of retinal and optic nerve illnesses. Advancements in surgery, including laser-assisted cataract surgery, femtosecond laser technology, and minimally invasive glaucoma surgeries (MIGS), allow for safer and quicker recovery times. In addition, the new vision stage of Industries' global enablement within Teleophthalmology, and helping enhance access to specialist care, especially in areas where this is notably lacking or in rural areas, and opening up a wider scope of appeal for eye care services globally.

FDA cleared in May 2024, Notal Vision's SCANLY Home OCT is the basis for remote self-monitoring of retinal health by patients, particularly those with neovascular AMD (nAMD), and automated AI diagnostics help reduce clinic visits and increase precision medicine.

Eye Care Services Market Restraints:

-

Market Restraints Due to High Cost of Advanced Treatments & Diagnostic Equipment

The high cost of advanced diagnostic devices and surgical procedures is one of the key restraining factors in the eye care services market analysis. Innovative technologies, including Optical Coherence Tomography (OCT), femtosecond lasers, intraoperative aberrometry, and Artificial Intelligence-powered screening systems, are necessary for the timely and accurate identification of eye diseases. Nevertheless, the startup costs of high-quality healthcare, along with keeping such devices, are great and likely beyond the capacity of small clinics or healthcare providers located in developing areas of the world.

Moreover, LASIK, premium cataract surgery with advanced IOLs, or MIGS are also costly surgical alternatives for the patient, especially in the absence of complete insurance coverage. In many instances, they are not defined by specialty guidelines as medically necessary, thus are not covered by insurance, so their availability is restricted to the population with disposable cash, a privilege mostly unattainable by people in low- and middle-income countries. Hence, the growth potential of the market will be limited due to cost-based disparities in access to contemporary eye care.

Eye Care Services Market Segment Analysis

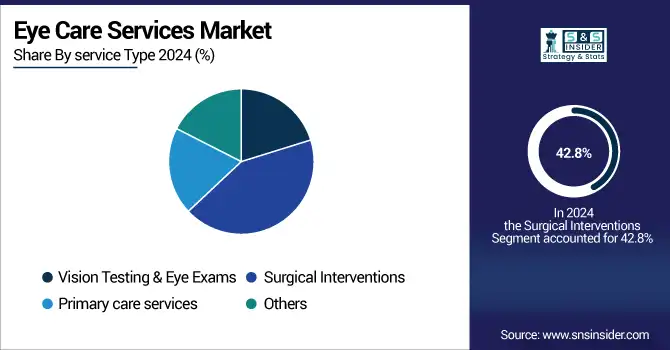

By Service Type, Surgical interventions dominate the eye care services market, Primary care services are expected to grow fastest.

The surgical interventions segment dominated the eye care services market with a 42.8% market share in 2024, owing to significant demand for cataract surgeries, LASIK, and glaucoma treatment. Age-related vision disorders, especially cataracts, which are amongst the most common causes of blindness worldwide, are increasing in both the developed and developing world, given the growing elderly population. Procedural improvements in surgery, such as those involving femtosecond lasers, minimally invasive and intraocular lenses, have improved postoperative results and time to recovery. This increase in access to specialized ophthalmic surgical centers and other enabling developments has cemented the leadership of this segment.

The primary care services segment is anticipated to gain the fastest growth in the forecast years because of greater awareness concerning preventive eye care and the early detection of vision defects. While digital eye strain, dry eye, and refractive errors have become more common, growing expenses for routine eye programs imply that more people are searching for the help of professionals when such issues occur. The increasing availability and affordability of primary eye care in community clinics, optical chains, and retail health stores has also contributed to this trend. This growth is driven by things, such as the increase of all these things in emerging markets.

By Indication, Refractive errors dominate the eye care services market. Glaucoma is expected to grow fastest.

In 2024, the refractive errors segment accounted for the largest share with a 40.11% market share, owing to the high prevalence of myopia, hyperopia, astigmatism, and presbyopia globally. The growth is also driven by lifestyle-related hazards, such as too much screen time and less time outdoors, which can cause vision problems in people of all ages, especially children and young adults. There are a variety of ways to correct vision, including eyeglasses, contact lenses, and refractive surgeries. Diagnosis and treatment are easy and commonplace. Apart from this, early diagnosis and treatment have also balanced out the segment growth, owing to routine checking of vision across the schools and workplaces.

Glaucoma is estimated to be the fastest-growing segment in the forecast years, owing to the increasing prevalence of this condition, especially among the elderly and also among patients with a chronic disease, such as diabetes and hypertension. Glaucoma is referred to as the silent thief of sight, as it usually develops slowly and damages eyesight. If untreated, it can lead to vision loss. Increased awareness, better screening methods (optical coherence tomography), and surgical and drug therapies are prompting more patients to seek treatment.

By Provider Type, Standalone eye clinics dominate the eye care services market, Optical retail chains with eye care services are expected to grow fastest.

In the 2024 eye care services market, the standalone eye clinics segment held the largest market share of 36.12% due to their concentrated nature of the services provided for comprehensive vision care, diagnosis and medical management, and surgical services. Staffed by experienced ophthalmologists and optometrists, these clinics offer focused services that cover everything from routine eye exams to advanced treatments for cataracts, glaucoma, and refractive errors. For such patients who either need preventive or corrective eye care, the personalized care, shorter wait times, and continuity of services offered by these practices make them the preferred option. In addition, the fact that specialized eye hospitals are equipped with the needed infrastructure and advanced diagnostic tools further solidifies their status as a tertiary center for eye care.

Optical retail chains with eye care services segment are anticipated to experience the highest growth on account of the growing presence of affordability and convenience. Long relegated to the basement of malls and urban retail strips, these chains are adding an element of optometry into the mix, including vision testing, prescriptions, and even corrective lenses, all in one trip. This creates an appeal for consumers who prefer an eyecare option that is highly accessible and time-efficient. This segment is anticipated to see rapid growth globally in both developed and emerging markets, driven by increasing demand for routine examination, particularly among younger, millennial, and Gen Z populations who are comfortable with technology, and strategic collaborations between retail chains and certified eye care professionals.

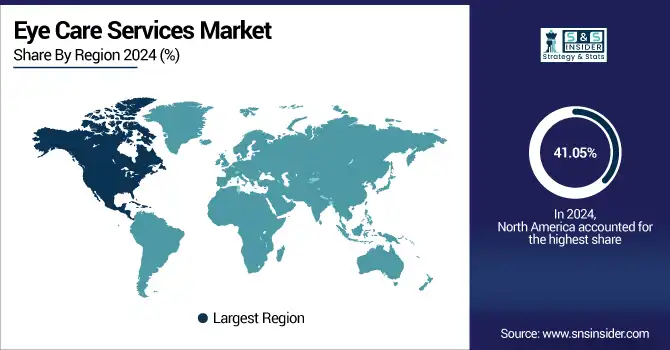

Eye Care Services Market Regional Analysis

North America Eye Care Services Market Insights

The eye care services market in North America accounted for the largest market share with 41.05% market share in 2024, owing to well-established healthcare infrastructure, high per capita healthcare expenditure, and the presence of leading eye care providers and institutions. Advanced, emerging diagnostic and surgical technologies differentiate the region, such as femtosecond lasers and point of care, AI-based imaging, with these technologies integrated as a standard of care into many clinical practices. Furthermore, periodic eye examinations among the geriatric population and public awareness initiatives promote the early identification and treatment of eye diseases, such as cataracts, glaucoma, and macular degeneration, thereby supporting its dominance in the regional market.

Get Customized Report as per Your Business Requirement - Enquiry Now

In April 2025, Alcon’s Voyager DSLT, a contactless, frequency-doubled Nd:YAG laser, is commercially available in the U.S. Works without gonioscopy to streamline early glaucoma treatment, enabling the innovation of an efficient, precise trabeculoplasty.

Asia Pacific Eye Care Services Market Insights

The eye care services market in Asia Pacific is growing at a fast pace with a 10.63% CAGR as Asia Pacific has a large population of older people, which is going to grow rapidly in the coming years, together with the increasing prevalence of vision problems and great accessibility to health care components and services. The high demand for vision testing, surgeries, and optical services can be attributed to the rising rate of urbanization, an increase in awareness toward eye wellbeing, and government initiatives to minimize avoidable blindness. China, India, and South Korea are advancing in eye care with the support of public and private infrastructure, while digital and teleophthalmology adapting solutions have widened the reach in underserved rural areas, which is propelling growth in the region.

Europe Eye Care Services Market Insights

Substantial growth of the eye care services market in Europe is driven by a strong presence of various public healthcare systems across countries, a large geriatric population, and a high prevalence of chronic eye diseases, viz. glaucoma, cataract, and diabetic retinopathy. Due to the early adoption of advanced diagnostic technologies, surgical procedures, and established referral schemes, the region has benefited from extremely short symptomatic-to-treatment times.

Additionally, the increasing need for regular vision care due to a rising ageing population and the use of electronic devices is propelling the uptake of services. The growing importance of Europe in the global eye care services market will be augmented by the concerted efforts of the government to ensure preventive eye care and vision rehabilitation, and the presence of prominent ophthalmology centers in countries, such as Germany, the U.K., and France.

Latin America Eye Care Services Market Insights

The market is significantly growing due to the rise in visual disorders such as cataracts, glaucoma, and refractive errors in the region of Latin America. Increasing usage of digital devices and growing disposable income are boosting the market for eye care services. Telemedicine and vision screening programs such as Operation Miracle have also expanded access to diagnostic and surgical care.

Middle East & Africa Eye Care Services Market Insights

The increase in healthcare investments, the rising incidences of age-related eye diseases (ISS, AMD, and dry eye), and increasing diagnosis capabilities in countries, such as Saudi Arabia, UAE, and South Africa are supporting the MEA region's growth. Expanding penetration of private eye-care providers and use of new diagnostic technologies such as meibomian gland expression, and the use of OCT scanners are increasing treatment capacity. However, imbalances in access between rural and underserved areas and a shortage of specialists in some nations still restrict growth speed.

Eye Care Services Market Competitive Landscape:

Alcon

Alcon is a global leader in eye care, specializing in surgical, pharmaceutical, and vision care products. The company focuses on advancing treatments for ocular diseases, improving visual outcomes, and delivering innovative solutions for eye health. Through continuous research, strategic acquisitions, and product launches, Alcon enhances patient care, strengthens clinic-based offerings, and supports ophthalmologists worldwide with state-of-the-art devices, prescription treatments, and vision restoration technologies.

-

2025: Alcon completed the acquisition of LumiThera, gaining the Valeda photobiomodulation device for early/intermediate dry AMD, expanding clinic-based vision restoration treatments.

-

2025: Alcon launched TRYPTYR (acoltremon ophthalmic solution) 0.003%, a first-in-class prescription eye drop providing rapid-onset relief for Dry Eye Disease, now available in the U.S.

Johnson & Johnson Vision Care

Johnson & Johnson Vision Care is a leading eye health company, offering innovative surgical, pharmaceutical, and vision solutions. The company focuses on improving patient outcomes, enhancing visual performance, and supporting ophthalmologists and optometrists worldwide. Its portfolio includes intraocular lenses, contact lenses, and vision correction technologies. By emphasizing patient-centered innovation, J&J Vision Care combines advanced research, high-quality products, and educational initiatives to address evolving eye care needs globally.

-

2024 – J&J Vision Care expanded its U.S. rollout of TECNIS Odyssey full-visual-range IOL, offering presbyopia-correcting lenses with continuous vision clarity, enhanced contrast, and reduced visual disturbances.

-

2023 – J&J Vision shared a personal story of an employee who helped develop a cataract lens inspired by treating their mother’s cataracts, underscoring human-centered innovation.

Eye Care Services Market Key Players:

-

Alcon

-

Bausch & Lomb Incorporated

-

EssilorLuxottica

-

CooperVision

-

HOYA Corporation

-

Rayner Intraocular Lenses

-

STAAR Surgical Company

-

Eyetec

-

GIEV

-

Alimera Sciences, Inc.

-

Regeneron Pharmaceuticals, Inc.

-

Novartis AG

-

Optovue, Inc.

-

NIDEK Co., Ltd.

-

Topcon Corporation

-

Glaukos Corporation

-

Santen Pharmaceutical Co., Ltd.

-

ZeaVision, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 156.28 Billion |

| Market Size by 2032 | USD 328.72 Billion |

| CAGR | CAGR of 9.81% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Vision Testing & Eye Exams, Surgical Interventions, Primary Care Services, Others) • By Indication (Refractive Errors, Cataracts, Glaucoma, Age-related Macular Degeneration (AMD), Diabetic Retinopathy, Dry Eye Syndrome, Others) • By Provider Type (Standalone Eye Clinics, Multispecialty Hospitals, Optical Retail Chains with Eye Care Services, Academic & Research Institutions, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles |

Alcon, Johnson & Johnson Vision Care, Bausch & Lomb Incorporated, Carl Zeiss Meditec AG, EssilorLuxottica, CooperVision, HOYA Corporation, Rayner Intraocular Lenses, STAAR Surgical Company, Eyetec, GIEV, Alimera Sciences, Inc., Regeneron Pharmaceuticals, Inc., Novartis AG, Optovue, Inc., NIDEK Co., Ltd., Topcon Corporation, Glaukos Corporation, Santen Pharmaceutical Co., Ltd., ZeaVision, Inc. |