Orthopedic Imaging Equipment Market Report Scope & Overview:

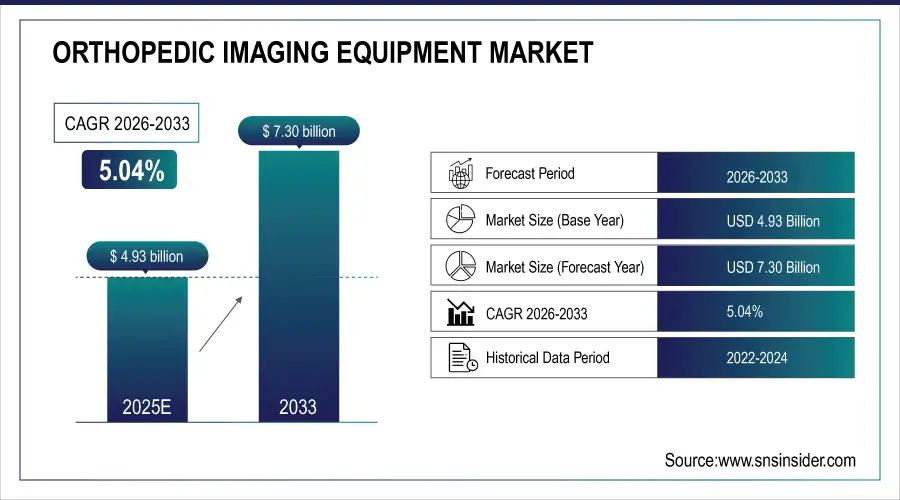

The Orthopedic Imaging Equipment Market size was valued at USD 4.93 billion in 2025E and is expected to reach USD 7.30 billion by 2033, growing at a CAGR of 5.04% over the forecast period of 2026-2033.

The growth of the global orthopedic imaging equipment market is mainly influenced by an increase in orthopedic disorders, growth in the aging population, and a rise in the number of trauma cases. A further increase is accounted for the demand for 3D imaging, AI-assisted imaging, and digital radiography owing to advancements that are driving the market, as hospitals and outpatient centers expand their diagnostic capabilities. Orthopedic imaging equipment market trends, including AI integration for automated fracture detection, portable imaging devices, and personalized musculoskeletal imaging solutions, will stimulate the demand for orthopedic imaging equipment across emerging and developed regions.

For instance, in June 2025, global adoption of 3D CT and MRI systems for orthopedic imaging rose by 18%, driven by surgical planning needs and complex musculoskeletal diagnostics.

Orthopedic Imaging Equipment Market Size and Forecast:

-

Market Size in 2025E: USD 4.93 Billion

-

Market Size by 2033: USD 7.30 Billion

-

CAGR: 5.04% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2021–2023

To Get more information on Orthopedic Imaging Equipment Market - Request Free Sample Report

Key Orthopedic Imaging Equipment Market Trends

-

Advanced imaging technologies: Rising adoption of 3D imaging, AI-assisted X-rays, and low-dose CT/MRI for precise bone and joint assessment.

-

Integration with smart systems: Use of AI, cloud-based storage, and imaging software for improved diagnostics and workflow efficiency.

-

Personalized diagnostics: Tailored imaging protocols based on patient age, anatomy, injury type, and surgical planning needs.

-

Collaborative solutions: Partnerships between hospitals, imaging device manufacturers, and orthopedic device companies for co-development and workflow optimization.

-

Portable & minimally invasive platforms: Growth of mobile X-ray, handheld ultrasound, and intraoperative imaging for faster, on-site evaluations.

-

Regulatory support & awareness: Enhanced clinical guidelines, safety protocols, and reimbursement frameworks promoting adoption of advanced orthopedic imaging.

U.S. Orthopedic Imaging Equipment Market Highlights:

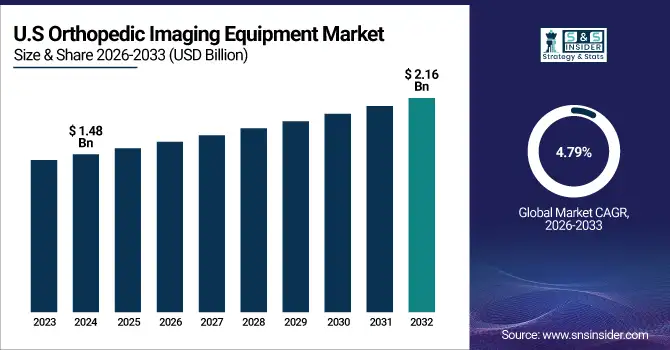

The U.S. orthopedic imaging equipment market was valued at USD 1.48 billion in 2025E and is expected to reach USD 2.16 billion by 2033, growing at a CAGR of 4.79% over 2026-2033. The U.S. occupies the largest share in the orthopedic imaging equipment market owing to advanced healthcare infrastructure, a greater number of hospitals and outpatient imaging centers, several private healthcare players, researchers, and the government in the development of 3D and AI-assisted imaging technologies. In the orthopedic imaging equipment market analysis, the robust medical imaging demand and range of diagnostic applications in place support the U.S. market dominance.

Orthopedic Imaging Equipment Market Growth Drivers:

-

Rising Awareness and Early Diagnosis are Driving the Orthopedic Imaging Equipment Market Growth

Rise in awareness of the importance of early diagnosis is anticipated to drive the global orthopedic imaging equipment market share as patients and clinicians depend on diagnostic tests for fractures, joint conditions, and musculoskeletal conditions to detect them at an early stage. These systems result in better treatment when used in early detection and intervention, consequently generating the demand for X-ray, CT, MRI, and AI-powered imaging equipment.

For instance, in February 2025, TeleVet Insights reported that remote consultations for chronic pet conditions, including diabetes, grew 18% in the U.S., improving home monitoring and treatment adherence.

Orthopedic Imaging Equipment Market Restraints:

-

Maintenance and Operational Challenges are Hampering the Orthopedic Imaging Equipment Market Growth

The orthopedic imaging equipment market is inhibited by maintenance and operational hurdles, including the requirement of skilled personnel, frequent preventive and calibration maintenance, which is expensive. Hospitals and diagnostic centers suffer higher costs of operation, downtime, training, and thus adoption of CT, MRI, and AI-accelerated devices by smaller clinics and in developing countries is curtailed, further limiting the overall market expansion.

Orthopedic Imaging Equipment Market Opportunities:

-

Personalized and Precision Diagnostics Drive Future Growth Opportunities for the Orthopedic Imaging Equipment Market

Orthopedic imaging equipment becomes even more personalized according to the patient's genetic, lifestyle, and disease-specific risk factors. This allows clinicians to personalize imaging protocols for better early detection, treatment planning, and monitoring of therapeutic success. Conclusion: Personalized diagnostics is improving clinical diagnostic accuracy, patient outcomes, and precision medicine in Trauma Cases, cardiology, and metabolic disorders.

For instance, in April 2025, AI-driven whole-body imaging enables faster reconstruction, automated anomaly detection, and predictive diagnostics, improving workflow efficiency and clinical decision-making in advanced imaging centers.

Key Orthopedic Imaging Equipment Market Segment Analysis

-

By Product Type, X-ray held the largest share of around 33.87%in 2025E, and the CT segment is expected to register the highest growth with a CAGR of 5.84%.

-

By Indication, the Trauma Cases segment dominated the market with approximately 21.53%share in 2025E, while Arthritis is expected to register the highest growth with a CAGR of 6.54%.

-

By Technology, 2D Imaging accounted for the leading share of nearly 50.08% in 2025E, and is expected to register the highest growth with a CAGR of 5.26%.

-

By end user, the hospitals led the market with about 42.80% share in 2025E, while the Diagnostic Imaging Centers segment is forecasted to grow the fastest at a CAGR of 5.81%.

By Technology, 2D Imaging Lead, and Registers Fastest Growth

The 2D Imaging accounted for the largest share of the Orthopedic Imaging Equipment Market with about 50.08%, owing to the online channel for buying insulin, glucose monitors, and diabetic pet diets continuing to grow. Convenience, broader availability of products, home delivery, and rising digital literacy in pet owners. In addition, it is slated to grow at the fastest rate with a CAGR of around 5.26% throughout the forecast period of 2026–2033, owing to its low cost, wide availability, and the possibility of being integrated into the clinical routine diagnostics. Its use is facilitated, even in first-intention screening, in emergency knowledge and follow-ups.

By Product Type, X-ray Leads the Market, While CT Registers Fastest Growth

The X-ray segment accounted for the highest revenue share of approximately 33.87% in 2025E, as it is low-cost, readily available, and vital for diagnosing fractures, joint dislocations, and osseous abnormalities. The ability for rapid imaging, with less radiation exposure, with digital radiography. In comparison, the CT segment is anticipated to achieve the highest CAGR of nearly 5.84% during the 2026-2033 period, driven by its better 3D visualization, ability to accurately identify complex fractures, and its utility in surgical planning. Growing demand for trauma care, greater acceptance of cone-beam CT in orthopedics.

By Indication, the Trauma Cases Segment dominates, while the Arthritis Segment Shows Rapid Growth

The trauma cases segment held the largest revenue share of approximately 21.53%in 2025E, due to road accidents, workplace injuries, and sports-related fractures on the increase globally. X-ray and CT are the most used modalities due to their immediate diagnostic requirements for fractures, dislocations, and spinal traumas. On the other hand, the arthritis segment is predicted to grow at the strongest CAGR of approximately 6.54% during 2026–2033, owing to the increasing prevalence of osteoarthritis and rheumatoid arthritis in elderly people. Rising requirements for timely diagnosis, disease observation, and treatment planning support the use of X-ray, MRI, and ultrasound systems.

By End User, Hospitals Lead, While the Diagnostic Imaging Centers Segment Grows the Fastest

The hospitals held the largest revenue share of around 42.80% in the Orthopedic Imaging Equipment Market in 2025E, due to their developed infrastructure, large patient volume, and availability of several imaging systems, including X-ray, CT, MRI, and ultrasound, covering different imaging techniques in one place. On the flip side, the Diagnostic Imaging Centers segment, however, is projected to register the highest CAGR of around 5.81% during the forecast period of 2026 - 2033, as there is an increasing need for cheap and convenient imaging services. Their niche approach, shorter wait times, and the advanced capabilities of their digital X-ray, CT, and MRI machines get them the numbers.

Orthopedic Imaging Equipment Market Regional Analysis:

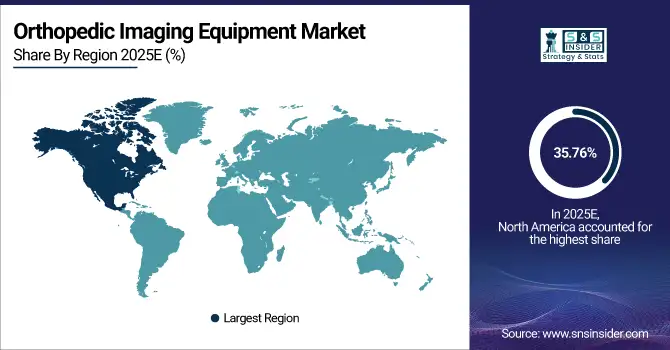

North America Urine Testing Cups Market Insights

North America accounted for the highest revenue share of approximately 35.76% in 2025E of the Orthopedic Imaging Equipment Market, owing to the presence of mature healthcare infrastructure, high patient awareness, and adoption of advanced imaging technologies, including AI-based MRI and CT machines. The region is supported by reimbursable favorable frameworks, good healthcare spending, and the presence of most global market leaders. Furthermore, the expanding geriatric population, surging sports injuries, and the upsurge in the incidence of arthritis and trauma cases are heightening capital.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Urine Testing Cups Market Insights

Asia Pacific is the fastest-growing region in the orthopedic imaging equipment market with a CAGR of 5.76% in the forecasted period 2026-2033, due to the rapid urbanization, growing healthcare spending, and high prevalence of orthopedic for instance arthritis, osteoporosis, and trauma incidence. The increasing aging population in the region, notably in countries including Japan, China, and India, is driving the demand for advanced diagnostic imaging solutions. Market growth is also boosted due to the expansion of healthcare access through government initiatives and the increasing adoption of AI-based and digital imaging systems. Furthermore, the development of hospital infrastructure, rise in medical tourism, and existence of local and international players launching affordable imaging systems further drive the growth of the region as the fastest-growing hub of the orthopedic imaging market globally.

Europe Urine Testing Cups Market Insights

Europe is the second dominant region in the orthopedic imaging equipment industry, owing to the strong healthcare infrastructure, government initiatives for advanced diagnostic options, and an increase in the patient pool suffering over musculoskeletal disorders. Moreover, growing investment in digital healthcare, rising medical tourism in countries including Germany and the U.K., and the number of large players in the imaging equipment market are other factors that enhance Europe’s dominance in the global imaging equipment industry.

Latin America (LATAM) and Middle East & Africa (MEA) Urine Testing Cups Market Insights

The orthopedic imaging market in Latin America will be mainly driven by increasing orthopedic surgeries, a growing aging population, increasing digitalization of imaging systems, and higher demand for better treatment with less recovery time, adoption of minimally invasive procedures. The Middle East & Africa are poised to witness market expansion due to the rise in trauma cases, government hospital initiatives, and increasing private healthcare structures, while the UAE, Saudi Arabia, and South Africa are embracing more portable and advanced imaging systems.

Competitive Landscape for the Orthopedic Imaging Equipment Market:

GE Healthcare is centered on AI-powered X-ray, low-dose CT, and mobile imaging opportunities, enhancing diagnostic confidence, efficiency, and surgical planning at orthopedic facilities globally.

-

In March 2025, Launched Revolution AI-Enhanced Orthopedic CT, enabling faster 3D bone imaging, reducing radiation by 30%, and improving fracture assessment and pre-surgical planning accuracy.

Siemens powers innovation with 3D imaging, AI-based diagnostic imaging, and hybrid imaging systems, to offer greater orthopedic diagnostics, lower radiation dose and interoperability with hospital information systems for better care.

-

In July 2024, introduced Multitom Rax Plus, a 3D extremity imaging system with AI-assisted fracture detection, offering precise orthopedic imaging for trauma care and outpatient clinics.

Philips is a leading provider of intelligent orthopedic imaging solutions, including AI-enabled x-ray and digital radiography solutions, radiography, and portable imaging systems designed to support the needs of orthopedic surgeons.

-

In October 2024, SmartDX Musculoskeletal X-ray Suite, integrating AI-guided imaging with real-time diagnostics, will enhance workflow efficiency, accuracy, and personalized orthopedic patient assessment.

Orthopedic Imaging Equipment Market Key Players:

Some of the Orthopedic Imaging Equipment Market companies are:

-

GE Healthcare

-

Siemens Healthineers

-

Philips Healthcare

-

Canon Medical Systems

-

Fujifilm Holdings

-

Carestream Health

-

Hologic

-

Hitachi Medical Systems

-

Shimadzu Corporation

-

Samsung Medison

-

Esaote S.p.A

-

Dilon Technologies

-

Analogic Corporation

-

Orthoscan, Inc.

-

Planmed Oy

-

Neusoft Medical Systems

-

Konica Minolta

-

Rayence Co., Ltd.

-

Varian Medical Systems

-

Carestream Health, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 4.93 billion |

| Market Size by 2033 | USD 7.30 billion |

| CAGR | CAGR of 5.04% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | "• By Product Type (X-ray, CT, MRI, Ultrasound, Nuclear Imaging) • By Indication (Trauma Cases, Sport Injuries, Spinal Injuries, Arthritis, Bone Disorders, Musculoskeletal Cancer, Muscle Atrophy, Others) • By Technology (2D Imaging, 3D Imaging, AI-Assisted Imaging) •By End User (Hospitals, Diagnostic Imaging Centers, Others) |

| Regional Analysis/Coverage | "North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America)" |

| Company Profiles | GE Healthcare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems, Fujifilm Holdings, Carestream Health, Hologic, Hitachi Medical Systems, Shimadzu Corporation, Samsung Medison, Esaote S.p.A., Dilon Technologies, Analogic Corporation, Orthoscan, Inc., Planmed Oy, Neusoft Medical Systems, Konica Minolta, Rayence Co., Ltd., Varian Medical Systems, Carestream Health, Inc. and other players. |