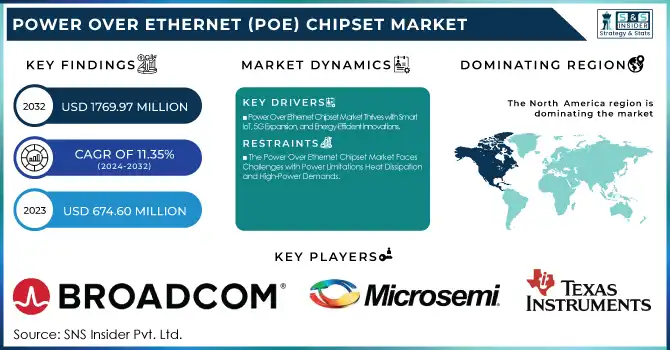

Power Over Ethernet (PoE) Chipset Market Size:

The Power Over Ethernet (PoE) Chipset Market size was valued at USD 674.60 million in 2023 and is expected to reach USD 1769.97 million by 2032, growing at a CAGR of 11.35% over the forecast period 2024-2032. The Power over Ethernet (PoE) Chipset Market is seeing rapid adoption in industrial automation, smart buildings, and enterprise networking as they carry both power and data on one cable. This is driving deployment in IoT, Security cameras, VoIP, and LED lighting to assist the efficiency of operations. Network improvements are aimed at faster, more reliable, more dependable, and lower-latency data transfer. Performance and reliability improvements better heat dissipation, reduced power loss, and enhanced fault tolerance. Energy efficiency is still one of the principal motors, powered by PoE chipsets supporting optimized power distribution, low idle consumption, and evermore stringent IEEE standards for eco-sustainability.

To Get more information on Power Over Ethernet (PoE) Chipset Market - Request Free Sample Report

Power Over Ethernet (PoE) Chipset Market Dynamics

Key Drivers:

-

Power Over Ethernet Chipset Market Thrives with Smart IoT, 5G Expansion, and Energy-Efficient Innovations

Power over Ethernet (PoE) chipset Market Overview The PoE chipset market is driven by the demand shift for a combined power and data transmission solution across verticals. The growing usage of smart IoT devices such as home and building security devices like network cameras, VoIP phones, and access points further accelerates market growth. The rising installation of smart lighting systems, especially LED lighting with PoE technology, is the primary factor fueling the market growth as organizations are looking for energy-efficient and economic solutions. Moreover, the development of 5G networks and IoT environments is driving the need for PoE-supported infrastructure that offers reliable connectivity and power transmission without tedious wiring. Growing penetration of smart buildings and industrial automation fueled the business demand and promoted centralized power management of connected devices, thereby contributing to market growth.

Restrain:

-

The Power Over Ethernet Chipset Market Faces Challenges with Power Limitations Heat Dissipation and High-Power Demands

Power limitation as imposed by PoE standards is one of the major restraints in the Power over Ethernet (PoE) chipset market. Although PoE++ (IEEE 802.3bt) raises the output power to 60W–100W, this is insufficient for various high-power applications, including industrial machinery, complex automation systems, and high-end medical devices. This limits PoE adoption in fields where there are energy-intensive devices. In addition, high-power PoE networks face heat dissipation difficulties due to the gathering of networking equipment leading to exhaustion, which can impair the performance and longevity of networking devices. Additionally, a demand for power-efficient thermal management solutions. This increases the complexity of PoE chipset cascade design and implementation.

Opportunity:

-

Power Over Ethernet Chipset Market Expands with Advanced Standards Smart Security and Sustainable Energy Initiatives

Technological advancements and expansion of applications are some of the opportunities that can be leveraged in the PoE chipset market. Next, the rise of high-power PoE standards (PoE++/IEEE 802.3bt) enables the powering of more power-hungry devices like large displays high-performance access points, and industrial automation equipment. The growing utilization of proximity sensors and smart security systems in sectors such as retail, healthcare, and smart city are other areas of high growth prospects. Moreover, the growth of government initiatives in the direction of sustainable energy solutions and smart city projects promises to generate further demand for PoE technology, making it a crucial driving force for future digital infrastructure.

Challenges:

-

Power Over Ethernet Chipset Market Faces Challenges with Standardization Compatibility and Reliability in Critical Applications

The standardization of PoE chipsets across various manufacturers, devices, and even different models leaving the factory poses another severe problem. Thus, while manufacturers are developing unique PoE solutions, that means it can be tough when it comes to compatibility because the PSEs may struggle to work with PDs. Moreover, in mission-critical applications like healthcare, security, and industrial automation, the risk of power fluctuations and network failures also remains high in PoE systems. Developing solutions to these technical challenges will continue to drive improvements in the efficiency, safety, and adaptability of PoE chipsets over time as the technology continues to achieve new milestones and ineffective performance for various use cases.

PoE Chipset Market Segment Analysis

By Type

In 2023 the share of PoE Powered Devices (PD) chipsets reached 53.8%, due to a large amount of Power Sourcing Equipment such as network cameras, VoIP phones, LED lighting, and wireless access points powered through remains of Wireline Power over Ethernet (PoE) technology. This strong position in the market is attributed to the rising demand for IoT-based smart devices and energy-efficient solutions in commercial and industrial sectors. Other reasons driving the use of PD chipsets is the increasing penetration of smart buildings and security systems which is turning them into a prominent electronic networking infrastructure.

PoE Power Sourcing Equipment (PSE) chipsets are expected to witness the highest CAGR during the forecast timeframe (2024-2032) due to continuous developments in high-power PoE standards (IEEE 802.3bt) and the rising need for centralized power management solutions. Due to the growing demand for efficient power delivery infrastructure owing to the acceleration of industrial automation, 5G networks, and smart city projects, PSE chipset adoption is set to witness significant growth.

By Standard

The 802.3at (PoE+) standard accounted for a larger chunk of the PoE chipset market with a 47.2% share in 2023, due mainly to its popularity in VoIP phones and other applications, including security cameras, wireless access points, and LED lighting. This was sufficient to roll out up to 30W per port, which is why businesses favored this piece of gear for PoE across commercial and industrial applications. Expanding smart infrastructure and IoT connectivity needs to cement its leadership in the market.

The IEEE 802.3bt standard is foreseen to grow at the highest CAGR over the forecasted period 2024-2032, due to the demand for increased power delivery (up to 100W). These standards power next-generation applications such as high-performance wireless access points, smart displays, and industrial automation, which is a major enabler for next-gen PoE upgrades.

By Device

In 2023, the Ethernet Switch & Injector PoE chipset market was holding the maximum revenue share of 24.6%, due to the growing need for efficient and flexible networking solutions. The popular applications of PoE switches and injectors in enterprises, data centers, and smart buildings have been widely designed to power IP cameras, VoIP phones, and wireless access points for data transmission and centralized power management respectively. The transition to IoT-driven infrastructure and cloud-based applications only cemented their top status in the market.

The fastest CAGR over the forecast period from 2024 to 2032 is expected to be represented by LED lighting, driven by the transition to smart and energy-efficient lighting. Rising deployment of PoE-powered LED systems in smart buildings, commercial spaces, and industrial facilities for cost savings benefits, remote control, and automation are expected to be the key factors driving the growth of the POE Led Driver Market throughout the forecast period.

By End Use

In 2023, the industrial segment led the market with a 43.7% share owing to the growing adoption of PoE-enabled industrial automation systems, PoE-enabled security systems, and wireless communication networks in various industrial applications. PoE technology is used by various industries to power IoT devices, sensors, and control systems where smooth data transfer and centralized power management are necessary.

The commercial sector is estimated to witness the fastest CAGR from 2024 to 2032. More businesses are adopting PoE solutions to achieve business efficiencies through VoIP phones, access control, and energy-efficient LED lighting. Another major aid for commercial PoE development or rather the growing demand for the same can be attributed to the increased adoption of co-working spaces, commercialization in automation, and smart city projects, which are some of the key growth driving factors in commercial PoE market over the forecast period.

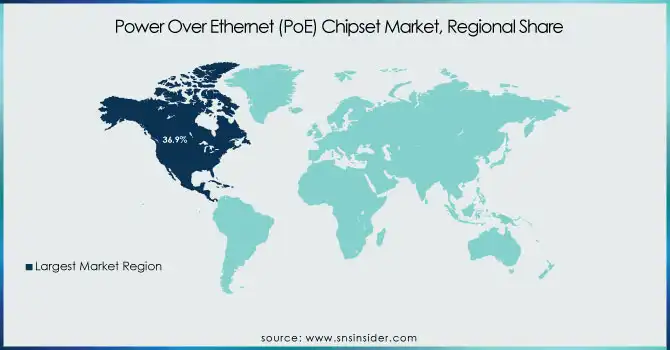

Power Over Ethernet (PoE) Chipset Market Regional Outlook

North America held a dominant share of 36.9% in the year 2023, attributed to the region's high adoption of smart infrastructure, catalyst equipment, and advanced networking solutions. The dominance of North America, which includes major technology companies like Cisco, Broadcom, and Texas Instruments, as well as rising investment in data centers, 5G networks, and smart buildings, has further reinforced this position. New York smart city projects, for example, utilize PoE-enabled smart audio-visual systems and intelligent lighting, and smart city projects such as the Office of Technology and Innovation Surveillance Camera program provide a research project that leverages PoE technology for such urban and infrastructure activities. Furthermore, proven market leaders and technology centers in Silicon Valley adopt PoE technology for office automation, voice-over-internet-phone (VoIP) communication, and security systems which, in turn, is expected to propel the market growth.

Asia Pacific is expected to experience the highest CAGR in the region from 2024 to 2032, driven by rapid urbanization, increasing industrialization, and growing smart city projects. PoE market growth is projected to be fueled by heavy investments in IoT, 5G, and smart infrastructure in China, India, and Japan. Singapore Smart Nation is an exemplary initiative that uses a combination of LEDs, smart security cameras, and IoT sensors powered by PoE to make city management efficient. Likewise, In India, efforts like Digital India have bolstered PoE-powered networking solutions within commercial and public domains and paved the way for rapid market progression.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Power Over Ethernet (PoE) Chipset Market are:

-

Broadcom (BCM59111, BCM59121)

-

Microsemi (PD69101, PD70201)

-

Marvell Technology (88E1510, 88E1111)

-

Texas Instruments (TPS23861, TPS2372)

-

Linear Technology (now part of Analog Devices) (LTC4267, LTC4279)

-

Maxim Integrated (MAX5969, MAX5980)

-

ON Semiconductor (NCP1095, NCP1096)

-

STMicroelectronics (STPD01, PM8805)

-

Silicon Labs (Si3402-B, Si3404-B)

-

Microchip Technology (PD70224, PD70210)

-

Qualcomm Atheros (AR8035, AR8033)

-

Realtek Semiconductor (RTL8211E, RTL8363SB)

-

ASIX Electronics (AX88796C, AX88772C)

-

Delta Electronics (DPH Series, DPR Series)

-

Sigma Designs (CG2210, CG3210)

Recent Trends

-

In December 2024, Marvell launched a 1.6 Tbps Linear-Drive Pluggable Optics (LPO) chipset to enhance high-bandwidth, short-reach interconnects in AI-driven data centers. Optimized for 200G per lane, it improves efficiency, reduces power consumption, and scales next-gen compute fabric networks.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 674.60 Million |

| Market Size by 2032 | USD 1769.97 Million |

| CAGR | CAGR of 11.35% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (PoE Power Sourcing Equipment (PSE) Chipset, PoE Powered Devices (PD) Chipset) • By Standard (802.3af standard, 802.3at standard, 802.3bt standard) • By Device (Network Cameras, VoIP Phone, Ethernet Switch & Injector, Wireless Radio Access Point, Proximity Sensor, LED Lighting) • By End Use (Commercial, Industrial, Residential) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Broadcom, Microsemi, Marvell Technology, Texas Instruments, Linear Technology (Analog Devices), Maxim Integrated, ON Semiconductor, STMicroelectronics, Silicon Labs, Microchip Technology, Qualcomm Atheros, Realtek Semiconductor, ASIX Electronics, Delta Electronics, Sigma Designs. |