Fats & Oils Market Report Scope & Overview:

Get More Information on Fats & Oils Market - Request Sample Report

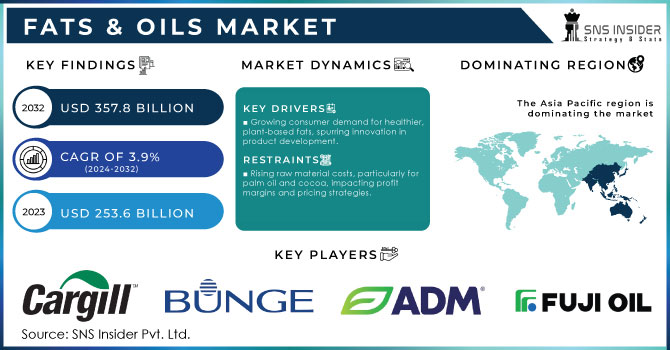

The Fats & Oils Market Size was valued at USD 253.6 billion in 2023 and will reach USD 357.8 billion by 2032, and grow at a CAGR of 3.9% by 2024-2032.

The fats and oils market is experiencing large-scale transitions mainly driven by changes in consumer preferences, concerns about sustainability, and technological change. Many recent developments demonstrate such shifts. For instance, innovations in fat formulations helped solve issues involving the rising costs of cocoa and became a critical issue facing the confectionery sector; that was in September 2024. Companies are now scouring alternative fats and oils for more competitive formulations of chocolate products while keeping the cost cheaper but remaining palatable. This change in consumer preference goes a long way in addressing the cost pressure while responding to heightened expectations from consumers for transparency in food production processes and sustainability issues. Marubeni Corporation in a declaration said in July 2024 that it has established a strategic partnership that would expand its portfolio of specialty fats to follow the upward trend in demand for this kind of product globally. As long as non-diet and healthier fats emerged, the manufacturers started to innovate in the spheres of non-hydrogenated fats and oils. The importance lies in the fact that it answers health-conscious consumers and pressure from regulation regarding trans fats in food products. Quality and health benefits are probably going to be the driving forces in product development over the next few years as companies push toward introducing more functional ingredients that serve these purposes.

One of the other major developments came in June 2024, when special attention was being given to cocoa butter equivalents and sustainable specialty fats and oils. That is part of an overall shift by the industry toward this end of sustainability. More and more companies are focusing on ethical sourcing and clean production processes. The trend toward sustainable ingredients goes beyond the conservation of the environment; in addition, it offers an added benefit to brands by attracting growing numbers of more sensitive consumer-offenders in terms of conscious purchasing decisions. The continuous shift underscores the pressing need to become part of product development so as not to lose its ground as a competitive advantage.

The benefits to health where plant oils are concerned were also highly placed in August 2024, as the nutritional benefits these oils present above traditional fats were shown. Therefore, the contribution of plant-based oils to healthy hearts and decreased inflammation has been defined by scientists, and the manufacturers are keenly introducing these oils into their product lines for the health-conscious consumer. This only proves that the market is changing towards healthier products and is a result of research that identifies these oils as having beneficial properties as well.

Global demand for specialty fats is growing, according to debates in July 2024 about how specialty fats have gained popularity within the food sectors overall. Specialty fats are adapted for their application, ranging from baking to chocolate, thereby enhancing their function and their usage. This trend indicates a bigger step for manufacturers to continuously innovate and gain the effectiveness needed to address market demands. The advanced technologies in processing and formulation, enable companies to create unique products that fulfill more than consumer preferences, but they must rather support the tightened ropes of health and safety regulation standards. The market for fats and oils is going to expand further as companies are handling the changes evolving in the market and using innovations to thrust their strategies.

Fats & Oils Market Dynamics:

Drivers:

-

Growing consumer demand for healthier, plant-based fats, spurring innovation in product development.

Strong consumer demand for healthier, plant-based fats is driving fairly high innovation within the fats and oils market. Higher health-conscious consumers who are shifting to plant-based diets are forcing manufacturers to reformulate their portfolios to suit these preferences. For instance, this trend is manifest when consumers are now looking for alternatives to traditional animal fats and hydrogenated oils with unhealthy trans fats, hence increasing the popularity of oils such as avocado, coconut, and olive oil. This has changed and, therefore, pushed firms to invest in research and development about oils. Oils must, therefore, not only contribute to the general health, for example, cholesterol levels and heart health but also flavor food products. Avocado oil, through Chosen Foods, came into the market as a versatile cooking oil with monounsaturated fats, hence attracting the health-aware and gourmet chef. However, the greatest innovation in blending techniques has resulted in creating new profiles of fats: the fusion of the health benefits of several plant oils, including flaxseed oil, for omega-3 fatty acids. This alone will fulfill the nutritional requirements of consumers while providing the companies an opportunity to differentiate products from one another in what else may be described as a saturated market. As awareness of the detriments resulting from saturated fats starts to grow, so does the emphasis of the industry on the development of functional fats that would allow for the maintenance of flavor and texture but add health benefits. Shaping the future direction of product development in the fats and oils sector are the consumer preferences.

-

Increasing awareness of sustainability, leading companies to adopt ethical sourcing and environmentally friendly practices.

With increased awareness of sustainability among consumers, companies operating in the fats and oils market are adopting socially responsible practices to source ethically and maintain environmental sustainability. Sustainability today is not the talk of many; instead, it leads people to expect transparency and sustainability in the goods they consume. As such, there are many brands that have adapted their practices towards sustainable agriculture and responsible modes of production. For instance, companies use certified sustainable palm oil, reducing the horror of deforestation and habitat destruction often caused by commercial palm oil production. Brands like Unilever are committing themselves to sourcing 100% sustainable palm oil and collaborating actively with farmers to improve their cultivation practices while strengthening local communities and cutting down on their carbon footprint. The trend has also resulted in alternative oils, which require less land and resources, such as algae oil that may be obtained with the least environmental impact. On the packaging, sustainability has also been brought forth for companies to opt for biodegradable or recyclable materials to lessen waste. The pressure toward sustainability drives not only the concerns in the environment but also brand loyalty, since consumers tend to give more support to companies with close values. Sustainable practices can, therefore be integrative measures within the various businesses, which not only contribute to a healthy planet but also place themselves right side of the market in an increasingly level of eco-conscious consumers.

Restraint:

-

Rising raw material costs, particularly for palm oil and cocoa, impacting profit margins and pricing strategies.

Raw material cost inflation is particularly impacting the fats and oils market, with palm oil and cocoa now taking on significant importance as factors hindering the growth of this market. Due to fluctuating prices driven by a growing demand for these crucial ingredients and being interlinked with climate change, supply chain disruptions, and geopolitics, manufacturers struggle to strike a balance between profit margins and pricing strategies. For instance, in the case of palm oil market price, there has been price volatility that is linked to environmental-related regulations and fears of deforestation and thus tighter supply constraints. Similarly, cocoa prices have risen to unprecedented levels in this regard since farmers face various challenges from pests, diseases, and adverse weather, which forms negative influences on yields. These increasing costs force manufacturers to absorb the costs, which will inevitably lead to reduced profitability or pass them on to consumers who may reduce demand for more expensive products. Companies have to tread these challenges carefully and find ways through which they could better their supply chains and look for alternative sourcing options that help them mitigate such raw material price fluctuations going into their operation.

Opportunity:

-

Expansion of specialty fats tailored for specific applications, allowing manufacturers to cater to diverse consumer needs.

The most important opportunity in the fats and oils market is the expansion of specialty fats tailored for specific applications, allowing for better fulfillment of the diverse consumer requirements. At the same time, major demand for fats which serve particular purposes, like high-performance baking, frying, or spreading, changes dietary preferences and trends in preparation methods. For example, specialty fats for vegan or gluten-free products are in high demand as customers increasingly adopt plant-based diets. In addition, high functionality fats with better melting points or greater shelf life enable food manufacturers to innovate their product lines and differentiate themselves from other market players. Brands also produce customized solutions for specific industries, such as confectionery or dairy alternatives, where unique textural properties have the highest priority. This trend not only assists in tapping into niches but also promotes brand loyalty by providing consumers with products that are consonant with their precise dietary preferences and lifestyle choices, encouraging growth and profit-building in a competitive environment.

Challenge:

-

Navigating regulatory changes and health guidelines while maintaining product quality and consumer appeal.

Regulatory changes and health guidelines in the fats and oils market pose a big challenge to companies as they must follow the constant change in the standards without compromising quality and appeal. Governments and health organizations have been actively focusing efforts on reducing the portion of trans fats with healthier eating; consequently, the manufacturer has to reformulate products with new regulations. Such matters are complex and costly. For instance, altering recipes to substitute fatty acids with more healthy ones may, in turn, result in the final product in terms of taste, texture, and functionality, thereby potentially causing consumers to buy less. Further, labeling regulations are becoming increasingly more stringent, which makes companies incur costs of transparent marketing that communicates the health benefits without misleading the consumers. The constant juggle, therefore between conformity to health trends and a requirement that products should be appealing and competitive in highly crowded markets puts manufacturers at a constant test of innovativeness and then refining their offerings to fit within the will of both health trends and consumer expectations.

Fats & Oils Market Segments

By Source

The vegetable segment dominated the fats and oils market in 2023, with a market share of around 70%. Such dominance can be attributed to the preference of consumers towards plant-based diets and healthier cooking options. Vegetable oils, especially olive, sunflower, and canola oil, are primarily preferred because of their health benefits, such as having lower saturated fats and a higher content of unsaturated fats. Interest in veganism and clean-label products is further driving this trend. As a result, companies have sought to innovate with oils from nuts, seeds, and other plants. Indeed, the new entrants in cooking oils such as avocado and flaxseed oil, with their nutritional properties, are reflective of this trend. As a result, the fresh vegetable space remains one of dominance with consumer trends as well as an expanding portfolio of offerings. With health concerns over nitrates in meats remaining foremost in public consciousness, this trend will continue.

By Type

In 2023, the oil type segment dominated the fats and oils market with an estimated market share of around 65%. Vegetable oils constituted a leading subsegment in this category accounting for about 45% of the total market share. This has been primarily spurred by rising health awareness amongst consumers along with a strong intention to adopt plant-based cooking options. Their versatility and health benefits, including greater unsaturated fat and beneficial fatty acids content, vegetable oils like sunflower and olive oil have been the leading choice. For example, olive oil is known for its contribution to the Mediterranean diet and its association with heart health, which has also increased popularity among consumers. With growth in this segment coming from healthy eating trends and product development in vegetable oils, the market for fats and oils continues to go ahead of the competition.

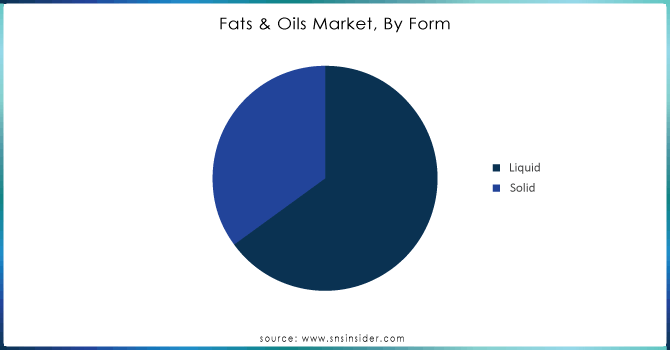

By Form

In 2023, the liquid segment dominated and accounted for about 75% of the fats and oils market. This category predominates because of the mass application of liquid oils in cooking, baking, and in processing foodstuffs, where they are used because they can easily be incorporated into any processing system. Liquid oils such as olive, canola, and sunflower oil are gaining preference among the health-conscious consumer who wants less saturated fats with more unsaturated fats. The usage of liquid oils also adds to their popularity because it is being used in cooking applications from salad dressings to frying. Another aspect is the growing trend of consuming a plant-based diet that leads to an increased demand for liquid oils to become an integral part of vegan and vegetarian food preparation, which confirms their leading status in the market. Another reflection of this new trend can be found in consumer buying trends, since liquid oils often become household necessities, hence resulting in a high market share of the product.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Application

In 2023, the food application segment dominated the fats and oils market, with an estimated 80% market share. Fats and oils are widely consumed in hundreds of food items, ranging from cooking oils and margarine to baked goods and processed foods. The growing demand for convenience foods and healthy fats in culinary practices provides a growth impetus for this segment. For instance, the increase in plant-based oil demand, such as that of olive and avocado oil, is a reflection of increasing interest in healthy cooking and dietary preferences. The food industry will also continually innovate with product development, thus incorporating these oils in new products while still fuelling demand. Health-conscious consumers are asking for quality ingredients in their diet, which has helped the food application segment remain firmly established as the leading application segment in the fats and oils market.

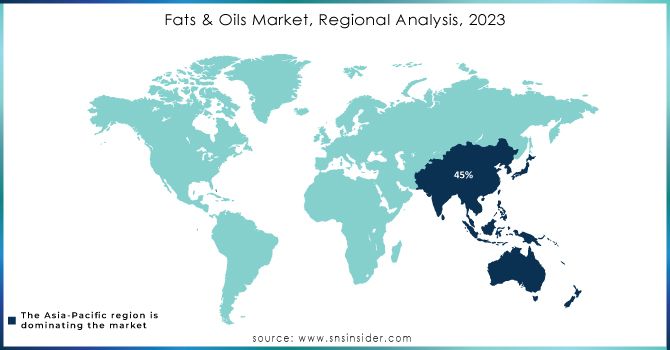

Fats & Oils Market Regional Outlook

Asia-Pacific dominated the fats and oils market in 2023, holding an estimated market share of nearly 45%. This dominance is attributed to region-wide consumption of a variety of oils, most of them in the form of palm oil, used widely in cooking and food processing. Therefore, the supply chain, presenting both international and local demand, is considerably supplied by the countries of Indonesia and Malaysia as they are major producers of palm oil. To this end, the increasing population and rising urbanization in the countries of China and India boost the need for convenience foods, which contain various forms of fats and oils. The increasing trend towards healthy cooking oils such as soybean and sunflower oil serves further to shore up the dominance of the region's market, as consumers increasingly look for options that meet health-conscious diets. Continuous innovation in product offerings adds to this strong demand and makes the Asia-Pacific region a critical market in the overall fats and oils market worldwide.

Key Players

-

Alami Commodities Sdn Bhd (palm oil, coconut oil)

-

Arista Industries (palm oil, vegetable shortening)

-

Bunge Limited (soybean oil, canola oil)

-

Cargill Incorporated (sunflower oil, margarine)

-

Fuji Oil Holding Inc. (palm oil, specialty oils)

-

Kuala Lumpur Kepong Berhad (palm oil, lauric oils)

-

Mehwah International (palm oil, cooking oils)

-

Musim Mas Group (palm oil, refined oils)

-

Olam International (palm oil, sunflower oil)

-

The Archer Daniels Midland Company (soybean oil, corn oil)

-

Unilever PLC (margarine, cooking oils)

-

Adani Wilmar Limited (Fortune cooking oil, palm oil)

-

Omega Protein Corporation (fish oil, omega-3 oils)

-

IOI Corporation Berhad (palm oil, specialty fats)

-

Catania Spagna Corporation (olive oil, blended oils)

-

Sappi Lanaken Mill (bio-based oils, specialty fats)

-

J-Oil Mills, Inc. (soybean oil, salad oils)

-

Nisshin Oillio Group, Ltd. (rapeseed oil, frying oils)

-

Darling Ingredients Inc. (rendered fats, specialty oils)

-

Wilmar International Limited (palm oil, cooking oils)

Recent Developments

-

January 2024: Cargill prioritizes your health! All their food customers globally can now be confident that Cargill's fats and oils adhere to the World Health Organization's (WHO) recommended maximum levels for industrially produced trans fats (iTFA).

-

February 2024: Cargill company is expanding its partnership with ENOUGH, a leader in sustainable fermented protein technology. This deeper collaboration aims to develop innovative, nutritious, and sustainable alternative meat and dairy solutions that satisfy consumer cravings.

-

November 2023: Musim Mas introduced its four new oil palm varieties. These innovative palms boast the potential to produce a whopping three times the industry average, exceeding a yield of 10 tons of total oil per hectare. This impressive achievement is the result of a dedicated 11-year research program focused on non-GMO genetic engineering.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 253.6 Billion |

| Market Size by 2032 | US$ 357.8 Billion |

| CAGR | CAGR of 3.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Source (Vegetables, Animals) •By Type (Oil Type [Vegetable Oils, Palm oil, Soybean oil, Sunflower oil, Rapeseed oil, Olive oil], Fat Type [Butter & margarine, Lard, Tallow & grease, Others]) •By Form (Liquid, Solid) •By Application (Food, Pharmaceutical, Personal Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cargill Incorporated, Bunge Limited, The Archer Daniels Midland Company, Fuji Oil Holding Inc., Olam International, Wilmar International Limited, Musim Mas Group, Alami Commodities Sdn Bhd, Kuala Lumpur Kepong Berhad, Arista Industries, Mehwah International and other key players |

| Key Drivers | •Growing consumer demand for healthier, plant-based fats, spurring innovation in product development •Increasing awareness of sustainability, leading companies to adopt ethical sourcing and environmentally friendly practices |

| RESTRAINTS | •Rising raw material costs, particularly for palm oil and cocoa, impacting profit margins and pricing strategies |