Federated Learning Market Report Scope & Overview:

To Get More Information on Federated Learning Market - Request Sample Report

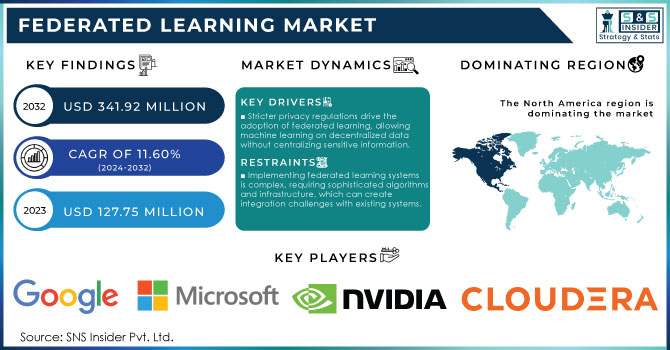

The Federated Learning Market size was valued at USD 127.75 Million in 2023. It is expected to hit USD 341.92 Million by 2032 and grow at a CAGR of 11.60% over the forecast period of 2024-2032.

The Federated Learning market is experiencing substantial growth as organizations increasingly prioritize data privacy and security in their machine learning initiatives. With around 67% of organizations exploring or implementing federated learning strategies, the approach is gaining traction across various sectors, particularly healthcare, finance, and telecommunications. In healthcare it is estimated that about 80% of healthcare organizations aim to leverage federated learning for secure patient data analysis, ensuring that privacy is maintained while extracting valuable information.

|

Technology |

Description |

Commercial Products |

|---|---|---|

|

Federated Averaging Algorithm |

A method to combine local models from multiple devices into a global model without sharing data. |

TensorFlow Federated, PySyft |

|

Differential Privacy in FL |

Techniques that add noise to local data or model updates to preserve individual privacy in federated systems. |

PySyft with Differential Privacy, Google DP |

|

Secure Multi-Party Computation (SMPC) |

A cryptographic method to securely compute outputs from multiple data sources without revealing inputs. |

Crypten, OpenMined |

|

Federated Transfer Learning (FTL) |

Applies transfer learning principles in a federated setting to allow training on small datasets at each node. |

Baidu PaddleFL, WeBank FATE |

|

Blockchain-based FL |

Uses blockchain to ensure trust and decentralization in federated learning environments. |

IBM Federated Learning with Blockchain |

|

Cross-Silo Federated Learning |

Used for training across multiple organizations or institutions with data silos. |

NVIDIA Clara FL, Intel OpenFL |

|

Cross-Device Federated Learning |

Training distributed models across millions of edge devices like smartphones. |

Google Federated Learning, Apple's Federated Analytics |

According to research, approximately 67% of organizations are exploring or implementing federated learning strategies to enhance data privacy and security in machine learning models. Federated learning is particularly prevalent in healthcare, where an estimated 80% of healthcare organizations are looking to leverage it for secure patient data analysis without compromising privacy. Studies show that federated learning can utilize data from thousands of edge devices, with some initiatives reporting participation from over 10 million devices globally, particularly in mobile applications. Furthermore, federated learning has been shown to reduce the need for data transfer by up to 90%, significantly lowering bandwidth costs and enhancing data management strategies for organizations. Implementing federated learning can decrease the risk of data breaches by over 50%, which is crucial for industries that handle sensitive personal information. Investment in federated learning technologies has surged, with over USD 400 million allocated to research and development in 2023 alone. Advances in federated learning algorithms have also led to performance improvements of up to 30% in model accuracy compared to traditional centralized models. As organizations prioritize data privacy and seek to harness the benefits of machine learning, the federated learning market is poised for significant growth, becoming a cornerstone of future AI applications.

MARKET DYNAMICS

DRIVERS

- In response to stricter data privacy regulations like GDPR and CCPA, organizations are increasingly adopting federated learning, which enables machine learning on decentralized data without transferring sensitive information to a central server.

The data-driven landscape and increased data privacy concerns significantly influence technology adoption, particularly in the realm of machine learning. Stricter regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) compel organizations to prioritize data protection. As a result, businesses are actively seeking innovative solutions that allow them to leverage machine learning while safeguarding sensitive user data. Federated learning has emerged as a viable response to these challenges, enabling models to be trained on decentralized datasets without transferring raw data to a central server. This approach ensures that individual data privacy is maintained, as the data remains localized on users' devices.

According to research, around 75% of organizations cite data privacy as a top priority in their digital transformation initiatives. Furthermore, that 61% of consumers express concerns about how their personal information is used, creating a pressing need for technologies that address these fears. Federated learning not only enhances data privacy but also improves model accuracy by utilizing diverse datasets from various sources, thus creating more robust and generalized machine learning models. As organizations continue to navigate the complexities of compliance and user trust, federated learning represents a critical step towards fostering responsible AI practices, ultimately aligning technological advancement with ethical data management.

- The growing adoption of IoT devices creates significant data that federated learning can utilize for model training while preserving privacy, enhancing its value in IoT environments.

The rising adoption of Internet of Things (IoT) devices is transforming the landscape of data generation and analysis. By 2025, it is projected that there will be over 75 million connected devices globally, significantly increasing the volume of data produced. This surge creates an opportunity for leveraging vast datasets to enhance machine learning models. However, traditional centralized data processing raises significant privacy concerns, particularly in sensitive areas like healthcare and finance. Federated learning addresses these challenges by allowing models to be trained locally on the data residing on individual devices without transferring it to a central server.

This method not only ensures data privacy but also complies with stringent data protection regulations like GDPR, which emphasize the need for secure data handling practices. In a federated learning setup, data can remain on devices, and only model updates are shared, protecting sensitive information while still improving model accuracy. According to research 55% of executives believe that data privacy concerns will drive their organizations to adopt federated learning strategies. Additionally, federated learning enables organizations to harness diverse data from various sources, enhancing model robustness and reducing biases inherent in training on a single dataset. This capability is particularly valuable in IoT ecosystems, where data is inherently heterogeneous, allowing for more accurate and generalized machine learning outcomes across different applications.

RESTRAIN

- Implementing federated learning systems is complex, requiring sophisticated algorithms and infrastructure, which can create integration challenges with existing systems.

Implementing federated learning systems presents notable challenges due to their inherent complexity. The integration of sophisticated algorithms, diverse data sources, and advanced infrastructure can strain an organization’s technical capabilities. Federated learning requires a shift from traditional centralized machine learning models, necessitating specialized knowledge in decentralized computing and privacy-preserving technologies. Organizations must develop and maintain secure communication channels for model updates, which can involve significant overhead.

Moreover, the variability of data across devices poses another challenge, as ensuring consistent data quality is crucial for effective training. In practice, approximately 70% of organizations report difficulties in deploying machine learning models at scale, often due to inadequate infrastructure and the complexity of handling heterogeneous data. These barriers can result in delays in the adoption of federated learning solutions, as companies may hesitate to invest in new technologies without clear, immediate benefits. Additionally, existing systems may not be designed to accommodate the decentralized nature of federated learning, requiring substantial modifications or even complete overhauls of current workflows. This transformation can lead to increased costs and resource allocation that organizations may be reluctant to undertake. As a result, while the potential of federated learning is immense, the technical challenges associated with its implementation can significantly hinder its adoption. Therefore, organizations must weigh these complexities against the benefits of improved privacy and collaboration that federated learning offers in their data-driven initiatives.

MARKET SEGMENTATION ANALYSIS

By Application

The Industrial Internet of Things (IIoT) segment dominated the market share over 25.04% in 2023. The increasing demand for federated learning is significantly influenced by its natural synergy with the decentralized architecture of IIoT ecosystems. By enabling the training of models across multiple distributed devices without the need to centralize data, federated learning aligns seamlessly with the decentralized characteristics of IIoT. This compatibility is particularly appealing to industries that depend heavily on IIoT technologies, fostering wider adoption and market expansion. Federated learning continuously improves AI models across various devices within IIoT environments, leading to enhanced operational efficiency and effectiveness. In terms of statistics, research indicates that industries employing IIoT solutions have experienced a reduction in operational costs by up to 20% through enhanced data utilization and process optimization.

By Organization

The large enterprises segment dominated the market share over 62.08% in 2023. These organizations are increasingly adopting federated learning because it aligns well with their complex, distributed structures. This innovative approach allows various branches or units to collaborate on training AI models without the need to centralize sensitive data, which is crucial for adhering to strict privacy regulations. Federated learning is particularly well-suited for large enterprises that manage extensive and varied datasets. By enabling decentralized data processing, it optimizes resource allocation and enhances the speed of model training across different divisions. Moreover, this method fosters greater collaboration among teams, leading to more robust AI models that reflect the diverse inputs from across the organization.

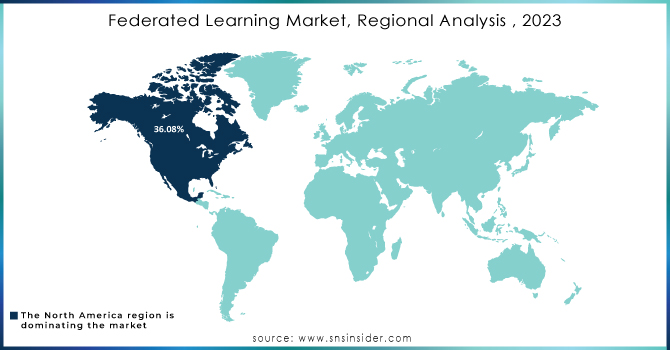

KEY REGIONAL ANALYSIS

In 2023, North America region dominated the market share over 36.08%. Key industries in the region, including healthcare, finance, and technology, have emerged as early adopters of advanced AI technologies, showcasing impressive investments in AI research and development, with funding reaching Millions. Federated learning specifically addresses critical data privacy concerns, enabling collaborative model training while adhering to stringent regulatory frameworks, making it particularly appealing to these sectors. As a result, the adoption of federated learning is gaining momentum, with a notable increase in pilot projects and partnerships.

The Asia Pacific region is poised for impressive growth, with an anticipated annual increase of 14.6% from 2024 to 2032. Countries such as China, Japan, South Korea, and Singapore are at the forefront of advancements in AI technologies, significantly enhancing their technological landscape. These nations are making substantial investments in research and development, cultivating a robust ecosystem for AI innovation, including federated learning. China has launched numerous initiatives to bolster AI capabilities, while South Korea’s government is backing extensive projects aimed at advancing machine learning and AI integration across industries. In this region, industries are increasingly recognizing the transformative potential of AI solutions across diverse applications, from healthcare to finance and manufacturing.

Do You Need any Customization Research on Federated Learning Market - Inquire Now

KEY PLAYERS

Some of the major key players of Federated Learning Market

-

Google (TensorFlow Federated)

-

Apple (Core ML)

-

Microsoft Corporation (Azure Machine Learning)

-

Nvidia Corporation (Nvidia Clara)

-

IBM (Federated Learning on Watson)

-

Amazon Web Services (SageMaker)

-

Cloudera Inc (Cloudera Data Platform)

-

Edge Delta Inc. (Edge Delta Platform)

-

Secure AI Labs (Secure AI Solutions)

-

Intellegens Ltd. (Alchemite)

-

Decentralized Machine Learning (Decentralized AI Solutions)

-

Owkin Inc. (Owkin Studio)

-

Enveil Inc. (Privacy-Enhancing Technologies)

-

DataFleets Ltd. (DataFleets Platform)

-

FEDML (FEDML Framework)

-

Alphabet Inc. (Google AI)

-

Apheris (Apheris Federated Learning Platform)

-

Consilient (Consilient Data Platform)

-

Zebra Medical Vision (AI for Radiology)

-

H2O.ai (H2O Driverless AI)

Suppliers for Offers robust federated learning solutions focusing on data security and privacy in AI applications of Federated Learning Market:

-

Google

-

IBM

-

Microsoft

-

OpenMined

-

NVIDIA

-

Apple

-

DataFleets

-

Zegami

-

Horizon

-

Fiddler AI

RECENT DEVELOPMENTS

-

In Sept 2024: Cloudera, the only true hybrid platform for data analytics, and AI, today announced several new Accelerators for ML Projects (AMPs), designed to reduce time-to-value for enterprise AI use cases. The new additions focus on providing enterprises with cutting-edge AI techniques and examples within Cloudera that can assist AI integration and drive more impactful results.

-

In May 2022: Edge Delta, a leading observability platform that analyzes and extracts data insights using distributed stream processing and federated machine learning, announced a USD 63 million Series B round led by Quiet Capital, with additional new investors BAM Elevate, Earlybird Digital East, Geodesic Capital, Kin Ventures, ServiceNow, Cisco and all insiders Menlo Ventures, MaC Venture Capital, and Amity Ventures also participating.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 127.75 Million |

| Market Size by 2032 | USD 341.92 Million |

| CAGR | CAGR of 11.60% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Industrial Internet of Things, Drug Discovery, Risk Management, Augmented & Virtual Reality, Data Privacy Management, Others) • By Organization (Large Enterprises, SMEs) • By Vertical (IT & Telecommunications, Healthcare & Life Sciences, BFSI, Retail & E-commerce, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Google, Apple, Microsoft Corporation, Nvidia Corporation, IBM, Amazon Web Services, Cloudera Inc, Edge Delta Inc., Secure AI Labs, Intellegens Ltd., Decentralized Machine Learning, Owkin Inc., Enveil Inc., DataFleets Ltd., FEDML, Alphabet Inc., Apheris, Consilient, Zebra Medical Vision, H2O.ai. |

| Key Drivers | • In response to stricter data privacy regulations like GDPR and CCPA, organizations are increasingly adopting federated learning, which enables machine learning on decentralized data without transferring sensitive information to a central server. • The growing adoption of IoT devices creates significant data that federated learning can utilize for model training while preserving privacy, enhancing its value in IoT environments. |

| RESTRAINTS | • Implementing federated learning systems is complex, requiring sophisticated algorithms and infrastructure, which can create integration challenges with existing systems. |