Infertility Treatment Market Report Scope & Overview:

Get More Information on Infertility Treatment Market - Request Sample Report

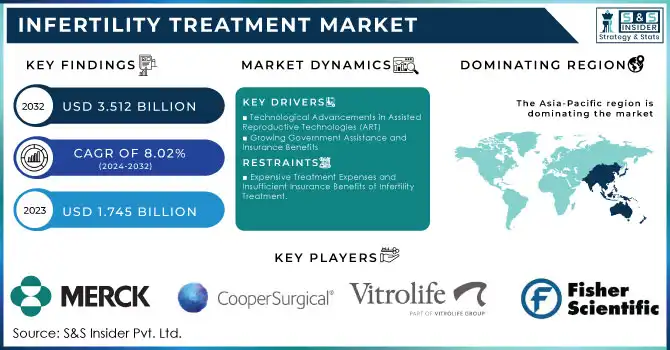

The Infertility Treatment Market Size was valued at USD 1.745 billion in 2023 and is expected to reach USD 3.512 billion by 2032, growing at a CAGR of 8.02% from 2024-2032.

The infertility treatment market is undergoing significant expansion, mainly fueled by elements like decreasing fertility rates, a rising number of fertility clinics, advancements in technology, and increasing investments from public and private entities. Nonetheless, the elevated procedural expenses tied to assisted reproductive technology (ART) treatments in advanced markets and the absence of favorable government regulations for specific infertility therapies are anticipated to somewhat restrict the market's growth.

Infertility continues to be a major worldwide issue, influenced by multiple factors that lead to its increase. A recent report indicates that about 25% of women experiencing fertility problems have irregular ovulation. Moreover, populations that smoke have demonstrated lower fertility rates. These elements have resulted in a spike in financial support for research and development projects focused on identifying the reasons for infertility and creating effective solutions.

The infertility treatment market is additionally fueled by growing awareness, progress in reproductive health technologies, and a general rise in infertility rates globally. In the U.S., the Centers for Disease Control and Prevention (CDC) estimates that close to 19% of women between 15 and 49 experience challenges with conception. Comparable patterns are seen in Europe and certain regions of Asia, where elements, like postponed family planning, lifestyle decisions, and environmental shifts, are impacting fertility challenges. Consequently, therapies like pharmaceuticals and assisted reproductive technologies (ART), such as in vitro fertilization (IVF), are increasingly common, with more than 2.5 million IVF processes performed worldwide annually.

Recent advancements in the sector are driving the market even further. In October 2024, the European Union revealed an increase in funding for reproductive health programs, emphasizing accessibility for neglected communities. In the United States, insurance provisions for infertility therapies are still growing, as 20 states currently require coverage for fertility treatments in specific health plans. Innovative technologies, like AI-based embryo selection and non-invasive genetic testing, are enhancing success rates and drawing more people to pursue treatment.

With rising global awareness, the infertility treatment market is likely to keep developing innovative solutions to address the increasing need for tailored, effective fertility choices.

Infertility Treatment Market Dynamics

Drivers

Technological Advancements in Assisted Reproductive Technologies (ART): The infertility treatments market is greatly benefiting from ongoing innovations in ART. Advancements such as AI-assisted embryo selection, less invasive methods, and improved genetic testing techniques are enhancing success rates and personalizing treatments. Non-invasive methods, including time-lapse embryo imaging and pre-implantation genetic testing, are increasingly being utilized, leading to greater success rates and enhanced patient outcomes. These innovations enhance the accessibility and attractiveness of treatments for a broader audience, including seniors and people facing intricate infertility challenges, thereby enlarging the market's opportunities.

Growing Government Assistance and Insurance Benefits: With rising infertility rates worldwide, governments and insurance companies are acknowledging the necessity of making infertility treatments more accessible. As a result, there have been policy adjustments and additional funding in numerous areas. For example, various European nations have implemented subsidies for ART services, whereas in the U.S., more than 20 states currently require insurance to cover infertility treatments in specific plans. These efforts alleviate the financial strain on patients and motivate more people to pursue treatment, thus promoting growth in the infertility treatment industry. Furthermore, as the stigma associated with infertility lessens, supportive laws aid in normalizing the pursuit of treatment.

Restraints

Expensive Treatment Expenses and Insufficient Insurance Benefits of Infertility Treatment.

A significant limitation in the infertility treatment market is the elevated expenses linked to procedures such as in vitro fertilization (IVF) and other assisted reproductive technologies (ART). In the U.S., IVF can cost between USD 10,000 and USD 15,000 for each cycle, and many patients may need several cycles to attain a positive result. Even with rising insurance coverage in certain areas, these expenses largely remain out-of-pocket for numerous individuals, particularly in nations lacking the required insurance for fertility therapies. This financial strain restricts access for numerous patients, especially those in low-income groups or areas with insufficient healthcare resources. Elevated treatment expenses, along with inadequate insurance support in numerous regions globally, persist in limiting the market’s growth opportunities by establishing a financial obstacle for a considerable segment of the population requiring infertility services.

Infertility Treatment Market Segmentation Overview

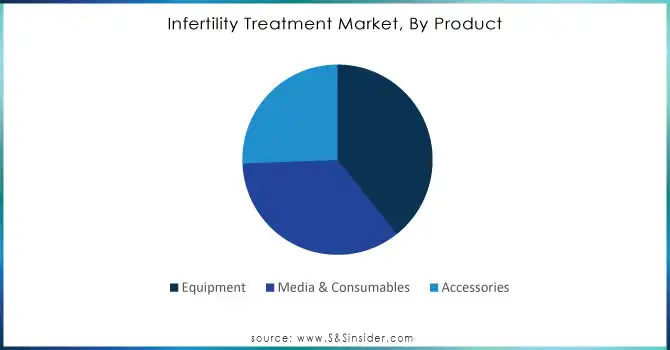

By Product

The equipment segment within the infertility treatment market dominated during the forecast period, fueled by swift technological progress in reproductive health devices. Established market leaders are consistently broadening their offerings with cutting-edge tools to improve treatment accuracy, including advanced imaging systems, egg collection devices, and sperm analysis tools. Enhanced awareness and availability of advanced technologies, along with continuous initiatives by companies to expand their market reach through product introductions and exhibitions, are anticipated to play a crucial role in the growth of this segment. For example, current efforts in developing nations to enhance healthcare facilities are increasingly driving the need for infertility treatment devices.

Need Any Customization Research On Infertility Treatment Market - Inquiry Now

By Procedure

Assisted Reproductive Technology (ART) represents the dominant segment in infertility treatment market and is expected to retain its leading position due to heightened global awareness, improved success rates, and wide acceptance of ART methods such as IVF (In-Vitro Fertilization) and ICSI (Intracytoplasmic Sperm Injection). It contributed 50% to the market in 2023. The increasing access to insurance for ART procedures in certain areas and the use of artificial intelligence to enhance results are strengthening this sector. Moreover, government-sponsored awareness initiatives on ART have increased its acceptance across various demographics, further enhancing the growth of this segment. Major stakeholders are progressively allocating funds to R&D to improve ART effectiveness and availability, fostering a robust growth path.

By Patient Type

Treatment for female infertility dominates the market by 68% in 2023, as its prevalence is linked to declining fertility rates in women caused by lifestyle, environmental, and physiological influences. The growing access to extensive fertility treatment alternatives, such as hormone therapies and egg freezing, coupled with a rising number of fertility clinics globally, has bolstered this movement. Lately, numerous startups and well-established fertility clinics have broadened their services specifically designed for female infertility treatment, promoting a more specialized method. Partnerships between healthcare providers and fertility clinics to enhance access to advanced treatments also stimulate growth, especially in urban areas where the demand for fertility services keeps increasing.

By End User

Fertility clinics account for the largest portion of the infertility treatment market by end users, demonstrating a rise in governmental backing to create fertility centers and collaborations with global healthcare providers. The emergence of fertility clinics as main treatment centers is also driven by the increased availability and affordability of IVF and ICSI methods. Initiatives by private healthcare networks to establish specialized fertility departments and partner with fertility startups are motivating more people to pursue treatment at focused centers. For instance, recent growth in the Asia-Pacific region has led to a rise in fertility center networks, enhancing patient engagement and further propelling expansion in this area.

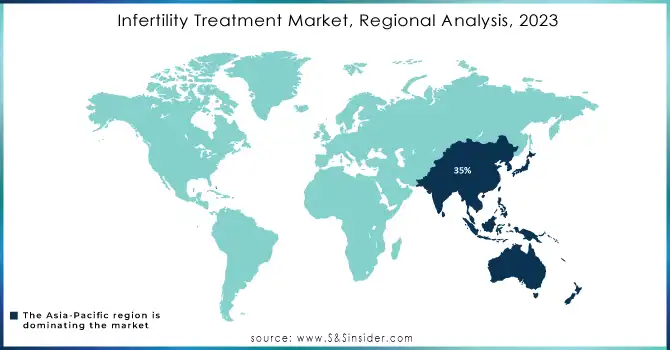

Infertility Treatment Market Regional Analysis

Asia Pacific region dominates the global market in 2023 by 35% and is projected to dominate the industry throughout the forecast period. This substantial portion can be linked to the considerable growth in medical tourism along with the increasing awareness of the accessibility of these treatment options. Additionally, the growing number of fertility clinics and the surging infertility rate in the area are expected to create significant market growth opportunities in the region. Furthermore, market expansion is driven by swift urbanization, enhanced living standards, and increasing disposable income, along with rising healthcare spending among the population in the developing country. Developing countries like South Korea, India, Japan, and China are mainly contributing to market growth. The increasing government initiatives aimed at enhancing access to infertility treatments are also expected to promote market expansion in the area. Moreover, the decline in costs for infertility treatments and the enhancement of healthcare facilities in developing countries is expected to propel market expansion.

North America's infertility treatment market is expected to demonstrate fastest growth during the forecast period. The rapid expansion of the market in the area can be linked to the different reimbursement programs along with the increasing infertility rates. The emergence of sophisticated technologies providing significant growth opportunities for fertility clinics, device manufacturers, and hospitals is expected to propel the market's expansion in the area. Moreover, the rising investments in research and development, supportive regulations, and heightened patient awareness in North America are anticipated to enhance the demand for the infertility treatment sector.

Key Market Players in Infertility Treatment Market

-

Merck & Co., Inc. (Gonal-f, Ovidrel)

-

Ferring Pharmaceuticals (Menopur, Bravelle)

-

CooperSurgical, Inc. (Sage IUI Catheter, Wallace Embryo Replacement Catheter)

-

Vitrolife AB (EmbryoScope+, VitroLife Cleav Media)

-

Cook Medical (K-MICR Catheter, MINC Incubator)

-

Fisher Scientific (IVF Witness, Vitrogen IVF Media)

-

Irvine Scientific (Continuous Single Culture (CSC) Media, ISolate Sperm Separation System)

-

Esco Medical (Miri Time-Lapse Incubator, Mini Miri Benchtop Incubator)

-

Origio (SpermFreeze Solution, ORIGIO Sequential Cleav Media)

-

Genea Biomedx (Gavi, Geri Incubator)

-

INVO Bioscience (INVOcell, INVO Pre-treatment Kit)

-

FUJIFILM Irvine Scientific (ISolate Media, Vit Kit-Freeze Media)

-

Hamilton Thorne Ltd. (Lykos Laser System, IMSI-Strict Software)

-

Nidacon International AB (PureSperm Wash, PureSperm Buffer)

-

Cryoport, Inc. (Cryoport Express Shipper, Cryoportal Logistics Platform)

-

Vitrolife Group (EmbryoGen, Primo Vision)

-

Ava AG (Ava Fertility Tracker, Ava Core)

-

Research Instruments Ltd. (Saturn 5 Laser System, RI Witness)

-

OXFORD Gene Technology (OGT) (CytoSure Fertility Array, IVF Genotyping Array)

-

Kitazato Corporation (Cryotop Method, Oocyte Retrieval Needle)

Recent Developments

-

In February 2024, Lupin Limited, a worldwide biopharmaceutical firm, revealed the launch of Ganirelix Acetate Injection after obtaining approval from the U.S. Food and Drug Administration (U.S. FDA); it is intended to prevent ovulation induction (increase in luteinizing hormone) during controlled ovarian hyperstimulation.

-

In July 2023, BPEA EQT will obtain a majority share in Indira IVF, the foremost provider of fertility services in India and one of the top five worldwide for annual IVF cycles, having achieved 125,000 successful pregnancies so far.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.745 Billion |

| Market Size by 2032 | US$ 3.512 Billion |

| CAGR | CAGR of 8.02% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Equipment, Media & Consumables, Accessories) • By Procedure (Assisted Reproductive Technology, Artificial Insemination, Fertility Surgeries, Other Infertility Treatment Procedures) • By Patient Type (Female Infertility Treatment, Male Infertility Treatment • By End User (Fertility Centers, Hospitals & Surgical Clinics, Cryobanks, Research Institutes) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Merck & Co., Inc., Ferring Pharmaceuticals, CooperSurgical, Inc., Vitrolife AB, Cook Medical, Fisher Scientific, Irvine Scientific, Esco Medical, Origio, Genea Biomedx, INVO Bioscience, FUJIFILM Irvine Scientific, Hamilton Thorne Ltd., Nidacon International AB, Cryoport, Inc., Vitrolife Group, Ava AG, Research Instruments Ltd., OXFORD Gene Technology (OGT), Kitazato Corporation, and other players. |

| Key Drivers | • Technological Advancements in Assisted Reproductive Technologies (ART) • Growing Government Assistance and Insurance Benefits |

| Restraints | • Expensive Treatment Expenses and Insufficient Insurance Benefits of Infertility treatment. |