Fiber Optic Connectors Market Size & Growth Analysis:

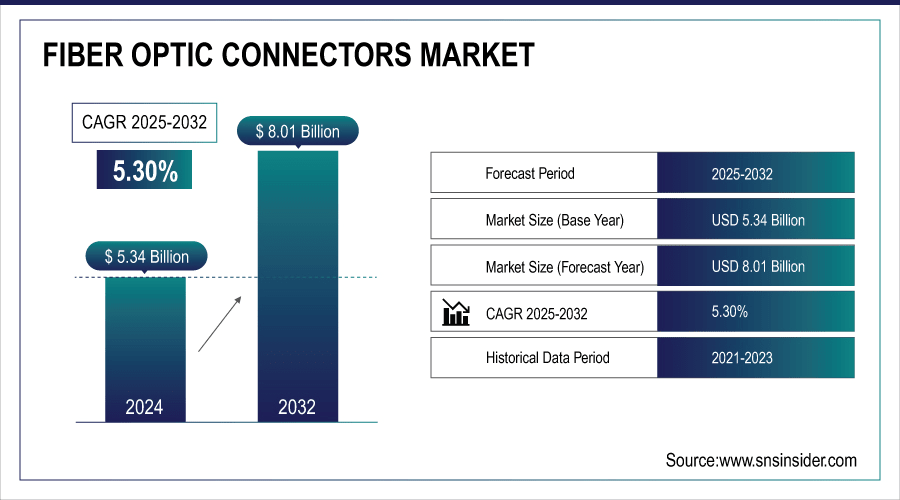

The Fiber Optic Connectors Market Size was valued at USD 5.34 billion in 2024 and is expected to reach USD 8.01 billion by 2032 and grow at a CAGR of 5.30 % over the forecast period 2025-2032.

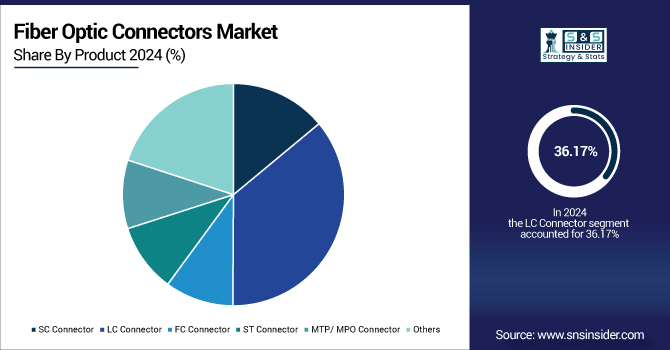

The world fiber optic connectors market growth is due to the growing demand for high-speed data transfer, the spread of telecommunication networks and the opening of data centers. The market includes different types of connectors as SC, LC, FC, ST, MTP/MPO, and Others that serve the particular demand of various end-user industries including telecommunications, medical and healthcare, aerospace, defense, and others.

To Get More Information On Fiber Optic Connectors Market - Request Free Sample Report

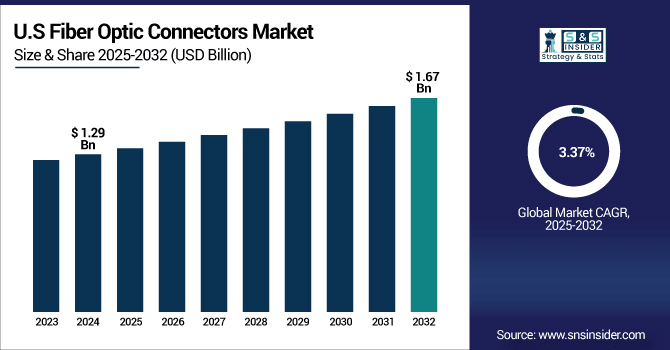

The U.S. Fiber Optic Connectors Market size was USD 1.29 billion in 2024 and is expected to reach USD 1.67 billion by 2032, growing at a CAGR of 3.37 % over the forecast period of 2025–2032.

The US market growth is driven by the rise in adoption of high-speed data services, growth of data centers, and the roll-out of 5G network. Market roads for high speed data transfer in numerous end use industries such as telecommunication, healthcare and military, are expected to drive growth of the market.

According to research, approximately 85% of US households have access to broadband internet, with a growing share subscribing to speeds above 100 Mbps.

Fiber Optic Connectors Market Dynamics

Key Drivers:

-

Growing demand for high-speed data transmission across various industries necessitates the adoption of fiber optic connectors

There is a lot more of data being consumed exponentially with applications such as streaming services, cloud computing and so on which demand the efficient and reliable ways of data transmission. The high-bandwidth and low-signal-loss properties of fiber optic connectors make them suitable for this purpose. They find use in telecommunications, data centers, health, and militaries where fast and reliable transfer of information is critical. The constantly demand of enhanced networking performance and the growing up of high speed Internet combine to essentially drive up the demand of the fiber optic connector.

According to research, over 60% of households in developed countries have access to gigabit-speed internet, increasing demand for reliable fiber optic infrastructure.

Restrain:

-

Lack of standardization across manufacturers reduces compatibility, creating integration issues and slowing technology adoption in critical multi-vendor networks

There are no industry standard about fiber optic connector; this means some of the connectors are not compatible with other manufactures. The manufacturers frequently apply different designs, thus resulting into compatibility issues in the multi-vendor network systems. With large enterprises looking to grow their fiber infrastructure, it becomes increasingly difficult to implement a variety of fiber solutions, causing time and costs associated to cutting and fitting customized connectors or adapters. These problems are especially challenging in industries such as telecom and aerospace in which system reliability and speed are critical. Besides, without standardization, quality control is difficult. As a result this hindersmassive deployment, hampers supply chain efficiency, and deters to end users from being moved onto fibre networks which in turn affects market growth and technology scalability.

Opportunities:

-

Rising deployment of 5G networks worldwide creates substantial demand for fiber optic connectors in high-speed, low-latency communication infrastructure systems

5G nets are also driving significant needs for high-end fiber-optic connectors that can service higher speeds with lower latency than ever before. Fiber optic Fiber cables are important for managing the high volume of data for 5G backhaul and fronthaul infrastructure. To really get the job done, rapid data transfer is essential between network components and connectors play a vital part in telecom roll out plans. Amphenol Corporation is well-positioned to benefit from the trend with customized solutions for 5G rollout. The rising demand is further accentuated by the emergence of smart city developments, connected cars and the expansion of IoT, giving manufacturers enhanced opportunities of market penetration, additional revenue streams, and future-proof technology integration into digital ecosystems and future infrastructure.

According to research, Fiber optic technology reduces energy consumption by up to 70% compared to traditional copper cables, supporting greener 5G infrastructure development.

Challenges:

-

Managing signal loss and physical fragility remains a major challenge for fiber optic connectors in harsh environments

Loss of signals from misalignment and the physical weakness of the connector are major problems for the fiber optic connector. Environmental conditions such as moisture, dust, and high/low temperatures may reduce the reliability of the connectors. This degrades signal integrity and network up time, particularly in outdoor and industrial environments. Durable yet optically efficient are difficult to find in one package and demand special materials and manufacturing. The type of companies like Corning Incorporated spends a lot in R&D to solve these problems. Overcoming these challenges is important to further grow the use of FO connectors in demanding industries such as the military and aerospace, and telecommunications, which have stringent demands for the reliability of the connectors.

Fiber Optic Connectors Market Segment Analysis:

By Product

The LC segment dominated the highest Fiber Optic Connectors Market Share of about 36.17% in 2024. It is perfect for high-density applications, like data centers and telecommunications equipment. Fiber optic connectors companies like Amphenol Corporation is a major participant in this market and has invested heavily in the development of LC connectors and its products are used across this industry. Push-pull structure of LC connector helps simplify installation and maintenance. Besides, it supports diverse devices and systems, which also contributes to its dominance in various fields.

The MTP/MPO Connector segment is expected to grow at the fastest CAGR of about 7.10% from 2025 to 2032. Such demand is attributed to the need for high-speed data transmission in data centers and enterprise networks. Molex LLC continues to build its MTP/MPO product offering for cloud infrastructure with new DC connectors. Such connectors are capable of receiving a plurality of fibers in a single connector to provide a dense and simple network of the array. Their ability to accommodate applications that require large bandwidth also makes them an indispensable part of future-proof network deployments.

By Application

The Telecom segment dominated the Fiber Optic Connectors Market with the highest revenue share of about 31.90% in 2024. The growth of mobile data, the spread of broadband and the deployment of 5G across the globe are demanding highly resilient networking. The company Corning, a key global supplier, supplies advanced connector products used throughout the telecom network. These companies require the bandwidth and reliability that fiber optic connectors can provide in this fast moving industry. Ongoing fibre-optic telecom backbone investment in the world's fibre-optic market also bolster the segment's market dominance.

The Medical segment is expected to grow at the fastest CAGR of about 11.01% from 2025 to 2032. High-quality data transmission is required with development of new medical devices, such as endoscope, imaging system and laser surgery. However, TE Connectivity provides critical precision connectors for use in medical-grade applications. The increasing use of telemedicine and remote diagnostics is pushing healthcare organizations to deploy more dependable fibre optic interfaces. With an increasing emphasis on obtaining real-time data from the patient, the medical fiber optic connectors market is growing at a fast pace.

Fiber Optic Connectors Market Regional Outlook:

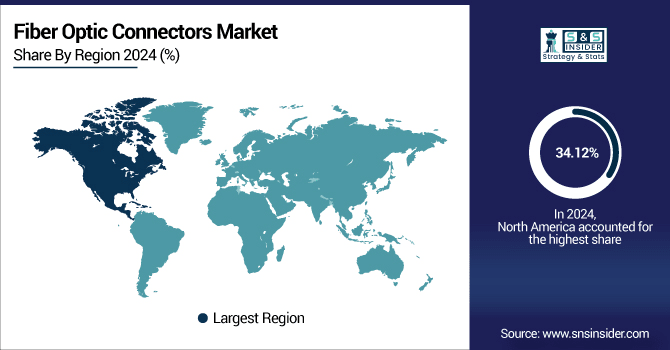

North America dominated the Fiber Optic Connectors Market with the highest revenue share of about 34.12% in 2024. That dominance is provided by the region’s strong telecommunications infrastructure, a track record for early technology adoption, and massive investments being put into 5G and expansion of data centers. The market is also driven by the presence of key industry players and governments support ongoing digital infrastructure improvements. Demand for secure, high-speed connections throughout industries continues to solidify North America as a mark leader in the world.

Get Customized Report as Per Your Business Requirement - Enquiry Now

-

The U.S. market for fiber optic connectors is North America’s largest, noted for a strong and well-developed digital infrastructure, strong government support, high demand for high-speed internet, and widespread deployment of 5G and data centers, stimulating ongoing growth and technological progress in the market.

The Asia Pacific segment is expected to grow at the fastest CAGR of about 6.42% from 2025 to 2032. Fast urbanization, growing telecom networks, and surging data consumption are the key growth attributes. Escalating investments in smart-city, cloud computing, and the deployment of 5G are fuelling the demand for fiber optic connectors. China, India, Japan and other countries are actively building network infrastructure, and the region is now a major hotbed of market expansion and technological innovation for fiber optics.

-

The Asia Pacific fiber optic connectors market is primarily dominated by China on account of huge telecom infrastructure investments, rapid 5G network growth, wide scale urbanization, and government measures for digitization and the country is also the biggest consumer and producer of cutting-edge fiber optic technologies across the Asia Pacific region.

The fiber optic connectors market in Europe is on the rise due to the growing demand for high-speed internet and burgeoning of telecommunications networks and 5G technology in the region. A robust support from the government for digital infrastructure, smart city initiatives, and increasing investments in the construction of data centers drive the market.

-

Germany is leading the Europe fiber optic connectors market on account of its robust industrial sector, developed telecom infrastructure, early adoption of 5G and significant investments in digital and smart city projects which, in turn, is on the high demand and technological advancements across the region.

Middle East & Africa fiber optic connectors industry is led by UAE on account of rapid 5G deployment, rising telecom infrastructure investments and smart city projects. Likewise, Brazil leads the way for Latin America with increasing internet penetration, government policies on digitalization, and demand for high-speed internet are driving huge growth in advanced fiber optics usage.

Fiber Optic Connectors Companies are:

Major Key Players in Fiber Optic Connectors Market are Corning Incorporated, Amphenol Corporation, TE Connectivity Ltd., Molex LLC, Sumitomo Electric Industries, Ltd., 3M Company, CommScope Holding Company, Inc., Radiall SA, LEMO, Fischer Connectors.

Rcent Developments

-

In May 2025, Corning has introduced a new bend-insensitive LC connector designed to withstand harsh environmental conditions, enhancing durability and performance in challenging installations

-

In May 2025, Molex released the External Laser Source Interconnect System (ELSIS), a comprehensive system of cage, optical, and electrical connectors. ELSIS provides engineers with a head start on development and testing, catering to the needs of high-speed data transmission applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.34 Billion |

| Market Size by 2032 | USD 8.01 Billion |

| CAGR | CAGR of 5.30% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (SC Connector, LC Connector, FC Connector, ST Connector, MTP/ MPO Connector, Others) • By Application (Telecom, Oil & Gas, Military & Aerospace, BFSI, Medical, Railway, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Corning Incorporated, Amphenol Corporation, TE Connectivity Ltd., Molex LLC, Sumitomo Electric Industries, Ltd., 3M Company, CommScope Holding Company, Inc., Radiall SA, LEMO, Fischer Connectors |