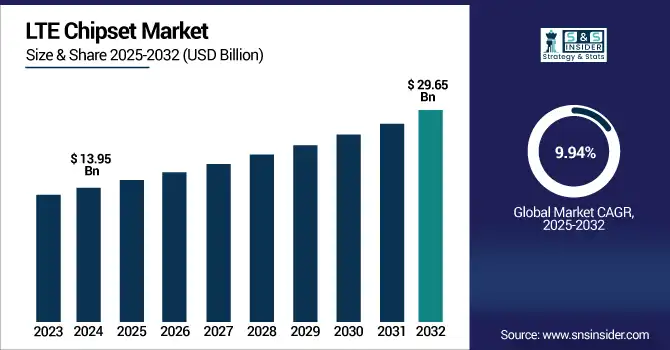

LTE Chipset Market Size & Growth:

The LTE Chipset Market Size was valued at USD 13.95 billion in 2024 and is expected to reach USD 29.65 billion by 2032 and grow at a CAGR of 9.94% over the forecast period 2025-2032. The global LTE chipset market is generating the demand for increased devices supporting both 4G and 5G in both consumer and ICT markets around the world, especially in emerging nations. High-speed mobile broadband is growing explosively in consumer and also enterprise applications driving chipsets makers to innovate more rapidly and to use less power. Furthermore, the design in of LTE chipsets into IoT, smart and connected devices are making them increasingly applicable in more segments than the traditional mobile segments. The world market is in a state of sustained expansion, which is spurred by technology evolving and demand for connectivity as network coverage deepens and data usage increases.

To Get more information on LTE Chipset Market - Request Free Sample Report

According to research, over 720 mobile operators across 220+ countries have commercially launched LTE networks as of early 2025.

The U.S. LTE Chipset Market size was USD 2.51 billion in 2024 and is expected to reach USD 5.76 billion by 2032, growing at a CAGR of 10.99% over the forecast period of 2025–2032.

The US LTE chipset market growth is primarily driven by the rising adoption of 5G-enabled smartphones, increasing IoT device penetration, and rising investments in telecom infrastructure. Additionally, the growing emphasis on high-speed, low-latency connectivity across industries like healthcare, automotive, and manufacturing is fueling demand. U.S.-based chipset manufacturers also benefit from strong R&D capabilities and early 5G commercial deployments, bolstering long-term LTE integration.

According to research, over 97% of the U.S. population is covered by LTE networks as of 2025, with ongoing rural expansion programs by carriers like Verizon and AT&T.

LTE Chipset Market Dynamics

Key Drivers:

-

Rising demand for IoT and M2M communication is accelerating LTE chipset integration in industrial and enterprise applications.

The surge in IoT adoption across sectors like smart manufacturing, logistics, agriculture, and utilities has significantly raised the need for reliable, wide-area wireless communication. LTE chipsets provide the necessary bandwidth, latency, and coverage required by connected devices in harsh or remote environments. Machine-to-machine (M2M) applications such as asset tracking, telemetry, and automation systems are increasingly relying on LTE-M and NB-IoT technologies powered by LTE chipsets. As industries pursue digital transformation and automation, LTE chipsets are becoming essential in building scalable, secure, energy-efficient, and high-performance IoT infrastructures for diverse, real-time operational demands.

According to research, by 2025, approximately 80% of newly deployed smart meters in utility grids will utilize LTE-M or NB-IoT technologies for efficient data transmission.

Restrain:

High power consumption of LTE chipsets remains a limiting factor for compact, battery-powered connected devices.

Despite advancements in LTE chipset efficiency, they still consume relatively high power compared to narrowband technologies. For IoT devices requiring long battery life, such as environmental sensors, wearable devices, and remote monitoring systems, power consumption poses a major constraint. This impacts the design and deployment feasibility of LTE-powered devices in low-maintenance or off-grid scenarios. Manufacturers are continuously working to optimize power efficiency through advanced fabrication, AI-based management, and circuit-level innovations, but until ultra-low power LTE variants become mainstream, this factor will restrain adoption in energy-sensitive applications.

Opportunities:

-

Integration of LTE chipsets in smart vehicles and connected mobility solutions presents vast market expansion potential.

Automakers and mobility service providers are increasingly incorporating LTE chipsets in vehicles for navigation, infotainment, telematics, and over-the-air updates. With the rise of connected car ecosystems, real-time data exchange through LTE is essential for functions like emergency services, diagnostics, and traffic management. LTE-based Vehicle-to-Everything (V2X) technologies are also emerging, enhancing safety and efficiency. As intelligent transport systems evolve, the automotive sector represents a high-growth opportunity for LTE chipset suppliers to diversify applications beyond mobile devices and tap into long-term, high-volume deployments and emerging autonomous mobility infrastructure needs.

According to research, major automakers like Ford, BMW, and Toyota are embedding LTE modules in over 95% of their new vehicle models by 2025 for OTA, infotainment, and telematics.

Challenges:

-

Growing competition from unlicensed spectrum technologies like Wi-Fi and LoRa creates pricing and application pressures for LTE chipsets.

Alternative wireless technologies such as Wi-Fi 6, Wi-Fi 7, and LoRaWAN are gaining traction due to cost advantages, low power use, and unlicensed deployment models. These solutions compete with LTE in smart homes, indoor IoT, and localized communication environments. For chipset vendors, this creates pricing pressure and limits addressable market segments. Additionally, the ease of deploying these alternatives without spectrum licenses or telecom dependencies makes them attractive for many businesses. LTE chipsets must demonstrate superior performance, scalability, and ROI to retain competitiveness in overlapping application areas.

LTE Chipset Market Segment Analysis:

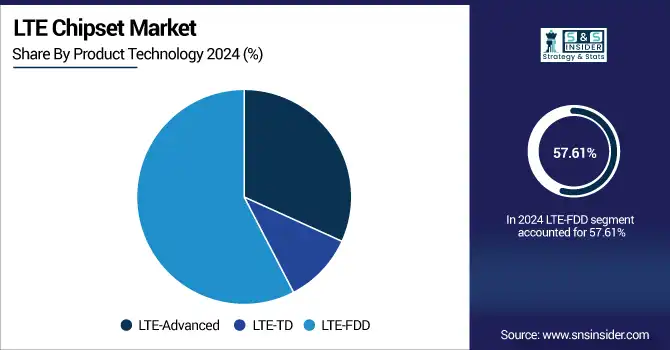

By Product Technology

The LTE-FDD segment dominated the highest LTE chipset market share of about 57.61% in 2024, primarily due to its widespread global deployment and compatibility with existing frequency bands. Its ability to offer better spectral efficiency and reduced interference made it a preferred choice for mobile operators, particularly in densely populated urban regions. Moreover, strong infrastructure support, a mature ecosystem, and extensive commercial adoption by telecom providers further reinforced its dominance in both developed and developing economies.

The LTE-Advanced segment is expected to grow at the fastest CAGR of about 10.99% from 2025 to 2032, driven by rising demand for high-speed data, ultra-low latency, and improved network capacity. With the increasing adoption of applications like 4K streaming, IoT, and augmented reality, LTE-Advanced offers critical enhancements such as carrier aggregation and MIMO technologies. Qualcomm Incorporated plays a key role in driving this segment with its advanced LTE modem technologies supporting enhanced data throughput and network efficiency.

By Component

The hardware segment dominated the LTE chipset market in 2024 with the highest revenue share of about 33.28%, owing to the strong demand for physical components such as RF transceivers, baseband processors, and power amplifiers. As LTE continues to be integrated into a wide array of devices ranging from smartphones to automotive and IoT applications hardware remains essential for enabling connectivity. MediaTek Inc. has significantly contributed to this segment’s dominance by offering cost-effective and high-performance LTE chipsets across a broad product portfolio.

The software segment is projected to grow at the fastest CAGR of about 11.58% from 2025 to 2032 due to the increasing need for flexible, upgradable, and efficient LTE solutions. As networks evolve, software-defined functionalities allow for dynamic spectrum management, enhanced security, and seamless device-to-network communication. LTE chipset companies such as Intel Corporation are actively advancing this segment by developing LTE software stacks optimized for network function virtualization and cloud-based radio access networks, enabling scalable and agile deployment across various use cases.

By End User

The smartphones segment dominated with the highest revenue share of about 35.30% in 2024, as LTE chipsets are a fundamental component in nearly all modern smartphones, enabling high-speed data and voice over LTE (VoLTE) services. The global surge in mobile subscriptions, the affordability of LTE-enabled smartphones, and increased mobile internet usage have solidified the segment's leading role. Samsung Electronics Co., Ltd. has remained a key contributor by integrating advanced LTE chipsets in its diverse smartphone lineup across different price segments.

The mobile hotspots segment is projected to grow at the fastest CAGR of about 11.29% from 2025 to 2032 due to rising demand for portable internet access in remote work, travel, and enterprise applications. As connectivity becomes critical in more mobile-centric environments, users are increasingly relying on LTE-based hotspots to ensure reliable, high-speed connections outside fixed networks. Huawei Technologies Co., Ltd. is a notable player accelerating this growth with its innovative LTE-enabled mobile hotspot devices tailored for global markets.

LTE Chipset Market Regional Insights:

Asia Pacific dominated the LTE chipset market in 2024 with the highest revenue share of about 37.14%, driven by the massive mobile subscriber base, rapid urbanization, and extensive rollout of LTE networks in countries like China, India, and Japan. Government initiatives to enhance digital connectivity, coupled with the proliferation of smartphones and IoT devices, have significantly boosted LTE adoption. Additionally, strong investment in telecommunications infrastructure and competitive pricing strategies have made LTE widely accessible across urban and rural regions.

-

China leads the Asia Pacific LTE chipset market driven by its massive mobile user base, aggressive 4G deployment, government-backed digital initiatives, and the strong presence of domestic players like Huawei and MediaTek. This robust ecosystem accelerates LTE adoption across devices and industries.

North America is expected to grow at the fastest CAGR of about 11.64% from 2025 to 2032, fueled by ongoing advancements in LTE and 5G technologies, high smartphone penetration, and strong demand for advanced connectivity solutions. The presence of leading chipset manufacturers and telecom operators investing in next-gen network upgrades is accelerating market growth. Furthermore, rising enterprise mobility, connected vehicle adoption, and consumer demand for high-bandwidth applications are intensifying the region's focus on enhancing LTE infrastructure and capabilities.

-

The U.S. dominates the North American LTE chipset market due to its advanced telecom infrastructure, early LTE adoption, and strong presence of key players like Qualcomm and Intel. High smartphone penetration and continuous investment in network upgrades further reinforce its leadership in the region.

Europe’s LTE chipset market is steadily growing, supported by extensive 4G coverage, regulatory push for network modernization, and rising IoT adoption across industries. Countries like Germany, the UK, and France are investing in smart infrastructure and digital connectivity. Additionally, collaboration between telecom operators and chipset manufacturers is fostering innovation and ensuring compatibility with evolving LTE and 5G technologies, further driving market expansion.

-

Germany dominates the European LTE chipset market owing to its robust telecom infrastructure, high mobile penetration, and strong demand for industrial IoT solutions. Significant investments in network modernization and government-backed digital initiatives further enhance its position as the regional leader.

In the Middle East & Africa, the UAE leads the LTE chipset market due to its advanced telecom infrastructure, early LTE adoption, and strong government focus on digital transformation. In Latin America, Brazil dominates, driven by a large mobile user base, expanding 4G networks, and growing demand for LTE-enabled devices.

Get Customized Report as per Your Business Requirement - Enquiry Now

LTE Chipset Companies are:

Major Key Players in LTE Chipset Market are Qualcomm Technologies Inc., MediaTek Inc., Intel Corporation, Samsung Electronics Co., Ltd., Huawei Technologies Co., Ltd., UNISOC, Broadcom Inc., Marvell Technology, Skyworks Solutions Inc., Sequans Communications S.A. and others.

Recent Development:

-

In 2024, Qualcomm introduced the Snapdragon 4s Gen 2 mobile platform mid‑2024, featuring enhanced LTE Cat18 modem support, targeting Xiaomi devices by late 2024.

-

In 2025, MediaTek unveiled the Dimensity 9400+ chipset on April 10, 2025, with an all‑big‑core CPU, LTE+5G modem, and generative‑AI enhancements for mobile devices.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 13.95 Billion |

| Market Size by 2032 | USD 29.65 Billion |

| CAGR | CAGR of 9.94% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Technology (LTE-Advanced, LTE-TD, LTE-FDD) • By Component (Hardware, Discrete cellular modem, Mobile processor/platform, 3GPP IoT chipset, Software, Services) • By End User (Tablets, Smartphones, Mobile Hotspots, USB Dongles, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Qualcomm Technologies Inc., MediaTek Inc., Intel Corporation, Samsung Electronics Co., Ltd., Huawei Technologies Co., Ltd., UNISOC, Broadcom Inc., Marvell Technology Group, Skyworks Solutions Inc., Sequans Communications S.A. |