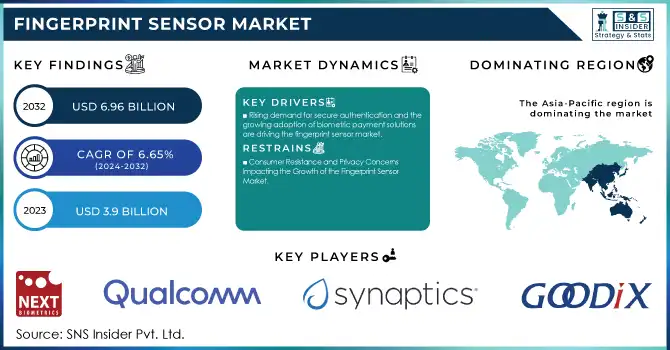

Fingerprint Sensor Market Size & Trends:

The Fingerprint Sensor Market Size was valued at USD 3.9 billion in 2023, and is expected to reach USD 6.96 billion by 2032 and grow at a CAGR of 6.65 % over the forecast period 2024-2032.

The fingerprint sensor market is experiencing significant growth, driven by advancements in technology, increased adoption across various industries, and the growing demand for biometric security solutions. In 2023, interest in AI applications for biometric sensors surged, with the Biometrics Institute reporting a rise from 8% in 2022 to 19% in 2023. This surge in AI adoption has enhanced the accuracy and reliability of fingerprint recognition systems, fostering broader applications in mobile devices, financial services, and beyond.

Get more information on Fingerprint Sensor Market - Request Sample Report

The industry is witnessing a shift toward more sophisticated solutions, particularly in-display fingerprint sensors and multi-modal biometric systems. Ultrasonic sensors have emerged as a major technological advancement, capable of reading fingerprints through materials such as glass and metal, allowing for more flexible and innovative device designs. The emergence of transparent sensors has also opened new possibilities for seamless integration into device displays, further enhancing their functionality. Improvements in processing capabilities have reduced recognition times and bolstered security features, making fingerprint sensors a preferred choice for authentication. In smartphones, manufacturers are increasingly integrating advanced fingerprint sensor technologies beneath display glass, contributing to the growing market.

The convergence of biometric authentication with payment technologies has created new opportunities, particularly in the financial sector. Biometrics-enabled payment cards are gaining popularity, allowing secure and convenient transactions without PIN entry. The automotive sector is also adopting fingerprint recognition for vehicle entry and ignition systems, while smart home security systems are increasingly incorporating fingerprint-based access control. The fingerprint sensor market is set to continue its growth, with multi-factor authentication systems gaining traction. Europe, in particular, is poised to lead the way in digital adoption, with GSMA projecting an 88% smartphone penetration rate and 82% internet penetration by 2025, providing a strong foundation for biometric applications. Standardization efforts are also underway, with stakeholders collaborating to establish unified protocols, ensuring consistent performance and security across platforms.

Fingerprint Sensor Market Dynamics

Drivers

-

Rising demand for secure authentication and the growing adoption of biometric payment solutions are driving the fingerprint sensor market.

Growing demand for secure and efficient authentication methods, especially in the financial services sector. Biometric payment cards, which integrate fingerprint recognition technology, are gaining significant traction. These cards enable secure, contactless transactions, eliminating the need for PINs and enhancing user convenience. A recent survey revealed that 77% of consumers who use biometrics on their smartphones or tablets are satisfied with the technology, underscoring the shift towards biometric identity authentication as a preferred method. This trend is further supported by a frictionless consumer experience, with next-generation biometric payment cards offering advanced features that encourage uptake. 62% of consumers expressed a willingness to switch banks to obtain a biometric payment card, signaling high demand for the enhanced security and convenience these cards provide. The biometric payment cards market is expected to continue expanding in the coming years, driven by increasing smartphone penetration and the rise of contactless payment methods. Biometric payment solutions are spreading rapidly, with notable deployments in regions like the UAE and Europe, which are set to further improve financial transaction security and efficiency. 91% of U.S. consumers are familiar with biometric payment technology, though only 36% have utilized it. These statistics indicate that the fingerprint sensor market's growth is closely tied to the continued evolution of biometric payment systems, which promise to reshape how consumers authenticate transactions across various industries.

Restraints

-

Consumer Resistance and Privacy Concerns Impacting the Growth of the Fingerprint Sensor Market

A significant restraint for the fingerprint sensor market is consumer resistance to biometric authentication, driven by concerns over privacy, security, and a general lack of understanding of the technology. Many consumers remain skeptical about using fingerprint-based systems, particularly due to fears regarding the potential misuse of their biometric data. Despite the convenience and security offered by fingerprint sensors, traditional methods such as PINs and passwords are still perceived by many as safer and more private. 30% of consumers are uncomfortable using biometrics, especially in the context of data breaches or inadequate data protection measures. This concern is echoed by the Biometric Institute, with nearly 50% of respondents expressing doubts about the security of biometric data storage and usage. Privacy remains a top barrier, with 47% of consumers stating they would only adopt biometrics if companies could guarantee the security of their data. In certain regions, such as the United States, consumers continue to favor alternative authentication methods due to a lack of trust in biometric systems. A survey by Biometric Research found that discomfort with biometric sensors is particularly pronounced in markets with limited exposure to such technologies, suggesting that cultural factors also play a role in consumer hesitation. 29% of the global population is still hesitant to adopt biometrics, reflecting ongoing resistance to fingerprint-based systems.

Fingerprint Sensor Market Segment Analysis

By Type

The capacitive segment holds the largest share of approximately 47% in the fingerprint sensor market in 2023. This dominance can be attributed to the widespread use of capacitive fingerprint sensors in smartphones, laptops, and other consumer electronics due to their high accuracy, reliability, and fast response times. Capacitive sensors work by measuring the electrical charge from the ridges and valleys of a fingerprint, offering enhanced image quality compared to other sensor types. Additionally, they are more resistant to wear and tear, making them ideal for devices that require frequent use. The cost-effectiveness and the ability to integrate seamlessly into various devices further support their popularity, solidifying capacitive sensors as the preferred choice for most fingerprint recognition applications.

The ultrasonic fingerprint sensor segment is poised to be the fastest growing in the fingerprint sensor market during the forecast period from 2024 to 2032. This growth is driven by the increasing demand for advanced biometric authentication solutions that offer enhanced security and functionality. Unlike capacitive sensors, ultrasonic sensors use sound waves to capture 3D images of the fingerprint, enabling more precise recognition even in challenging conditions such as wet or dirty fingers. Additionally, they can be integrated under thicker materials like glass, making them ideal for use in smartphones with edge-to-edge displays and other devices requiring sleek, seamless designs. As consumer demand for secure and convenient authentication solutions rises, the ultrasonic sensor segment is expected to experience significant market expansion, benefiting from its superior performance and versatility.

By Application

The smartphones and tablets segment dominated the fingerprint sensor market in 2023, accounting for around 55% of the market share. This dominance is primarily due to the widespread adoption of fingerprint sensors in mobile devices as a convenient and secure method of user authentication. Consumers increasingly prefer biometric authentication over traditional PINs or passwords, as it offers faster and more reliable access to their devices. As smartphone manufacturers continue to innovate, integrating fingerprint sensors into displays and advancing security features, the demand for fingerprint sensors in this segment remains strong. Additionally, the growing trend of bezel-less and edge-to-edge displays has spurred the development of in-display fingerprint sensors, further fueling growth in the smartphones and tablets segment. With mobile devices becoming essential in daily life, this segment is expected to maintain its leading position in the fingerprint sensor market.

The IoT and Other Applications segment is expected to be the fastest growing segment in the fingerprint sensor market during the forecast period from 2024 to 2032. This growth is attributed to the rapid proliferation of IoT devices and the increasing demand for advanced security measures across various applications. As IoT devices become more integrated into everyday life, from smart home systems to healthcare and automotive industries, the need for secure and seamless user authentication is rising. Fingerprint sensors offer a highly efficient and reliable solution for access control and data protection. Additionally, the increasing focus on user convenience and privacy protection further drives the adoption of fingerprint sensors in a wide range of IoT-enabled devices, thereby boosting market growth in this segment.

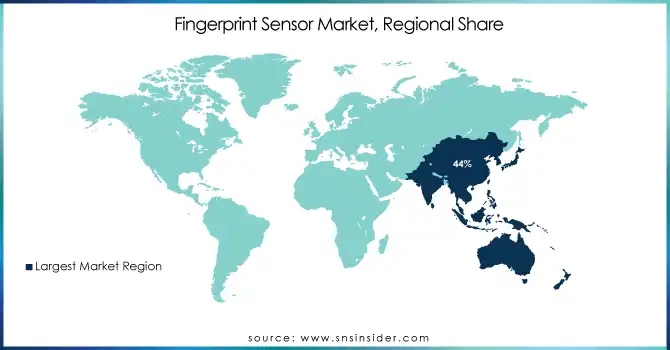

Fingerprint Sensor Market Regional Overview

The Asia-Pacific region is the dominant player in the fingerprint sensor market, accounting for around 44% of the market share in 2023. This dominance can be attributed to rapid technological advancements, high smartphone penetration, and growing adoption of biometric authentication systems across various industries in countries such as China, India, Japan, and South Korea. China, in particular, leads the region with strong government support for the development of biometric technologies and a high rate of smartphone and IoT device usage. Japan and South Korea are also significant contributors, with a focus on advanced security solutions in sectors like banking, healthcare, and consumer electronics. Additionally, the increasing emphasis on security in mobile payments and the expansion of fingerprint sensors in consumer electronics, including wearables and automotive applications, further bolster the region's leadership in the fingerprint sensor market.

North America is the fastest-growing region in the fingerprint sensor market from 2024 to 2032, driven by technological advancements, increasing adoption of biometric authentication in mobile payments, and growing security concerns. The U.S. and Canada lead the market, with companies like Apple and Google integrating fingerprint sensors into smartphones, tablets, and wearables. Additionally, the increasing demand for secure identification systems in banking, healthcare, and government sectors is contributing to market growth. The rise in IoT devices and the push for enhanced data privacy are expected to further fuel growth in the region, positioning North America as a key player in the global fingerprint sensor market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the Major Players in Fingerprint Sensor Market:

-

Shenzhen Goodix Technology Co., Ltd. (China) – (Fingerprint Sensors)

-

Fingerprints (Sweden) – (Fingerprint Biometrics Solutions)

-

Synaptics Incorporated (US) – (Fingerprint Sensors, Touchpads)

-

NEXT Biometrics (Norway) – (Fingerprint Sensors)

-

Novatek Microelectronics Corp. (Taiwan) – (Display Drivers, Fingerprint Sensors)

-

Qualcomm Technologies, Inc. (US) – (Fingerprint Sensors, Mobile Solutions)

-

THALES (France) – (Biometric Identification, Digital Security Solutions)

-

HID Global Corporation (US) – (Identity Solutions, Fingerprint Sensors)

-

SecuGen Corporation (US) – (Fingerprint Scanners, Biometrics)

-

IDEMIA (France) – (Biometric Solutions, Fingerprint Recognition Systems)

-

3M Cogent Inc. (US) – (Biometric Authentication Solutions)

-

Precise Biometrics (Sweden) – (Fingerprint Scanners, Software)

-

EGIS Technology Inc. (Taiwan) – (Fingerprint Sensors)

-

Crossmatch (US) – (Biometric Devices, Fingerprint Scanners)

-

OXI Technology (Germany) – (Fingerprint Sensors)

-

IDloop (Switzerland) – (Biometric Solutions, Fingerprint Sensors)

-

Sonavation Inc. (US) – (Fingerprint Sensors)

-

Touch Biometrix (UK) – (Fingerprint Sensor Technology)

-

Vkansee (China) – (Fingerprint Sensors)

-

ELAN Microelectronics (Taiwan) – (Fingerprint Sensors)

-

CMOS Sensor Inc. (South Korea) – (Fingerprint Sensor Technology)

-

ID3 Technologies (France) – (Biometric Solutions)

List of Suppliers who Provide Raw material and Component in for fingerprint sensors:

-

TSMC

-

SK Hynix

-

Lumentum Holdings Inc.

-

Murata Manufacturing Co., Ltd.

-

Texas Instruments

-

STMicroelectronics

-

Infineon Technologies

-

NXP Semiconductors

-

Shinko Electric Industries

-

ULVAC Technologies

Recent Development

-

In May 2024 Goodix Unveils New Ultrasonic Fingerprint Solution with vivo X100 Ultra Goodix launches its advanced ultrasonic fingerprint solution in collaboration with vivo, marking a major step in large-scale commercialization. The solution enhances security, recognition speed, and reduces power consumption, meeting the growing demand for ultrasonic fingerprint technology in mobile devices.

-

In Macrch 2024, Mastercards from Thales and FPC, Idex Biometrics Launch in Turkey Fingerprint Cards and Thales have rolled out Mastercard-certified biometric payment cards in Turkey, marking their eleventh global launch. The cards integrate with existing bank infrastructures and POS systems, requiring no upgrades, and are certified by major EMV payment plans.

| Report Attributes | Details |

| Market Size in 2023 | USD 3.9 Billion |

| Market Size by 2032 | USD 6.96 Billion |

| CAGR | CAGR of 6.65% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Optical, Capacitive, Thermal, Ultrasonic) • By Application (Smartphones/Tablets, Laptops, Smartcards, IoT and Other Applications) • By End User Industries (Military and Defense, Consumer Electronics, BFSI, Government, Other End-user Industries) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Shenzhen Goodix Technology Co., Ltd. (China), Fingerprints (Sweden), Synaptics Incorporated (US), NEXT Biometrics (Norway), Novatek Microelectronics Corp. (Taiwan), Qualcomm Technologies, Inc. (US), THALES (France), HID Global Corporation (US), SecuGen Corporation (US), IDEMIA (France), 3M Cogent Inc. (US), Precise Biometrics (Sweden), EGIS Technology Inc. (Taiwan), Crossmatch (US), OXI Technology (Germany), IDloop (Switzerland), Sonavation Inc. (US), Touch Biometrix (UK), Vkansee (China), ELAN Microelectronics (Taiwan), CMOS Sensor Inc. (South Korea), ID3 Technologies (France). |

| Key Drivers | • Rising demand for secure authentication and the growing adoption of biometric payment solutions are driving the fingerprint sensor market. |

| Restraints | • Consumer Resistance and Privacy Concerns Impacting the Growth of the Fingerprint Sensor Market. |