Infrared Thermography Market Size

Get E-PDF Sample Report on Infrared Thermography Market - Request Sample Report

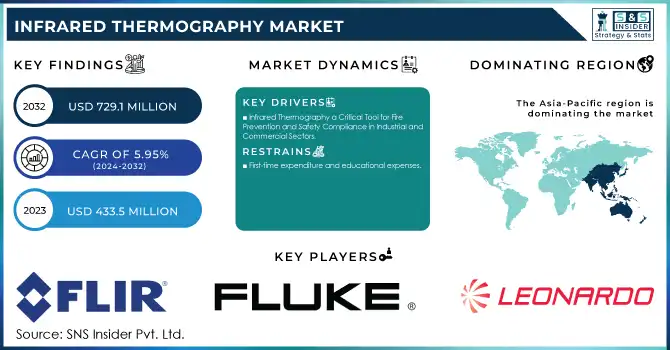

The Infrared Thermography Market Size was valued at USD 433.5 Million in 2023 and is expected to grow to USD 729.1 Million by 2032 and grow at a CAGR of 5.95% over the forecast period of 2024-2032.

The infrared thermography market is experiencing significant growth, driven by the increasing demand for predictive maintenance across various industries, including manufacturing, energy, and utilities. This non-invasive diagnostic tool enables early detection of potential issues, thereby reducing downtime and maintenance costs.In the manufacturing sector, infrared thermography is utilized to monitor equipment such as motors, bearings, and electrical systems, facilitating timely interventions and enhancing operational efficiency. Similarly, in the energy sector, it aids in inspecting power lines, transformers, and substations, ensuring the reliability of energy distribution networks. Notably, 30% of all fires in industrial settings originate from electrical malfunctions. Power lines, being the backbone of energy supply for equipment and operations, require regular maintenance to avoid disruptions. Infrared thermography plays a critical role here by detecting potential electrical problems that could lead to failures in power transmission and distribution, preventing costly downtime and hazards. Utilities employ infrared thermography to assess infrastructure like pipelines and electrical grids, identifying faults before they lead to service disruptions. The adoption of infrared thermography is also expanding in building inspections, where it is used to detect hidden fire and electrical hazards, moisture intrusion, and insulation deficiencies. This capability is crucial for maintaining building safety and energy efficiency. Moreover, with 40% of global energy consumption originating from buildings, retrofitting to improve building envelopes presents an effective solution to reduce energy usage, further driving demand for thermographic technologies. Advancements in infrared camera technologies have made these systems more affordable and accessible, further propelling market growth. Integration with Internet of Things (IoT) devices and artificial intelligence (AI) enhances real-time monitoring and data analysis, providing actionable insights for preventive maintenance strategies. Government regulations focusing on energy efficiency and safety are also contributing to the market's expansion. For instance, compliance with standards such as OSHA and NFPA 70 necessitates regular thermographic inspections of electrical distribution systems, underscoring the importance of infrared thermography in maintaining workplace safety.

Infrared Thermography Market Dynamics

Drivers

-

Infrared Thermography a Critical Tool for Fire Prevention and Safety Compliance in Industrial and Commercial Sectors

The increasing focus on safety and fire prevention in industrial and commercial sectors is a significant driver of the infrared thermography market these risks highlight the need for advanced tools like infrared thermography, which offers a non-invasive and efficient means to identify potential hazards. By detecting heat signatures and anomalies such as hot spots, loose connections, or overloaded circuits, thermography enables timely interventions, minimizing downtime and enhancing the operational safety of critical systems. In commercial settings, thermographic inspections are critical for detecting insulation deficiencies, moisture intrusion, and concealed faults in electrical infrastructure. This is especially vital for large facilities like office complexes, warehouses, and shopping malls, where fire risks pose significant safety and operational challenges. The integration of infrared thermography with technologies like IoT and AI amplifies its effectiveness, enabling real-time monitoring and predictive analytics to proactively address safety concerns. By providing actionable insights, these advancements enhance risk management and ensure facilities remain compliant with safety protocols. Overall, the growing emphasis on fire prevention and safety across industrial and commercial sectors underscores the indispensable role of infrared thermography in safeguarding assets, protecting lives, and ensuring regulatory compliance.

RESTRAIN:

-

First-time expenditure and educational expenses

The use of infrared thermography for building inspections requires the purchase of thermal imaging equipment up front, which entails expensive infrared cameras along with related hardware and software. These upfront expenses can add up, particularly for startups or smaller organizations with tighter budgets. The cost of operating thermal imaging equipment is increased by regular calibrations, accuracy checks, and maintenance. Maintaining the quality of thermal images and guaranteeing accurate findings during inspections require routine maintenance.

Restraints

-

Economic uncertainties, particularly during downturns, lead to budget constraints that affect the growth of the infrared thermography market.

As companies to reduce operational costs, there is often a tendency to delay or scale down investments in advanced diagnostic tools such as infrared thermography systems. These systems, which are essential for predictive maintenance and safety monitoring, require significant upfront capital for purchase and ongoing maintenance, making them less attractive in times of financial instability. According to research, economic factors such as recessions and financial crises can lead to a decline in capital expenditures, including the adoption of technologies like infrared thermography, which are seen as non-essential or high-cost investments in the short term. Furthermore, the uncertainty surrounding global economic conditions can also slow the pace of technological advancements, leading to hesitation in adopting the latest infrared thermography solutions. While the technology offers long-term benefits, including reducing downtime, improving safety, and preventing costly breakdowns, its high initial cost and maintenance requirements can deter potential customers, especially in emerging markets or among smaller businesses that lack the financial flexibility to invest in such tools. As a result, the market faces challenges in widespread adoption, particularly in regions or industries where cost control is a top priority. Economic uncertainties not only limit the purchasing power of organizations but also affect the overall confidence in making long-term investments in diagnostic technologies, thus slowing the growth of the infrared thermography market. Despite these challenges, the growing awareness of the long-term cost savings and safety benefits associated with infrared thermography may help mitigate these economic constraints over time.

Infrared Thermography Market Segmentation Overview

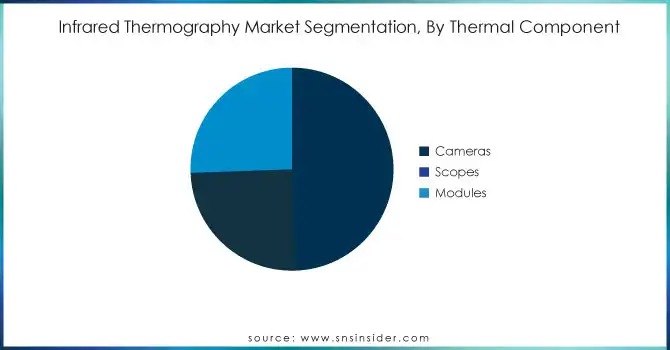

By Thermal Component

In 2023, the Cameras segment dominated the infrared thermography market, accounting for approximately 50% of the market share. This dominance is attributed to the growing demand for high-resolution, portable, and cost-effective infrared cameras used in various applications such as predictive maintenance, building inspections, and safety monitoring. These cameras provide real-time thermal images, allowing for quick detection of anomalies like overheating components, electrical faults, and insulation deficiencies. As industries increasingly adopt preventive maintenance practices, infrared cameras have become essential for identifying potential issues before they lead to costly failures or safety hazards. Additionally, advancements in camera technology, including integration with AI and IoT, have enhanced their capabilities, making them even more attractive for both industrial and commercial sectors.

By End Use Industry

In 2023, the Industrial segment dominated the infrared thermography market, holding around 55% of the market share. This dominance is driven by the widespread adoption of infrared thermography in industrial applications such as predictive maintenance, equipment monitoring, and safety inspections. Industries like manufacturing, energy, and utilities rely heavily on thermography to detect electrical faults, overheating components, and mechanical wear, which helps reduce downtime and improve operational efficiency. The technology’s ability to identify potential issues before they result in costly failures or safety hazards has made it an essential tool in industrial environments. Additionally, the increasing focus on automation, Industry 4.0, and the integration of AI and IoT further enhance the relevance and utility of infrared thermography in industrial settings, ensuring its continued market dominance.

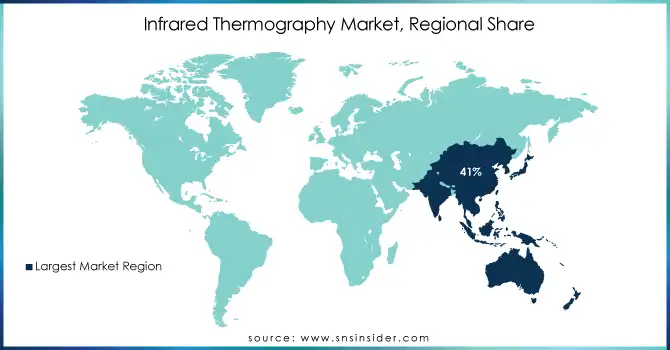

Infrared Thermography Market Regional Analysis

In 2023, the Asia-Pacific region held the largest share of the infrared thermography market, accounting for approximately 41% of the total revenue. The region's dominance is driven by rapid industrialization, significant technological advancements, and increasing demand for predictive maintenance across sectors such as manufacturing, energy, and utilities. China, Japan, and India are key contributors, with China leading due to its massive manufacturing base, while Japan's advanced technology and precision industries boost the demand for thermography solutions. Additionally, the growing emphasis on energy efficiency, safety, and compliance with international standards in sectors like construction and automotive further accelerates market adoption. Government initiatives, along with the integration of AI, IoT, and automation technologies, are strengthening the region’s leadership in the infrared thermography market.

North America is the fastest-growing region in the infrared thermography market over the forecast period from 2024 to 2032. The growth is primarily driven by the increasing demand for predictive maintenance, safety inspections, and energy efficiency solutions across industries such as manufacturing, construction, and utilities. The United States, in particular, is a major contributor to this growth, driven by advancements in technology, regulatory requirements, and the widespread adoption of infrared thermography for electrical inspections, fire prevention, and building assessments. The integration of artificial intelligence (AI) and Internet of Things (IoT) technologies into thermography systems enhances real-time monitoring, making them more effective and efficient.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

KEY PLAYERS

Some of the major players in Infrared Thermography Market with their product:

-

FLIR Systems (Teledyne FLIR) - (Infrared Thermography Cameras)

-

Fluke Corporation - (Thermal Imaging Cameras for Diagnostics)

-

Leonardo DRS - (Thermal Imaging Modules for Defense Applications)

-

BAE Systems - (Thermal Imaging Devices for Military and Surveillance)

-

Raytheon Technologies - (Infrared Sensors and Thermography Systems)

-

L3Harris Technologies - (Infrared Imaging Systems for Industrial Use)

-

Seek Thermal - (Compact Infrared Thermography Cameras)

-

Opgal Optronic Industries - (Thermography Solutions for Industrial Monitoring)

-

Bosch Security Systems - (Thermal Cameras for Building Inspections)

-

Honeywell International - (Infrared Thermography Sensors for Automation)

-

Axis Communications - (Thermal Network Cameras for Security)

-

Thermoteknix Systems Ltd. - (Wearable Infrared Thermography Devices)

-

Excelitas Technologies - (Infrared Detectors for Thermography Applications)

-

Hikvision - (Thermal Imaging Cameras for Perimeter Security)

-

InfraTec GmbH - (Infrared Thermography Measurement Systems)

-

ULIS (Lynred) - (Microbolometers for Thermal Imaging and Thermography)

-

Dahua Technology - (Thermal Cameras for Safety and Surveillance)

-

Wuhan Guide Infrared Co., Ltd. - (Handheld Thermography Cameras)

-

Infrared Cameras Inc. (ICI) - (Thermal Cameras for Industrial Inspections)

-

Testo SE & Co. KGaA - (Thermography Cameras for HVAC Applications)

-

Keysight Technologies - (Infrared Testing and Thermography Solutions)

-

Rohde & Schwarz GmbH & Co KG - (Infrared Thermography and Testing Systems)

-

Anritsu Corporation - (Infrared Imaging Systems for Industrial Use)

-

Teledyne Technologies Incorporated - (Infrared Thermography Cameras and Components)

-

B&K Precision Corporation - (Infrared Thermography Analyzers)

-

Tektronix Inc. - (Infrared Thermography Testing Equipment)

-

National Instruments Corporation - (Thermography and Measurement Systems)

-

Keithley Instruments Inc. - (Thermal Testing and Thermography Instruments)

-

Leader Electronics Corp. - (Infrared Inspection Systems for Thermography)

-

Vaunix Technology Corporation - (Infrared Control Components for Thermography)

List of companies that supply raw materials and components for the infrared thermography market:

-

Infrared Materials Inc.

-

VIGO Photonics

-

Vital Materials

-

SemiConductor Devices (SCD)

-

InfraTec GmbH

-

Excelitas Technologies

-

Lynred

-

Teledyne Judson Technologies

-

Amorphous Materials Inc.

-

5N Plus Inc.

RECENT DEVELOPMENT

-

December 16, 2024 – Leonardo DRS’s Land Systems unit has assured there are no capacity constraints in meeting projected demand for short-range air defense and counter-drone platforms. With ample manufacturing capacity at its St. Louis and West Plains facilities, DRS is prepared to meet both current and future requirements, including the Army's expanding demand for force protection capabilities.

-

April 8, 2024 – Raytheon, an RTX business, has successfully completed thermal vacuum testing of the fourth VIIRS sensor, J4, ahead of schedule. This milestone ensures the VIIRS program remains on track for timely delivery and integration into the NASA-NOAA Joint Polar Satellite System (JPSS) in 2024.

-

November 12, 2024 – Tektronix has unveiled its groundbreaking power instrumentation lineup, including the world’s first RF isolated current probes and a three-channel bidirectional power supply, designed to accelerate innovation in industries requiring enhanced power efficiency and capacity.

| Report Attributes | Details |

| Market Size in 2023 | USD 433.5 Million |

| Market Size by 2032 | USD 729.1 Million |

| CAGR | CAGR of 5.95% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Thermal Component (Cameras, Scopes, Modules) • By Modes (Energy Auditing, HVAC System Inspection, Electrical System Inspection, Insulation Inspection, Structural Analysis, Fire/Flare Detection, Others) • By End Use End Use Industry (Industrial, Commercial, Residential) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | FLIR Systems (Teledyne FLIR), Fluke Corporation, Leonardo DRS, BAE Systems, Raytheon Technologies, L3Harris Technologies, Seek Thermal, Opgal Optronic Industries, Bosch Security Systems, Honeywell International, Axis Communications, Thermoteknix Systems Ltd., Excelitas Technologies, Hikvision, InfraTec GmbH, ULIS (Lynred), Dahua Technology, Wuhan Guide Infrared Co., Ltd., Infrared Cameras Inc. (ICI), Testo SE & Co. KGaA, Keysight Technologies, Rohde & Schwarz GmbH & Co KG, Anritsu Corporation, Teledyne Technologies Incorporated, B&K Precision Corporation, Tektronix Inc., National Instruments Corporation, Keithley Instruments Inc., Leader Electronics Corp., and Vaunix Technology Corporation are key players in the infrared thermography market. |

| Key Drivers | • Infrared Thermography a Critical Tool for Fire Prevention and Safety Compliance in Industrial and Commercial Sectors. |

| Restraints | • Economic uncertainties, particularly during downturns, lead to budget constraints that affect the growth of the infrared thermography market. |