Fibromyalgia Treatment Market Report Scope & Overview:

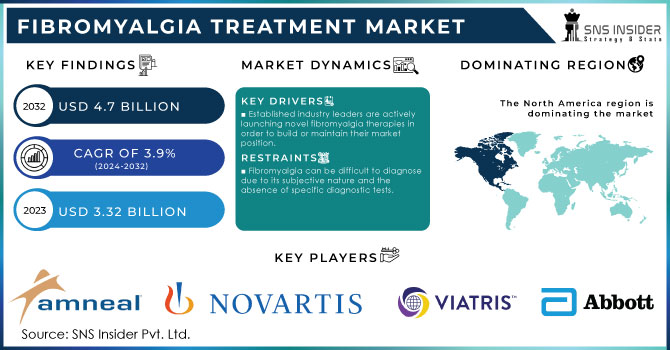

The fibromyalgia treatment market size was USD 3.32 Billion in 2023 and is expected to reach USD 4.70 billion by 2032 and grow at a CAGR of 3.94% over the forecast period of 2024-2032.

The report offers detailed insights into the fibromyalgia treatment market, covering market size, growth rates, and emerging trends. The report highlights the growing prevalence of fibromyalgia, rising diagnosis rates, and growing adoption of antidepressants, anticonvulsants, and muscle relaxants. Key trends include the shift toward personalized medicine, the expansion of online pharmacy channels, and ongoing drug development in clinical pipelines. The study offers segment analysis by drug class and distribution channel, along with regional performance trends. It also studies treatment adherence rates, patient demographics, and economic burden statistics.

To Get More Information on Fibromyalgia Treatment Market - Request Sample Report

The U.S. held the largest share in the fibromyalgia treatment market in 2023, valued at USD 574 Million, and is projected to reach USD 853 Million by 2032, growing at an impressive CAGR of 4.50% during the forecast period.

According to the U.S. CDC, approximately 4 million adults in the country are suffer from fibromyalgia, further creating high demand for effective treatment options. furthermore, the presence of several leading pharmaceutical companies, who are heavily investing in research and development and favorable insurance coverage and reimbursement policies for fibromyalgia therapies, has propelled the market expansion. The position of the U.S. in the market is getting strong owing to the surged public awareness, stringent pipeline of drugs undergoing clinical trials, and availability of FDA-approved medications, including pregabalin and duloxetine. Also, the dominance of the market is driven by a higher rate of diagnosis and treatment-seeking behavior among patients in the U.S. compared with other nations.

Market Dynamics

Drivers:

-

Growing Prevalence of Fibromyalgia Drives Market Growth

The growing prevalence of fibromyalgia globally, coupled with increasing awareness initiatives by healthcare organizations, is a major driver for market growth. According to the U.S. CDC, fibromyalgia affects around 2% of the adult population in the country, with similar prevalence rates reported in Asia Pacific and Europe. the growing number of awareness campaigns by groups, such as the National Fibromyalgia Association and several other government bodies have enhanced the early diagnosis rates, further allowing for timely treatment interventions. These initiatives help normalize fibromyalgia and encourage patients to seek medical help, further raising acceptance of long-term management therapies.

Additionally, the main focus of the healthcare industry is on chronic pain management, which has further led to advancements in pharmacological solutions, fulfilling the rising demand. There is tremendous improvement in patient access to treatment due to the availability of both over-the-counter drugs options and prescription drugs, further boosting the market expansion across several major regions.

Restraints:

-

High Costs Related to Long-Term Fibromyalgia Treatment Hampers Market Expansion

The high costs related with the fibromyalgia's long-term management substantially hampers the market growth, especially in the developing countries. Fibromyalgia needs continuous pharmacological therapies, frequent healthcare visits, and lifestyle changes, which leads to significant financial burdens for patients. However, insurance coverage exists in developed nations including the U.S., and several fibromyalgia-specific medications, including pregabalin and duloxetine that is expensive and is largely involved in ongoing therapy with no permanent cure.

The Out-of-pocket costs for complementary treatments including psychotherapy, physical therapy, and many alternative therapies, such as acupuncture that raise household budgets in the future. In many developing nations, limited healthcare reimbursement policies are increasing access to the advanced therapies, which are difficult for the general population. As fibromyalgia is a chronic condition requiring lifelong management, high cumulative treatment costs deter patients from adhering to therapies consistently, thus restraining the market's full growth potential.

Opportunities:

-

Rising Focus on Personalized Medicine and Targeted Therapies Generates Lucrative Growth Opportunities

The rising focus on personalized medicine and the development of targeted therapies for fibromyalgia presents significant growth opportunities for the market. Personalized medicine approaches, which tailor treatments to individual genetic, biological, and lifestyle factors, are gaining traction in chronic pain management. Researchers are increasingly investigating fibromyalgia’s underlying mechanisms, such as neurotransmitter imbalances and genetic predispositions, to develop more specific and effective therapies. Companies are now advancing clinical trials for biologics and novel small-molecule drugs designed to address patient-specific symptoms rather than offering generalized pain relief.

Moreover, diagnostic innovations such as biomarker identification are enabling early and more accurate detection of fibromyalgia, allowing for precision treatment approaches. With patient demand shifting toward customized, highly effective therapies that minimize side effects, the market is expected to capitalize on this emerging personalized care trend over the next few years.

Challenges:

-

Lack of Standardized Diagnostic Criteria and Misdiagnosis Challenge the Market Expansion

One of the major challenges hindering the fibromyalgia treatment market is the lack of standardized diagnostic criteria, leading to frequent misdiagnosis. Fibromyalgia symptoms often overlap with other conditions such as rheumatoid arthritis, chronic fatigue syndrome, and depression, making accurate diagnosis difficult even for experienced healthcare providers.

Although diagnostic guidelines have improved over time, fibromyalgia remains largely a diagnosis of exclusion, with no definitive laboratory tests available. This uncertainty results in delayed or incorrect diagnoses, causing frustration among patients and limiting early treatment opportunities. Consequently, undiagnosed and misdiagnosed patients often experience worsened symptoms, reducing the effectiveness of subsequent treatments. The lack of consistent, universally accepted diagnostic protocols across countries and healthcare systems further complicates the management and treatment outcomes of fibromyalgia, posing a considerable barrier to market growth and therapeutic advancements.

Segmentation Analysis:

By Drug Class

Based on drug class, the antiepileptics held the largest fibromyalgia market share, which was around 55%, in 2023. The growth is driven by their proven efficacy in chronic pain symptoms management related to the condition. Medications including gabapentin and pregabalin, primarily developed for epilepsy, have been largely recommended and approved for fibromyalgia due to their ability to modulate nerve signals and decrease widespread discomfort and pain. The effectiveness of antiepileptics to relieve neuropathic pain, which is a major feature of fibromyalgia, has led to their widespread prescription by healthcare providers globally.

Furthermore, the high availability of strong clinical evidence backing their use, along with several regulatory approvals from agencies, such as the U.S. FDA, has improved the confidence of patients and physicians in conducting antiepileptic therapies. As patients often require long-term medication management, the dependable symptom control offered by antiepileptic drugs continues to solidify their dominant position in the market.

By Distribution Channel

On the basis of distribution channel, the hospital pharmacy segment dominated the market in terms of share at around 44% in 2023. The critical role hospital pharmacies play in managing chronic conditions and dispensing specialized medications under medical supervision, propel segment's expansion in the market. Patients that are diagnosed with fibromyalgia generally require prescription-only including muscle relaxants, antiepileptics, and antidepressants, that are commonly used during specialized pain management clinics and hospital visits.

Hospital pharmacies provide immediate access to a large range of approved medications, facilitate close monitoring for side effects, and dosage adjustments on the basis of physician consultations, particularly for the newly diagnosed patients. Furthermore, the growing number of hospital admissions with chronic pain and the high preference of patients for professional healthcare settings to start treatment regimens have further boosted the dominance of hospital pharmacies in the market. The ability hospital pharmacies to manage complex medication needs and provide integrated care makes them an initial dispensing channel for fibromyalgia therapies.

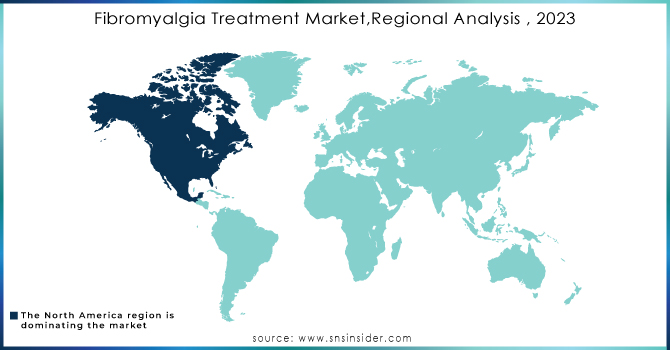

Regional Analysis:

North America held the largest market share around 42% in 2023. It is due to the high prevalence of fibromyalgia, advanced healthcare infrastructure, and strong awareness among patients and healthcare providers. According to the U.S. Centers for Disease Control and Prevention (CDC) data, millions of adults are suffering fibromyalgia, which creates a substantial demand for effective treatment options in the U.S. North America is also benefited from robust healthcare spending, rapid newly approved therapies adoption, and widespread availability of prescription medications.

Additionally, favorable initiatives and reimbursement policies imposed by organizations including the American College of Rheumatology for promoting early diagnosis and disease management have fueled region's growth in the market. The presence of several key pharmaceutical firms that are heavily investing in research and development of drugs, integrated with the rising patient access to pain management centers and specialty clinics and pain management centers, further boosts the position of North America in the market.

Europe held a significant market share in the fibromyalgia treatment market. This is due to the region's strong healthcare infrastructure, rising awareness of chronic pain disorders, and supportive government initiatives promoting early diagnosis and treatment. The well-established healthcare systems in countries, such as the U.K., Germany, Spain, and France, facilitate patient access to fibromyalgia therapies via insurance coverage and national health services. The growing focus on research into chronic pain management and partnerships among various academic institutions and pharmaceutical companies, has further driven the market expansion.

Moreover, the European League Against Rheumatism (EULAR) provides guidelines, further offering standardized treatment practices across Europe for better patient results. The surging geriatric population, which is more prone to fibromyalgia, and the surging demand for multidisciplinary treatment approaches, such as non-pharmacological and pharmacological therapies, continue to boost Europe's growth in the market.

Do You Need any Customization Research on Fibromyalgia Treatment Market - Enquire Now

List of Key Players in the Fibromyalgia Treatment Market:

-

Amneal Pharmaceuticals LLC (Gabapentin, Pregabalin)

-

Novartis AG (Lyrica, Aimovig)

-

Viatris Inc. (Gabapentin, Pregabalin)

-

Sun Pharmaceutical Industries Limited (Pregabalin, Duloxetine)

-

Abbott Laboratories (Depakote, Nortriptyline)

-

Lupin Limited (Pregabalin, Gabapentin)

-

Zydus Lifesciences Limited (Fluoxetine, Clonazepam)

-

Eli Lilly and Company (Cymbalta, Emgality)

-

Teva Pharmaceutical Industries Ltd. (Amitriptyline, Pregabalin)

-

AbbVie Inc. (Elagolix, Nortriptyline)

-

Pfizer Inc. (Lyrica, Tofacitinib)

-

Mylan Pharmaceuticals (Gabapentin, Duloxetine)

-

Roche (MabThera, Actemra)

-

Johnson & Johnson (Xarelto, Spravato)

-

Boehringer Ingelheim (Ofev, Spiriva)

-

GSK (GlaxoSmithKline) (Ventolin, Duloxetine)

-

Bristol-Myers Squibb (Orencia, Eliquis)

-

Merck & Co. (Keytruda, Duloxetine)

-

Amgen Inc. (Aimovig, Enbrel)

-

AstraZeneca (Fasenra, Lynparza)

Recent Development:

-

In October 2024, Amneal Pharmaceuticals LLC received U.S. FDA approval for its Pyridostigmine Bromide Extended-Release Tablets, a once-daily treatment designed for the U.S. Armed Services. Additionally, in June 2024, the company expanded its injectables portfolio with the launch of six new therapies, aimed at addressing critical shortages in the U.S. institutional market.

-

In 2024, Eli Lilly's Cymbalta (duloxetine) gained U.S. FDA approval for the treatment of fibromyalgia, after two major clinical trials that showed significant improvement in symptoms and pain reduction.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.32 Billion |

| Market Size by 2032 | USD 4.70 Billion |

| CAGR | CAGR of 3.94 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug Class (Antidepressants, Anticonvulsants, Muscle relaxants, Others), •By Distribution Channel (Hospital Pharmacy, Drug stores, Retail Pharmacies, Online Providers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amneal Pharmaceuticals LLC, Novartis AG, Viatris Inc., Sun Pharmaceutical Industries Limited, Abbott Laboratories, Lupin Limited, Zydus Lifesciences Limited, Eli Lilly and Company, Teva Pharmaceutical Industries Ltd., AbbVie Inc., Pfizer Inc., Mylan Pharmaceuticals, Roche, Johnson & Johnson, Boehringer Ingelheim, GSK (GlaxoSmithKline), Bristol-Myers Squibb, Merck & Co., Amgen Inc., AstraZeneca. |