Financial Risk Management Software Market Report Scope & Overview:

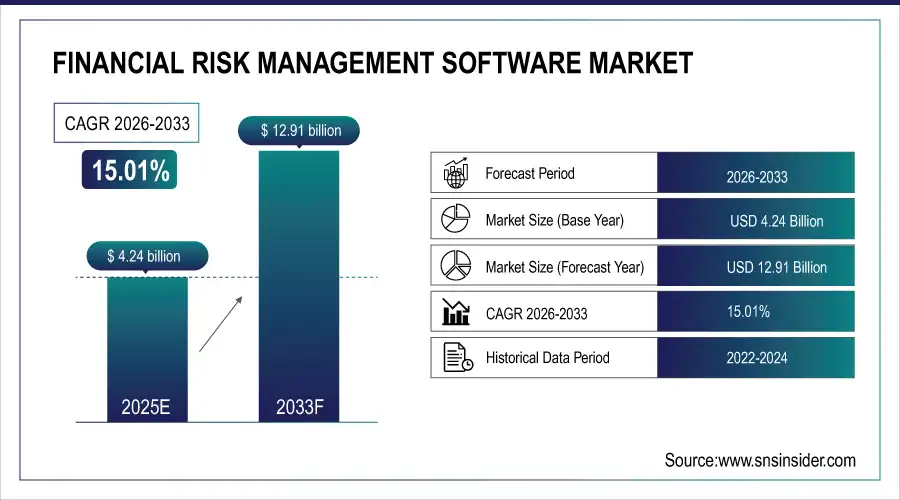

Financial Risk Management Software Market is valued at USD 4.24 billion in 2025E and is expected to reach USD 12.91 billion by 2033, growing at a CAGR of 15.01% from 2026-2033.

The growth of the financial risk management software market is driven by rising regulatory compliance requirements, increasing market volatility, and growing exposure to credit, operational, and cyber risks. Financial institutions are adopting advanced analytics, AI, and real-time risk assessment tools to improve decision-making and resilience. Expansion of digital banking, complex investment portfolios, and the need for enterprise-wide risk visibility further accelerate adoption across banks, insurers, and asset management firms.

82% of financial firms deployed AI-powered risk management software enhancing real-time visibility, meeting regulatory demands, and mitigating credit, operational, and cyber risks amid market volatility.

Financial Risk Management Software Market Size and Forecast

-

Market Size in 2025E: USD 4.24 Billion

-

Market Size by 2033: USD 12.91 Billion

-

CAGR: 15.01% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Financial Risk Management Software Market - Request Free Sample Report

Financial Risk Management Software Market Trends

-

Increasing adoption of cloud-based risk management solutions to enhance real-time monitoring and regulatory compliance

-

Growing integration of AI and machine learning for predictive risk analytics and automated decision-making

-

Rising demand for enterprise-wide risk platforms to consolidate credit, market, and operational risk management

-

Expansion of cybersecurity and fraud detection features to protect sensitive financial data and transactions

-

Increasing use of scenario analysis and stress testing tools for proactive risk mitigation strategies

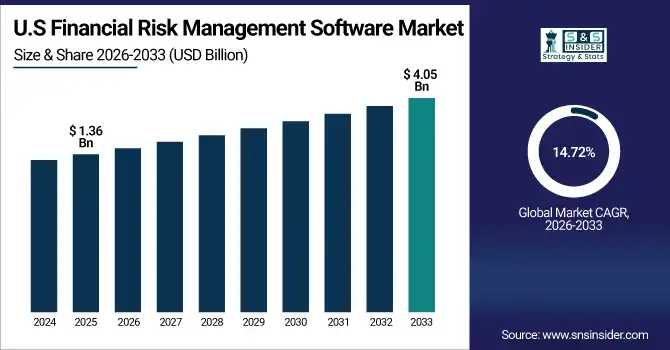

U.S. Financial Risk Management Software Market is valued at USD 1.36 billion in 2025E and is expected to reach USD 4.05 billion by 2033, growing at a CAGR of 14.72% from 2026-2033.

The U.S. financial risk management software market is growing due to strict regulatory compliance mandates, rising cybersecurity and fraud risks, and increasing financial market volatility. Banks and enterprises are investing in AI-driven, real-time risk analytics to strengthen governance, improve forecasting accuracy, and support digital transformation initiatives across financial operations.

Financial Risk Management Software Market Growth Drivers:

-

Increasing regulatory compliance requirements and stringent risk management standards are driving adoption of financial risk management software across banks, financial institutions, and corporations globally

Governments and regulatory bodies worldwide have introduced stringent compliance standards, including Basel III, IFRS 9, and Dodd-Frank regulations, to mitigate financial risks. Organizations face increasing pressure to monitor, report, and manage credit, market, and operational risks efficiently. Financial risk management (FRM) software enables institutions to automate compliance reporting, track risk exposure in real time, and maintain transparency with regulators. The growing complexity of financial regulations has accelerated FRM software adoption, helping banks and corporations reduce regulatory penalties, enhance decision-making, and maintain operational resilience across global markets, supporting overall market growth.

81% of global financial institutions adopted FRM software to meet tightening regulatory mandates and strengthen risk governance across banking and corporate sectors.

-

Growing complexity of financial transactions and rising exposure to credit, market, and operational risks is fueling demand for advanced risk management software solutions

Global financial markets are becoming increasingly complex, with interconnected economies, diversified portfolios, and sophisticated financial instruments. Organizations face higher exposure to credit defaults, market volatility, liquidity risks, and operational uncertainties. Advanced FRM software provides predictive analytics, scenario modeling, and real-time monitoring to identify and mitigate potential threats. These solutions enable businesses to manage risk proactively, optimize capital allocation, and safeguard profitability. As companies seek to enhance risk visibility and reduce unexpected losses, the demand for comprehensive, technologically advanced FRM software continues to grow, especially among banks, investment firms, and large enterprises.

79% of financial institutions invested in advanced risk management software to address escalating credit, market, and operational risks from increasingly complex transactions.

Financial Risk Management Software Market Restraints:

-

High implementation costs and integration challenges with legacy systems restrict adoption of financial risk management software, particularly among small and medium-sized enterprises

Implementing FRM software requires significant investment in technology, training, and infrastructure. Small and medium-sized enterprises (SMEs) often lack the financial resources and IT capabilities to deploy advanced risk management solutions. Additionally, integrating new software with existing legacy systems can be technically challenging, time-consuming, and disruptive to business operations. Compatibility issues, data migration complexities, and high customization costs can further hinder adoption. These financial and technical barriers slow market growth, limiting FRM software penetration among smaller organizations that could benefit from improved risk monitoring, predictive analytics, and compliance management.

70% of SMEs avoided financial risk management software due to high implementation costs and legacy system integration hurdles, limiting adoption despite rising regulatory pressures.

-

Lack of skilled professionals and limited technical expertise to operate advanced FRM software slows deployment and reduces overall market growth

FRM software requires trained risk analysts, IT specialists, and data scientists to configure, monitor, and interpret complex analytics. Many organizations face shortages of personnel with the necessary technical expertise, particularly in emerging markets. Insufficient training and lack of awareness about software capabilities hinder optimal usage and reduce operational efficiency. Organizations may delay adoption or underutilize software features, impacting return on investment. This talent gap limits scalability and slows market expansion, as companies must invest additional time and resources in hiring, training, and retaining skilled professionals to maximize FRM software benefits.

65% of financial institutions delayed FRM software adoption due to a shortage of skilled professionals, slowing deployment and limiting market growth by an estimated 20%.

Financial Risk Management Software Market Opportunities:

-

Integration of artificial intelligence, machine learning, and cloud-based platforms offers opportunities to enhance predictive risk analytics, real-time monitoring, and automation in FRM solutions

Technological advancements, including AI, machine learning, and cloud computing, are transforming financial risk management. AI-powered algorithms can detect anomalies, predict credit defaults, and optimize portfolio risk, while cloud-based platforms provide scalable, real-time access to risk data. Automation reduces manual errors, improves operational efficiency, and allows institutions to respond quickly to market changes. FRM providers can leverage these technologies to develop innovative solutions, attract new clients, and enhance product offerings. Adoption of intelligent, cloud-enabled FRM systems represents a major growth avenue, especially among financial institutions seeking enhanced predictive capabilities and regulatory compliance.

In 2025, 76% of financial risk management (FRM) platforms integrated AI, ML, and cloud technologies enabling real-time monitoring, predictive analytics, and 40% faster risk response.

-

Increasing demand for comprehensive enterprise risk management solutions across emerging markets provides significant growth potential for financial risk management software providers

Emerging economies are witnessing rapid financial sector growth, with banks, investment firms, and corporates seeking robust risk management frameworks. Increased exposure to credit, market, and operational risks in these regions drives demand for integrated FRM solutions. Companies require tools to manage liquidity, compliance, fraud, and operational risks efficiently while maintaining transparency for stakeholders. As awareness of risk mitigation benefits grows, FRM software adoption is expected to increase. Providers entering emerging markets have opportunities to capture untapped client segments, expand regional presence, and contribute to financial stability and resilience across developing economies.

In 2025, 68% of financial risk software providers expanded into emerging markets driven by rising demand for integrated ERM solutions amid regulatory complexity and digital transformation.

Financial Risk Management Software Market Segment Analysis

-

By Component: Software led with 48.5% share, while Support & Maintenance is the fastest-growing segment with CAGR of 18.2%.

-

By Deployment Mode: On-Premises led with 42.7% share, while Cloud-Based is the fastest-growing segment with CAGR of 20.3%.

-

By Risk Type: Credit Risk Management led with 36.8% share, while Operational Risk Management is the fastest-growing segment with CAGR of 18.9%.

-

By End-User: Banks & Financial Institutions led with 44.3% share, while Corporate Enterprises is the fastest-growing segment with CAGR of 19.4%.

By Component: Software led, while Support & Maintenance is the fastest-growing segment.

Software dominates the FRM market as it forms the core of risk management solutions, offering modules for credit, market, operational, and enterprise risk. Banks, insurance firms, and corporations rely heavily on software to perform accurate risk modeling, reporting, and compliance management. Its scalability, integration with existing IT infrastructure, and automation capabilities ensure efficiency, accuracy, and regulatory compliance. The widespread adoption across financial institutions, coupled with ongoing demand for upgraded and customized solutions, reinforces software’s dominance as the leading component segment in the FRM market.

Support & Maintenance services are the fastest-growing segment due to increasing reliance on third-party technical support, system upgrades, and managed services. Organizations are investing in maintenance contracts, consulting, and cloud support to ensure continuous operation of FRM systems. Rising complexity of software, regulatory updates, and the need for proactive troubleshooting and performance optimization are fueling demand. Companies increasingly prefer service-based agreements to reduce operational risk, ensure timely updates, and leverage expert support, making this segment the fastest-growing component in the market.

By Deployment Mode: On-Premises led, while Cloud-Based is the fastest-growing segment.

On-Premises deployment leads due to high adoption among large banks and financial institutions that require complete control over data security, compliance, and system customization. Organizations with strict regulatory mandates or sensitive financial data prefer local installations that allow for dedicated IT oversight and integration with existing internal systems. On-premises solutions offer stability, reliability, and robust access controls, which are critical for risk-sensitive operations, solidifying their position as the dominant deployment mode in the FRM software market.

Cloud-Based deployment is the fastest-growing segment, driven by digital transformation, remote accessibility, and scalable infrastructure. Cloud FRM solutions offer flexible subscription models, real-time analytics, and lower upfront costs, making them attractive to mid-sized institutions and corporate enterprises. Increased trust in cloud security, enhanced data processing, and faster deployment are accelerating adoption. Organizations seek cloud platforms to improve collaboration, reduce IT burden, and ensure seamless updates, contributing to strong CAGR growth in this deployment mode segment.

By Risk Type: Credit Risk Management led, while Operational Risk Management is the fastest-growing segment.

Credit Risk Management dominates as it is critical for monitoring borrowers’ financial health and preventing defaults. Banks and financial institutions rely on credit risk tools for lending, portfolio evaluation, and regulatory reporting. Advanced software modules enable risk scoring, scenario analysis, and predictive modeling, making it indispensable in day-to-day operations. The high regulatory focus on credit exposure, loan management, and compliance ensures consistent demand, maintaining its position as the leading risk type segment in the FRM software market.

Operational Risk Management is the fastest-growing segment due to increasing need for managing process, technology, and human errors across financial organizations. Growing regulatory scrutiny, digital transformation, and cyber threat concerns push organizations to invest in operational risk frameworks. Solutions offer real-time monitoring, loss event tracking, and process automation to minimize disruption and financial loss. Adoption is rising across banks, insurance firms, and corporates, driving CAGR growth and positioning operational risk management as a rapidly expanding segment.

By End-User: Banks & Financial Institutions led, while Corporate Enterprises is the fastest-growing segment.

Banks and financial institutions dominate as they are the primary users of FRM software for compliance, portfolio management, credit assessment, and market risk monitoring. Large volumes of financial transactions and complex regulatory requirements necessitate sophisticated risk solutions. These institutions invest in advanced software, integrated support, and expert consulting to ensure accuracy and mitigate losses. Their extensive adoption and recurring software upgrades make them the largest end-user segment in the market.

Corporate enterprises are the fastest-growing segment as non-financial organizations increasingly adopt FRM software to monitor market, operational, and liquidity risks. The growing emphasis on risk-aware decision-making, regulatory compliance, and enterprise risk frameworks drives adoption. Cloud-based FRM tools, user-friendly interfaces, and tailored analytics for corporates accelerate implementation. Enterprises seek scalable, integrated solutions to manage exposures, optimize capital, and support strategic planning, contributing to high growth in this end-user segment.

Financial Risk Management Software Market Regional Analysis

North America Financial Risk Management Software Market Insights:

North America dominated the Financial Risk Management Software Market with a 40.00% share in 2025 due to the presence of leading financial institutions, advanced IT infrastructure, and strong adoption of sophisticated risk management tools. Stringent regulatory frameworks, high demand for real-time risk analytics, and continuous technological innovation further reinforced the region’s market leadership.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Financial Risk Management Software Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 21.06% from 2026–2033, driven by rapid digital transformation in banking and financial services, increasing adoption of cloud-based risk solutions, and rising awareness of regulatory compliance. Expanding financial markets, growing fintech adoption, and investments in AI and analytics technologies accelerate the region’s demand for advanced risk management software.

Europe Financial Risk Management Software Market Insights

Europe held a significant share in the Financial Risk Management Software Market in 2025, supported by mature financial markets, strong regulatory compliance requirements, and widespread adoption of advanced risk analytics tools. The presence of major banks and financial institutions, coupled with increasing demand for integrated, AI-driven software solutions, strengthened Europe’s market position.

Middle East & Africa and Latin America Financial Risk Management Software Market Insights

The Middle East & Africa and Latin America together showed moderate growth in the Financial Risk Management Software Market in 2025, driven by increasing financial sector modernization, rising adoption of digital risk management platforms, and growing awareness of regulatory compliance. Expanding banking infrastructure, fintech investments, and demand for real-time analytics further supported the regions’ emerging presence in the market.

Financial Risk Management Software Market Competitive Landscape:

IBM

IBM is a leading global provider of financial risk management software, offering advanced analytics, artificial intelligence, and data-driven solutions for banks and financial institutions. Its platforms support credit risk, market risk, operational risk, and regulatory compliance. IBM’s solutions integrate AI, machine learning, and cloud capabilities to enhance risk assessment, fraud detection, and stress testing. With a strong global presence and deep industry expertise, IBM helps organizations improve risk visibility, meet regulatory requirements, and make informed, resilient financial decisions.

-

March 2024, IBM launched IBM Risk Analytics for Finance, a cloud-native suite powered by watsonx.ai and watsonx.data, designed for real-time financial risk modeling and scenario analysis.

Oracle

Oracle delivers comprehensive financial risk management solutions through its cloud-based and on-premises platforms, serving banks, insurers, and large enterprises worldwide. Its software supports credit risk modeling, market risk analysis, liquidity risk management, and regulatory reporting. Oracle’s strength lies in scalable databases, advanced analytics, and integrated enterprise systems. By combining risk management with finance and compliance functions, Oracle enables organizations to improve decision-making, ensure regulatory adherence, and manage financial risks efficiently across global operations.

-

October 2023, Oracle enhanced its Financial Services Risk Management Cloud, offering a unified platform for credit, market, liquidity, and operational risk fully integrated with Oracle Fusion Cloud ERP and Banking.

SAP

SAP provides robust financial risk management software as part of its enterprise and finance solutions portfolio, helping organizations identify, analyze, and mitigate financial risks. Its platforms support treasury risk, market risk, credit exposure, and compliance management. SAP leverages real-time data processing, analytics, and cloud technology to deliver accurate risk insights. Widely used by global enterprises and financial institutions, SAP’s solutions enhance transparency, regulatory compliance, and proactive risk control across complex financial environments.

-

January 2025, SAP launched SAP Risk Management for Financial Services, a SaaS solution on SAP Business Technology Platform (BTP), enabling banks and insurers to manage financial and compliance risks in real time.

Financial Risk Management Software Market Key Players

-

IBM

-

Oracle

-

SAP

-

SAS Institute

-

FIS Global

-

Moody’s Analytics

-

Murex

-

IHS Markit

-

RiskMetrics Group

-

Thomson Reuters

-

S&P Global

-

Misys

-

Kyriba

-

Active Risk

-

Pegasystems

-

Resolver

-

MetricStream

-

LogicManager

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 4.24 Billion |

| Market Size by 2033 | USD 12.91 Billion |

| CAGR | CAGR of 15.01% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services, Support & Maintenance) • By Deployment Mode (On-Premises, Cloud-Based, Hybrid) • By Risk Type (Credit Risk Management, Market Risk Management, Operational Risk Management, Liquidity Risk Management, Enterprise Risk Management) • By End-User (Banks & Financial Institutions, Insurance Companies, Hedge Funds & Asset Management Firms, Corporate Enterprises, Government & Regulatory Authorities) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | IBM, Oracle, SAP, SAS Institute, Experian, FIS Global, Moody’s Analytics, Murex, IHS Markit, RiskMetrics Group, Thomson Reuters, S&P Global, Wolters Kluwer, Misys, Kyriba, Active Risk, Pegasystems, Resolver, MetricStream, LogicManager. |