Flat Panel Detector (FPD) Market Report Scope & Overview:

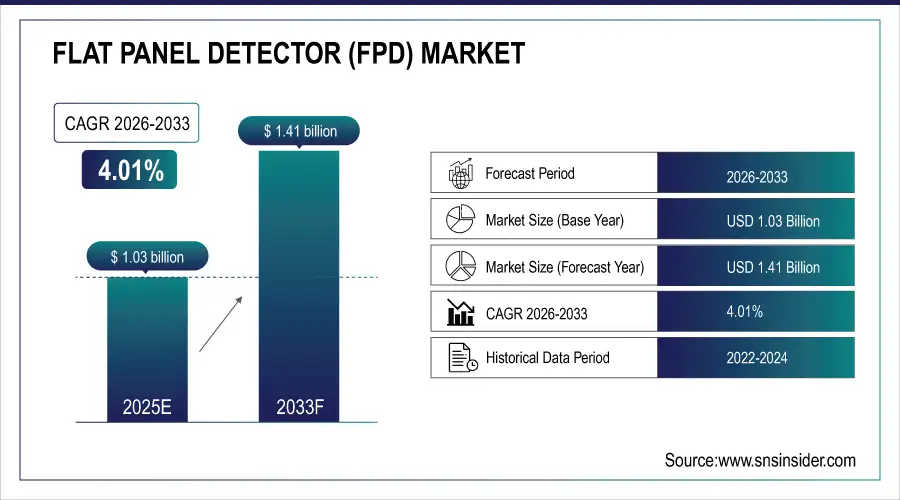

The Flat Panel Detector (FPD) Market size is valued at USD 1.03 Billion in 2025E and is projected to reach USD 1.41 Billion by 2033, growing at a CAGR of 4.01% during 2026-2033.

The Flat Panel Detector (FPD) Market analysis highlights the rising adoption of digital imaging technologies across medical, dental, veterinary, and industrial sectors. Demand is driven by superior image quality, faster processing, and reduced radiation exposure.

Over 85% of new radiography systems globally in 2025 use flat panel detectors, replacing film and CR due to superior image quality and workflow efficiency

Market Size and Forecast:

-

Market Size in 2025E: USD 1.03 Billion

-

Market Size by 2033: USD 1.41 Billion

-

CAGR: 4.01% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Flat Panel Detector (FPD) Market - Request Free Sample Report

Flat Panel Detector (FPD) Market Trends

-

Growing adoption of digital radiography systems as healthcare facilities replace analog and CR systems with advanced flat panel detectors.

-

Increasing integration of AI and machine learning in FPD-based imaging systems to enhance diagnostic precision and workflow efficiency.

-

Rising demand for portable and wireless FPDs in point-of-care diagnostics and mobile medical imaging applications.

-

Expanding use of flat panel detectors in industrial and security sectors for non-destructive testing and inspection.

-

Technological advancements in direct conversion FPDs offering superior image quality, faster processing, and lower radiation exposure.

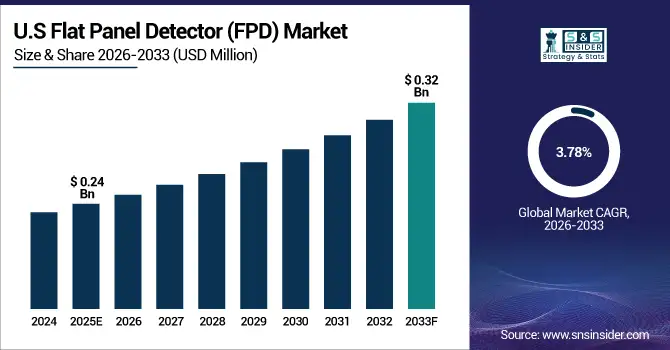

The U.S. Flat Panel Detector (FPD) Market size is valued at USD 0.24 Billion in 2025E and is projected to reach USD 0.32 Billion by 2033, growing at a CAGR of 3.78% during 2026-2033. Flat Panel Detector (FPD) Market growth is driven by rapid digitalization of imaging systems and growing replacement of computed radiography. Increasing adoption across hospitals, diagnostic centers, and dental clinics supports market expansion.

Flat Panel Detector (FPD) Market Growth Drivers:

-

Rising Demand for Digital Imaging Systems and Transition from Analog Radiography

The Flat Panel Detector (FPD) Market growth is expanding due to the global shift toward digital imaging in medical diagnostics, industrial inspection, and security applications is a key market driver. Flat Panel Detectors (FPDs) enable faster image acquisition, superior resolution, and lower radiation exposure compared to analog systems. The growing need for accurate, real-time imaging in hospitals, dental clinics, and research institutions further fuels adoption. Additionally, government initiatives promoting digital healthcare transformation continue to accelerate the replacement of traditional X-ray technologies with advanced FPD systems.

Over 90% of new X-ray systems installed globally in 2025 are digital, with Flat Panel Detectors (FPDs) replacing film and computed radiography due to speed and image quality

Flat Panel Detector (FPD) Market Restraints:

-

High Initial Cost and Complex Integration of Flat Panel Detector Systems

The high cost of flat panel detector systems, particularly direct conversion types, limits adoption in cost-sensitive markets and small healthcare facilities. Integration challenges with legacy imaging systems and the requirement for advanced infrastructure further increase deployment costs. Maintenance expenses and frequent software upgrades add to the total ownership cost, impacting affordability in developing regions. Moreover, reimbursement uncertainties for digital imaging procedures and lack of skilled operators hinder broader market penetration, particularly across rural healthcare setups.

Flat Panel Detector (FPD) Market Opportunities:

-

Growing Adoption in Non-Medical Applications and Emerging Economies Expansion

The Flat Panel Detector market is witnessing new opportunities across non-medical sectors such as industrial inspection, defense, and security screening. Rapid infrastructure growth and modernization in Asia-Pacific and Latin America are creating strong demand for digital imaging technologies. Local manufacturing initiatives and government investments in healthcare digitization enhance accessibility. Additionally, technological advancements like portable and wireless FPDs open new possibilities for mobile diagnostics, veterinary applications, and point-of-care imaging, driving future expansion opportunities globally.

In 2025, over 35% of global FPD sales came from non-medical sectors, including aerospace NDT, border security scanners, and defense imaging systems

Flat Panel Detector (FPD) Market Segment Analysis

-

By Panel Type, Large-Area Flat-Panel Detectors led the market with a 46.50% share in 2025, while Medium-Area Flat-Panel Detectors emerged as the fastest-growing segment with a CAGR of 9.20%.

-

By Application, the Medical segment dominated the market with a 41.80% share in 2025, whereas the Security segment recorded the fastest growth at a CAGR of 10.40%.

-

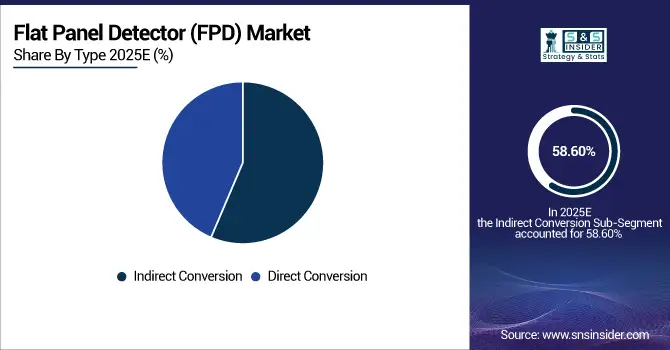

By Type, Indirect Conversion detectors led the market with a 58.60% share in 2025, while Direct Conversion detectors registered the fastest growth at a CAGR of 9.80%.

-

By End-User, Hospitals accounted for 49.30% of the market in 2025, whereas Diagnostic Centers were the fastest-growing segment with a CAGR of 10.10%.

By Type, Indirect Conversion Lead While Direct Conversion Registers Fastest Growth

Indirect conversion detectors dominate the market as they offer a balanced combination of image quality, cost-effectiveness, and high availability across medical and industrial imaging applications. Their proven reliability and lower manufacturing cost make them widely adopted. However, direct conversion detectors are witnessing the fastest growth due to their superior spatial resolution, reduced noise levels, and ability to deliver sharper images for demanding applications such as oncology diagnostics, dental imaging, and high-end radiology equipment.

By Panel Type, Large-Area Flat-Panel Detectors Leads Market While Medium-Area Flat-Panel Detectors Registers Fastest Growth

Large-area flat-panel detectors dominate the market due to their wide usage in radiography, fluoroscopy, and mammography applications, offering superior image capture and diagnostic accuracy. Their ability to cover broader anatomical regions in a single exposure enhances efficiency in hospitals and diagnostic centers. Meanwhile, medium-area detectors are witnessing the fastest growth, driven by rising demand in compact imaging systems, veterinary applications, and portable X-ray devices that require flexible and cost-effective imaging solutions.

By Application, Medical Dominate While Security Shows Rapid Growth

The medical segment holds the largest share in the flat-panel detector market owing to increasing use in digital radiography, dental imaging, and diagnostic screening. Rising cases of chronic diseases and technological advances in healthcare imaging continue to fuel demand. However, the security segment is expanding rapidly, propelled by increasing adoption of FPDs in airport baggage scanners, border security systems, and industrial inspection due to their fast-imaging capability, precision, and non-destructive analysis potential.

By End-User, Hospitals Lead While Diagnostic Centers Grow Fastest

Hospitals dominate the flat-panel detector market owing to their high adoption of advanced digital radiography systems and large patient volumes requiring routine imaging. The demand is driven by modernization of healthcare infrastructure and preference for faster, more accurate diagnostic tools. While, diagnostic centers are the fastest-growing end-user segment, driven by rising outpatient imaging demand, increased private investment in digital imaging technologies, and the growing trend of decentralized and preventive healthcare diagnostics.

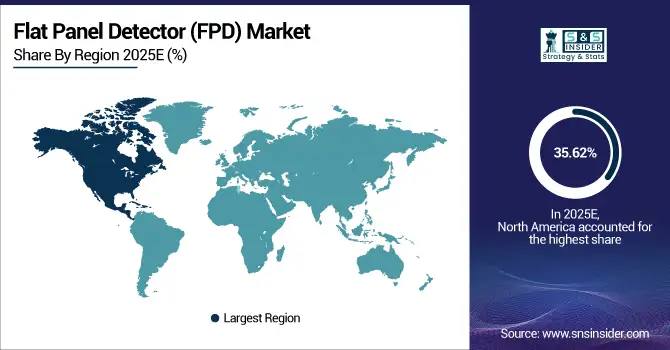

Flat Panel Detector (FPD) Market Regional Analysis:

North America Flat Panel Detector (FPD) Market Insights

In 2025 North America dominated the Flat Panel Detector (FPD) Market and accounted for 35.62% of revenue share, this leadership is due to the advanced healthcare systems, strong R&D investment, and high adoption of digital imaging technologies. The region benefits from the presence of leading players like Varex Imaging, Varian Medical Systems, and Teledyne DALSA. Increasing demand for minimally invasive diagnostics and radiology workflow automation enhances growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Flat Panel Detector (FPD) Market Insights

The U.S. remains the largest contributor to the global FPD market, owing to advanced healthcare infrastructure and continuous innovation in digital radiography. Growing replacement of computed radiography systems with FPD-based solutions is a major driver. The country’s focus on portable and mobile imaging for emergency and remote care strengthens demand.

Asia-pacific Flat Panel Detector (FPD) Market Insights

Asia-pacific is expected to witness the fastest growth in the Flat Panel Detector (FPD) Market over 2026-2033, with a projected CAGR of 4.57% due to expanding healthcare infrastructure, rising digital radiography adoption, and increasing investments in diagnostic imaging. Government initiatives promoting early disease detection and affordable imaging are further enhancing adoption. The presence of key manufacturers and local production facilities supports market expansion and cost competitiveness across the region.

China Flat Panel Detector (FPD) Market Insights

China dominates the Asia-Pacific FPD market, driven by strong domestic manufacturing, government healthcare reforms, and rapid digital transformation in hospitals. Local companies like iRay Technology and Carestream China are major contributors to technological innovation and affordability. Increasing urbanization and healthcare expenditure are boosting demand for digital X-ray and CT imaging.

Europe Flat Panel Detector (FPD) Market Insights

In 2025, Europe emerged as a promising region in the Flat Panel Detector (FPD) Market, due to strong regulatory frameworks and rising healthcare digitalization. Adoption is driven by the EU’s emphasis on diagnostic accuracy and radiation safety. Countries like France, Italy, and Spain are upgrading radiology departments with advanced detectors. Increased investment in hybrid imaging modalities such as PET/CT and growing demand for digital mammography systems contribute to market growth.

Germany Flat Panel Detector (FPD) Market Insights

Germany holds a dominant share in the European FPD market due to its advanced healthcare infrastructure, robust manufacturing base, and focus on precision imaging technologies. The presence of major imaging equipment manufacturers drives innovation and product quality.

Latin America (LATAM) and Middle East & Africa (MEA) Flat Panel Detector (FPD) Market Insights

The Flat Panel Detector (FPD) Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the healthcare modernization and rising awareness of digital imaging benefits. Countries such as Brazil, Mexico, Saudi Arabia, and the UAE are increasing investments in hospital digitalization. Despite budget limitations, public-private collaborations are enhancing access to modern radiology systems. Portable FPD solutions are gaining popularity in rural and underserved areas.

Flat Panel Detector (FPD) Market Competitive Landscape:

Canon Inc. is a leading player in the Flat Panel Detector (FPD) market, offering advanced digital imaging solutions for medical diagnostics and industrial inspection. The company’s detectors provide high resolution, low noise, and fast image processing. Canon focuses on expanding portable and wireless FPD technologies, enhancing workflow efficiency. Continuous innovation in X-ray imaging and integration with AI-based systems strengthen its global market position.

-

In November 2024, Canon partnered with Penn Medicine to develop photon-counting CT systems featuring advanced detector technology, marking a strategic step toward next-generation, high-resolution imaging solutions for enhanced diagnostic precision and clinical efficiency.

Fujifilm Holdings Corporation leverages its imaging expertise to deliver high-quality FPDs for medical, dental, and veterinary applications. Its DR systems provide superior image quality with lower radiation doses. The company emphasizes innovation in energy-efficient and lightweight detectors for improved mobility. Fujifilm continues to invest in AI integration and smart diagnostic systems. Its strong global distribution and R&D initiatives reinforce its leadership in digital radiography.

-

In July 2025, Fujifilm unveiled the FDR Go iQ portable digital radiography system in the U.S., integrating ultra-light glass-free detectors and AI-powered positioning tools for faster, high-quality bedside imaging in healthcare environments.

Konica Minolta, Inc. offers cutting-edge flat panel detectors designed for diagnostic imaging with enhanced image clarity and reduced exposure. The company’s solutions support both fixed and mobile radiography units. It focuses on AI-driven imaging advancements and smart healthcare integration. Continuous product innovations aim to improve speed, reliability, and diagnostic accuracy. Konica Minolta’s global service network ensures widespread adoption and clinical trust.

-

In December 2024, Konica Minolta unveiled the AeroDR PDR wireless 14×17″ flat-panel detector and Bone Suppression Imaging (BSI) solution at RSNA 2024, enhancing diagnostic accuracy, workflow efficiency, and radiographic performance for clinical imaging applications.

PerkinElmer, Inc. is known for high-performance FPDs used in medical imaging, security screening, and industrial inspection. Its detectors deliver superior sensitivity and image sharpness under various conditions. The company emphasizes innovation in digital X-ray conversion and low-dose imaging. PerkinElmer’s strong R&D pipeline focuses on sustainability and miniaturization. Its global presence and technical reliability make it a trusted imaging technology partner.

-

In March 2025, PerkinElmer acquired Project Farma to strengthen its OneSource professional services, expanding imaging, automation, and life-science support capabilities, fostering integrated diagnostic solutions and service innovation.

Flat Panel Detector (FPD) Market Key Players:

Some of the Flat Panel Detector (FPD) Market Companies are:

-

Canon Inc.

-

Fujifilm Holdings Corporation

-

Konica Minolta, Inc.

-

PerkinElmer, Inc.

-

Teledyne DALSA Inc.

-

Varian Medical Systems, Inc.

-

Agfa-Gevaert Group

-

Carestream Health, Inc.

-

Rayence Co., Ltd.

-

Vieworks Co., Ltd.

-

Hamamatsu Photonics K.K.

-

Analogic Corporation

-

DRTECH Corporation

-

Thales Group

-

Trixell

-

iRay Technology Company Limited

-

Varex Imaging Corporation

-

Detection Technology Plc

-

YXLON International GmbH

-

Rigaku Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1.03 Billion |

| Market Size by 2033 | USD 1.41 Billion |

| CAGR | CAGR of 4.01% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Panel Type (Large-Area Flat-Panel Detectors, Medium-Area Flat-Panel Detectors, and Small-Area Flat-Panel Detectors) • By Application (Medical, Dental, Veterinary, Industrial, Security, and Others) • By Type (Indirect Conversion and Direct Conversion) • By End-User (Hospitals, Diagnostic Centers, Research Institutes, and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Canon Inc., Fujifilm Holdings Corporation, Konica Minolta, Inc., PerkinElmer, Inc., Teledyne DALSA Inc., Varian Medical Systems, Inc., Agfa-Gevaert Group, Carestream Health, Inc., Rayence Co., Ltd., Vieworks Co., Ltd., Hamamatsu Photonics K.K., Analogic Corporation, DRTECH Corporation, Thales Group, Trixell, iRay Technology Company Limited, Varex Imaging Corporation, Detection Technology Plc, YXLON International GmbH, Rigaku Corporation |