Drone Cybersecurity Market Size & Trends:

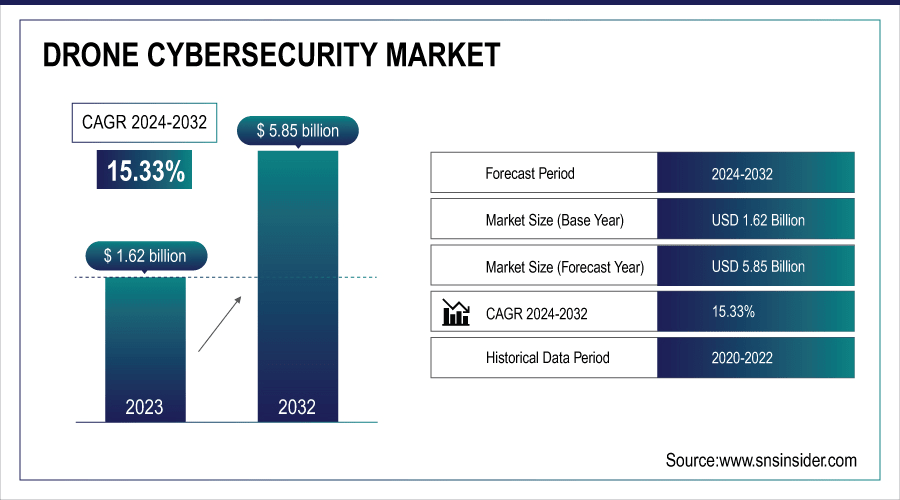

The Drone Cybersecurity Market was valued at 1.62 Billion in 2023 and is projected to reach USD 5.85 Billion by 2032, growing at a CAGR of 15.33% from 2024 to 2032. This growth is primarily driven by the rising frequency of drone-specific malware attacks, increased adoption of AI-powered cybersecurity systems for real-time threat detection, and the rapid implementation of Zero Trust Architecture to counter insider and remote access threats. Additionally, growing concerns around the vulnerability of public infrastructure particularly in smart cities and surveillance applications are pushing governments and enterprises to invest heavily in secure drone communication protocols.

To Get more information on Drone Cybersecurity Market - Request Free Sample Report

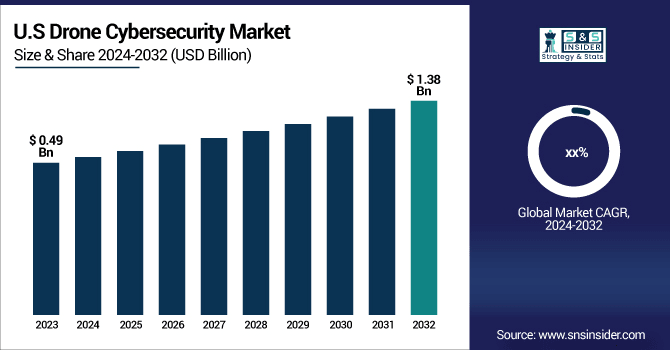

In the United States, the market stood at USD 0.49 billion in 2023 and is expected to reach USD 1.38 billion by 2032, fueled by stringent defense requirements, increasing drone deployments across critical infrastructure, and rising federal investments in cybersecurity frameworks tailored to unmanned aerial systems.

Drone Cybersecurity Market Dynamics:

Drivers:

-

Explosive Drone Adoption and Escalating Cyber Threats Drive Urgent Need for Advanced Drone Cybersecurity Solutions

The rapid expansion of drone use across industries such as defense, logistics, agriculture, and surveillance has created a significant demand for advanced cybersecurity solutions. With more than 200 drone startups and an anticipated economic impact of USD 885 million by 2025 in India alone, driven by innovations like AI and blockchain, the drone sector is witnessing explosive growth (PwC India, Fisdom). This global trend is reflected in the increased adoption of drones for delivery, monitoring, and mapping applications. However, the rising prevalence of low-cost, high-impact drones such as USD 500 FPV models used in modern warfare along with 5G-connected commercial drones, introduces critical security vulnerabilities (Digitimes). The Cybersecurity and Infrastructure Security Agency (CISA) has highlighted the heightened risk of cyberattacks and data breaches through Unmanned Aircraft Systems (UAS), while academic research from Taylor’s University and the Cyber Security Cooperative Research Centre (CRC) of Australia points to the growing threats of GPS spoofing, denial-of-service attacks, and firmware exploitation. These factors collectively emphasize the urgent need for sophisticated, adaptable, and cost-effective cybersecurity solutions to safeguard drone operations. The growing complexity and value of drone applications are driving the strong demand for robust drone cybersecurity measures in both military and civilian sectors.

Restraints:

-

High Implementation Costs as a Major Barrier to Widespread Adoption of Advanced Drone Cybersecurity Solutions

Advanced cybersecurity solutions for drones, particularly those leveraging AI, machine learning, and blockchain, often come with significant costs, making them difficult for smaller companies and startups to implement. The complexity of these technologies requires specialized hardware, software, and expertise, which drives up expenses. This financial strain translates too many organizations, particularly in emerging markets, not being able to afford the requisite security infrastructure, resulting in security coverage gaps. Furthermore, the challenges to widespread adoption of robust cybersecurity measures that slow the growth of the Drone Cybersecurity Market include the time-consuming and expensive nature of implementing, maintaining, and upgrading these systems.

Opportunities:

-

Growing use of 5G-enabled drones creates opportunities for specialized cybersecurity solutions to address new threats from high-speed, low-latency connections.

The increasing reliance on 5G networks for drone communication presents both significant opportunities and challenges in the realm of cybersecurity. As drones leverage the high-speed, low-latency capabilities of 5G for more efficient and real-time operations, they become more susceptible to emerging cyber threats. The ultra-fast communication speeds allow drones to transmit large volumes of data quickly, but they also expose them to potential risks like data interception, unauthorized access, and remote control by malicious actors. To mitigate these risks, there is a growing need for specialized cybersecurity protocols that can safeguard drones operating on 5G networks. This requires cybersecurity solutions that can adapt and protect in real-time across platforms to face these complexities. Securing such a large interconnected ecosystem while not compromising on performance or operational efficiency is one of the major challenges faced by Drone Cybersecurity Market, which further leads to the need for developed integrated cybersecurity frameworks.

Challenges:

-

Complexity of Ensuring Seamless Cybersecurity across Interconnected Drone Systems

The growing adoption of drones, particularly in commercial and military sectors, has led to an increase in the integration of advanced technologies like artificial intelligence (AI), machine learning, and the Internet of Things (IoT). These technologies enable drones to perform complex tasks, but they also create significant challenges in ensuring robust cybersecurity. The interconnected nature of these systems makes it difficult to provide seamless protection against cyber threats. As each system interacts with others, vulnerabilities can be exposed, leading to a higher risk of attacks. This requires cybersecurity solutions that can adapt and protect in real-time across platforms to face these complexities. Securing such a large interconnected ecosystem while not compromising on performance or operational efficiency is one of the major challenges faced by Drone Cybersecurity Market, which further leads to the need for developed integrated cybersecurity frameworks.

Drone Cybersecurity Market Segment Analysis:

By Component

The hardware segment dominated the Drone Cybersecurity Market, accounting for around 41% of the total revenue in 2023. This dominance can be attributed to the critical role that hardware plays in ensuring the security of drone systems, especially in defense, surveillance, and commercial sectors. Hardware solutions, such as advanced encryption modules, secure communication systems, and intrusion detection systems, are essential for preventing cyberattacks and safeguarding sensitive data transmitted by drones. As drones become increasingly integrated into industries like logistics, agriculture, and military applications, the demand for secure, tamper-resistant hardware continues to grow. Additionally, with the rise of advanced drone technologies, including AI-driven flight systems and 5G connectivity, hardware solutions are becoming more sophisticated to address emerging cybersecurity threats.

The software segment of the Drone Cybersecurity Market is expected to be the fastest-growing over the forecast period from 2024 to 2032. This expansion is propelled by an increasing dependence on advanced software solutions including artificial intelligence (AI), machine learning solutions, and blockchain technologies to counteract emerging cyber threats targeting drone systems. With the rising use of drones in essential industries such as defense, logistics, and agriculture, robust demand arises for solutions that ensure real-time threat detection, secure communication channels, and effective encryption protocols. Software solutions offer the adaptive, scalable, cost-efficient cybersecurity needed to safeguard against hacking attempts, data breaches, and other vulnerabilities. Moreover, drone technology continues to advance, with new hardware and features being developed in the market, which will also drive the demand for sophisticated software solutions required to perform complex missions such as autonomous navigation and secure data transfer, further bolstering the rapid growth of the software segment across the drone cybersecurity market.

By Drone Type

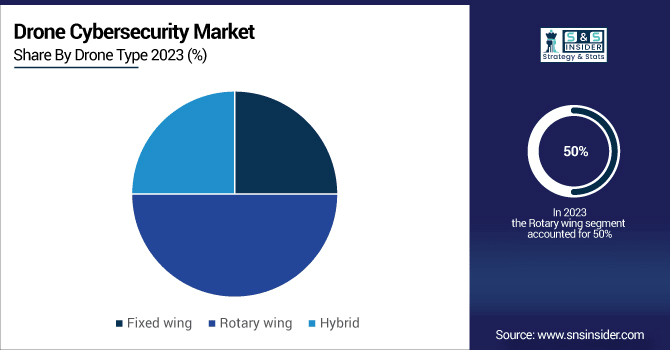

The Rotary-Wing segment is expected to dominate the Drone Cybersecurity Market, accounting for around 50% of the total revenue by 2032. Rotary-wing drones, commonly known as helicopters or quadcopters, are increasingly utilized in various industries, including defense, agriculture, surveillance, and logistics. The complex operations and sensitive data these flying robots often carry, like high-resolution imagery, communications, and real-time analytics, require sophisticated cybersecurity measures. The increased use of rotary-wing drones for utility tasks such as surveillance, monitoring, and package delivery has led to a rising need for firm cybersecurity measures to prevent cyber threats such as hacking, data breaches, and GPS spoofing from happening. With the increasing dependence of these drones in civilian and military operations, the importance of securing these systems and ensuring the safety and reliability of communication channels will be of foremost concern and will continue to establish rotary-wing segment's dominance in the market.

The Fixed-Wing segment is expected to experience rapid growth over the forecast period from 2024 to 2032 in the Drone Cybersecurity Market. Fixed-wing drones, which are typically used for long-range missions and large-area surveillance, are increasingly adopted in sectors like agriculture, defense, and environmental monitoring. These drones offer advantages such as extended flight times and the ability to cover larger areas, making them ideal for tasks like mapping, surveillance, and geospatial data collection. As their use expands, so does the need for specialized cybersecurity measures to protect the sensitive data they collect and transmit. With vulnerabilities in communications and flight systems posing significant risks, securing fixed-wing drones is crucial to preventing cyberattacks that could compromise operations or lead to unauthorized access.

By Application

The military and defense segment dominated the largest share of revenue in the Drone Cybersecurity Market, accounting for approximately 35% in 2023. This segment’s prominence is driven by the increasing use of drones for surveillance, reconnaissance, and combat missions, where the need for robust cybersecurity measures is critical to national security. Military drones are often used in high-risk operations, requiring advanced protection against potential cyberattacks such as GPS spoofing, hacking, and data breaches. As the defense sector continues to adopt more sophisticated, autonomous, and connected drone systems, ensuring their cybersecurity has become a top priority to maintain operational integrity and prevent adversaries from compromising sensitive military assets. With the growing reliance on unmanned aerial systems (UAS) in modern warfare, the demand for specialized cybersecurity solutions to safeguard military drones will continue to rise, driving significant market growth in this segment.

The agriculture segment is the fastest-growing in the Drone Cybersecurity Market from 2024 to 2032. They are used in precision farming, for crop monitoring, irrigation management, and the spraying of pesticides. These unmanned aerial vehicles (UAVs) give farmers real-time data and insights to increase yield and operational efficiency. Yet, as drone usage in agriculture continues to increase, the cybersecurity of these systems is becoming a focal point of concern, particularly as they become more intertwined with IoT devices and AI-directed analytics. Agricultural drones can collect sensitive information about crop health, soil conditions, and yield predictions, so protecting this data from cyberattacks and unauthorized access is essential. Rapid segment growth is fueled by a rising demand for robust cybersecurity solutions to guard against potential attacks such as data breaches, GPS spoofing, and malware.

Drone Cybersecurity Market Regional Outlook:

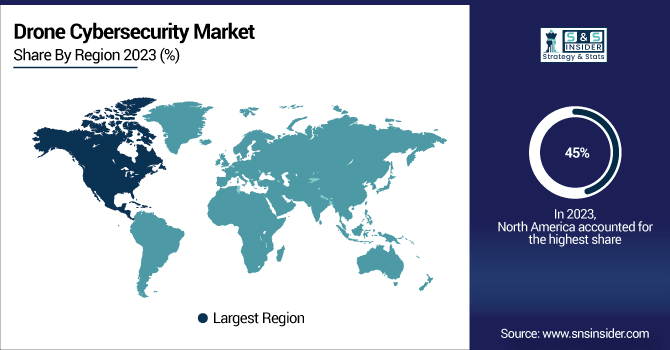

North America dominates the largest share of revenue in the Drone Cybersecurity Market, accounting for around 45% in 2023. The region's stronghold in the market is driven by advanced technological infrastructure, high levels of drone adoption across sectors like defense, agriculture, logistics, and surveillance, and a robust cybersecurity framework. With major players in the aerospace, defense, and tech industries, North America has been at the forefront of drone innovation, leading to an increased demand for sophisticated cybersecurity measures to protect critical drone operations. Additionally, government agencies, including the Department of Defense, have been instrumental in implementing stringent cybersecurity regulations to mitigate the risks associated with drone usage. The region's well-established cybersecurity expertise and rapidly expanding drone sector ensure that North America will continue to maintain a dominant position in the global drone cybersecurity market.

The Asia-Pacific region is expected to experience the fastest growth in the Drone Cybersecurity Market from 2024 to 2032. This increase is supported by the growing use of the drones in the fields presentation agriculture, logistics, defense and surveillance. This growth is supported by rapid tech development combined with favorable governmental basis in regions like India, China and Japan. Furthermore, the increasing adoption of drones, coupled with the rising demand for advanced cybersecurity solutions to mitigate emerging threats, is also driving market growth in this area. The rising presence of drone manufacturers and cybersecurity companies in the region is also driving the growth of the market. With the growing aspirations of Asia-Pacific to adopt drone technology for commercial and military use, the requirement for custom built cybersecurity solutions will certainly remain a driving factor resulting in the growth of the region’s presence in the overall drone.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in Drone Cybersecurity Market along with their Products:

-

Airspace Systems (USA) – Drone detection and management solutions

-

Dedrone (USA) – Counter-UAS systems and drone detection technologies

-

DroneSec (Australia) – Drone cybersecurity services and threat analysis

-

Fortem Technologies (USA) – Drone defense systems and counter-UAS solutions

-

Mobilicom (Australia) – Secure communications for drones and UAS cybersecurity

-

Thales Group (France) – Aerospace and defense technology, including drone security

-

WhiteFox Defense Technologies (USA) – Drone detection and counter-drone systems

-

Raytheon Technologies (USA) – Advanced defense systems, including drone defense technologies

-

Collins Aerospace (USA) – Aerospace systems and UAS cybersecurity solutions

-

Airbus (France) – Aerospace solutions, including drone and UAS technologies

-

General Dynamics (USA) – Drone defense and cybersecurity solutions

-

Boeing (USA) – Aerospace solutions and counter-UAS systems

-

Palantir Technologies (USA) – Data analytics for drone and security applications

-

BAE Systems (UK) – Defense systems and drone detection technologies

-

FireEye (USA) – Cybersecurity services for drone systems

-

IBM (USA) – AI-driven cybersecurity solutions for drones and UAS

-

Accenture (Ireland) – Consulting services, including cybersecurity for drones

-

Cisco Systems (USA) – Network and security solutions for drone systems

-

Microsoft (USA) – Cloud and AI solutions for drone cybersecurity

-

Lockheed Martin (USA) – Aerospace and defense technologies, including drone security

-

Northrop Grumman (USA) – Aerospace and defense systems, including counter-drone technologies

List of companies that supply raw materials and components for the drone and aerospace industries:

-

Hexcel Corporation

-

Toray Industries

-

3M

-

DuPont

-

SABIC

-

Alcoa Corporation

-

ArcelorMittal

-

BASF

-

Victrex

-

Honeywell International

-

TE Connectivity

-

Parker Hannifin

-

Mitsubishi Materials

-

Cree, Inc.

-

Kemet

-

Sicomin

-

Amphenol

-

GKN Aerospace

-

Meggitt

-

Tata Steel

Recent Development:

-

30 Jul 2024, Thales and Garuda Aerospace have signed an MoU to promote secure drone operations and innovation in India, focusing on UTM solutions, UAV detection, and system integration

-

July 11, 2024, Boeing is expanding its autonomous aircraft inspection efforts using AI-based algorithms and small drones, aiming to enhance military aircraft readiness, reduce costs, and improve safety by automating damage detection.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.62 Billion |

| Market Size by 2032 | USD 5.85 Billion |

| CAGR | CAGR of 15.33% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Hardware, Services) • By Drone Type (Fixed wing, Rotary wing, Hybrid) • By Application (Military & defense, Agriculture, Logistics & transportation, Surveillance & monitoring, others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Airspace Systems, Dedrone, DroneSec, Fortem Technologies, Mobilicom, Thales Group, WhiteFox Defense Technologies, Raytheon Technologies, Collins Aerospace, Airbus, General Dynamics, Boeing, Palantir Technologies, BAE Systems, FireEye, IBM, Accenture, Cisco Systems, Microsoft, Lockheed Martin, and Northrop Grumman are key players in drone cybersecurity and defense technologies. |