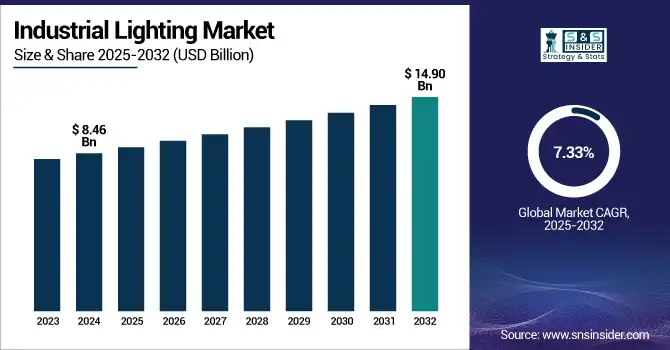

Industrial Lighting Market Size Analysis:

The Industrial Lighting Market size was valued at USD 8.46 Billion in 2024 and is projected to reach USD 14.90 Billion by 2032, growing at a CAGR of 7.33% during 2025-2032.

To Get more information on Industrial Lighting Market - Request Free Sample Report

The industrial lighting market is rapidly evolving as demand shifts toward intelligent, energy-efficient solutions that achieve targets for performance and sustainability. Industry is benefitting from breakthroughs in LED, smart lighting controls, and networked systems, using these to lower energy consumption, operational expenses, and carbon output. Automated, interconnected, and intelligent lighting systems with predictive maintenance and real-time energy data analytics is increasing the norm in factories, warehouses, and logistics centers. Rising focus on grid connectivity, long-term performance, and low-maintenance facilities is catalyzing technological breakthroughs throughout the industry. Beneficial legislation, financial incentives, and changing industry standards are encouraging adoption. Amid increasing modernization of industry for resilience and decarbonization, smart lighting is becoming a key tool to ensure operational efficiency, safety and long-term sustainability.

May 15, 2024, over 100 lighting professionals from around the world participated in the DOE–IES 2024 Research Symposium in Portland, where the U.S. Department of Energy (DOE) announced the release of its latest Lighting Market Characterization report. DOE also kicked-off the L-Prize® Manufacturing and Installation Phase to help American businesses develop cutting-edge, energy-saving lighting technologies.

The U.S Industrial Lighting Market size was valued at USD 2.52 Billion in 2024 and is projected to reach USD 3.92 Billion by 2032, growing at a CAGR of 5.65% during 2025-2032, due to the demand for energy-efficient, automation control, and industrial compliance with sustainability guidelines. Increasing deployment of LED lights, intelligent lighting controls, and IoT-enabled systems in manufacturing and logistics facilities is contributing to the market expansion. Holistic support form regulatory authorities, development of the industrial architecture and increasing interest towards cost reduction will drive the industry industrial lighting market growth.

Industrial Lighting Market Dynamics:

Drivers:

-

Net-Zero Demands Accelerate Shift to Intelligent Industrial Lighting

A growing push for carbon neutrality is fueling the demand for advanced lighting systems across industrial facilities. With low-carbon regulations getting more strict, intelligent, energy-efficient lighting that is smart-grid compatible is being built into industries. For net-zero objectives to be met, lighting infrastructure now needs to connect with real-time energy systems, microgrids, and AI-enabled controls. The transition from traditional to smart lighting, sensor-enabled, controllable, and even predictive maintenance-based, can drive both energy conservation and greater operational efficiency. As efforts to reduce emissions and make energy use more efficient intensify, policy-led incentives are making industrial lighting a strategic priority, so it is being rolled out on a large scale across factories, warehouses, logistics hubs, and the factories of the future.

China signaled its zero-carbon turn in Liyang on April 22, 2025 where the 100-hectare industrial park is now producing 5.2 million kWh per year from its 77,000m² of solar panels. Companies, such as NR Electric reduced CO₂ by over 21,000 ton and savings of ¥20 million with more than 10 zero-carbon parks and 15 factories by 2026.

Restraints:

-

Operational Barriers and Cost Sensitivity Restrict Industrial Lighting Modernization

The industrial lighting market faces several restraints that slow modernization efforts. The significant initial investment required for smart lighting solutions, such as IoT-enabled LED lights and automation platforms are not practical for many organizations, particularly in small and mid-sized businesses. It is difficult and expensive to retrofit due to existing infrastructure including outdated voltage systems or architectural barriers. Furthermore, it is not adopted immediately as people are worried about factory stopping time during installation. In other areas, uneven regulations coupled with insufficient technical capacity baskets the progress. Low utilization rates are mainly attributed to lack of understanding of long-term energy and maintenance savings. These variables in combination impede the market’s ability to expand at a rapid pace, despite the rising demand for energy efficiency and low-carbon processes throughout industry.

Opportunities:

-

Carbon Reduction Pressures Drive Surge in Smart Industrial Lighting Adoption

The growing focus on carbon neutrality is creating significant opportunities for the industrial lighting market. As companies are under more and more pressure to reduce energy usage, energy efficient lighting is becoming one of the largest and more convenient areas for measurable energy savings. Enterprises are looking for next generation lighting solutions that can automate, reduce energy consumption, and seamlessly integrate well with a smart energy ecosystem. Smart lighting solutions, featuring sensor-driven controls, dynamic lighting, and connected LED infrastructure, are now critical in order to achieve sustainability objectives, and to lower operating expenses. With the increasing prevalence of carbon verification and energy audits, there is growing demand for lighting solutions that meet requirements for environmental compliance and advance long-term energy strategy, laying the foundation for rapid adoption in the industrial decarbonization sector.

May 29, 2024, a leading industrial park in Jiangsu launched one-stop carbon neutrality services, combining carbon verification, trading, and certification to support business decarbonization. With over 90% clean energy usage, the park is advancing “dual carbon” goals through initiatives including lighting efficiency, solar deployment, and carbon sinks.

Challenges:

-

Outdated Infrastructure Slows LED Adoption, Limiting Industrial Lighting Market Growth

LED penetration gaps remain a significant barrier in the industrial lighting market, particularly in older manufacturing facilities, educational institutions, and multifamily buildings where outdated infrastructure and limited upgrade budgets persist. These industries typically have legacy systems in place due to cost constraints, ignorance, or impacts in operations with regard to retrofitting. Full-scale adoption of LEDs is thus delayed, with reduced energy and environmental benefits. Poor performance optimization is also due to the lack of integration with smart control in these environments. This gap can only be closed by incentives tailored to the respective conditions on the one hand, and by simple, easy to implement retrofit Industrial lighting solutions and awareness campaigns to show the economic and environmental advantages of highly efficient LED systems adapted to the respective underperforming segments on the other.

Industrial Lighting Market Segmentation Analysis:

By Light Sources

In 2024, LED lighting holds a holds a largest industrial lighting market share revenue of around 59% in 2024 and is expected to grow at the fastest CAGR with 7.67% during 2025-2032. Demand for the Cost-effective, and energy-efficient lighting solutions in industrial end users, is driving the market. LED lights are more energy efficient and more durable than traditional lighting and are the go-to choice for smart lighting in a home. Government tax encouragement and energy-saving service programs also promote the deployment of LED throughout industrial facilities for infrastructure upgrade.

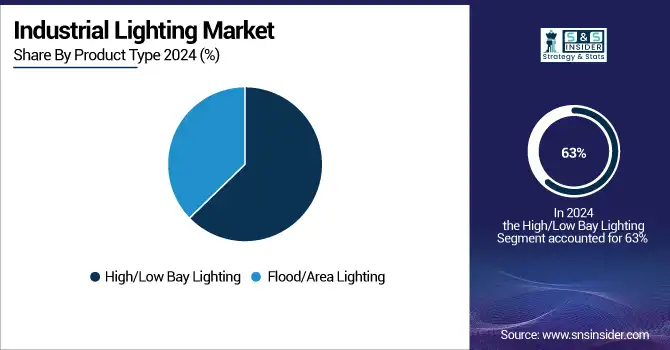

By Product Type

High/Low Bay Lighting holds a largest industrial lighting market share revenue of around 63% in 2024 and is expected to grow at the fastest CAGR with 8.26% during 2025-2032. These lighting systems are widely used in warehouses, manufacturing plants, and large industrial spaces due to their high lumen output, energy efficiency, and suitability for high-ceiling environments. Their ability to provide uniform, powerful illumination while reducing energy consumption and maintenance costs positions them as the preferred choice in industrial lighting applications.

By End-User Application

Manufacturing accounts for the largest segment industrial lighting market share of around 36% in 2024. This power position is a result of the industry’s ongoing requirement for effective, high performance lighting for the purposes of safety, precision and productivity. Automation, energy efficiency and smart factory programs are further reinforcing the implementation of advanced lighting solutions in manufacturing plants.

Warehouse segment is expected to experience the fastest growth in the industrial lighting market over 2025-2032 with a CAGR of 9.01%. This surge is driven by the rapid expansion of e-commerce, increased demand for automated storage solutions, and the need for energy-efficient, high-visibility lighting to enhance operational efficiency and safety in large-scale warehousing facilities.

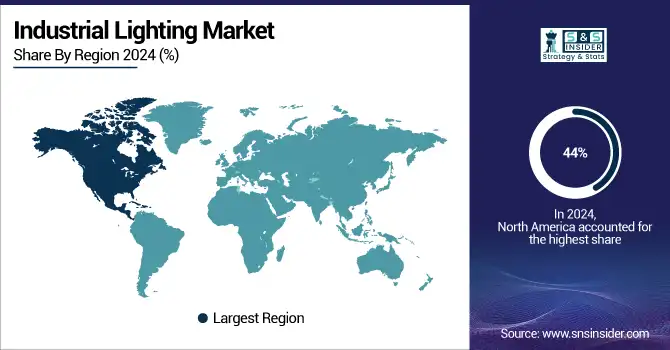

Industrial Lighting Market Regional Analysis:

In 2024, North America led the industrial lighting market with a 44% share, due to strong regulatory assistance, easy penetration of LED, and increasing smart manufacturing investments. Focus of the region on conserving energy and investments in industrial infrastructural upgrades will positively impact the demand for smart lighting systems in factories, warehouses, and logistics centers.

The industrial lighting market in the U.S. is expanding steadily due to rising energy-efficiency mandates, increased adoption of smart lighting technologies, and modernization efforts across manufacturing and warehouse facilities.

July 18, 2024 – The U.S. Department of Energy has announced grants totaling USD 52 million to small businesses in 24 states, including USD 3 million for 15 projects in 13 states that will help companies to commercialize promising energy technologies developed at the department's national laboratories. These practices include solid state lighting, air sealing, insulation and energy-efficient building advancements that will help spur a clean energy economy.

Asia-Pacific is expected to witness the fastest growth in the Industrial lighting Market over 2025-2032, with a projected CAGR of 8.55%. Demand is being fueled by rapid industrialization, the smart factory drive and increasingly massive infrastructure spending in places such as China, India and South East Asia. Favorable government policies advocating energy conservation and manufacturing expansions on a large scale are also supplementing the demand for advanced lighting systems.

June 11, 2025 – The 33rd China (Guzhen) International Lighting Fair will be held from October 22–25, showcasing over 3,500 brands and 1,000+ exhibitors across 1.5 million+ sq. meters in Zhongshan. With Guzhen contributing 70% of China’s domestic lighting output, the event highlights smart, decorative, and industrial lighting innovations within a 100-billion-yuan cluster.

In 2024, Europe emerged as a promising region in the industrial lighting market owing to stringent environment control regulations, higher LED penetration and increasing investments to develop sustainable infrastructure. “Green building and smart factory projects are stimulating intelligent lighting system sales, especially in the industrial sector, notably in Germany.

June 19, 2025 – German-headquartered LAPP Group has purchased the Chinese moulded circular connector specialist Cableforce Electronics to extend its international manufacturing and market position. LAPP will continue to invest in local research and development (R&D) and production in China, in a bid to maintain its strong local presence and gain a better foothold in the Chinese and Asia Pacific industrial connectors market, he adds.

LATAM and MEA is experiencing steady growth in the Industrial lighting market, due to growing industrialization and infrastructure development, along with the increasing use of energy-efficient lighting products. Efforts of the government to encourage the utilization of sustainable energy and to upgrade industrial facilities contribute to the demand for next-gen industrial lighting systems in these developing economies.

Get Customized Report as per Your Business Requirement - Enquiry Now

Industrial Lighting Companies:

The Industrial lighting market companied are ams OSRAM, Emerson Electric, Legrand, Zumtobel Group, Acuity Brands Lighting Inc., General Electric, TOYODA GOSEI Co. Ltd, Hubbell Lighting Inc., Cree Inc., Philips Lighting Holding B.V. and others.

Recent Developments:

-

In October 2024, Cree Lighting unveiled advanced LED solutions with NanoComfort® Technology at the 2024 NACS Show, enhancing energy efficiency and visual comfort. Their new luminaires cater to petroleum sites and convenience stores with superior durability and performance.

-

In October 2024 – ams OSRAM announced its participation at electronica 2024, showcasing intelligent lighting and sensor innovations for automotive, industrial, and smart city applications, including its new EVIYOS™ Shape micro-LED technology.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 8.46 Billion |

| Market Size by 2032 | USD 14.90 Billion |

| CAGR | CAGR of 7.33% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Light Source(LED, High-intensity Discharge (HID) Lighting, Fluorescent Lighting) • By Product Type(High/Low Bay Lighting, Flood/Area Lighting) • By End User(Oil and Gas, Mining, Pharmaceutical, Manufacturing, Warehouse, Other End-user Applications) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | The Industrial lighting market companied are ams OSRAM, Emerson Electric, Legrand, Zumtobel Group, Acuity Brands Lighting Inc., General Electric, TOYODA GOSEI Co. Ltd, Hubbell Lighting Inc., Cree Inc., Philips Lighting Holding B.V. and others. |