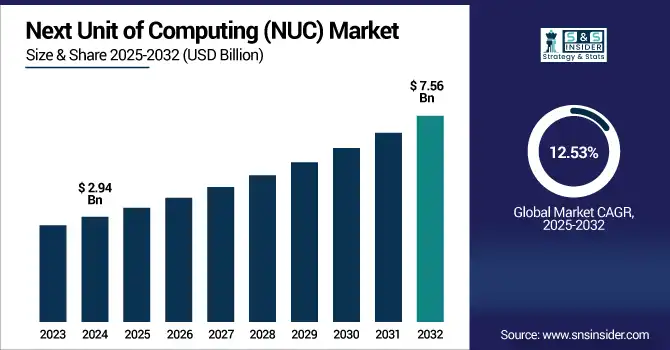

Next Unit of Computing (NUC) Market Size Analysis:

The Next Unit of Computing (NUC) Market size was valued at USD 2.94 Billion in 2024 and is projected to reach USD 7.56 Billion by 2032, growing at a CAGR of 12.53% during 2025-2032. The Next Unit of Computing (NUC) market is witnessing robust growth globally due to the high demand for compact and power-efficient computing systems that can be used in education, retail, healthcare or small office/home office (SOHO) applications. With a powerful performance, modular design, and space-saving designs, these mini pcs are suitable for digital signage, POS system, and remote working environment.

To Get more information on Next Unit of Computing (NUC) Market - Request Free Sample Report

The low-power draw, simple deployment, and growing support for upgraded technologies, such as DDR5 RAM, multi-display output, and high-speed connections are making NUCs popular with end-users as viable replacements for traditional retail desktops. The NUC market is expected to grow steadily over 2024 to 2032 as companies look for scalable and affordable solutions, with improved penetration across developed and developing economies.

ASUS NUC 14 Essential Claims Over 1000 Units Sold in South Africa Since Launch in January 2025 Designed for SMEs and SOHO users, the compact mini PC offers triple-display support, DDR5 memory, and energy-efficient performance.

The U.S Next Unit of Computing (NUC) Market size was valued at USD 0.88 Billion in 2024 and is projected to reach USD 1.87 Billion by 2032, growing at a CAGR of 9.81% during 2025-2032. The U.S. Next Unit of Computing (NUC) market growth is driven by rising demand for compact, energy-efficient, and high-performance computing across education, retail, and SOHO sectors. Businesses increasingly favor NUCs for their reliability, scalability, and minimal space requirements.

The Next Unit of Computing (NUC) market trends include growing adoption of ready-to-go systems among SMEs and schools, integration of DDR5 memory, Wi-Fi 6E, and multi-display capabilities, and expanding use in POS, digital signage, and edge computing. Modular and customizable NUC platforms are also gaining traction to meet evolving user needs.

Next Unit of Computing Market Dynamics:

Drivers:

-

Rising Demand for Space-Efficient and Low-Power PCs Drives NUC Market Expansion

The increasing need for small, power-efficient, and modular computers systems to meet the demands of the current users/users constitutes one of the major factors driving the growth of the Next Unit of Computing (NUC) market. With the demand for tiny PCs, NUCs are more popular than ever since they can bring high performance in low footprints, which are ideal for space-limited environments Including call centers, retail counters, classrooms, and work-from-home setups. With less power-consuming capabilities, it aids in sustainability goals, along with upgrade options for modular RAM and storage. As hybrid work models undergo more comprehensive adoption, the widening edge computing deployment and the rising digital signage and POS systems significantly contribute to the NUC market growth by acting as the epitome of modern-day computing.

MSI Cubi NUC 1M Eco-friendly mini PC with quiet performance and efficient power use — MTA Tech News It packs workstation-class specifications in a tiny, VESA-mount compatible case with Intel Core 7, DDR5, and Thunderbolt 4.

Restraints:

-

Costly Prices & Less Upgrade Capital of NUC Makes NUC Systems slower in Adoption

NUC market has very high growth potential but it has some key constraints. One of the drawbacks is the low possibility of upgrading key components, especially the CPU, which turns off hobbyists and techies who want to stay flexible for the long-haul. Also, the higher price points over the traditional desktop alternative can deter at least the cost sensitive buyer out there, which most certainly does include buyers in more emerging economies. Small size is also a thermal management limitation when it comes to extended high-performance use. In addition, availability and cost are susceptible to everything from dependence on a handful of semiconductor vendors and geology to supply-chain disruptions.

In addition, market uncertainty will continue as Intel withdraws from actually building NUCs (although it may well continue altogether to design NUCs that are then built by third-party OEMs), meaning any third-party OEM has work ahead to build brand confidence, but also to ensure reliability and ongoing support. These factors combined serve as speed bumps to broader market penetration, particularly in the most competitive and price-sensitive segments.

Opportunities:

-

Growth in AI and Edge Workloads Drives Demand for High-Performance Compact NUC Systems

As AI computing continues to scale across industries, there is a growing need for localized, high-efficiency computing solutions that can support intensive workloads at the edge. The reason for this shift is the decentralization of AI infrastructure that needs processing closely at the data source to minimize latency and bandwidth costs. One consequence is the increasing need for high-performance NUC systems with high-FPS single-thread performance with GPUs, multi-view, multi-monitor support, and rich I/O in a small and modular footprint. They are suitable for research environments, smart factories, and enterprise AI testing setups. NUCs combine plenty of performance but contained between two hands and that is why they stand out as an important catalyst for next-generation AI and edge deployments.

Nvidia presented next-gen GB300 systems, RTX Pro Server, and NVLink Fusion, all designed to enhance the ability of AI to compute even more. It will also construct a 10,000-Blackwell-GPU AI supercomputer factory in Taiwan alongside Foxconn.

Challenges:

-

Hardware Limitations and Competitive Pressure Slow NUC Market Adoption

The Next Unit of Computing (NUC) market faces several key challenges that could limit its broader adoption. A primary concern is the restricted hardware flexibility, particularly the inability to upgrade processors, which deters tech-savvy users and DIY builders. In addition, compact form factors can lead to thermal limits on sustained high-performance workloads, particularly in industrial or AI applications. NUCs are also witnessing increased competition from alternative miniature systems ranging from compact desktops and mini-PCs to ARM-based systems with similar capabilities at lower price points. Also, there is Intel's departure from direct NUC production, which has led to an increased focus on OEMs to prove their worth and credibility. Combined, these constrain penetration in value-constrained and performance-dependent segments, despite the substantial market growth opportunity.

Next Unit of Computing (NUC) Market Segmentation Analysis:

By Product

In 2024, the Barebone NUC segment accounted for approximately 44% of the Next Unit of Computing (NUC) market share, owing to the increasing demand for customizable, cost-effective mini-PCs. It is a popular segment that caters to the needs of both consumers and commercial applications and appeals to those users and system integrators who prefer flexibility to configure RAM, storage, and operating systems.

The Ready-to-Go NUC segment is expected to experience the fastest growth in Next Unit of Computing (NUC) market over 2025-2032 with a CAGR of 16.54%, providing plug-and-play solutions requiring little or no configuration and pre-installed software to serve rapid deployment needs of SMEs, educational institutions, and remote workers.

By Application

In 2024, the Consumer Electronics segment accounted for approximately 35% of the Next Unit of Computing (NUC) market share, making it the largest application segment. This dominance is attributed to the growing adoption of compact PCs for home entertainment, media centers, and general-purpose computing. Increasing consumer preference for energy-efficient, space-saving devices is further fueling demand in this segment across global households.

The Digital Signage segment is expected to experience the fastest growth in Next Unit of Computing (NUC) market over 2025-2032 with a CAGR of 16.77%. This growth is fueled by the increasing requirement for small footprint and high-performance solutions in applications Including retail, transportation, and public venues, where NUCs help deliver content in an efficient way, multi-display support, and 24×7 reliability.

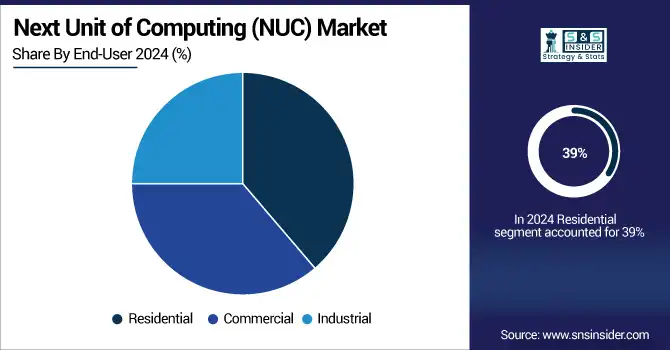

By End-User

In 2024, the Residential segment accounted for approximately 39% of the Next Unit of Computing (NUC) market share due to increasing demand for compact and highly power-efficient PCs for residential purposes. NUCs are hybrids between a PC and a console, regarding their style, they are small and quiet, a perfect duo for a home office, a media stream, or a light gaming station.

The Commercial segment is expected to experience the fastest growth in Next Unit of Computing (NUC) market over 2025-2032 with a CAGR of 15.17%. This growth is primarily due to the growing inclination of the customers and businesses toward e-commerce platforms for large varieties of NUC models, price differences, and doorstep delivery. The increasing trends in digital purchase and higher global accessibility drives the online NUC sales in each region.

By Distribution Channel

In 2024, the Online Stores segment accounted for approximately 39% of the Next Unit of Computing (NUC) market share and is expected to register the fastest growth over 2025-2032, with a CAGR of 15.07%. This growth is primarily driven by the increasing shift of consumers and businesses toward e-commerce platforms that offer a broad range of NUC models, price comparisons, and convenience of doorstep delivery. The growing trend of digital purchasing and global accessibility further boosts online NUC sales across regions.

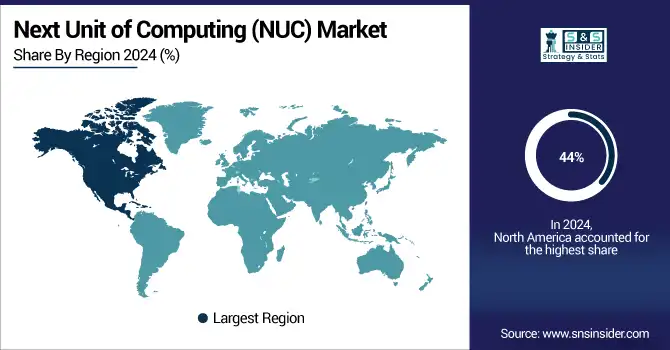

Next Unit of Computing Market Regional Analysis:

In 2024, North America dominated the Next Unit of Computing (NUC) market and accounted for 44% of revenue share, driven by strong adoption across commercial, residential, and institutional sectors. The region has advanced IT infrastructure, early tech adoption, and growing demand for compact, high-performance computing devices have positioned it as a key contributor to NUC market expansion.

Asia Pacific is expected to witness the fastest growth in the Next Unit of Computing (NUC) market over 2025-2032, with a projected CAGR of 14.29% due to Rapid developments in digital transformation, increasing need for small-scale computing due to urban explosion, and a rise in government smart infrastructure initiatives in the region are some of the major factors that will contribute to the fastest growing Next Unit of Computing (NUC) market. Rising NUC deployments by countries such as China, India, Japan, and South Korea are driven by the presence of major manufacturers of electronics and high SME adoption.

In 2024, Europe emerged as a promising region in the Next Unit of Computing (NUC) market, supported by increasing adoption of energy efficient and compact form factor computing solutions among enterprise, educational and residential users. The deployment of NUC continues to trend due to increasing green technology focus, EU Digital Transformation initiatives, growing adoption of edge computing applications. The regional expansion is being spearheaded by neighboring countries, including GER, the U.K., and FR, with promising infrastructure and tech expenditure.

LATAM and MEA are experiencing steady growth in the Next Unit of Computing (NUC) market, owing to digital transformation, early adoption of compact computing in education and government sectors, and growing internet infrastructure, and as a result LATAM and MEA are projected to witness steady growth in NUC market. Additionally, the gradual penetration of e-commerce along with increasing awareness regarding energy-efficient IT solutions, are also supporting the penetration of NUC in these emerging regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Next Unit of Computing (NUC) Companies are:

The Key Players in Next Unit of Computing (NUC) Market are Intel, ASRock, Gigabyte, ZOTAC, Shuttle, Acer, ASUS, HP, Dell, Lenovo, MSI, Fujitsu, Panasonic, Apple, Samsung, HPE, Compulab, Minisforum, Beelink, Chuwi. and Others.

Recent Developments:

-

In July 2025, NovaCustom has unveiled a Meteor Lake-powered NUC Box running on open-source Dasharo/Coreboot firmware, offering a privacy-focused alternative to proprietary BIOS.Set to ship in September 2025, it supports up to 96GB RAM, 2.5G Ethernet, Wi-Fi 7, and starts at €830.

-

In March 2025, Acer’s gaming PC listing reveals Nvidia RTX 5060 GPU with 8GB GDDR7 memory, hinting at an imminent launch. The leak supports speculation that RTX 5060 will be one of the first consumer GPUs based on Nvidia’s Blackwell architecture.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.94 Billion |

| Market Size by 2032 | USD 7.56 Billion |

| CAGR | CAGR of 12.53% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type(Barebone NUC, Ready-to-Go NUC, NUC Kits) • By Application(Consumer Electronics, Industrial Automation, Digital Signage, Healthcare, Gaming and Others) • By End-User(Residential, Commercial and Industrial) • By Distribution channel(Online Stores and Offline Retailers) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | The Next Unit of Computing (NUC) companies are Intel, ASRock, Gigabyte, ZOTAC, Shuttle, Acer, ASUS, HP, Dell, Lenovo, MSI, Fujitsu, Panasonic, Apple, Samsung, HPE, Compulab, Minisforum, Beelink, Chuwi. and Others. |